AUSTRALIA, AUD, COAL, AND IRON ORE

Australia’s “hawkish exceptionalism” is the defining macro theme of early 2026. With the RBA at 3.85 percent and signaling further tightening, the AUD above 0.70, and commodity exports resilient, the

Monday, February 09, 2026

Australia’s “hawkish exceptionalism” is the defining macro theme of early 2026. With the RBA at 3.85 percent and signaling further tightening, the AUD above 0.70, and commodity exports resilient, the currency maintains its carry-trade premium over all G10 peers.

Feb 20 Labour Force Survey: A sub-4.2 percent unemployment would be bullish and strengthen the case for a May rate hike.

Mar 17 RBA Rate Decision: A hold at 3.85 percent is expected, forward guidance and Bullock’s press conference.

HAWKISH DIVERGENCE AND GREEN IRON AMBITIONS RESHAPE AUSTRALIA’S MACRO LANDSCAPE

Australia’s macro environment is defined by a single tension: the RBA’s hawkish divergence from global peers. With the cash rate hiked to 3.85 percent, inflation at 3.8 percent, and unemployment at just 4.1 percent, the central bank is signaling that further tightening remains on the table. The government’s improved fiscal position and the structural pivot toward green metals provide medium-term support, but the near-term outlook hinges entirely on whether the March 4 GDP and February 25 CPI data validate the case for a May rate hike.

Albanese’s 94-Seat Majority Steers Fiscal Policy Through Inflationary Crosswinds

The Australian Federal Government is led by Prime Minister Anthony Albanese, whose Australian Labor Party secured 94 of 150 seats in the House of Representatives at the May 2025 federal election, delivering the strongest ALP mandate since 1975 with a two-party preferred vote of 55.22 percent. The 48th Parliament opened on July 22, 2025, and the Cabinet is anchored by Treasurer Jim Chalmers and Finance Minister Katy Gallagher, who together direct the nation’s fiscal architecture. Deputy Prime Minister Richard Marles oversees defense, while Senator Penny Wong manages foreign affairs and Don Farrell leads trade. Resources Minister Madeleine King coordinates the critical minerals and energy agenda (https://www.pmc.gov.au/government/australian-government-ministers).

The government’s second-term agenda centers on five pillars: alleviating cost-of-living pressures, strengthening Medicare through a record 7.9 billion AUD bulk-billing investment, broadening economic opportunity via the “Future Made in Australia” clean energy programme, expanding home ownership with a 1.2-million homes target, and meeting AUKUS defense commitments valued at approximately 268-368 billion AUD. The 2025-26 Federal Budget projected total spending of approximately 785.7 billion AUD, with the December 2025 MYEFO revising this to approximately 786.6 billion AUD, representing 26.9 percent of GDP, a near-40-year high.

Fiscal policy between July 2025 and January 2026 pivoted from aggressive pandemic-era spending toward revenue-focused discipline. The Mid-Year Economic and Fiscal Outlook (MYEFO), released December 17, 2025, revised the underlying cash deficit downward to 36.8 billion AUD from 42.1 billion AUD, driven by stronger commodity-linked tax receipts. The government returned one hundred percent of upward revenue revisions to the budget bottom line, generating 20 billion AUD in additional savings. However, the MYEFO revised the inflation forecast sharply upward to 3.75 percent by June 2026, intensifying fiscal-monetary tension (https://budget.gov.au).

Key legislative milestones included a 16-billion-dollar write-off of twenty percent of all student loan debts, part of a broader 19-billion-dollar package that included prior indexation reforms, and energy bill rebates of 150 AUD for every household. Looking ahead, the government is finalising the May 2026 Federal Budget and advancing a personal income tax cut from 16 to 15 percent effective July 1, 2026. The South Australian state election on March 21, 2026, and the progression of “Future Made in Australia” production credits, including a 2 billion AUD green aluminium credit and a 1 billion AUD green iron investment fund, will dominate the upcoming seven weeks. Notable diplomatic events include the Australia-Indonesia Treaty on Common Security, signed during PM Albanese’s Jakarta visit on February 6, 2026.

