2024 to See Seismic Changes to Monetary Policy

FOREX TRADERS REFERENCE: your regularly updated guide to the currency markets

DERBYSHIRE UK, Jan 02, 2023, Week 1. Hello, here is what you need to know as we enter 2024. In the United States, traders are eyeing a tug-of-war between robust GDP growth and cooling inflation, with whispers of Federal Reserve rate cuts nudging the US Dollar to near five-month lows. The Euro is caught between persistent inflation and signs of economic resilience, with the European Central Bank's hawkish stance lending it some strength against the dollar. The UK's narrative is one of high inflation and anticipated rate cuts, balancing the scales for the Pound-Sterling as it navigates economic headwinds. Meanwhile, Japan's economy presents a mix of contraction and stable unemployment, keeping traders on their toes about the Yen's direction amidst persistent inflation and aggressive monetary easing.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Macroeconomics

UNITED-STATES: There are expectations of Federal Reserve rate cuts, causing the US Dollar to drop to near five-month lows. Projections suggest a decrease in interest rates and continued, albeit slower, economic growth, which may reduce the dollar's attractiveness. Yet, if inflation and employment remain stable and improve, it could prevent significant downsides for the dollar, maintaining a stable economic and monetary setting.

EURO-AREA: The Euro-Area economy is facing a complex situation with high inflation and a slight GDP contraction in Q3 2023, leading the ECB to keep interest rates high and end its bond purchase scheme, theoretically strengthening the Euro. However, low consumer demand and stable unemployment rates are hindering growth. Despite these issues, decreasing inflation rates and positive signs in consumption and public spending indicate some economic resilience. The Euro has been strengthening against the dollar, influenced by the ECB's aggressive anti-inflation stance compared to the Federal Reserve's anticipated rate cuts. Forecasts suggest easing inflation and moderate unemployment ahead, which could stabilise the economy and support the Euro. Yet, if inflation stays high or growth remains weak, the Euro could face downward pressure, negatively impacting the economic outlook.

UNITED-KINGDOM: The UK economy's persistent inflation and a contracting GDP in Q3 2023 have prompted the Bank of England to keep interest rates at a 15-year high, potentially supporting a strong Pound short-term due to the tight labour market and inflation risks. However, expected rate cuts in 2024 by the Bank of England and the Federal Reserve, amid slowing inflation and economic growth, provide optimism and may stabilise the Pound. Projections suggest a gradual reduction in UK interest rates and slow economic improvement. If accurate, upcoming rate cuts could diminish the Pound's attractiveness. Yet, if the economy remains resilient and inflation is effectively managed, the Pound could stabilise or strengthen. The interaction between these domestic factors and global economic trends will significantly influence the Pound's future and the broader UK economic landscape.

JAPAN: The Japanese economy and the Yen are affected by various factors. A Q3 2023 GDP contraction, reduced consumer spending, and capital expenditures, alongside above-target inflation, present challenges, leading the Bank of Japan (BoJ) to continue its ultra-loose monetary policy, traditionally weakening the Yen. However, a stable unemployment rate and a tight labour market are positive signs. Slight inflation decreases and a cautious central bank approach indicates a potential move towards normalisation, possibly strengthening the currency. Forecasts suggest a minor increase in interest rates and a modest GDP recovery. If these predictions hold, they could indicate economic improvement and support a stronger Yen. Conversely, if the recovery lags or inflation remains high, ongoing or intensified monetary easing might be necessary, potentially further weakening the Yen. The balance between these domestic dynamics and broader economic conditions will crucially impact the Yen's future trajectory and Japan's economic health.

Currency Pairs

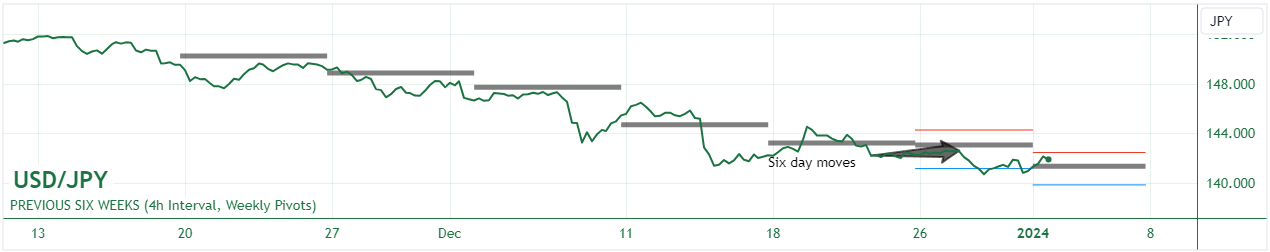

USD/JPY: Over the short term, the pair has been stable since December 27 due to mixed influences from both the US and Japan. The US Dollar's recent direction reflects expectations of the Federal Reserve reducing interest rates due to lower inflation and slower economic growth, which generally weakens the Dollar. Conversely, the Japanese Yen may strengthen as the Bank of Japan considers ending negative interest rates and reducing stimulus, reflecting slight inflation increases and stronger equity markets. This balance has led to a temporary market equilibrium as traders wait for clearer central bank policies.

