Big Week of Central Banks and Inflation

Market Analysis for Week Number 50 2023

DERBYSHIRE UK, Dec 10, 2023, Week 50. The focus of the upcoming week will be towards the central bank meetings and observations for dovish hints in their press conferences.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

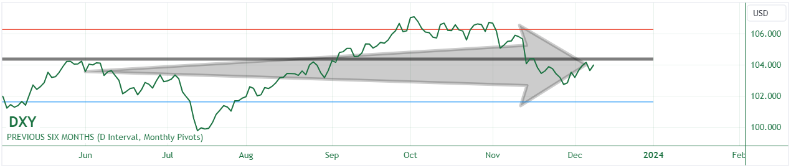

DXY

The key narrative that is influencing the short-term direction of the DXY is the prospect of a slowdown in the US labour market, which could lead to the Federal Reserve easing its monetary policy more quickly than expected.

CME Group 30-Day Fed Fund futures:

97% in favour of a hold at the December meeting, very slightly down from 99% last week

First rate cut of 0.25% priced in has been pushed back to May (49%, prev 52% for March)

The DXY is at a higher value today than it was six days ago because of several factors:

The US economy added more jobs than expected in November and the jobless rate fell to 3.7%. This data suggests that the US economy is still relatively strong and that the Federal Reserve may not need to raise interest rates as aggressively as previously thought.

The University of Michigan's consumer sentiment index rose to 69.4 in December, the highest level since August. This suggests that US consumers are becoming more optimistic about the economy and that they may be more likely to spend money.

The yield on the US 10-year Treasury bond rose by as much as 13bps to 4.26%, rebounding from a 3-month low of 4.11% hit on Wednesday. This suggests that investors are becoming more confident in the US economy and that they are willing to accept a higher return on their investments.

The DXY is at about the same value than it was six months ago:

The Federal Reserve has kept the benchmark interest rate at 5.50% and has been consistent in their message that rates will remain higher for longer.

The US economy is showing signs of slowing down. This has also made the US dollar less attractive, as investors seek out assets that are considered to be safer havens.

The inflation rate in the US has been declining. This has made the US dollar less attractive to investors who are looking for assets that will yield returns in excess of inflation.

This Week's Key Events:

US Core Inflation Rate MoM NOV (December 12, 2023, 14:30 GMT): A higher-than-expected reading could strengthen the dollar as it would signal that inflation is still a concern for the Fed.

US Federal Reserve Rate Decision (December 13, 2023):

Next Week's Key Events:

US Retail Sales MoM NOV (December 14, 2023, 14:30 GMT): A stronger-than-expected reading could strengthen the dollar as it would signal inflationary pressures.

US MBA 30-Year Mortgage Rate DEC/15 (December 20, 2023, 13:00 GMT): A higher-than-expected reading could weaken the dollar as it would make borrowing more expensive and could dampen consumer spending.

Paid-subscribers can view the Dollar Trade Plans here.

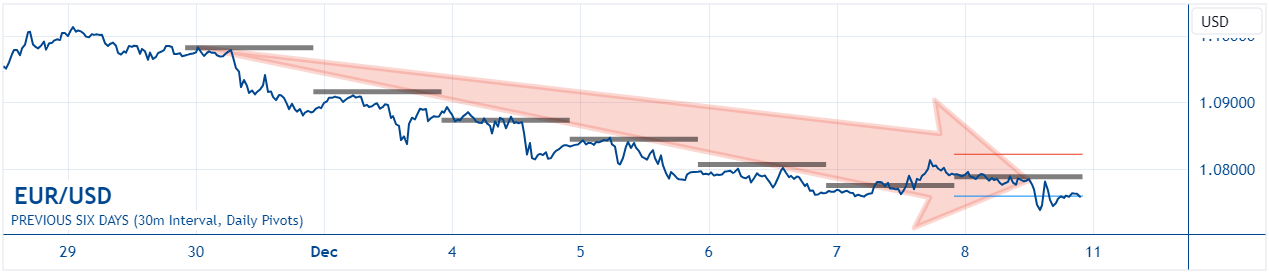

EUR/USD

The key narrative that is influencing the short-term direction of the EUR/USD is the expectations of a rate cut by the ECB.

The EUR/USD is at a lower value than it was six days ago because of the following reasons:

Dovish comments from ECB policymakers: ECB policymakers have been more dovish in recent days, suggesting that they may be less likely to maintain high interest rates in the future. This has weakened the euro against the dollar, which is considered a risk-off asset.