The RBA’s Stunning Reversal: From Three Cuts to a Rate Hike in Six Months

The Reserve Bank of Australia (RBA) is governed by a newly bifurcated board structure that took effect on March 1, 2025, following the most significant institutional reform in its 66-year history. The nine-member Monetary Policy Board is chaired by Governor Michele Bullock, who assumed office on September 18, 2023, and whose term extends to September 2030. Deputy Governor Andrew Hauser, Treasury Secretary Jenny Wilkinson, and six non-executive members, including Marnie Baker, Professor Renee Fry-McKibbin, and Ian Harper, complete the Board. The RBA’s statutory mandate requires the Monetary Policy Board to pursue price stability, defined as consumer price inflation of 2 to 3 percent, alongside full employment (https://www.rba.gov.au/about-rba/).

The preceding seven months witnessed one of the most dramatic monetary policy reversals among major central banks. Having cut the cash rate twice in early 2025, from 4.35 to 3.85 percent, the RBA delivered a third cut to 3.60 percent on August 12, 2025, as trimmed mean inflation sat at 2.7 percent. This proved to be the final easing. Headline CPI surged from 2.1 percent in Q2 to 3.2 percent in Q3 2025, driven by housing costs, the unwinding of energy rebates, and persistent services inflation that hit a two-year high of 4.1 percent. The Board held at 3.60 percent through September, November, and December, with the December 9 minutes revealing discussion of conditions under which a hike “might need to be considered” (https://www.rba.gov.au/monetary-policy/rba-board-minutes/).

On February 3, 2026, the RBA unanimously hiked the cash rate 25 basis points to 3.85 percent, making Australia the first major central bank to pivot from rate cuts back to hikes following the post-COVID inflation cycle. Governor Bullock stated the “inflation pulse is too strong” but noted the Board “did not discuss 50 basis points.” The accompanying Statement on Monetary Policy forecast trimmed mean inflation peaking at 3.7 percent by mid-2026 and not returning to the target band until early 2027.

The March 16-17, 2026, meeting is the next critical event. Most major banks, including ANZ, expect a hold, as no quarterly CPI data will be available before then. However, CBA, NAB, and Westpac all lean toward a follow-up hike in May 2026 following the February decision. Market pricing indicates approximately 70 percent probability of a May hike to 4.10 percent, with the terminal rate potentially reaching 4.35 percent. The RBA’s hawkish stance distinguishes it from the US Federal Reserve, creating a widening interest rate differential that is the primary catalyst for AUD strength (https://www.commbank.com.au/articles/newsroom).

Growth Accelerates to 2.1 Percent but Inflation Bites Back Above Target

Australia is the 15th-largest economy globally with nominal GDP of approximately 1.83 trillion USD. The services sector accounts for roughly 65 percent of GDP and 79 percent of employment, while mining contributes approximately 13.5 percent of GDP but dominates the export profile. Total resources and energy exports reached approximately 385 billion AUD in FY2024-25, with iron ore generating 116 billion AUD. The industry is led by BHP Group, which posted FY25 revenue of 51.3 billion USD with record iron ore production of 290 million tonnes; Rio Tinto, which completed the 6.7 billion USD Arcadium Lithium acquisition; and Fortescue, whose net profit fell 41 percent to 3.37 billion USD on lower iron ore prices. Gold has surged to become the second-largest export by value, driven by record prices exceeding 5,000 USD per ounce (https://www.industry.gov.au).

China remains Australia’s dominant trading partner, absorbing approximately 24 percent of total goods and services trade, followed by Japan at 49.9 billion AUD, South Korea at 29.2 billion AUD, and India at 18.9 billion AUD. The trade relationship with China has stabilised significantly after years of bilateral tension, providing a tailwind for the trade balance. A massive increase in gold exports to the United States and a 140 percent surge in exports to Hong Kong in late 2025 indicate diversification of the export base.

Annual GDP growth accelerated from a trough of 0.8 percent in Q3 2024 to 2.1 percent by Q3 2025, the strongest annual pace since Q3 2023, driven by private investment surging 2.9 percent and household consumption growing 0.5 percent (https://www.abs.gov.au). The labour market delivered mixed signals: December 2025 unemployment fell to 4.1 percent with 65,200 jobs added, pushing total employment to a record 14.68 million. However, the participation rate declined to 66.7 percent from a peak of approximately 67.0 percent in October 2025, and full-year 2025 employment growth of approximately 176,000-182,000 was well below 2024’s 386,000.

