UPDATE on Friday, January 09 2026

The short term volatility gives opportunity to reset risk, look to take profits early (if price falls towards entry) and then re-buy from a lower position in preparation for the longer term rally this pair is expected to take.

The fundamental picture got a little cloudy in the last 48 hours; on Wednesday, the Australian monthly CPI cooled to 3.4 percent, and Thursday’s trade surplus came in lighter than expected at 2.94 billion AUD. These figures dampened the “guaranteed” February rate hike bets for the Reserve Bank of Australia, triggering some profit-taking from the recent high of 0.6733.

However, the big picture remains solidly in your favor because the Federal Reserve is pivoting to cuts while the RBA remains uncomfortable with inflation sitting well above its target band. The main event arrives today with the US Non-Farm Payrolls report. Markets are nervously expecting a print below 100,000 jobs. If we see that kind of weakness, it will confirm that the US labor market is cracking, which should crush US yields and send the AUDUSD higher.

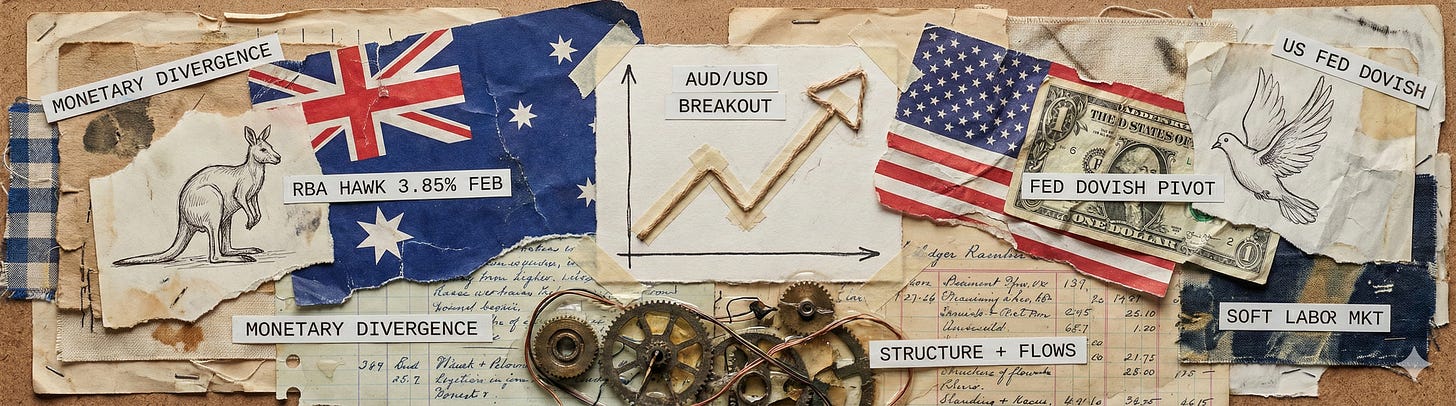

Strategic Long Opportunity Targeting RBA Hawkishness

I’m aiming to catch a structural breakout of the AUD/USD as it moves higher. The stars are aligning here thanks to a mix of structure, fiscal flows, and widening monetary divergence. The RBA remains the “last hawk standing,” potentially lifting rates to 3.85% come February. This creates a stark contrast with the Federal Reserve, where a softening labor market makes a dovish pivot look increasingly likely.