CANADA, CAD, AND OIL

The immediate future for the CAD hinges on inflation data and central bank signaling. Traders should prepare for volatility around data releases that will confirm or deny the “neutrality trap” thesis.

Monday, 02 February 2026

The immediate future for the CAD hinges on inflation data and central bank signaling. Traders should prepare for volatility around data releases that will confirm or deny the “neutrality trap” thesis. If inflation spikes, the “hold” becomes a “hike” risk; if it collapses, the door to cuts reopens.

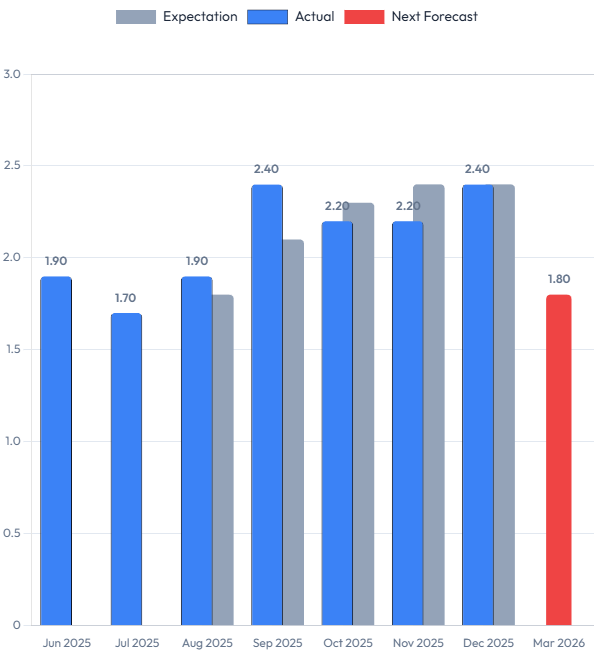

Feb 17 CPI: Above 2.5% would remove dovish bets, likely boosting CAD. Below 2.0% would revive cut calls, weakening the currency.

Mar 18 Rate Decision: hold expected, traders will look for any shifts in the “neutral rate” assessment or commentary on the US trade war. A hawkish hold could decouple the CAD from broader risk sentiment.

CANADA’S ECONOMIC PIVOT: FISCAL DEFENSE AND STRUCTURAL TRANSITION

Canada is executing a high-stakes structural pivot under Prime Minister Carney, attempting to move from consumption-led growth to capital investment to counter US protectionism. The sentiment is defensive yet determined. The “Canada Discount” persists as the economy stalls and the Bank of Canada remains frozen at 2.25 percent to protect the currency. The immediate outlook depends on whether fiscal stimulus can offset trade headwinds without reigniting inflation in early 2026.

The Carney Doctrine: A Technocratic Response to Protectionism

The governance of Canada has shifted dramatically following the general election of April 28, 2025, which saw Mark Carney take the helm as Prime Minister. Leading a minority Liberal government, the administration has moved away from broad consumption stimulus toward a rigorous “Capital Budgeting Framework.” For you as a trader, this is the key pivot to watch: the government is now focused entirely on restoring industrial competitiveness to counter the United States’ “One Big Beautiful Bill Act” (OBBBA). This US legislation, passed in July 2025, introduced permanent tax incentives and protectionist measures that threatened to siphon capital away from Canada. In response, Finance Minister François-Philippe Champagne has been tasked with a defensive fiscal strategy dubbed “Building Canada Strong,” which aims to stop that capital flight cold.

Fiscal policy has become aggressive and highly targeted. Breaking with tradition, Minister Champagne tabled the primary budget on November 4, 2025, projecting a deficit of 78.3 billion CAD for the 2025-2026 fiscal year. This wasn’t just standard spending; it introduced immediate spending to match US provisions and outlined a roadmap to catalyze one trillion CAD in private investment. To fund this without blowing out the bond market, the government has initiated a comprehensive expenditure review targeting 60 billion CAD in savings over five years. This “spend money to make money” approach is a high-stakes gamble on productivity.

