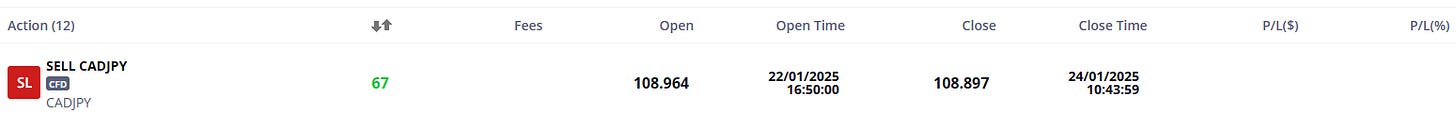

Friday, January 24, 2025: Stop loss has been lowered to 108.9, removing all risk from the trade as the entry is at 109.

Wednesday, January 22, 2025, Week 4

The Canadian dollar and Japanese yen have been on diverging paths recently. The Loonie's been struggling under the weight of political uncertainty after Trudeau's resignation and the looming threat of US tariffs. Meanwhile, the yen's been fluctuating, caught between a moderately recovering Japanese economy and the BOJ's ambiguous stance on monetary policy. Geopolitical tensions, especially the US-China trade spat, are adding fuel to the fire, making this a tricky but potentially rewarding pair to trade. The upcoming BoC and BOJ meetings will be key, so we'll need to keep a close eye on those.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

CAD/JPY: Weak - Bearish Outlook

The dominant narrative for CAD/JPY over the past ten days has been the divergence in monetary policy between the Bank of Canada (BoC) and the Bank of Japan (BOJ). The BoC's dovish stance, fueled by weak Q3 GDP growth (1% annualized) and rising unemployment (6.8% in November), contrasts sharply with the BOJ's potential shift towards normalization, driven by persistent inflation (2.9% YoY in November) and a moderately recovering economy (Q3 GDP revised up to 0.3% QoQ). Trudeau's unexpected resignation on January 6th added to the CAD's woes, injecting political uncertainty into the mix.

The latest COT report (January 14th) showed a bearish positioning in CAD futures, with Asset Managers significantly net short and Leveraged Funds also net short. JPY futures positioning was mixed, with Leveraged Funds holding a substantial net short position while Other Reportables were significantly net long. This divergence in JPY positioning suggests conflicting views on the currency's near-term trajectory.

Upcoming Economic Indicators

Jan 24: JP Inflation Rate YoY (DEC), covering inflation in December. Forecast: 3.00%. Market Reaction: JPY strength if inflation surprises to the upside, potentially signaling a more hawkish BOJ. JPY weakness if inflation disappoints.

Jan 24: JP BoJ Interest Rate Decision. Forecast: 0.50%. Market Reaction: JPY strength if the BOJ hikes, likely triggering a sharp CAD/JPY sell-off. JPY weakness if the BOJ holds, potentially leading to a CAD/JPY rally.

Jan 24: JP BoJ Press Conference and Summary of Opinions. Market Reaction: High impact. Hawkish commentary and signals of future tightening would support JPY. Dovish commentary would weigh on JPY.

Jan 29: CA BoC Monetary Policy Report, covering the BoC's economic and inflation outlook. Market Reaction: Will set the tone for the rate decision. Hawkish commentary could support CAD; dovish commentary would weigh on it.

Jan 29: CA BoC Interest Rate Decision. Consensus: Potential rate cut. Market Reaction: CAD weakness if the BoC cuts or maintains a dovish tone, especially with negative forward guidance. Limited CAD strength if the BoC surprises with a hawkish hold.

Jan 29: JP Consumer Confidence (JAN). No specific forecast, but previous data suggests potential improvement. Market Reaction: Modest JPY support if confidence improves significantly, but BOJ policy remains the primary driver.

Trade Thesis

The current setup favors a short CAD/JPY position. The BoC's dovish bias, driven by weak economic data and political uncertainty, contrasts sharply with the potential for BOJ normalization amid persistent inflation. This divergence in monetary policy is the primary driver of the bearish outlook. Upcoming economic indicators, particularly the BoC and BOJ meetings, will be crucial. A BoC rate cut or dovish guidance, coupled with a BOJ hike or hawkish signals, would reinforce the bearish CAD/JPY view. Conversely, a surprise hawkish hold by the BoC or a dovish hold by the BOJ could invalidate the trade. Trump's trade policies, especially concerning potential tariffs on Canada, and any escalation in US-China tensions could further weigh on CAD, supporting the short trade.

Trade Plan

The plan is to sell CAD/JPY, capitalizing on the diverging monetary policy outlooks and the potential for a risk-off environment.

Entry: ~109

Stop-Loss: 200 pips

Take-Profit: ~106.50

Conclusion

This trade plan is based on a confluence of factors favoring a short CAD/JPY position. The diverging monetary policy outlooks between the BoC and BOJ, the political uncertainty in Canada, and the potential for a risk-off environment all support the bearish view. The upcoming central bank meetings will be crucial in determining the trade's success. Conviction level: Moderately High. While the fundamental and technical backdrop is favorable, unexpected news or policy shifts could impact the trade, so active risk management is essential.

Sources

Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve (Fed), Bank of Japan (BOJ), Bank of Canada (BoC), Statistics Canada, Cabinet Office Japan, Ministry of Internal Affairs and Communications (Japan), Ministry of Finance Japan, CFTC.