Friday April 25th Update

Progress Report: Derailed and Invalidated

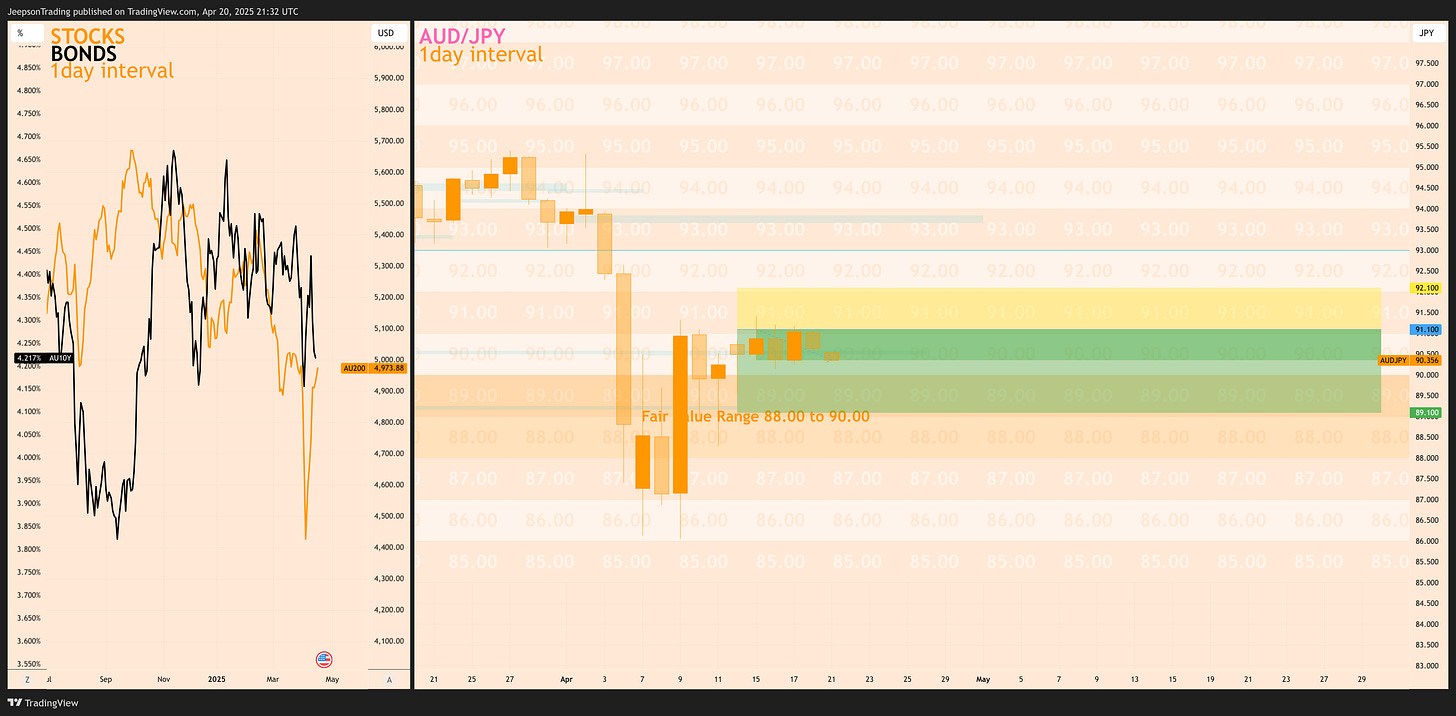

This review confirms that the short AUD/JPY trade plan has been invalidated, having hit its stop-loss level at 92.10.

Current Status: The trade is closed due to the stop-loss trigger. The price moved significantly against the planned direction.

Reason for Invalidation: Unexpected Yen weakness, driven by an improvement in global risk sentiment following US comments on trade negotiations and Fed leadership stability, overwhelmed the anticipated AUD weakness and supportive Japanese inflation data.

Key Developments: Easing trade tensions and reduced haven demand were the primary drivers undermining the plan. Stronger-than-expected Tokyo CPI was insufficient to counteract these forces.

