Australian Dollar Currency Report September

Derbyshire, UK – September 19, 2023: The first edition of the Australian Dollar Currency Report explains how the Australian dollar may have a volatile time ahead. The next update is planned to be published after the RBA monetary policy meeting on Tuesday, October 3rd or before if any significant event occurs.

Decisions to trade are made at your own monetary risk.

Australian Dollar Currency Report Summary

The macroeconomic outlook for Australian (AU) is mixed and suggests the Australian dollar could be volatile due to slowing economy, geopolitical tensions but higher commodity prices.

The AU interest rate is anticipated to be held at its present level which is likely to lead to stagnant borrowing. This suggests an indifferent outlook for the AU economy which may apply indifferent pressure to the value of the Australian dollar.

AU GDP is projected to deteriorate in Q3. The Q2 report beat expectations and suggests a slightly pessimistic outlook for the AU economy which may apply some downward resistance to the value of the Australian dollar.

AU CPI is projected to fall towards 4.25% in 2023. The 6.0% for Q2 beat expectations and suggests a slightly optimistic outlook for the AU economy which may apply upward support to the value of the Australian dollar.

AU unemployment is projected to rise to 4.0% in 2023. The 3.7% in August matched expectations and suggests an indifferent outlook for the AU economy which may apply some indifferent support to the value of the Australian dollar.

The Australian-China trade war is likely to apply downward pressure to the value of the Australian dollar as the tariffs applied by China are having an effect on Australian exports.

The AUKUS alliance is likely to apply some upward support to the value of the Australian dollar as it brings security to the region as well as jobs. However, it may also add to the increasing tensions between Australia and China which would add downward pressure to the value of the Australian dollar.

The war in Ukraine will at times cause risk aversion and may lead to decreased foreign investment and apply downward pressure to the value of the Australian dollar. However, the war has led to a rise in commodity prices, such as iron ore and coal which Australia is a major exporter of and may apply some upward support to the Australian dollar.

Monetary Policy

The Reserve Bank of Australia (RBA) Reserve Bank Board

In Australia, monetary policy decisions are made by the nine members of the Reserve Bank Board. The cash rate is the rate charged on overnight loans between financial intermediaries.

The September meeting saw a rate hold of the target Cash rate, leaving it at 4.10% which is the same as the hold in August. Markets were expecting a hold.

The latest rate now matches the Trading Economics Q3 ‘23 forecast of 4.10% which they also identify as the peak.

Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.10% and a high of 4.10%. Over the previous six months, the rate has continued to climb.

The next meeting is due on Tuesday, October 3rd.

The Reserve Bank Boards September statement summarised:

Interest rates have increased by 4 percentage points since May last year.

Inflation in Australia has passed its peak and is expected to continue to decline, but is still too high and will remain so for some time.

The Australian economy is experiencing a period of below-trend growth, and is expected to continue to do so for a while.

Returning inflation to target within a reasonable timeframe remains the Board's priority.

There are significant uncertainties around the outlook, including the persistence of services price inflation, the lags in the effect of monetary policy, and the outlook for household consumption.

Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks.

Sources: Reserve Bank of Australia, Statements on Monetary Policy, Trading Economics, FXStreet

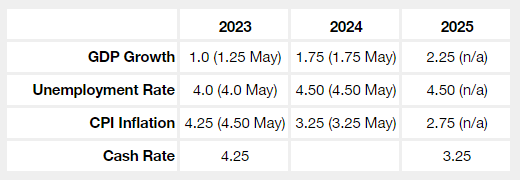

Outlook from the Statement on Monetary Policy

The Reserve Bank Board revised its outlook at their September meeting. They will update them again in November.

Inflation is too high and is expected to remain above the target until mid-2025.

The labour market is still tight, but conditions have eased a little.

Economic activity is expected to remain subdued.

The housing market has turned around earlier than anticipated.

There are both upside and downside risks to the inflation outlook.

Monetary conditions have tightened further over recent months.

The RBA is taking steps to ensure that inflation returns to the target range within a reasonable time.

ECONOMIC DATA

Gross Domestic Product (GDP)

The quarterly change in the value of all goods and services produced across the AU during Q2 remained at 0.40%, the same as the first quarter (Q1 revised up from 0.20%), and above expectations of 0.30%.

Over the previous nine quarters, the rate of growth has been trending down with a high of 3.90% and a low of -2.10%. Over the previous three quarters, the rate of growth has been falling although now stable.

The latest report is on track to achieve the Reserve Bank Boards GDP 2023 annual growth rate outlook of 1.0% (revised down from 1.25%) if the Trading Economics Q3 ‘23 forecast of 0.1% q/q is accurate.

The next report is published on Wednesday, December 6th.

Sources: Australian Bureau of Statistics, Trading Economics, FXStreet

Consumer Price Index (CPI)

The yearly change in the average price of goods and services purchased by consumers across the AU during Q2 fell to 6.0%, below expectations of 6.2%.

Over the previous nine months, CPI has been trending up with a high of 7.8% and a low of 1.1%. Over the previous three months, CPI has fallen quickly.

The latest report is on track to beat the Reserve Bank Boards 2023 CPI rate outlook of 4.25% if the Trading Economics Q3 ‘23 forecast of 5.1% is accurate.

The next report is published on Wednesday, October 25th.

Sources: Australian Bureau of Statistics, Trading Economics, FXStreet

Labour

Measures the number of people actively looking for a job as a percentage of the labour force.

