Bears Circle EUR/USD as US CPI Looms

Week Number 37 2023 Market Analysis (first update)

DERBYSHIRE GB / SEPTEMBER 10th, 2023 - The week ahead is significant for the next phase of the dollar. We get US CPI on Wednesday which may see another rise. Investors will also be watching the ECB meeting on Thursday and the updated projection material.

US Dollar Bears Are Ready if CPI Misses Expectations

Macroeconomic analysis suggests the US dollar will have bullish strength and this is matched by the recent moves which are extending the two-month long uptrend of the DXY. The gain is recently supported by risk-averse sentiment looking at rates being higher for longer due to last week’s PMI and balance of trade reports, both of which were higher than expected as well as hawkish comments by Fed officials. Intermarkets are also reflecting this sentiment with the S&P 500 falling below the 50-day moving average and the yield on six-month treasury bonds remains steady above 5.5%. Fed fund futures show that the higher rates are being priced in with September favouring a hold over a hike ( 90/10) and November also favouring a hold although only slightly ahead of a 0.25 hike (60/40).

The week ahead will be pivotal for the next direction of the dollar as Wednesday will see CPI potentially climb for the second consecutive month suggesting inflation is sticky, requiring interest rates to be higher for longer resulting in a stronger dollar. However, bears will jump into the markets should there be a miss to the downside. Also watch Thursday when retail sales are expected to show a fall over the previous month.

The following week is headlined by the FOMC meeting and it is highly likely that rates will be held although sentiment for November remains mixed.

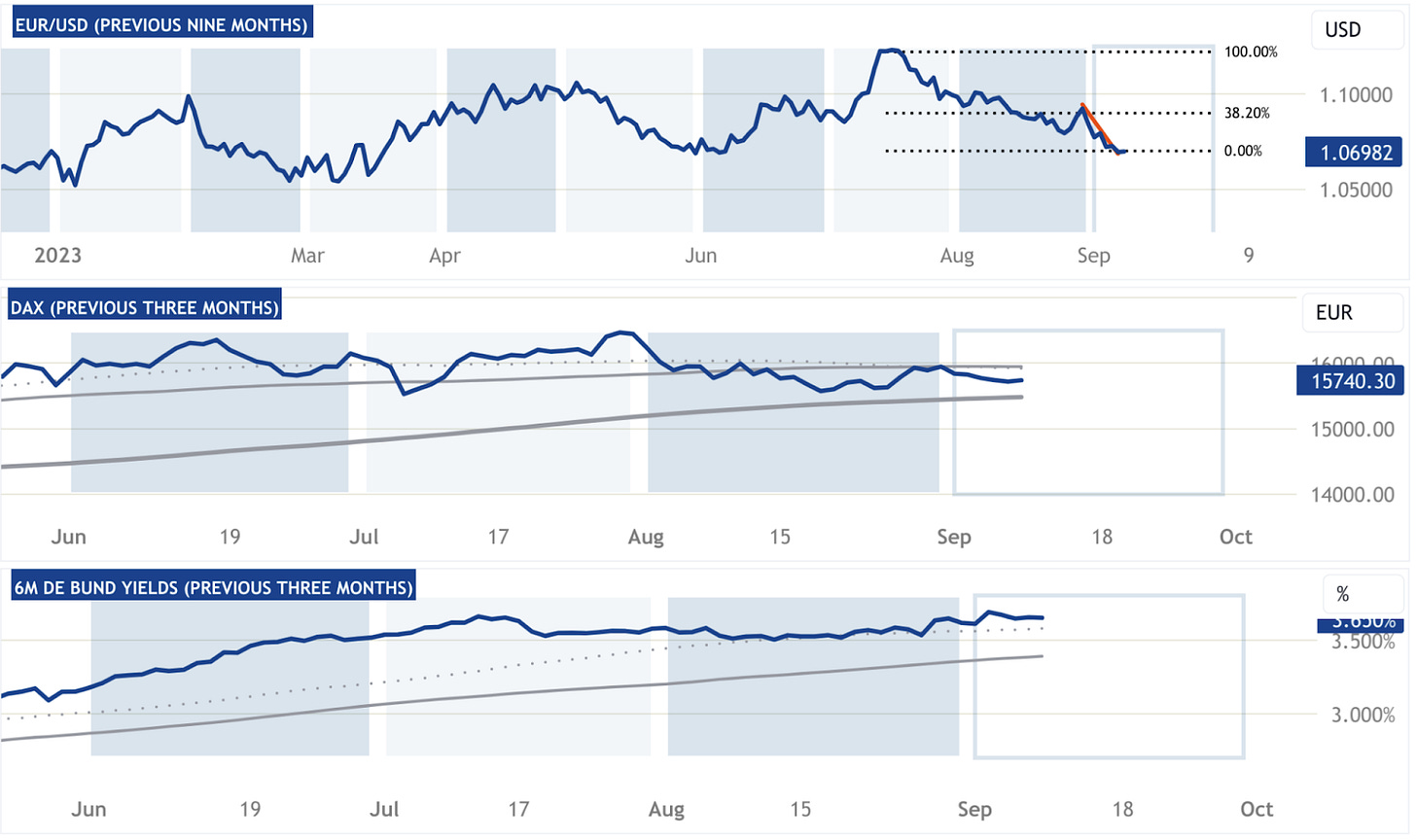

Euro Steady Prior to ECB Meeting but Watch for US CPI

Macroeconomic analysis suggests the Euro will have bearish weakness and this is matched by the recent moves which are extending the two-month long downtrend of the EUR/USD. The fall is recently pressured by a risk-averse sentiment due to a slowing EU economy which is losing the interest of foreign investors. Intermarkets are also reflecting this sentiment with the DAX falling below the 100-day moving average and the yield on six-month German bunds remains steady above 3.6%.