Looking at the immediate horizon, you need to be aware of the “fiscal cliff” hitting consumers. The temporary GST/HST holiday is set to expire on February 15, 2026, which will likely create a drag on retail consumption in late Q1. Simultaneously, the legislative agenda is heating up with Bill C-19, designed to support low-income households, and preparations for the Spring Economic Statement. The government is also aggressively diversifying trade ties, pushing an “East-West” strategy with missions to the Gulf and Indo-Pacific to reduce reliance on the increasingly hostile US trade environment.

The Bank of Canada: Navigating the Neutrality Trap

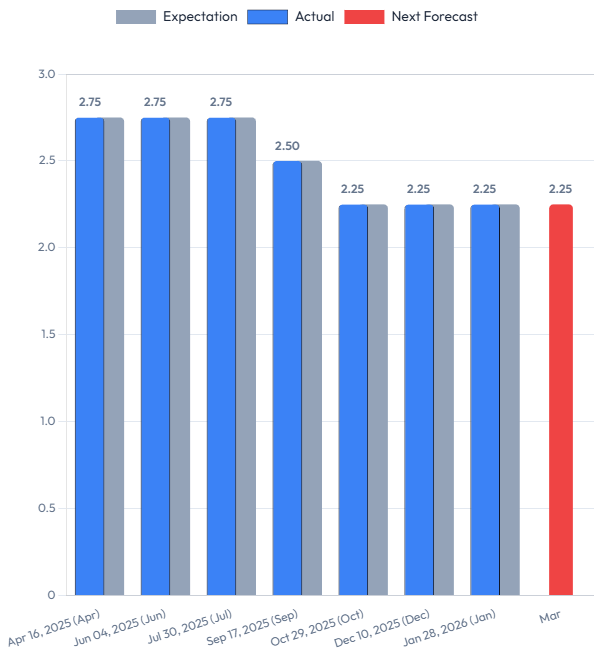

The Bank of Canada (BoC), under the leadership of Governor Tiff Macklem, finds itself in what we call a “neutrality trap.” They are trying to thread a needle between a domestic economy that is stalling out and a trade environment that keeps threatening to spike inflation. Over the last seven months, we watched the BoC shift from a cutting cycle—delivering cuts in September and October 2025 that brought the policy rate to 2.25 percent—to a hard pause. They held rates in December and again on January 28, 2026. The rationale is explicit: “heightened uncertainty” regarding the USMCA review and sticky core inflation that refuses to drop below 2.8 percent.

For traders, the signal is clear: the 2.25 percent rate is the new neutral. The Governing Council has pushed back against market pressure for more stimulus, despite GDP growth projections for 2026 sitting at a meager 1.1 percent. Their fear is that cutting rates further would crash the CAD, importing inflation just as tariffs are driving prices up. Conversely, hiking rates would devastate the fragile housing market. This “wait-and-see” approach has effectively decoupled Canadian monetary policy from the Federal Reserve, which has recently pivoted, creating some very complex yield dynamics across the border.

In the upcoming seven weeks, the central bank is going to be hyper-focused on the data. The February inflation release is the major risk event; if we see an upside surprise, expect a hawkish repricing in the swap markets. On the flip side, if labor data deteriorates further, the political pressure to cut will become immense. Currently, the consensus for the next decision on March 18 is a continued HOLD, but you should treat that as a fragile consensus dependent entirely on the inflation trajectory.