A major structural theme is the government’s “Future Made in Australia” initiative, which aims to convert raw iron ore into green hot-briquetted iron for Asian markets, potentially doubling iron export revenues to 250 billion AUD annually by 2027. The Q4 2025 GDP release on March 4, 2026, will be a critical data point. The OECD projects growth of 2.3 percent in 2026 and 2.4 percent in 2027, while the RBA forecasts growth moderating to 1.8 percent by Q4 2026 as rate hikes feed through. Key downside risks include persistent inflation, a deeper China property downturn, US tariffs on Australian steel and aluminium, and weak productivity growth with unit labour costs rising approximately 4.7 percent annually (https://www.oecd.org).

RECORD GOLD, SURGING YIELDS, AND THE AUSSIE DOLLAR ABOVE 0.70

The Australian dollar above 0.70 is the market’s clearest verdict on the RBA’s hawkish divergence. With the 10-year yield at 4.87 percent, iron ore holding near 100 USD, and gold at record highs above 5,000 USD, the “commodity-carry” trade is firmly in play. The critical question for the next seven weeks is whether iron ore can hold its floor as Simandou supply ramps, and whether the March 17 RBA meeting confirms or undermines the market’s pricing of a May rate hike to 4.10 percent.

Bonds Rally, Iron Ore Holds, and AUD/USD Breaches a Three-Year High

Australian government bond yields surged to multi-year highs in early 2026, mirroring the RBA’s hawkish transition. The benchmark 10-year yield rose from approximately 4.10 percent in mid-2025 to 4.87 percent by February 9, 2026, a 48 basis point year-on-year increase and the highest level since October 2023. The 2-year yield climbed to approximately 4.25 percent, creating a positively sloped 2s-10s spread of roughly 60 to 65 basis points. Australia’s 10-year spread over US Treasuries widened to approximately 66 basis points, making it the highest-yielding developed-market sovereign and attracting significant carry-trade demand. Credit spreads have remained relatively stable, reflecting Australia’s economic soft-landing trajectory. The bond market outlook for February and March 2026 points to continued elevated yields, with the 10-year likely to trade in the 4.70 to 5.00 percent range. A potential May rate hike could push shorter-dated yields higher and flatten the curve (https://tradingeconomics.com/australia/government-bond-yield).

The S&P/ASX 200 endured a volatile period. After plunging 14.2 percent from its February 2025 high of 8,555.8 to a low of 7,343.3 in mid-April during the US “Liberation Day” tariff shock, the index rallied 23.8 percent to a record closing high of 9,094.7 on October 21, 2025. A correction in late November pushed it to 8,383 before a recovery to approximately 8,709 by early February 2026. The full-year 2025 price return of approximately 6-7 percent made the ASX 200 one of the weaker performing major equity indices globally, weighed down by narrow technology weighting and the truncated RBA cutting cycle. Financials led for much of 2025, with CBA posting a modest gain of approximately 3-5 percent, while gold miners were standout performers given gold’s extraordinary 65 percent rally. Mining giants underperformed early but staged a rotation rally in July, with Fortescue rising 16.3 percent in that month alone (https://www.livewiremarkets.com). The February 2026 rate hike dampened equity sentiment, and the technology sector fell to a two-year low.

Iron ore prices bottomed at 93.41 USD per tonne on July 1, 2025, recovered above 100 USD through Q3 and Q4 2025, and reached a yearly high of 107.88 USD on December 4 before settling near 100.11 USD in early February 2026. China’s property downturn continues with new home starts down nearly 20 percent, but blast furnace utilisation has been supportive and Chinese imports rose 2 percent in 2025. The Simandou mine in Guinea began formal mining operations in mid-November 2025, with first ore shipments departing in early December, expected to add 15 to 20 million tonnes of supply in 2026. Morgan Stanley forecasts an average of approximately 100 USD per tonne in 2026, while Goldman Sachs targets 93 USD and Westpac warns of a decline to 83 USD by year-end. Thermal coal at the Newcastle benchmark traded at 116 USD per tonne in early February, up 6.5 percent year-on-year, supported by Indonesian supply curtailments. Coking coal surged to 234.50 USD, up 23.4 percent year-on-year. Gold delivered an extraordinary 65 percent gain in 2025 to approximately 5,030 USD per ounce, with JP Morgan targeting 6,300 USD by year-end 2026 (https://tradingeconomics.com/commodity/iron-ore).