However, in the long term, since November 21, the USD/JPY has depreciated. This is primarily due to a stronger narrative around the US Dollar weakening as the Federal Reserve signals interest rate cuts to address cooling inflation and support the economy. Meanwhile, the Yen has found some support, potentially strengthening due to Japan's central bank contemplating a shift from its very loose monetary stance and relatively better equity market performance. This has resulted in the USD/JPY's longer-term decline, driven by a weakening Dollar and a cautiously strengthening Yen.

Here are some key events to watch in relation to the USD/JPY:

Wednesday January 03, 2024 - US FOMC Minutes: The minutes from the Federal Reserve's meeting could provide deeper insights into the future monetary policy, potentially affecting the USD. If the minutes suggest a more dovish stance due to lower inflation, this could weaken the USD against the JPY.

Friday January 05, 2024 - US Non-Farm Payrolls and Unemployment Rate DEC: These indicators are crucial for assessing the health of the US economy. Strong figures could bolster the USD by tempering rate cut expectations, while weaker figures might lead to a softer USD as they could reinforce the case for a more dovish Fed.

Thursday January 11, 2024 - US CPI DEC: Inflation data is a key driver of central bank policies. Lower than expected inflation might confirm the market's expectations for rate cuts, potentially weakening the USD. Conversely, higher inflation could lead to a stronger USD if it suggests a delay in rate reductions.

Friday January 05, 2024 - JP Jibun Bank Services PMI Final DEC: This indicator provides insights into the service sector's performance, a significant part of Japan's economy. A stronger than expected reading might suggest a more robust economy, potentially strengthening the JPY.

Friday January 12, 2024 - JP Current Account NOV: This is a broad measure of Japan's international trade. A higher surplus could indicate a strengthening economy and potentially bolster the JPY, especially if the market perceives the Bank of Japan as moving away from its ultra-loose monetary policy.

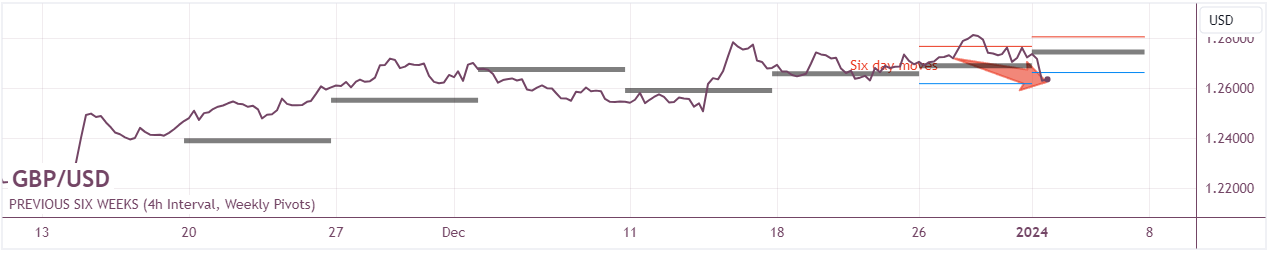

GBP/USD: Over the short term, the GBP/USD has lost some value since six days ago on Wed Dec 27, primarily due to the more aggressive anticipated rate cuts by the Federal Reserve compared to the Bank of England. Markets are pricing in a substantial probability of the Fed cutting rates as early as March, driven by cooling US inflation and a moderating growth outlook, which, in turn, has pressured the US Dollar. However, the Bank of England has maintained a cautious stance, signalling a potential delay in following the Fed's lead, which has comparatively supported the Pound in the short term.

Conversely, over the long term, the GBP/USD has gained value since six weeks ago on Tue Nov 21, reflecting a broader adjustment in expectations. While the Pound has been buoyed by a relatively robust UK economic narrative, including a tight labour market and controlled inflation, the US Dollar has faced headwinds from a deceleration in economic growth and anticipation of rate cuts. This dynamic has gradually shifted the currency pair's balance, with the Pound benefiting from its relatively higher yield appeal and the US Dollar adjusting to a softer expected monetary policy stance. This interplay between the two narratives and central bank actions has shaped the short and long-term trends in the GBP/USD exchange rate.

