AUD/USD, USDCAD, GBP/JPY: Forex Outlook Amidst Shifting Monetary Policies

Sunday, 22 September, Week 38

Welcome, forex traders, to this comprehensive analysis of the AUD/USD, USD/CAD, and GBP/JPY pairs. Over the next few sections, we'll unpack the forces at play, from diverging monetary policies to fluctuating oil prices, providing you with the insights you need.

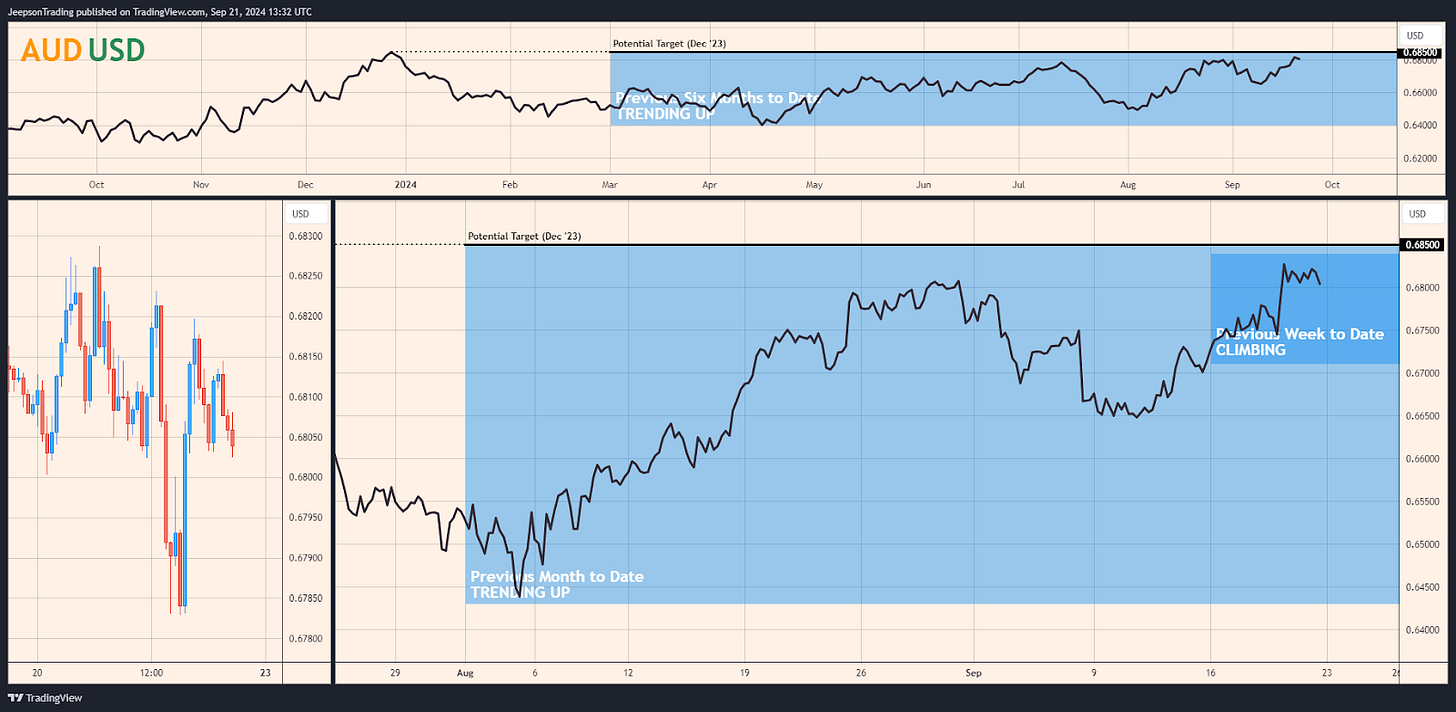

AUD/USD: Aussie's Ascent Faces RBA's Hawkish Shadow

The AUD/USD pair is a popular choice for traders seeking exposure to the Australian economy, commodity price fluctuations, and carry trade opportunities. Its liquidity is often dictated by swings in commodity prices—especially iron ore, given Australia's role as a major exporter.

Currently, the AUD/USD is enjoying an upward trend. Driven by the recent global risk-on rally and fuelled by the Fed's rate cut, the pair is climbing, with a potential target of 0.685. This upward trajectory, evident in both the previous week and month-to-date trends, is a stark contrast to the broader downtrend observed over the past six months.

