Autumn Budget Jitters Rattle Sterling

Saturday, October 12, 2024 (Week 41)

The dominant theme impacting the British pound and UK markets during the past week has been the looming Autumn Budget, set for release on October 30th. Chancellor Reeves' hints of "difficult decisions" have fueled uncertainty, contributing to market volatility and a weaker pound. Adding to the anxiety, the 10-year gilt yield climbed above 4.2%, near three-month highs, on October 10th. While positive data, like the 4.7% YoY surge in UK house prices reported on October 7th (the most robust growth since November 2022), offered some respite, the budget's uncertainty has been paramount.

Over the past month, UK economic uncertainty has been the prevailing theme. Mixed economic signals and an unclear BoE policy path have kept investors cautious. This has contributed to the pound's fluctuations against other major currencies. Upbeat surprises in retail sales and the housing market offered temporary support. However, the narrative of a slowing economy, coupled with concerns about global economic health and weaker PMI figures, has weighed on sterling.

Investment Thesis

Upcoming Week (October 12 - October 18): Bearish. Market focus remains fixed on the Autumn Budget. Expect persistent volatility and potential further weakness for the pound until the details are revealed. Key economic indicators, like the September CPI and labour market data, are scheduled for release next week. They will offer insights into the state of the UK economy, but they are likely to be overshadowed by the budget's influence.

Upcoming Month (October 12 - November 30): Neutral. The Autumn Budget’s release on October 30th will be a pivotal event. A positive market reaction to fiscally responsible, growth-supportive measures could trigger a pound recovery. However, a negative perception could lead to further GBP weakness. The November BoE meeting will also be critical. The market will be keenly analysing the Bank’s assessment of the budget's economic impact and any signs of monetary policy shifts.

UK Economy: Navigating Uncertainty

GDP: Growth Moderates

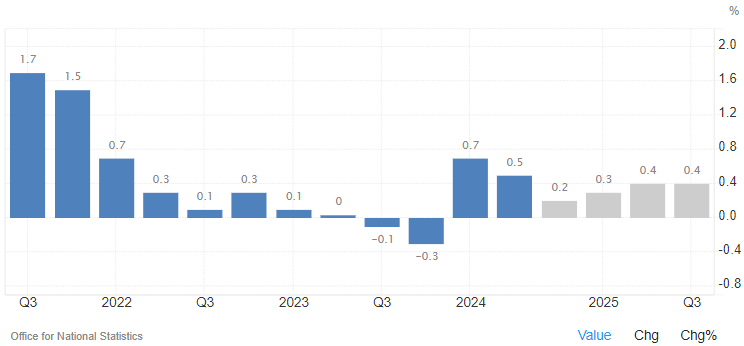

UK GDP growth has presented a mixed picture lately. Q1 and Q2 2024 witnessed growth of 0.7% and 0.6%, respectively, exceeding BoE forecasts (Office for National Statistics). However, more recent data indicates a deceleration. Monthly GDP figures were stagnant in June and July before a modest 0.2% rise in August. The BoE anticipates 0.3% growth in Q3, marking a slight downward revision. This uncertain performance has added to the volatility surrounding the pound. Confirmation of a slowdown could weaken sterling. A positive surprise, however, may offer support.

Inflation: Persistent Price Pressures

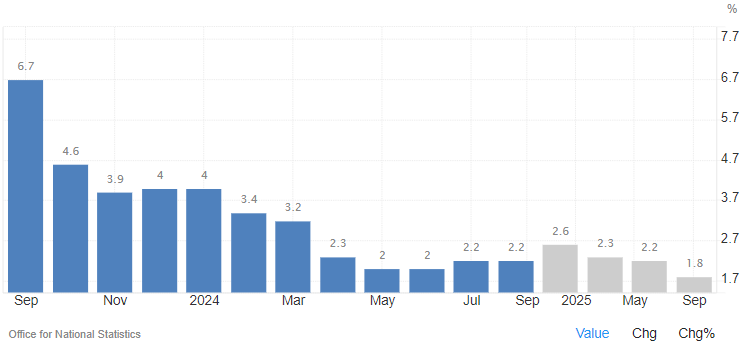

UK inflation, while declining, remains stubbornly above the BoE's 2% target. August CPI inflation held steady at 2.2%, unchanged from July (Office for National Statistics). Although this represents a notable drop from the peaks seen in 2023, persistent services inflation at 5.6% is troubling policymakers. This stickiness in core inflation has tempered expectations of rapid rate cuts, keeping the pound under pressure. Further declines, especially in services inflation, are essential for bolstering the currency.