The Australian dollar broke above the 0.70 level against the USD following the February rate hike, trading near three-year highs at approximately 0.7040 to 0.7085, up 5.5 percent year-to-date. AUD/JPY reached a 35-year high of 110.32 on extreme RBA-BOJ policy divergence. Australia’s status as the highest-yielding G10 economy at 3.85 percent is the primary driver, alongside broad USD weakness and commodity tailwinds. The “commodity-carry” trade, where investors pair Australian yield with resource exposure, has re-emerged as the dominant positioning theme. The 12-month forward expected cash rate has shifted from a discount to a 100-basis point premium relative to the United States over the last six months. However, traders should remain vigilant: a sharp deterioration in Chinese demand or an unexpected spike in US unemployment could rapidly unwind the carry trade.

DATA-DEPENDENT AND DIVERGENT: THE INDICATORS DRIVING THE RBA’S NEXT MOVE

The data tell a story of an economy running hotter than expected. Inflation at 3.8 percent and unemployment at 4.1 percent leave the RBA with no room to ease. The February 20 labour force data and February 25 CPI release will be the decisive inputs for the March 17 meeting. A sub-4.2 percent unemployment reading or a CPI print above 3.6 percent would cement expectations for a May hike to 4.10 percent, further supporting the AUD’s carry-trade appeal.

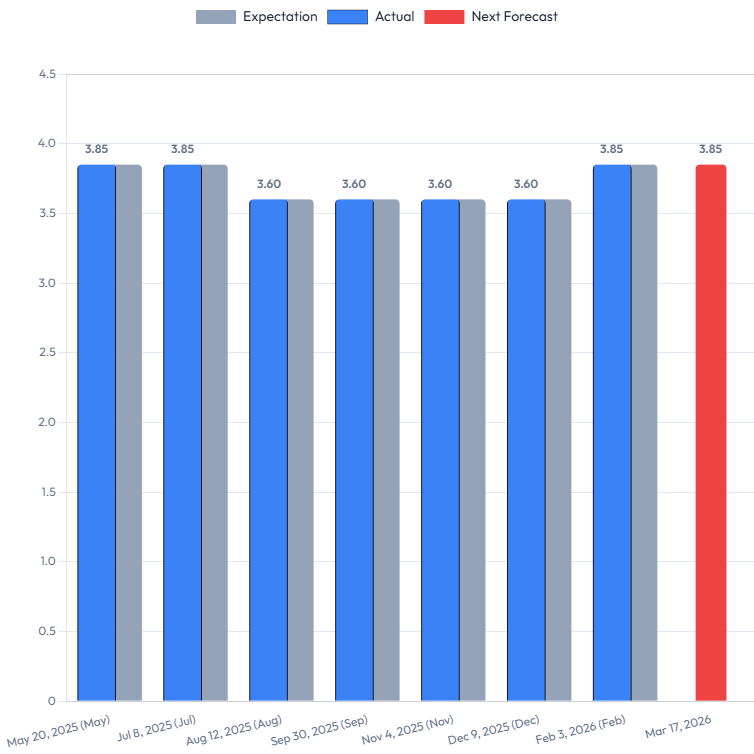

Interest Rate: RBA Cash Rate Target

The RBA’s cash rate decisions reflect one of the most dramatic monetary policy reversals among major central banks, with three cuts totaling 75 basis points in the first half of 2025 followed by a 25 basis point hike in February 2026.

Next Meeting: March 16-17, 2026, with the decision announced at 2:30pm AEDT on March 17. Trading Economics Forecast: 3.60 percent for end-2026 (pre-hike model; post-hike pricing implies 4.10 percent by May) (https://tradingeconomics.com/australia/interest-rate). Market Consensus: Divided. NAB, CBA, and Westpac lean toward a May hike to 4.10 percent; ANZ expects an extended hold at 3.85 percent. Long-Term View: The RBA’s February 2026 SMP projects underlying inflation not returning to the 2 to 3 percent band until early 2027. Econometric models project a trend toward 3.60 percent in 2027 and 3.10 percent in 2028. Remaining 2026 meeting dates: May 4-5, Jun 15-16, Aug 10-11, Sep 28-29, Nov 2-3, Dec 7-8.