Structural Bifurcation: The Service-Goods Divergence

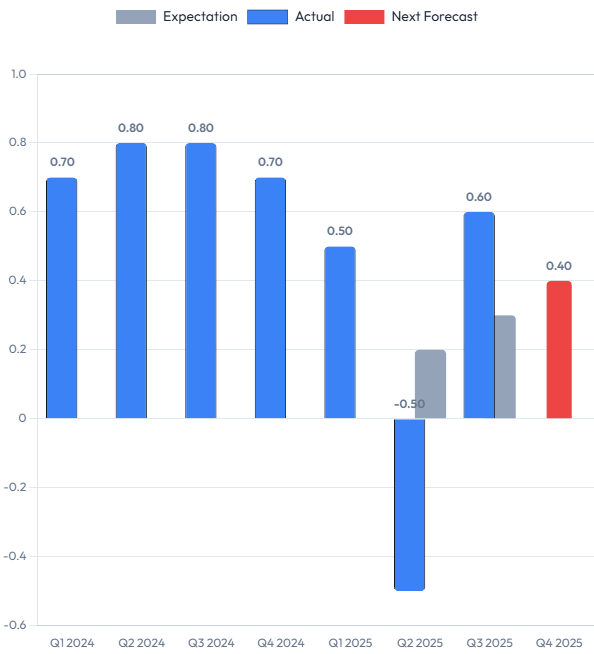

The Canadian economy is currently living a tale of two sectors. We are seeing a sharp bifurcation between a surprisingly resilient services sector and a goods-producing industry that is contracting under the weight of US trade aggression. The “Building Canada Strong” agenda is attempting to pivot the entire economy from a reliance on real estate toward productive capital formation in energy, AI, and defense. Energy Minister Tim Hodgson is prioritizing infrastructure to narrow the price discount on Canadian crude, but it is a slow process. Meanwhile, the manufacturing heartland in Ontario and Quebec is taking the brunt of the trade war, with sales contracting 1.3 percent in November 2025.

Economic development over the last seven months has been a rollercoaster. After a scary contraction of 1.6 percent annualized in Q2 2025, the economy bounced back with 2.6 percent growth in Q3, only to stall out completely by year-end with 0.0 percent monthly GDP in November. This volatility tells us that the economy is incredibly sensitive to external shocks right now. While the US remains the dominant trading partner, the aggressive push to open markets in the Gulf and Indo-Pacific is a desperate but necessary move to hedge against US volatility.

Looking ahead to the next seven weeks, we are officially on “Recession Watch.” With Q4 2025 estimated to be negative, the performance in early 2026 is critical to avoid a technical recession. Business sentiment is cautious; firms are sitting on their hands regarding hiring until they get clarity on the USMCA review. You should expect this caution to weigh on growth data, making the upcoming reports vital for determining if the “soft landing” is still possible or if a harder contraction is inevitable.

MARKET DYNAMICS AND ASSET CLASS BEHAVIOR

Canadian financial markets are defined by divergence: equities are at record highs while the real economy stagnates, and bond yields are rising despite weak growth. The CAD is stuck in a “neutrality trap” at 0.71 USD, pinned between a hawkish Bank of Canada floor and a bearish US trade war ceiling. The sentiment is cautious, with markets pricing in a persistent “Canada Discount” until structural clarity emerges.

The “Canada Discount” and Cross-Asset Volatility

If you are trading Canadian assets, you are currently pricing in a geopolitical risk premium that desks are calling the “Canada Discount.” Over the past seven months, we have seen a breakdown in traditional correlations, particularly in fixed income and currencies. The bond market is behaving counter-intuitively; normally, weak economic data would send yields lower. Instead, Canadian yields are rising. This is being driven by the gravitational pull of higher US Treasury yields and the sheer volume of new supply coming from the Canadian government to fund its 78.3 billion CAD deficit. For the next seven weeks, you need to watch the spread against US Treasuries closely. If that spread widens further, it is a sign that international investors are losing faith in Canada’s fiscal credibility.