The week ahead will be pivotal for the next direction of the EUR/USD as Wednesday will see US CPI potentially climb for the second consecutive month suggesting inflation is sticky, requiring interest rates to be higher for longer resulting in a stronger dollar. Also watch Thursday when the ECB is expected to hold rates at 4.25% and although economic stimulus is on the minds of investors it is highly unlikely that this will be mentioned although pay attention to the press conference and updated projection materials.

The following week is headlined by the FOMC meeting and it is highly likely that rates will be held although sentiment for November remains mixed. There will also be the final EA CPI report for August.

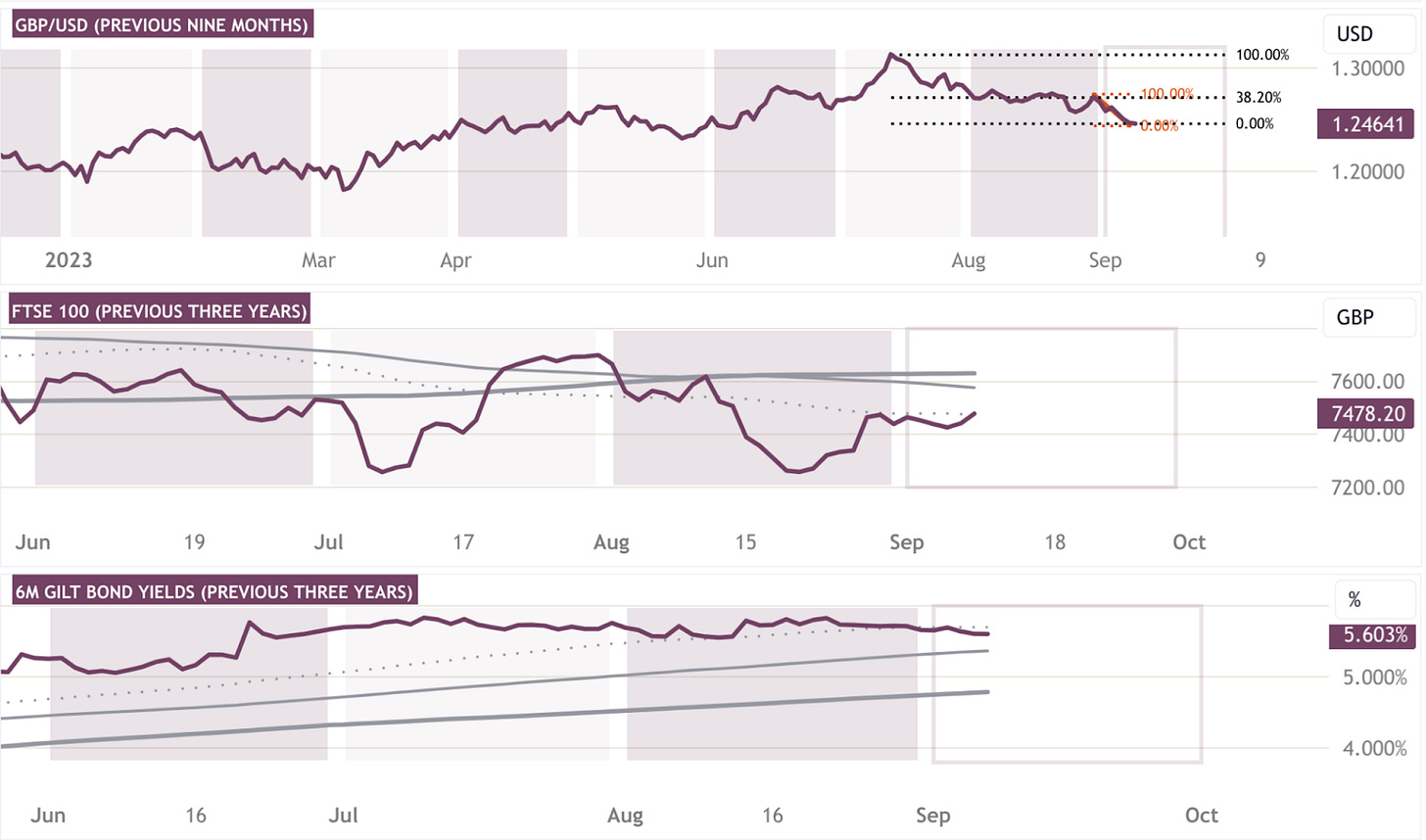

Pound Bears Have Control

Macroeconomic analysis suggests the Pound will have bearish weakness and this is matched by the recent moves which are extending the two-month long downtrend of the GBP/USD. The fall is recently pressured by a stronger dollar rather than sentiment pricing in a a weaker pound. Intermarkets are also reflecting this sentiment with the FTSE 100 regaining above the 50-day moving average and the yield on six-month Gilt bonds falling although still above 5.6%.

The week ahead is likely to see some weakness building for the GBP/USD as the GDP report on Wednesday is expected to show a contraction occurred during July and if the US CPI comes in hotter as is expected then this too would further pressure the GBP/USD.

The following week will be significant as it will see the BoE and FOMC meetings as well as a fresh reading on UK CPI.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-