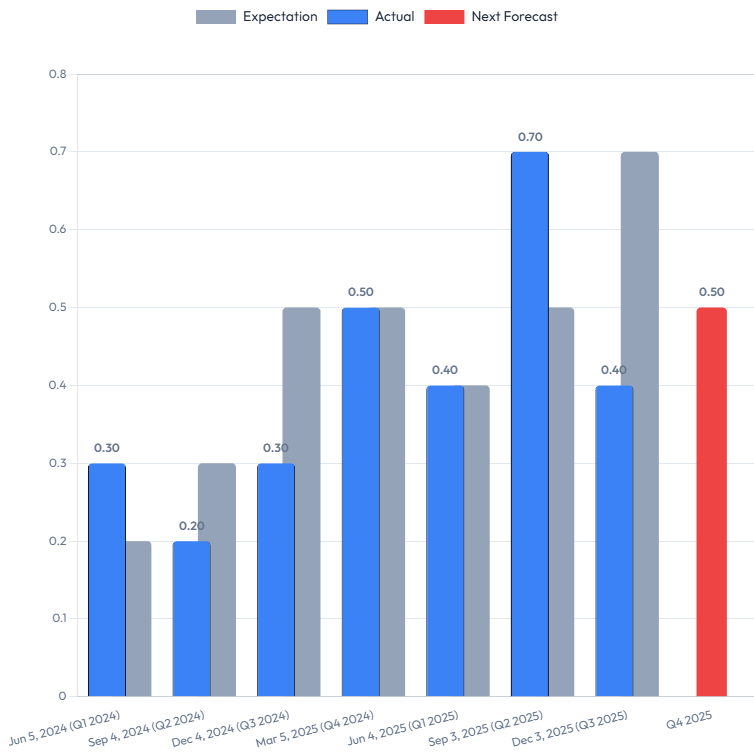

Economic Growth Rate: GDP

Quarterly GDP growth has oscillated between soft patches and modest rebounds, with annual growth accelerating from a trough of 0.8 percent in mid-2024 to 2.1 percent by Q3 2025.

Next Release: March 4, 2026, covering Q4 2025. Trading Economics Forecast: 0.50 percent quarter-on-quarter (https://tradingeconomics.com/australia/gdp-growth

). Market Consensus: Expected to centre near 0.5 percent. Long-Term View: The OECD projects annual growth of 2.3 percent in 2026 and 2.4 percent in 2027. The RBA’s February 2026 SMP forecasts growth moderating to 1.8 percent by Q4 2026. Trading Economics longer-term projections indicate 0.50 percent quarterly growth in 2027 and 0.60 percent in 2028.

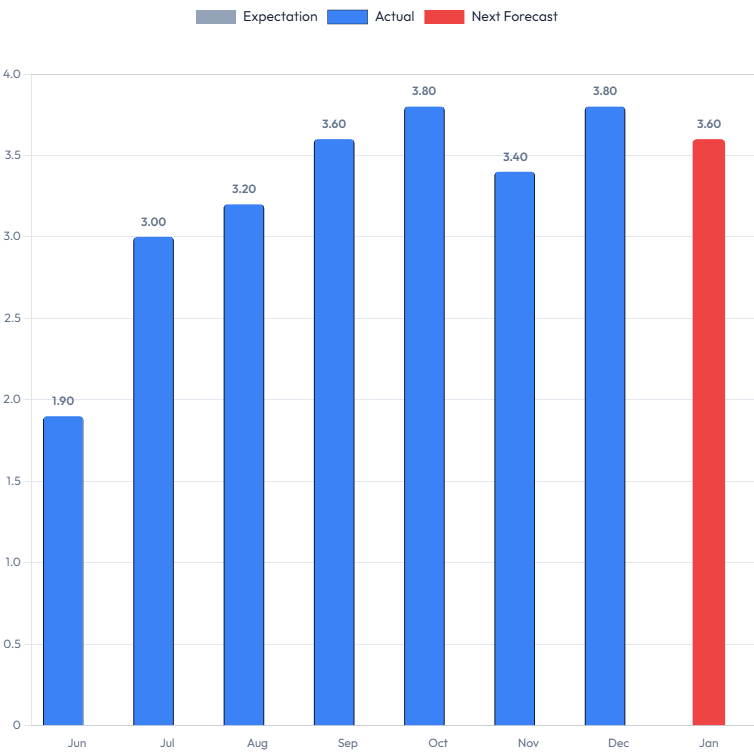

Inflation Rate: CPI (Year-on-Year)

Australia transitioned from quarterly to monthly CPI reporting in November 2025. Headline inflation surged from a low of 2.1 percent in Q2 2025 to 3.8 percent by December 2025, well above the RBA’s 2 to 3 percent target band.