Signals of a weakening US labour market: There have been some signs in recent weeks that the US labour market is weakening. This could lead the Federal Reserve to be less aggressive with its rate hikes, which would also put downward pressure on the euro.

Weak economic data from the Eurozone: Economic data from the Eurozone has also been weak in recent months. This has made investors less optimistic about the eurozone economy, which has also put downward pressure on the euro.

The EUR/USD is at about the same value than it was six months ago due to the following factors:

The ECB's dovish stance: The ECB has become increasingly dovish in recent months, signalling that it may cut interest rates in the near future. This has weakened the euro against the dollar, as the dollar is considered a safe-haven asset.

Declining inflation in the Eurozone: Inflation in the Eurozone has eased in recent months, falling below the ECB's target of 2%. This has reduced the urgency for the ECB to raise interest rates, further weakening the euro.

Softening economic growth in the Eurozone: The Eurozone economy is expected to contract in 2023, and growth is expected to remain weak in 2024. This has also weighed on the euro.

Rising unemployment in the Eurozone: Unemployment in the Eurozone has risen in recent months, reaching a level of 6.5% in October 2023. This is a further sign of weakness in the Eurozone economy.

This Week's Key Events:

ZEW Economic Sentiment Index (DEC): A higher reading suggests that investors are more optimistic about the Eurozone economy, which could boost the euro.

ECB Interest Rate Decision and Press Conference: The ECB will announce its interest rate decision on Thursday, December 14. If the ECB cuts interest rates, the euro is likely to fall. If the ECB does not cut interest rates, the euro is likely to rise.

Next Week's Key Events:

Final Inflation Rate YoY (NOV): The Eurozone's final inflation rate for November will be released on Tuesday, December 19. If inflation is lower than expected, it could ease ECB pressure to raise interest rates, which could support the euro. If inflation is higher than expected, it could increase ECB pressure to raise interest rates, which could put downward pressure on the euro.

Paid-subscribers can view the EUR/USD Trade Plans here.

GBP/USD

The key narrative that is influencing the short-term direction of the GBP/USD is the Bank of England's upcoming policy meeting due on Thursday. Expectations lean toward the UK central bank keeping interest rates steady at a 15-year high, while traders are particularly focused on policymakers' perspectives regarding growth and inflation, seeking cues about the potential timing for the first rate cut.

The GBP/USD is at a lower value than it was six days ago due to a combination of factors, including:

Weak UK economic data: The S&P Global/CIPS UK Composite PMI was revised higher to 50.7 in November 2023, up from 48.7 in October. However, this reading indicated the first expansion of UK private sector output since July. Growth was confined to the service economy, while manufacturing production saw a marginal decline, the smallest since April.

High US interest rates: The Federal Reserve is expected to maintain interest rates in December, which could make the US dollar more attractive to investors.

Downbeat economic sentiment: The BRC-KPMG report showed cautious British consumers delayed Christmas spending in November, despite Black Friday deals. This suggests that the UK economy is facing headwinds.

The GBP/USD is at about the same value as it was six months ago because the economic situation of the United Kingdom has been relatively stable over the past few months.

The Bank of England has maintained a relatively hawkish stance, keeping interest rates at a 15-year high of 5.25%. This has helped to keep inflation in check, but it has also weighed on economic growth.

The UK economy has stalled in recent quarters, but it is not expected to enter a recession. GDP growth is expected to be modest in the coming quarters, but it should be enough to support the GBP/USD.

Inflation in the UK has moderated in recent months, but it is still above the Bank of England's target of 2%. This could put some upward pressure on the GBP/USD in the future.

This Week's Key Events:

Bank of England Interest Rate Decision (Thursday, December 14): The Bank of England is widely expected to keep interest rates unchanged at 5.25% this week. However, any hints from policymakers about the timing of the first rate cut could have a significant impact on the GBP/USD.

UK Unemployment Rate (October) and Average Earnings incl. Bonus (3Mo/Yr) (Tuesday, December 12): Strong employment data could support the GBP, while weaker data could weigh on the currency.

Next Week's Key Events:

UK CBI Industrial Trends Orders (December) (Tuesday, December 19): This release will gauge business sentiment in the UK manufacturing sector. Positive sentiment could lift the GBP, while negative sentiment could drag it down.

UK Inflation Rate YoY (November) and Core Inflation Rate YoY (November) (Wednesday, December 20): These two releases will measure the rate of price growth in the UK. If inflation is higher than expected, the GBP could fall. If inflation is lower than expected, the GBP could rise.

Paid-subscribers can view the GBP/USD Trade Plans here.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from th e5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-

Great rundown