Here are some key events to watch in relation to the GBP/USD:

Wednesday January 03, 2024 - US FOMC Minutes.

Thursday, January 4, 2024 - BoE Consumer Credit NOV & Mortgage Lending NOV: These indicators provide insight into consumer confidence and borrowing behaviour, which are critical for economic health. A significant deviation from expectations could influence BoE's monetary policy stance, potentially affecting the Pound's strength against the Dollar.

Friday, January 5, 2024 - US Non-Farm Payrolls DEC & Unemployment Rate DEC: These are key indicators of the American labour market's health. Strong figures could bolster the USD by indicating economic resilience, possibly influencing the Federal Reserve's rate decision narrative, while weaker than expected results might lead to USD weakness.

Thursday, January 11, 2024 - US Inflation Rate YoY DEC & US Core Inflation Rate YoY DEC: Inflation is a significant factor in Fed's rate decision process. Lower than expected inflation could reinforce the narrative of impending rate cuts, weakening the USD. Higher inflation might suggest a more cautious approach to rate cuts, potentially strengthening the USD.

Friday, January 12, 2024 - GB GDP MoM NOV & GB GDP 3-Month Avg NOV: GDP is a primary indicator of economic health. If the UK's growth is robust, it could strengthen the Pound by reducing the likelihood of BoE rate cuts. Conversely, weaker growth might lead to a softer Pound as it increases the chances of monetary easing.

Tuesday, January 16, 2024 - US NY Empire State Manufacturing Index JAN: As a measure of business conditions and economic outlook in New York, a significant change can signal broader economic shifts. Strong data could support the USD by indicating economic momentum, while weak figures might suggest slowing growth, potentially influencing Fed's rate decisions.

EUR/USD: Over the short term, the EUR/USD has gained a little value since six days ago on Wed Dec 27, primarily due to the evolving narrative around the Federal Reserve's anticipated shift from a hawkish stance to one of easing, in response to cooling inflation and moderating economic growth in the US. This expectation, reinforced by recent economic indicators and market sentiment, has led to a softening of the US Dollar as markets price in a high likelihood of rate cuts as soon as March. In contrast, while the European Central Bank (ECB) has also faced a slowdown and cooling inflation, its comparatively more hawkish stance and slower pace in shifting towards rate cuts have provided short-term support to the Euro.

However, over the long term, the EUR/USD has lost some value since six weeks ago on Tue Nov 21. This longer-term trend reflects concerns over the Euro-Area's economic challenges, including persistent high inflation and subdued growth, which have weighed on the Euro even as the ECB maintains higher interest rates. These factors, combined with the ECB's aggressive stance on inflation and the Federal Reserve's earlier rate hikes, have shaped a complex interplay influencing the EUR/USD exchange rate over different time horizons.

Here are some key events to watch in relation to the EUR/USD:

Wednesday, January 3, 2024 - US FOMC Minutes: The minutes from the Federal Reserve's December meeting will provide deeper insights into the Fed's outlook on the economy and its future policy direction. Any indications of a more aggressive rate-cutting approach or concerns about slowing growth could weaken the Dollar and alter the EUR/USD dynamic.

Friday, January 5, 2024 - EA Inflation Rate YoY Flash DEC & EA Core Inflation Rate YoY Flash DEC: These indicators provide critical insights into the inflationary pressures within the Euro-Area. Higher than expected inflation might reinforce the European Central Bank's hawkish stance, potentially strengthening the Euro. Conversely, lower inflation rates could suggest an easing path ahead, aligning the ECB's stance closer to the Federal Reserve's anticipated cuts, potentially affecting the EUR/USD pair.

Friday, January 5, 2024 - US Non-Farm Payrolls DEC & US Unemployment Rate DEC: These key labour market indicators will impact perceptions of the US economy's health. Strong job growth and a low unemployment rate could suggest a more robust economy, potentially delaying the Fed's easing cycle and strengthening the Dollar. Weak figures, on the other hand, might hasten the anticipated rate cuts, affecting the EUR/USD rate.

Monday, January 8, 2024 - EA Economic Sentiment DEC & EA Retail Sales MoM NOV: These readings will provide a snapshot of consumer confidence and spending in the Euro-Area. Positive data might indicate economic resilience, supporting the Euro, while disappointing figures could highlight economic challenges, possibly affecting the EUR/USD pair as they might prompt a more dovish stance from the ECB.