Next Release: February 25, 2026, covering January 2026, at 11:30am AEDT. Trading Economics Forecast: 2.80 percent by end of Q1 2026, trending to 2.30 percent in 2027 (https://tradingeconomics.com/australia/inflation-cpi). Market Consensus: Analysts expect a potential repeat of the 3.8 percent reading due to services price inertia. Long-Term View: The RBA’s February 2026 SMP forecasts trimmed mean inflation peaking at 3.7 percent in mid-2026, remaining above the target band until early 2027, and declining to approximately 2.6 percent by mid-2028. Key drivers include housing costs rising 5.5 percent and electricity costs up 21.5 percent as state rebates expired.

Unemployment Rate

The Australian labour market has remained resilient, with unemployment falling to 4.1 percent in December 2025, significantly below market expectations.

Next Release: Thursday, February 20, 2026, covering January 2026. Trading Economics Forecast: 4.30 percent for Q1 2026, with longer-term projections of 4.40 percent in 2027 and 4.20 percent in 2028 (https://tradingeconomics.com/australia/unemployment-rate). Market Consensus: The December 2025 reading of 4.1 percent was the lowest since May 2025 and a significant beat versus the 4.4 percent consensus. The RBA’s February 2026 SMP forecasts unemployment rising gradually to 4.3 percent by Q4 2026 and 4.5 percent by Q4 2027. The historical average is 6.53 percent; the record low is 3.4 percent from October 2022.

Employment Change

Monthly employment additions have been volatile, ranging from a loss of 21,300 in November to a gain of 65,200 in December 2025.

Next Release: Thursday, February 20, 2026, covering January 2026. Trading Economics Forecast: +34,200 for Q1 2026, with a longer-term trend of approximately +15,000 per month in 2027 (https://tradingeconomics.com/australia/employment-change). The December 2025 gain of 65,200 was the strongest since April 2025, comprising 54,800 full-time and 10,400 part-time positions, pushing total employment to a record 14.68 million. Calendar year 2025 net employment growth of approximately 176,000-182,000 was significantly below 2024’s 386,000. The participation rate fell to 66.7 percent in December from a peak of approximately 67.0 percent in October 2025.

Other Economic Indicators Due in the Upcoming Two Weeks (February 9-23, 2026)

Week of February 9-13, 2026: The Westpac-Melbourne Institute Consumer Sentiment Index for February is expected on or around February 10. The January reading was 92.9, down 1.7 percent month-on-month and in pessimistic territory. This will be the first consumer sentiment reading following the RBA’s 25 basis point hike and is closely watched for its signal on household confidence (https://tradingeconomics.com/australia/consumer-confidence). NAB Business Confidence for January is also expected during this week, along with the ABS Household Spending Indicator and Dwelling Finance data for December.

Week of February 16-20, 2026: This is the highest-impact week. The Wage Price Index for Q4 2025 is expected around Wednesday, February 19, representing a critical input for the RBA’s assessment of inflation persistence; the Q3 2025 reading showed wages growing at 3.4 percent annually. On Thursday, February 20, the Labour Force Survey for January 2026 is due, covering the unemployment rate (previous: 4.1 percent, TE forecast: 4.3 percent), employment change (previous: +65,200, TE forecast: +34,200), and the participation rate (previous: 66.7 percent). The RBA Meeting Minutes from the February 3 decision are expected during this week, providing detail on the Board’s deliberations around the rate hike (https://tradingeconomics.com/australia/calendar).

Week of February 21-23, 2026: Private Capital Expenditure data for Q4 2025 may fall in this window. RBA board member speeches are expected throughout. The January 2026 Monthly CPI is due on February 25, falling just outside this two-week window but representing a critical inflation data point ahead of the March 17 meeting.

This is an extremly thorough breakdown of the Aus economy and your connection between RBA policy and fiscal dynamics is super insightful. The point about Australia being the odd one out globally while everyone cuts rates isnt getting enough attention. I've been tracking iron ore markets for awhile and your Simandou analysis is spot on. Feb meeting is definately gonna be huge for AUD.