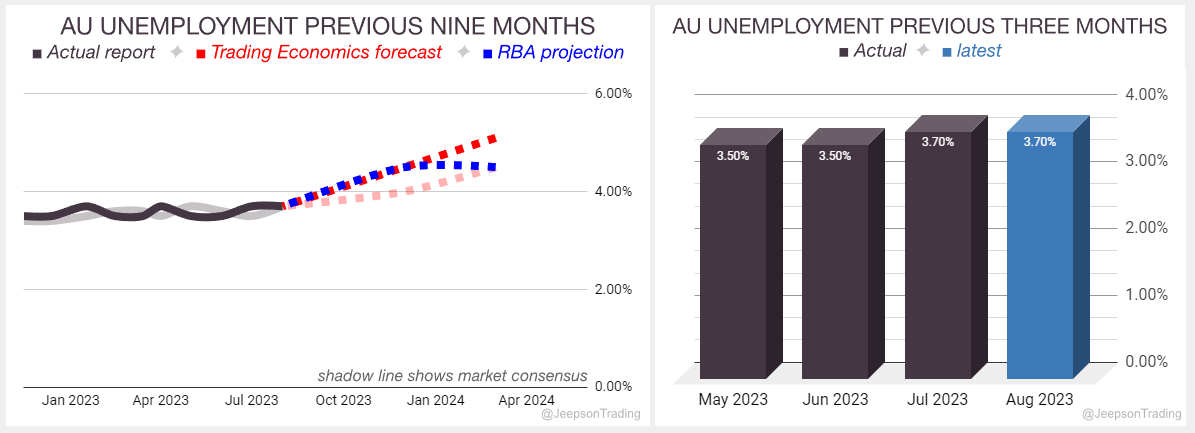

As a percentage of the labour force, unemployment across the AU for August remained at 3.7% as expected.

Over the previous nine months, unemployment has been moving sideways with a low of 3.5% and a high of 3.7%. Over the previous three months, unemployment has continued to move sideways.

The latest report is on track to match the Reserve Bank Boards 2023 unemployment rate outlook of 4.00% if the Trading Economics Q3 ‘23 forecast of 3.7% is accurate.

The next report is published on Friday, October 20th.

Sources: Australian Bureau of Statistics, Trading Economics, FXStreet

Market Influences

Australia-China Trade War

Australia has long been wary of China’s intentions and has been publicly critical of their human rights record, endorsed an international investigation into the origins of COVID-19 and banned the use of Huawei in government contracts.

The sentiment of caution towards China by Australia is what caused China to place tariffs and bans on Australian goods in 2020. The effects have been detrimental to the Australian economy, especially the agricultural sector. The Australian government is trying to reduce its reliance on China by diversifying its trading partners and investing in new industries.

April 2020: Australia calls for an independent inquiry into the origins of COVID-19.

May 2020: China imposes tariffs on Australian barley.

November 2020: China imposes tariffs on Australian wine.

December 2020: China bans imports of Australian coal.

March 2021: China extends the tariffs on Australian wine for another five years.

April 2022: Australia temporarily suspends its WTO action against China's tariffs on Australian wine, pending an expedited review by China.

August 2022: China ends its barley tariffs.

The AUKUS alliance

AUKUS is a security agreement between Australia, the United Kingdom, and the United State intended to counter China’s military build up. The agreement was announced in September 2021 and aims to provide Australia with nuclear-powered submarines and other advanced technologies, such as cyber warfare and artificial intelligence.

September 2021: The AUKUS pact is announced by the leaders of Australia, the United Kingdom, and the United States. France recalls its ambassadors from Australia and the US in protest of the pact as it involves cancelling a prior contract.

November 2021: The US, UK, and Australia hold their first trilateral meeting under the AUKUS pact.

February 2022: The US, UK, and Australia sign an agreement to help Australia build nuclear-powered submarines.

March 2022: The US announces that it will sell three Virginia-class nuclear-powered submarines to Australia.

May 2022: The US, UK, and Australia hold their second trilateral meeting under the AUKUS pact.

June 2022: The Australian government announces that it will build a new nuclear submarine base in South Australia and settles the disagreement with France by way of compensation.

August 2022: The UK announces that Australian submariners will receive training aboard Astute-class nuclear-powered submarines.

March 2023: Japanese Prime Minister Kishida Fumio expresses his support for Australia's planned acquisition of US-made nuclear-powered submarines under the AUKUS pact.

Russian Invasion of Ukraine

The war in Ukraine has raised concerns about the potential for a wider conflict between Russia and the West. Australia is a member of NATO, and it is committed to supporting its allies in the event of a conflict with Russia.

The war in Ukraine has also had a significant impact on the global economy, causing energy prices to rise and disrupting supply chains. This is having a negative impact on the Australian economy, which is already facing a number of other challenges.

February 2022: Russia launches a full-scale invasion of Ukraine.

March 2022: The Australian government announces a ban on exports of alumina and bauxite to Russia.

March 2022: The Australian government announces a ban on imports of Russian oil and gas.

March 2022: The Australian government announces a $25 million package to support Australian businesses affected by the war in Ukraine.

April 2022: The Australian government announces a $6.5 million package to support Ukrainian refugees in Australia.

May 2022: The Australian government announces a $100 million package of military aid to Ukraine.

June 2022: The Australian government announces a $100 million package of economic aid to Ukraine.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-