Overall Assessment: The trade plan is definitively off-track and closed, resulting in a loss. The failure highlights the significant impact that shifts in global risk sentiment and geopolitical narratives can have, sometimes overriding domestic economic fundamentals or established central bank expectations.

Sunday April 20th Update

Overall, the AUD/JPY short trade plan remains largely on track, guided by persistent global trade uncertainties and divergent central bank outlooks favouring the Yen over the Aussie dollar.

Price Action: The pair has tested resistance near the proposed entry zone (91.10) after bouncing from deep lows, confirming the plan's assessment of recent volatility and levels.

Fundamentals: Key drivers remain supportive. US-China trade tensions persist, and RBA easing expectations are reinforced by meeting minutes. Key Japanese data points largely support the bearish case: core CPI significantly beat the plan's forecast, and the trade balance swung strongly positive against the plan's expected deficit. While headline Japan CPI missed expectations (JPY-negative) and Machinery Orders were mixed vs. plan forecasts, these don't negate the core JPY-positive drivers. Australian employment data was broadly neutral relative to the plan.

Strategy: The short bias is still logical and the primary profit target remains plausible if bearish drivers intensify.

Risks: Conviction holds at moderate to high, but the headline Japan CPI miss and mixed Machinery Orders introduce slight nuances. The primary risks – a sudden easing of trade tensions or unexpected shifts in central bank rhetoric – remain crucial monitor points. Vigilance around the stop-loss level (92.10) is essential given current price proximity and market volatility.

Fair Value and Recent Activity

Based on the prevailing drivers, the fair value range for AUD/JPY likely resides below current levels, potentially skewed towards the lower end of its recent range. The pair closed the previous week around 90.2, having experienced significant volatility driven by global trade tensions. It plummeted to test support near 87.0 early in the week following the implementation of US tariffs and China's retaliation, marking a multi-month low. A subsequent relief rally, spurred by the US announcement of a 90-day tariff pause for most allies, pushed the pair back above 90.0, encountering resistance near the 90.8-91.0 zone before settling slightly lower. The sharp decline and subsequent partial recovery highlight the pair's extreme sensitivity to risk sentiment.

Key Drivers for the Upcoming Week

The key influences on AUD/JPY this week are expected to exert further downward pressure on the pair's fair value range. For the Australian dollar, global risk sentiment tied directly to the US-China trade conflict remains paramount; persistent tensions represent a significant headwind. Domestically, the release of the RBA's April meeting minutes and crucial March employment data will be pivotal. Any reinforcement of expectations for RBA rate cuts, particularly from weak jobs figures, will likely weigh heavily on the AUD. Meanwhile, the Japanese yen will be driven by the interplay between its safe-haven appeal during global uncertainty and domestic factors. Upcoming Japanese inflation data (CPI) and trade figures are critical; strong readings could bolster the yen by reigniting BoJ tightening speculation, while weak data might limit its upside. However, the dominant theme of risk aversion linked to trade is expected to favour the JPY over the AUD.

Economic Indicators

Here is a list of key economic indicators and events for Australia (AU) and Japan (JP) due this week, along with a summary of their potential influence on the AUD/JPY fair value range if forecasts hold:

Apr 15, 2025: AU RBA Meeting Minutes (Apr)

Potential Influence: Confirmation of RBA's concerns about trade impacts or weak domestic outlook could reinforce easing expectations, pressuring AUD/JPY lower.

Apr 16, 2025: JP Machinery Orders MoM (Feb) - Forecast: 4.0%

Potential Influence: Stronger-than-expected orders could offer modest support to JPY, potentially nudging AUD/JPY slightly lower.

Apr 16, 2025: JP Machinery Orders YoY (Feb) - Forecast: 4.7%

Potential Influence: Similar to MoM, a positive YoY result could lend minor support to JPY against AUD.

Apr 17, 2025: AU Employment Change (Mar) - Forecast: 30.0K

Potential Influence: A significant miss below forecast could sharply increase RBA rate cut bets, leading to a notable decline in AUD/JPY.

