Tuesday April 15th Update: This trade couldn’t have gone any better…pip perfect…

Fair Value Trending Lower Amidst Headwinds

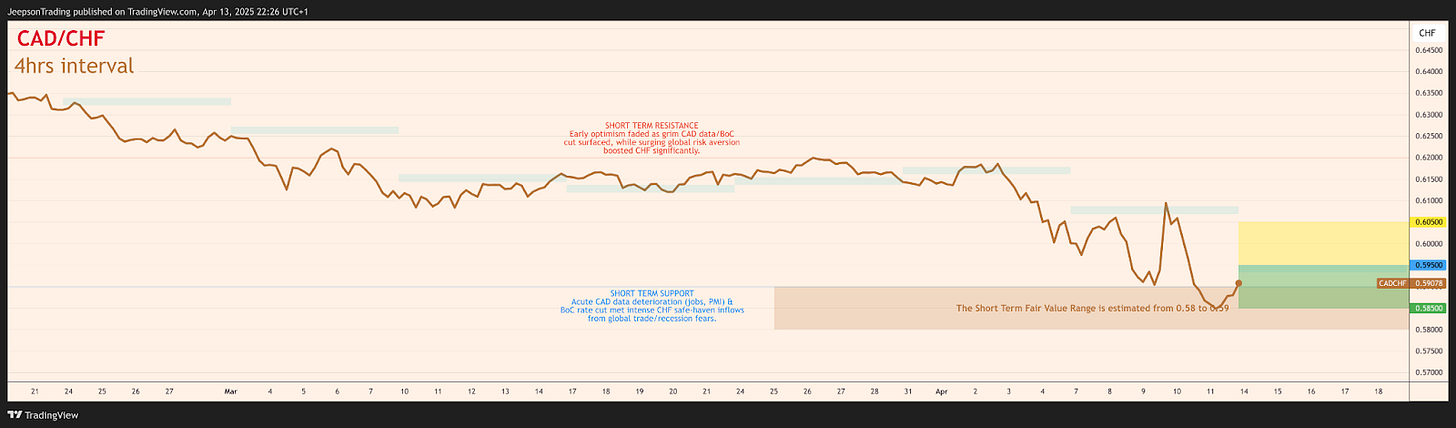

The CAD/CHF pair is expected to remain bearish in the coming week, with a fair value around 0.585. This bearish outlook is primarily fueled by the Bank of Canada's upcoming policy meeting on April 16th and the ongoing negative repercussions of the US-Canada trade war. The BoC is expected to maintain its dovish stance, acknowledging the economic downturn and emphasizing downside risks, which will likely put downward pressure on the CAD. Conversely, the Swiss Franc is expected to remain strong due to its safe-haven appeal amid global trade tensions.

The previous week saw the CAD/CHF pair fall dramatically from levels near 0.6180 to a low of 0.5877, breaking through support levels at 0.6100 and 0.6000. This sharp decline was triggered by the confirmation of harsh US tariffs, Canada's retaliation, and dismal Canadian jobs data, coupled with safe-haven inflows into the Swiss Franc.

While the BoC is expected to hold rates at 2.75%, the accompanying Monetary Policy Report and press conference are anticipated to adopt a strongly dovish tone. This, contrasted with the Swiss Franc's continued strength, is likely to push the pair's fair value lower. Canadian inflation data on April 15th is secondary to the growth narrative but could add volatility, while the Swiss trade balance on April 17th is unlikely to significantly alter the dominant risk sentiment driving CHF strength.

Canadian Data Dominates the Calendar

The key economic events for CAD/CHF traders in the upcoming seven days are heavily weighted towards Canada, culminating in the Bank of Canada's policy decision.

Apr 15, 2025 (CAD): Housing Starts (Mar 2025) - Forecast: 238K. Expected Impact: Likely minor unless a significant deviation occurs; market focus is primarily on inflation and the BoC.

