BOJ’s Policy Tightrope: Yen Strength Amidst Economic Uncertainty

Saturday, October 12, 2024 (Week 41)

The Japanese yen has appreciated recently, primarily due to the Bank of Japan's (BOJ) hawkish monetary policy. However, the JPY's upward trajectory has been moderated by mixed domestic data. Weaker-than-expected industrial production and retail sales for August (released August 26th) have contributed to market fluctuations. Market narratives are centred on the BOJ's challenge of controlling inflation while also considering the potential impact of a strong yen on Japan's export-oriented economy.

Throughout the last month, the JPY’s narrative has been influenced by its safe-haven status. Geopolitical tensions, particularly in the Middle East, periodically triggered risk-off flows into the JPY. Despite reaching a two-week high of 39,606 on October 10th, the Nikkei 225 has faced headwinds from global risk aversion and Japan's uncertain economic outlook. Tokyo’s core CPI exceeding forecasts at 2.4% in August (released August 30th) added another layer of complexity, influencing speculation about future BOJ policy adjustments.

Investment Thesis:

Upcoming Week (October 12 - 18): Neutral. Several factors will likely influence the JPY in the upcoming week. These include the BOJ’s policy stance, key economic data releases like the Current Account (Aug) and Reuters Tankan Index (Oct), and the overall global risk environment. This confluence of factors creates a neutral outlook.

Upcoming Month (October 12 - November 30): Neutral. The JPY’s trajectory over the coming month remains uncertain. While the BOJ's hawkish policy and the yen’s safe-haven appeal could lend support, the evolving economic situation in Japan and fluctuations in global market sentiment may exert countervailing pressures.

Japanese Economy: Assessing Growth, Inflation, and Sentiment

GDP: Growth Momentum and External Risks

Japan's Q2 2024 GDP grew by 0.7% qoq, exceeding expectations (Cabinet Office, August 8th). This was fueled by higher consumer spending and business investment, though tempered by weak external demand. Trading Economics forecasts 0.3% qoq growth for Q3 2024. The JPY could be negatively impacted if the strong yen further weakens export demand.

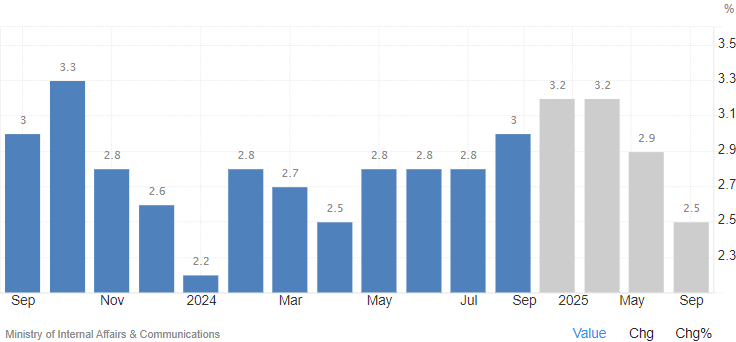

Inflation: Persistent Price Pressures

Inflation in Japan reached a 10-month high of 3.0% year-on-year in August (Ministry of Internal Affairs & Communications, September 20th). Core inflation, excluding fresh food, also accelerated to 2.8%, exceeding the BOJ's 2% target. This persistent price pressure could reinforce the BOJ's hawkish stance and influence future policy decisions.

Labour Market: Tightening Conditions

Japan’s unemployment rate improved to 2.5% in August (Ministry of Internal Affairs & Communications, September 27th). However, the slight decline in the jobs-to-applications ratio adds a layer of nuance to the labour market picture.

Consumer and Business Sentiment: Mixed Signals

Consumer confidence rose to a high of 36.9 in September (Cabinet Office, September 27th). Conversely, the Reuters Tankan index for manufacturers fell to a seven-month low of +4 in September (Reuters, October 4th). These mixed signals highlight ongoing economic uncertainty.

BOJ Monetary Policy: Hawkish Bias and Future Expectations

The BOJ's hawkish stance has been a crucial factor in the JPY’s recent appreciation. The central bank held its interest rate steady at 0.25% in September (Bank of Japan, September 20th), signalling a pause after two rate hikes earlier in the year. However, the BOJ indicated it is prepared to continue raising rates if inflation persists above target. The market is anticipating potential rate increases later this year, with the BOJ's outlook report and Governor Ueda's speech on October 31st being key events to watch.

JPY Intermarket Dynamics

Bond Market: Yields Rise on Hawkish Expectations

The Japanese 10-year bond yield has climbed from its four-week low of 0.84% on September 13th to near 4% at the end of September, reflecting expectations for higher interest rates. The BOJ's policy stance will be the primary driver of JGB yields in the coming weeks.

Equity Market: Nikkei's Trajectory Tied to BOJ Policy

The Nikkei 225's performance has mirrored broader market trends and economic anxieties, with the strong yen and rising interest rates acting as headwinds for certain sectors. The BOJ's policy decisions and communications will continue to be key influences on equity market performance.

Commodity Market: External Factors Remain Important

As a significant commodity importer, Japan is susceptible to fluctuations in global commodity prices. The recent decline in iron ore prices due to softening Chinese demand is an important factor to monitor, particularly for the potential impact on Japanese manufacturers’ sentiment.

Geopolitical Landscape and Sovereign Risk

Political and Geopolitical Risks: Uncertainties on the Horizon

Japan faces several political and geopolitical challenges, including the ongoing recovery from the January 2024 Noto Peninsula earthquake, the evolving US-China relationship, and potential regional tensions stemming from North Korea. These factors introduce uncertainties into the economic and financial outlook, with implications for the JPY.

Sovereign Risk: Fiscal Prudence Remains Key

Despite its high credit rating and low sovereign risk, Japan's large public debt necessitates close attention to fiscal policies. Maintaining fiscal discipline and pursuing debt consolidation measures will be essential for ensuring market confidence and stability.

JPY Currency Valuation: A Confluence of Influences

The JPY's valuation is shaped by an array of factors. Monetary policy, domestic economic performance, the yen's safe-haven status, and overall market sentiment all influence the JPY's trajectory. The BOJ’s hawkish stance has been pivotal, bolstering the JPY's strength. However, uncertainty over future policy adjustments and the evolving domestic and global economic landscape necessitate ongoing vigilance.

Investment Thesis and Key Takeaways:

The JPY's strength is anchored in the BOJ's hawkish stance and its safe-haven status. However, uncertain economic conditions and potential changes in global sentiment add risks to the outlook. Japan's economic recovery continues, but concerns remain about the impact of a stronger yen on exports and the effects of persistent inflation. The BOJ's upcoming outlook report and Governor Ueda's speech on October 31st will be key indicators of future monetary policy, significantly impacting the JPY. Investors should closely monitor economic releases, central bank statements, and geopolitical factors to anticipate future JPY fluctuations.