Apr 17, 2025: AU Unemployment Rate (Mar) - Forecast: 4.10%

Potential Influence: An unexpected rise in the unemployment rate would amplify concerns about the Australian economy, likely causing AUD/JPY to fall.

Apr 17, 2025: JP Balance of Trade (Mar) - Forecast: ¥-100.0B

Potential Influence: A larger-than-expected deficit might slightly weaken JPY, offering minor support to AUD/JPY, while a smaller deficit or surplus could strengthen JPY.

Apr 17, 2025: JP Exports YoY (Mar)

Potential Influence: Strong export growth could support JPY, potentially pressuring AUD/JPY lower, while weak exports might have the opposite effect.

Apr 17, 2025: JP BoJ Nakagawa Speech

Potential Influence: Any surprisingly hawkish comments could boost JPY, pushing AUD/JPY down, while dovish remarks might limit JPY strength.

Apr 18, 2025: JP Inflation Rate YoY (Mar) - Forecast: 4.3%

Potential Influence: Inflation meeting or exceeding the high forecast could strengthen BoJ tightening speculation and JPY, pressuring AUD/JPY. A miss might weaken JPY.

Apr 18, 2025: JP Core Inflation Rate YoY (Mar) - Forecast: 2.5%

Potential Influence: Core inflation meeting or beating expectations would be JPY-positive (AUD/JPY negative), while a miss would be JPY-negative (AUD/JPY positive).

Trading Strategy Consideration

Considering the very bearish outlook for the AUD driven by trade sensitivities and potential RBA easing, contrasted with the JPY's neutral stance benefiting from safe-haven flows, a short position on AUD/JPY appears strategically sound. A potential entry point could be sought following any minor technical rally towards recent resistance, or upon a break of immediate support if downside momentum accelerates.

Entry Level: Consider entering short around 91.10. This level is slightly above recent highs tested after the rebound from the 87.00 low, allowing for a potential minor bounce before initiating the trade based on the overall bearish bias.

Stop-Loss Level: A stop-loss placed 100 pips above the entry at 92.10 provides a buffer against volatility and sits well above the recent resistance zone.

Profit Target Level: A primary profit target could be set near 89.10. This targets the area above the significant low tested around 87.00 during the previous week's risk-off plunge, offering a substantial potential reward while remaining realistically achievable if bearish drivers dominate.

Conclusion

Conviction and Risks

Conviction Level: Moderate to High. The rationale for shorting AUD/JPY is strongly supported by the AUD's vulnerability to ongoing global trade tensions and potential for imminent RBA easing. The JPY's safe-haven status provides an additional tailwind in the current uncertain environment. However, conviction is tempered slightly by the potential for JPY weakness if Japanese domestic data significantly disappoints or if the BoJ remains overtly dovish.

Key Risks to Invalidate the Plan:

Strong Australian Data: Unexpectedly robust Australian employment figures could significantly reduce RBA rate cut expectations, boosting the AUD.

Easing Trade Tensions: A sudden de-escalation in US-China trade friction or positive breakthroughs in negotiations could trigger a risk-on rally, weakening the safe-haven JPY and strengthening the AUD.

Weak Japanese Data/Dovish BoJ: Softer-than-expected Japanese inflation or economic data, or explicitly dovish commentary from the BoJ, could weaken the JPY, counteracting the AUD's potential decline.

Improved Global Growth Outlook: Renewed optimism about global economic prospects could lift commodity prices and risk sentiment, benefiting the AUD more than the JPY.

Trader Takeaways

For traders considering this AUD/JPY short setup, vigilance is key. Closely monitor the upcoming Australian employment data release, as it holds significant potential to shift RBA expectations and impact the AUD directly. Keep abreast of developments in US-China trade relations, as any significant shifts in tone or policy can rapidly alter risk sentiment and currency flows. Be mindful that while the overall bias favours JPY strength due to haven demand, domestic Japanese data releases, particularly inflation, could introduce volatility or temporary counter-trend moves. Finally, given the potential for sharp swings driven by news headlines, disciplined risk management, including adhering to stop-loss levels, is paramount.