Selling the GBP/USD 🇬🇧 🇺🇸

Fed brings the bears, BOE brings the bulls

SUMMARY

The sentiment has opposing forces that may keep the GBP/USD in a range until the US CPI data comes out on Thursday. The market is pricing in an annual inflation of 8.0 percent for October which would be a fall from 8.2 percent for September.

The USD is expected to be resistant to higher moves until the report comes out.

The GBP USD will be:

Bullish if US CPI is lower than expected

Bearish if US CPI is higher than expected

The on-going Risk Level One orders to sell GBP/USD will be maintained as the Stop Loss level at 1.182 is not expected to be broken.

After Thursday's US CPI data the market attention will move towards Friday’s UK preliminary Q3 GDP report which is expected to show a contraction of 0.5 percent and will likely resist higher moves on the GBP/USD.

SENTIMENT

BOE POLICY SUPPORTS THE GBP/USD AGAINST MOVES LOWER

On Thursday the 3rd of November the Bank of England hiked rates by 0.75 percent and commented that higher rates are necessary to control inflation but probably not as high as has been priced in. This was interpreted as a dovish move but in reality it is simply less-hawkish.

The outlook is still dire as the bank projects a two-year investment but the not-as-bad as expected moves on rates will improve sentiment towards borrowing costs. This in turn will move the FTSE 100 away from overly-bearish moves as earnings pick up due to less-than-terrible consumer spending and foreign investment. There may also be some pick up on government bonds resulting in a lower peak yield than had been expected.

FED POLICY RESISTS THE GBP/USD AGAINST MOVES HIGHER

On Wednesday the 2nd of November the Federal Reserve hiked rates by 0.75 percent and commented that it would be better to raise too-high rather than too-low. This has been interpreted as a hawkish move.

The outlook on higher rates is bad news for growth due to higher borrowing costs. This will have a bearish effect on the S&P 500 as earnings fall due to lower consumer spending and foreign investment. There may also be a fall in government bonds resulting in a higher peak yield than had been expected.

𝗙𝗨𝗡𝗗𝗔𝗠𝗘𝗡𝗧𝗔𝗟𝗦

UNITED KINGDOM

The Monetary Policy Committee of the Bank of England (BoE) met yesterday on the 3rd of November and a decision was made to hike the Bank Rate (Interest Rate) by 0.75 percent to 3.00 percent which was as expected and fully priced in. The policy outlook is less hawkish as the Governor Andrew Bailey commented that it is likely that rates will not rise as much as markets are pricing in. The meeting was accompanied by a fresh monetary policy report which projects a recession for the next two years. The MPC will meet again next month on Thursday the 15th of December.

The outlook for:

UK GDP is pessimistic deterioration (pr. )

UK CPI is indifferent improvement (pr. )

UK Unemployment is pessimistic deterioration (pr. )

UNITED STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met earlier this week on the 2nd of November and a decision was made to hike the Federal Funds Rate (Interest Rate) by 0.75 percent to 3.75-4.00 percent which was as expected and fully priced in. The policy outlook is hawkish as Chairman Powell commented that hikes will go higher than previously projected (4.6 percent in Sep). The FOMC will meet again next month on Wednesday the 14th of December and the CME FedWatch tool indicates 60 percent odds of a 0.50 hike and 40 percent of a 0.75 hike.

The outlook for:

US GDP is pessimistic deterioration (pr. )

US CPI is optimistic improvement (pr. )

US Unemployment is pessimistic deterioration (pr. )

𝗧𝗘𝗖𝗛𝗡𝗜𝗖𝗔𝗟𝗦

SHORT TERM

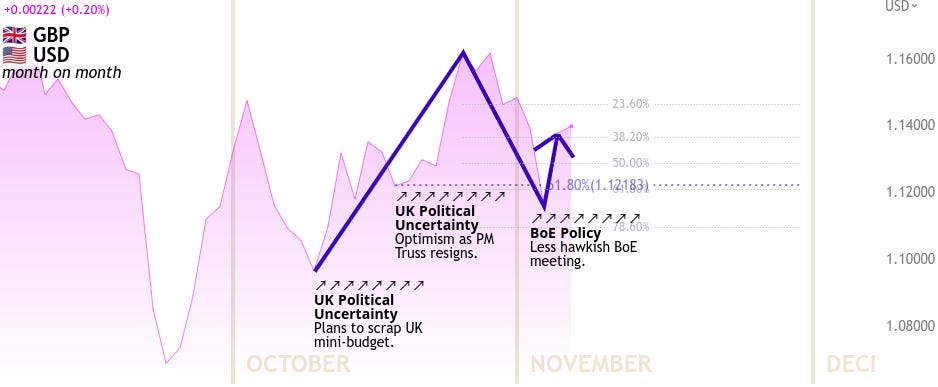

The short term view (month on month) shows that the GBP/USD has been uptrending since last month that began in mid-October when the unfunded fiscal policy of the-then Chancellor Kwarteng was planned to be reversed.

This optimism was further supported as the-then PM Truss announced her resignation and paved the way for Rishi Sunak to take office as PM. This sentiment faded towards the end of October as the ‘rishi rally’ peaked.

Into this month of November the Sterling lost value against a hawkish Federal Reserve who forecast higher than expected rates. However - the Bank of England painted a terrible but not as bad as expected picture last week which has supported the Sterling against moves lower.

LONG TERM

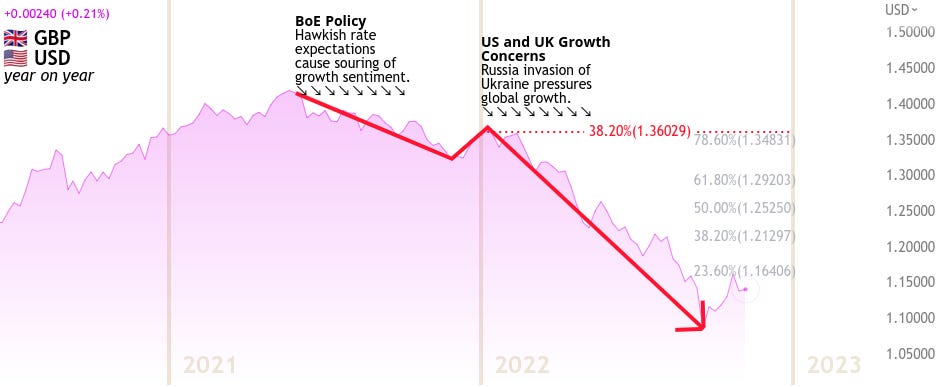

The long term view (month on month) shows that the GBP/USD has been downtrending since last year, which began in mod-2021 when the inflation rate began to pick up in the UK and expectations were elevated that the Bank of England would look to raise rates sooner than had been previously expected.

This Sterling fall was pressured further as safe haven flows into the USD picked up this year in February 2022 as Russia invaded Ukraine. The subsequent sanctions that followed and lack of supply to the energy markets pushed global inflation higher than had been anticipated and central banks have had to tighten at a record pace. This has lowered global growth which keeps the USD higher and GBP lower.

𝗘𝗡𝗗 𝗗𝗜𝗦𝗖𝗟𝗔𝗜𝗠𝗘𝗥

Copy traders will automatically be entered into all orders placed by JeepsonTrading.

subscribe for full access to research and analysis www.jeepsontrading.substack.com

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.