A look at the US Dollar before NFP - more bears on the way?

US Economic Fundamentals

Federal Funds Rate

The Federal Funds rate was hiked on the 22nd of March by 0.25 to between 4.75 and 5.00 percent. This is the ninth consecutive rate hike and borrowing costs are nearing the 2007 high of 5.25 which occurred prior to the financial crash. Policymakers commented that the US banking system is sound and resilient although the recent situation regarding uncertainty and the collapse of SVB is going to see tighter lending as banks take a less risky posture.

Quarterly GDP Growth Rate

The Fed’s 2024 projection for GDP can be classified as ‘indifferent deterioration’ as they are expecting a fall to a 1.2 percent expansion which is lower than the previous 1.6. The outlook has since become more pessimistic as the latest data which was for Q4 2023 showed a 2.6 percent expansion which was lower than the 2.9 expected as well as being lower than the Q3 2023 expansion of 3.2.

Annual CPI Rate

Trading Economics have a 2024 forecast for CPI that can be classified as ‘indifferent improvement’ as they have maintained an expectation of a fall to 3.5 percent inflation. The outlook remains the same as the latest data which was for February showed 6.0 percent inflation which was as expected and a good way below the January inflation of 6.4.

Unemployment Rate

The Fed’s 2024 projection for Unemployment can be classified as ‘indifferent deterioration’ as they are expecting a climb to 4.6 percent. The outlook has since become more pessimistic as the latest data which was for February showed 3.6 percent which was higher than the 3.4 expected but matched the January rate.

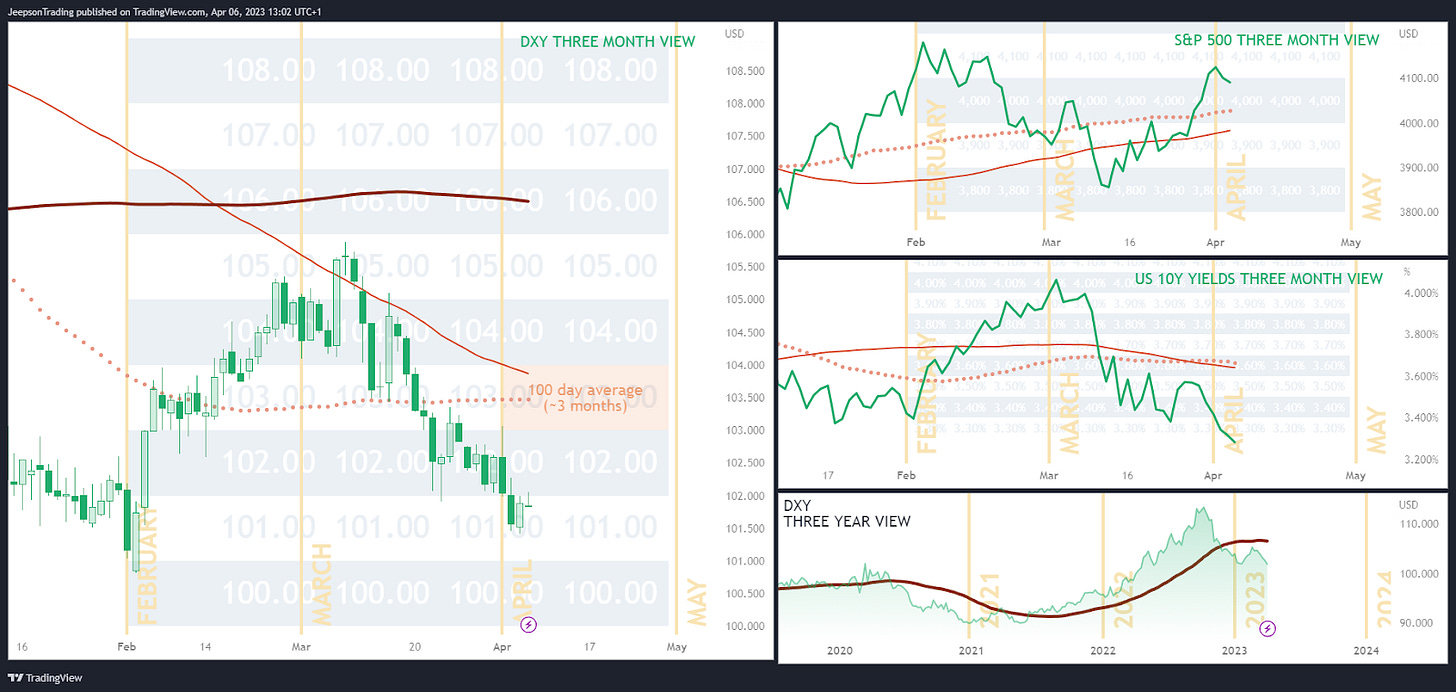

US Dollar Sentiment

The Fed hike of 0.25 in March and the updated projections suggest that the Fed are not considering cuts in the near future as the peak 2023 rate suggested is 5.1 with a fall to 4.3 in 2024, however this is more hawkish than the 4.1 that was projected in December. The banking crisis following the collapse of SVB appears to have stabilised for now. Inflation is cooling quickly and unemployment is rising slowly suggesting that the hard landing is avoidable. The moving averages indicate that the stock market and 10Y yields are more optimistic. Sentiment is tilted towards a less hawkish Fed.

US Dollar Outlook

The US Dollar (DXY) weakness is expected to remain and is unlikely to climb above $104.00 unless the US Non-Farm Payrolls that are due tomorrow come in unexpectedly high. A high reading would add pressure to inflation and therefore the Fed would be likely to take an even more hawkish stance which would elevate sentiment of a hard landing. A low reading is the base case (pressuring the DXY to the downside) and this would be helpful to the Fed in that it would be doing their inflation reduction work for them.

Jeepson Trading is a currency focused fund, managed by Gavin Pearson in the UK - all trading decisions are made at your own risk.