Labour Market: Gradual Loosening

The UK labour market remains tight, albeit with gradual signs of loosening. The unemployment rate dipped to 4.1% in the three months to July, its lowest since January (Office for National Statistics). Wage growth has moderated but stays elevated. Average weekly earnings, including bonuses, were up 4% year-on-year in July (Office for National Statistics), a decrease from previous months yet still above levels aligned with the 2% inflation goal. Continued wage pressure could compel the BoE to maintain its current stance, limiting upward movement for the pound.

Consumer and Business Sentiment: Budget Jitters

Consumer and business confidence data underscore the prevalent economic uncertainty. The GfK consumer confidence index dropped to -20 in September, its lowest in six months, reflecting apprehension surrounding the Autumn Budget (GfK Group). The CBI's monthly retail sales balance saw a slight uptick to +4% in September, but retailers' concerns about the financial outlook persist (BRC - British Retail Consortium). This cautious sentiment is a drag on the pound. The market’s response to the budget will be pivotal for both future sentiment and currency performance.

Upcoming Economic Data and Events

Key economic data and events for next week with potential to influence the pound:

Tuesday, October 15: Unemployment Rate, Average Earnings (3Mo/Yr), Employment Change

Wednesday, October 16: Inflation Rate YoY, Core Inflation Rate YoY, Inflation Rate MoM

Friday, October 18: Retail Sales MoM, Retail Sales ex Fuel MoM, Retail Sales YoY

UK Monetary Policy: Balancing Act

Bank of England: Hawkish Hold

The BoE maintains a cautious approach to monetary policy. The Bank Rate was held at 5% during the September meeting, defying rate cut expectations (Bank of England). This reflects the Bank's focus on persistent inflation, particularly within the services sector. While some members advocate for easing, the majority favours a holding pattern until inflation’s return to the 2% target appears more sustainable. This relatively hawkish stance has provided the pound with some support. However, uncertainties about the future policy trajectory limit its potential for significant appreciation. The BoE’s plan to reduce gilt holdings by £100 billion over the next year signals ongoing quantitative tightening.

UK Intermarkets: Volatility and Uncertainty

Bond Market: Budget Anxiety Drives Yields

UK bond yields have been climbing, reflecting concerns about the Autumn Budget. The past week saw the 10-year gilt yield surpass 4.2%, reaching near three-month highs. This reflects growing investor anxiety surrounding potential fiscal imbalances. The bond market will be closely watching the budget announcements and assessing their implications for government borrowing.

Equity Market: FTSE's Uneasy Ride

The FTSE 100’s performance has mirrored the broader economic uncertainty, fluctuating in response to various factors. While occasional positive economic news has provided temporary boosts, concerns about the upcoming budget and the global economic outlook have limited gains. The equity market is waiting for greater clarity from both the Autumn Budget and the BoE's reaction to it.

Commodity Market: Indirect Influence

Fluctuations in commodity prices, notably oil and gold, can affect sentiment, but their direct impact on the pound has been relatively limited recently. The dominant drivers for the GBP continue to be economic data, monetary policy, and the forthcoming budget.

UK Geopolitics: Budget and Global Risks

Politics: Budget Dominates the Landscape

The UK political scene is dominated by the upcoming Autumn Budget. The market's reaction will be a key test of the government's credibility and could significantly impact sterling. Any signs of fiscal mismanagement or a lack of a well-defined strategy to tackle the UK's economic challenges could trigger a sell-off in both the pound and UK assets.

Geopolitics: External Uncertainties

Global geopolitical risks, including the conflict in Ukraine and escalating Middle East tensions, remain a significant concern. While their direct effect on the UK has been limited thus far, these situations have the potential to spark market volatility and negatively affect the pound.

Sovereign Risk: Fiscal Reckoning Approaches

The UK's sovereign risk profile faces increasing scrutiny as investors evaluate the government's long-term fiscal sustainability. The Autumn Budget will be a critical test of the government’s commitment to responsible fiscal management. A believable plan to address public debt and control spending is crucial for maintaining market confidence and supporting the pound.

Pound Valuation: Budget Holds the Key

Currency Valuation: GBP's Uncertain Future

The pound has been under pressure recently, mirroring the prevailing economic uncertainty and diverging monetary policy expectations. GBP has weakened against the USD, slipping below $1.31 to near one-month lows. The impending Autumn Budget is a significant factor contributing to the currency's vulnerability. While better-than-expected economic data and a more hawkish BoE could offer some support, the overall trend for sterling appears weak.

Investment Thesis and Key Takeaways

The outlook for the British pound is clouded by uncertainty. The Autumn Budget's reception and the BoE's reaction will be pivotal in determining the currency's direction. Key downside risks include a negative market response to the budget, stubbornly high inflation, and a more pronounced economic slowdown. Potential upside could come from a fiscally sound budget, stronger-than-anticipated economic data, or a more hawkish shift from the BoE. Investors are advised to diligently monitor these factors and be prepared for ongoing pound volatility.