Apr 15, 2025 (CAD): Inflation Rate YoY (Mar 2025) - Forecast: N/A (TE: 2.80%). Expected Impact: A reading in line with or slightly above forecast may have limited impact as growth concerns dominate; a significant downside surprise could amplify BoC easing expectations, pressuring CAD/CHF lower.

Apr 15, 2025 (CAD): Core Inflation Rate YoY (Mar 2025) - Forecast: N/A (TE: 2.80%). Expected Impact: Similar to headline inflation, focus will be on the BoC's interpretation within the context of the growth slowdown.

Apr 15, 2025 (CAD): Inflation Rate MoM (Mar 2025) - Forecast: 0.70% (TE: 0.80%). Expected Impact: Less impactful than the annual rate, likely overshadowed by the upcoming BoC meeting.

Apr 16, 2025 (CAD): Bank of Canada Interest Rate Decision - Forecast: 2.75%. Expected Impact: The hold is widely anticipated; the key market driver will be the tone of the statement, MPR, and press conference. An expected dovish message confirming growth concerns would be bearish for CAD/CHF.

Apr 16, 2025 (CAD): Bank of Canada Monetary Policy Report (MPR) & Press Conference. Expected Impact: Crucial for forward guidance. Acknowledgment of severe economic impact from trade disputes should reinforce CAD weakness and push CAD/CHF lower.

Apr 17, 2025 (CHF): Balance of Trade (Mar 2025) - Forecast: CHF 3.9B. Expected Impact: Secondary driver. A strong surplus could offer marginal CHF support (bearish CAD/CHF), but is unlikely to override broader risk sentiment or BoC impact.

Trading Strategy: Selling Rallies

Given the strong bearish fundamental outlook for CAD/CHF, a strategy focused on selling rallies appears appropriate. The sharp decline has left the pair potentially oversold in the very short term, suggesting opportunities might arise to enter short positions at more favourable levels near resistance.

Entry Level: Consider initiating short positions if the pair rallies towards 0.5950, just below the significant psychological and technical resistance level of 0.6000. Waiting for price action confirmation (e.g., rejection candles on higher timeframes) near this zone could improve entry timing.

Stop-Loss: Place a stop-loss approximately 100 pips above the entry point.

Profit Target: An initial profit target could be set near 0.585, near the recent lows. Achieving this target would depend heavily on the BoC delivering the anticipated dovish message and the absence of any positive resolution to the US-Canada trade dispute.

CONCLUSION

Conviction Tempered by Event Risk

Conviction Level: High, based on the strong alignment of fundamental factors: severe Canadian economic downturn driven by the trade dispute, expected dovish BoC policy response, and the CHF's firm position as a preferred safe haven.

Key Risks:

BoC Dovishness Underwhelms: If the BoC's statement or press conference is less concerned about growth than anticipated, perhaps focusing more on residual inflation, it could trigger a CAD short-covering rally.

Trade De-escalation: Any unexpected positive developments or signals of negotiation progress in the US-Canada trade dispute would rapidly undermine the bearish CAD thesis.

Global Risk Appetite Shift: A significant improvement in global risk sentiment (e.g., positive US-China news) could diminish safe-haven demand for the CHF, slowing the pair's decline.

Oil Price Spike: While currently secondary, a substantial and sustained surge in oil prices could offer some temporary support to the CAD.

Technical Rebound: Following the sharp sell-off, the pair is susceptible to a technical bounce before resuming its downtrend.

Trader Takeaways

For traders approaching CAD/CHF this week, the fundamental picture is overwhelmingly bearish. The Canadian economy is clearly suffering from the trade dispute, and the Bank of Canada is expected to acknowledge this reality. The Swiss Franc, conversely, continues to benefit from global uncertainty. Therefore, the path of least resistance appears lower. However, the upcoming BoC meeting constitutes significant event risk, capable of causing sharp volatility. Selling rallies towards the 0.6000 resistance area offers a potential strategy, but careful risk management, including appropriate stop-loss placement, is essential given the potential for news-driven price swings. Keep a close eye on BoC communications and any headlines related to US-Canada trade relations.