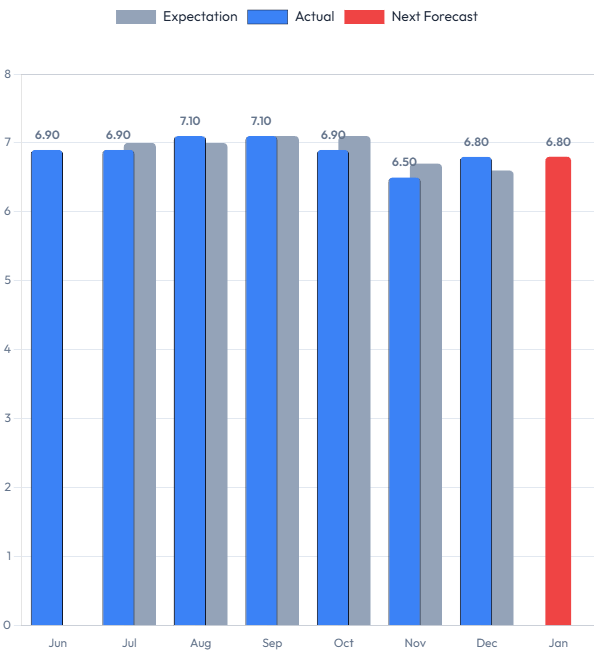

The commodities market has been a source of significant frustration. WTI crude has been stuck around the 60.46 USD level as of January 2026, capped by a global supply glut and record US production. The Canadian benchmark, Western Canadian Select (WCS), is still suffering from a painful discount, which hurts the government’s revenue projections. However, we did see a violent spike in natural gas to 6.80 USD in late January due to winter storms, which gave a short-term boost to the terms of trade. Gold has been the silent hero, acting as a hedge for Canadian miners and propping up the materials sector of the TSX. Looking forward, the US “drill baby drill” policy is a major headwind that could keep a ceiling on energy prices for the foreseeable future.

The stock market has completely decoupled from the real economy. The S&P/TSX Composite Index hit an all-time high of 33,428 in January 2026, gaining over 31 percent in 2025. This rally is driven by the financial sector enjoying higher-for-longer rates and the materials sector riding the gold wave. Investors are treating the TSX as a “value play” compared to the expensive US tech sector. But be warned: this divergence between record stock prices and 0 percent GDP growth is unsustainable. There is a significant correction risk in the coming weeks, especially if bank earnings start to show cracks from the wave of mortgage renewals hitting Canadian consumers.

Finally, the currency market is where all these tensions meet. The CAD is stuck in a “neutrality trap,” trading defensively near 0.71 USD (1.40 USD/CAD). It is being pushed down by a strong US Dollar attracting safe-haven flows, but held up by the Bank of Canada’s refusal to cut rates below 2.25 percent. This floor prevents a total collapse, but there is no fuel for a rally. For the next seven weeks, expect the CAD to remain rangebound and highly sensitive to US trade headlines.

ECONOMIC INDICATORS: DATA ANALYSIS

The data confirms an economy in “Stagflation-Lite.” Growth has flatlined with 0.0 percent monthly GDP, while inflation remains sticky above target at 2.4 percent and unemployment is drifting higher to 6.8 percent. The interest rate hold at 2.25 percent reflects a central bank trapped by conflicting signals. The trend suggests continued stagnation in Q1 2026, with the labor market likely to deteriorate further before any recovery takes hold.

Interest Rate History

Next Release & Period: March 18, 2026 (March Decision).

Trading Economics Forecast: 2.25 percent (https://tradingeconomics.com/canada/interest-rate).

Consensus / Long Term Views: The consensus is overwhelmingly for a continued HOLD. The Bank of Canada has signaled that 2.25 percent represents the neutral rate in the current high-tariff environment. Markets do not anticipate a move until trade policy clarity improves or inflation deviates significantly from the 2.5 percent range.

Economic Growth Rate (GDP QoQ)

Next Release & Period: February 27, 2026 (Q4 2025 GDP).

Trading Economics Forecast: 0.4 percent Q4 2025 (QoQ) (https://tradingeconomics.com/canada/gdp-growth).

Long-term forecasts for 2026 peg growth at a modest 1.1 percent, heavily dependent on the government’s capital investment strategy taking hold.

Inflation Rate (CPI YoY)

Next Release & Period: February 17, 2026 (January 2026 CPI).

Trading Economics Forecast: 2.5 percent (https://tradingeconomics.com/canada/inflation-cpi).

Consensus / Long Term Views: Inflation is expected to remain sticky near 2.5 percent due to base effects and the expiration of the GST holiday in February. Core inflation remains a concern for the central bank, preventing easing despite weak growth.

Unemployment Rate

Next Release & Period: February 06, 2026 (January 2026 Data).

Trading Economics Forecast: 6.8 percent (https://tradingeconomics.com/canada/unemployment-rate).

Consensus / Long Term Views: The labor market is loosening. While the unemployment rate dropped in November, the rebound in December suggests the trend is volatile. Structural mismatch and public sector hiring freezes are expected to push the rate toward 7.0 percent in Q2 2026.

The 'Carney Doctrine' and that technocratic response to protectionism really hit home. It's like they're trying to debug an economy, which is a massive task. Very insightfull.