Thursday, January 11, 2024 - US Core Inflation Rate YoY DEC & US Inflation Rate YoY DEC: Inflation data from the US will be crucial in shaping expectations for the Federal Reserve's monetary policy. Lower than anticipated inflation could reinforce the case for rate cuts, potentially weakening the Dollar against the Euro. If inflation remains stubbornly high, it might complicate the Fed's easing path, impacting the EUR/USD exchange rate.

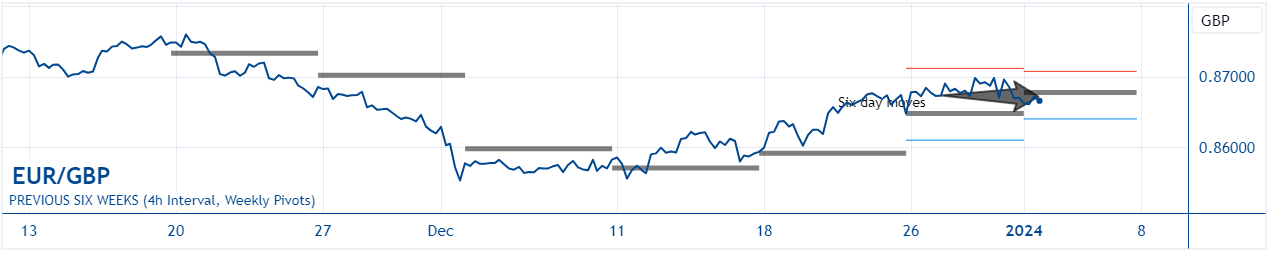

EUR/GBP: Over the short term, the EUR/GBP has remained steady since six days ago on Wed Dec 27, largely due to a balance of expectations and economic indicators from both the Eurozone and the UK. While the Euro has been somewhat buoyed by a slower expected pace of rate cuts by the European Central Bank compared to the aggressive anticipated cuts by the Federal Reserve, the Pound has found support in the UK's relatively high-interest rates and the Bank of England's cautious stance, despite looming rate cuts. This parity of monetary policy outlooks and the mixed economic signals from both regions have kept the EUR/GBP relatively stable in the short term.

However, over the long term, the EUR/GBP has lost value since six weeks ago on Tue Nov 21. This decline reflects the cumulative effect of the Eurozone's persistent economic challenges, including high inflation and subdued growth, which have dampened the Euro's appeal. In contrast, the Pound has seen some support from the UK's tight labour market and initial resilience against a swift move to lower interest rates, despite the economic slowdown. This divergence in the economic narrative and the relative strength of the Pound, amidst the broader anticipation of synchronised rate cuts, has led to a long-term depreciation of the EUR/GBP exchange rate.

Here are some key events to watch in relation to the EUR/GBP:

Friday, January 5, 2024 - EA Inflation Rate YoY Flash DEC & EACore Inflation Rate YoY Flash DEC: These inflation reports from the Eurozone are critical for assessing the European Central Bank's future monetary policy decisions. Higher-than-expected inflation might delay the anticipated rate cuts, potentially strengthening the Euro against the Pound. Conversely, lower inflation could affirm the need for rate reductions, possibly weakening the Euro.

Friday, January 5, 2024 - GB Halifax House Price Index MoM DEC & YoY DEC: This is an important indicator of the UK housing market's health, which significantly influences consumer confidence and spending. A robust housing market might reinforce the Pound's strength, while signs of a slowdown could indicate broader economic weaknesses, impacting the GBP.

Tuesday, January 9, 2024 - EA Unemployment Rate NOV: The unemployment rate is a key indicator of economic health. If the Eurozone's unemployment is lower than expected, it might indicate economic resilience, supporting the Euro. Conversely, higher unemployment could signal economic troubles, potentially weakening the Euro against the Pound.

Friday, January 12, 2024 - GB GDP MoM NOV & 3-Month Avg NOV: These GDP figures are crucial for understanding the UK's economic trajectory. Strong growth could bolster the Pound by decreasing the likelihood of aggressive rate cuts from the Bank of England. On the other hand, weak growth might pressure the Pound, as it could lead to more dovish monetary policy.

Friday, January 12, 2024 - GB Industrial Production MoM NOV & GB Manufacturing Production MoM NOV: These indicators provide insights into the UK's industrial and manufacturing sectors. Positive data might strengthen the Pound by suggesting a resilient economy, while negative figures could indicate economic slowdown, potentially weakening the GBP.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from th e5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-