Adding another layer to this complex equation is the upcoming RBA meeting on Tuesday, 24th September. Despite the global shift towards easing, the RBA has maintained a resolutely hawkish stance, determined to keep inflation in check. The release of the August CPI data, scheduled for Wednesday, 25th September, will be crucial. An in-line or higher-than-expected CPI reading could embolden the RBA's hawkish bias, potentially leading to a correction in the AUD/USD.

And let's not forget about China. The AUD's fortunes are closely tied to the health of the Chinese economy, a major importer of Australian commodities. Remember those disappointing economic data points from China earlier this month? They weighed heavily on iron ore prices, and the AUD felt the sting. Further evidence of a slowdown in the Chinese economy could dampen AUD sentiment, potentially triggering a decline in the AUD/USD pair.

Key Indicators / Events to Watch

Tuesday, 24th September, Week 40: RBA Interest Rate Decision (Australia). The market consensus is for a hold at 4.35%. Will the RBA maintain its hawkish stance, or will global easing pressures nudge them towards a more dovish tone?

Wednesday, 25th September, Week 40: Australian CPI Indicator (Australia). The forecast is 3.80%. An upside surprise could embolden the RBA hawks.

Thursday, 26th September, Week 39: Australian Employment Change (Australia). A stronger-than-expected figure might bolster the AUD, but will it be enough to offset broader market forces?

USD/CAD: Loonie Navigates a Sea of Uncertainty

The USD/CAD pair attracts institutional investors, corporations involved in cross-border trade, and central banks managing currency reserves. Its liquidity often ebbs and flows with the tides of oil prices (Canada's key export) and the ever-shifting interest rate differentials between the US and Canada. And, as you might expect, an inverse correlation typically exists between the USD/CAD and oil prices.

Over the past week and month, the USD/CAD has been on a downtrend, potentially heading towards 1.349 and 1.337, respectively. This decline reflects the combined forces of a weakening USD (courtesy of the Fed's rate cut and expectations of further easing) and surging oil prices. WTI and Brent crude have been rallying, driven by supply disruptions from Hurricane Francine and the prospect of a Fed-induced demand boost.

Looking ahead, the USD/CAD's fate hangs in the balance. Continued USD weakness and elevated oil prices could extend the downtrend. However, the BoC's policy stance is the wild card. Will they follow the Fed's lead and cut rates aggressively? Or will they remain cautious, prioritising their own fight against inflation?

Key Indicators / Events to Watch

Tuesday, 1st October, Week 40: S&P Global Manufacturing PMI (Canada). The forecast is 51.5. A move above 50 would signal expansion in the manufacturing sector, potentially adding fuel to the CAD's fire.

GBP/JPY: Sterling's Ascent Meets the Yen's Safe-Haven Appeal

The GBP/JPY pair is a haven for carry traders, hedge funds, and institutional investors who aim to exploit the interest rate differential between the UK and Japan. Shifts in these interest rate differentials, combined with global risk sentiment and economic data from both countries, are the primary drivers of the pair's liquidity. Typically, the GBP/JPY dances to the tune of the UK's economic performance while maintaining an inverse relationship with safe-haven flows into the JPY.

Currently, the GBP/JPY is on an upward trajectory, potentially reaching 193.3. The question on everyone's mind is: Will this uptrend persist? Escalating tensions, especially in the Middle East, could send investors scurrying for the JPY's safe-haven embrace, putting downward pressure on the GBP/JPY.

Key Indicators / Events to Watch

Monday, 30th September, Week 40: GDP Growth Rate QoQ Final (UK). Confirmation of positive growth in the second quarter could bolster the GBP, but will it be enough to offset other headwinds?

Conclusion

The forex market is currently caught in the crosscurrents of diverging monetary policies, a wobbly global economy, and ever-present geopolitical risks. The Fed's aggressive rate cut has pushed the USD lower, creating opportunities for currencies like the AUD and GBP. But the question remains: How sustainable is this trend?

Sources:

Bank of England

Office for National Statistics

Trading Economics

BRC - British Retail Consortium

Confederation of British Industry

GfK Group

S&P Global

Nationwide Building Society

Office for Budget Responsibility

Eurostat

US Bureau of Labor Statistics

Federal Reserve

Reserve Bank of Australia

Australian Bureau of Statistics

Australian Government

Westpac Banking Corporation

Melbourne Institute

National Australia Bank

CoreLogic

Bank of Canada

Statistics Canada

Department of Finance Canada

Bloomberg

Reuters

OECD

IMF

Stratfor