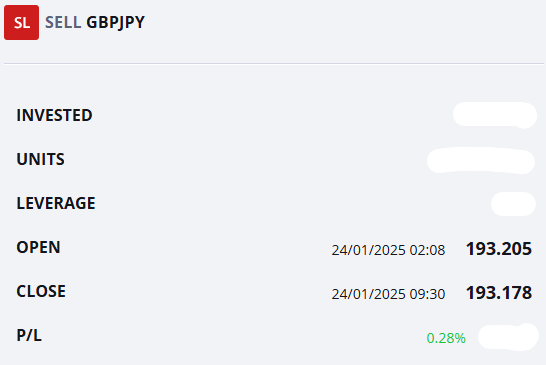

Friday, January 24, 2025: UK PMI data beat expectations and pushed this towards the SL for a minor profit.

Friday, January 24, 2025: Trade has been triggered following poor economic data from the UK and a rate hike from the BOJ. The stop loss has been lowered to 193.10 which removes all risk from the trade as the entry was 193.20.

Tuesday, January 14, 2025, Week 3

GBP/JPY presents a trading opportunity due to diverging outlooks for the UK and Japan. The UK faces slowing growth, persistent inflation, and a cautious BoE, while Japan shows moderate recovery and potential for a hawkish BOJ policy shift. This divergence, combined with upcoming UK economic data and the BOJ's policy decision, suggests a compelling argument for selling GBP/JPY. Geopolitical risks add further complexity.

Trading involves the possibility of losing money; therefore, all decisions in market speculation are undertaken at your own financial risk.

GBP/JPY: Navigating a Bearish Pound and a Bullish Yen

The GBP/JPY pair has seen significant volatility over the past ten days, reflecting contrasting narratives surrounding the constituent currencies. The GBP has been under pressure due to weak UK data and a cautious BoE, while the JPY has benefited from a more hawkish BOJ and rising inflation expectations.

Market Influences:

GBP: The Pound Sterling has been weakening, driven by a series of disappointing economic releases. The unexpected contraction in October's GDP, the sharp decline in November retail sales, and surging gilt yields have fueled bearish sentiment. The BoE's decision to hold rates at 4.75% in December, despite recessionary risks, further stoked speculation of rate cuts in early 2025.

JPY: The Japanese Yen has rallied, propelled by a more hawkish BOJ and rising inflation expectations. The better-than-expected 2.9% inflation figure for November has increased pressure on the BOJ to consider a rate hike, while the Tankan survey has painted a mixed picture of Japanese business sentiment due to trade and global growth concerns.

Market Events & Statistics:

Forex Market: The GBP/JPY pair has been volatile, reflecting diverging policy expectations.

Stock Markets: The UK stock market (FTSE 100) has shown mixed performance, influenced by UK economic concerns. The Japanese stock market (Nikkei 225) has also been volatile, driven by global risk sentiment and BOJ policy uncertainty.

Stock Indices: Both the FTSE 100 and Nikkei 225 have experienced periods of volatility, reflecting uncertain economic outlooks.

Commodities: Oil prices (WTI crude) have fluctuated, indirectly influencing the GBP/JPY pair through correlated currencies.

Government Bonds: UK gilt yields have surged, raising concerns about the UK's fiscal health. Japanese government bond yields have remained more stable, reflecting safe-haven demand.

Commitment of Traders (COT) Report:

GBP: The COT report shows leveraged funds increasing their net short GBP positions, adding to the bearish outlook.

JPY: The COT report reveals a mixed JPY positioning. Leveraged Funds have added to their net short positions, while Dealer Intermediaries have increased their net long positions.

Upcoming Economic Indicators

Jan 15, 2025: GB Inflation Rate YoY (Dec 2024). Forecast: 2.60%. Previous: 2.60%. A higher reading could support the BoE's cautious stance.

Jan 16, 2025: GB GDP MoM (Nov 2024). Forecast: 0.20%. Previous: -0.10%. A negative reading could exacerbate recessionary fears.

Jan 16, 2025: GB GDP YoY (Nov 2024). Forecast: 1.50%. Previous: 1.30%. Weak growth will likely weigh on GBP.

Jan 17, 2025: GB Retail Sales MoM (Dec 2024). Forecast: 0.40%. Previous: 0.20%. Weak retail sales could further pressure GBP.

Jan 21, 2025: GB Unemployment Rate (Nov 2024). Forecast: 4.30%. Previous: 4.2%. A rising unemployment rate might increase BoE easing expectations.

Jan 23, 2025: JP Balance of Trade (Dec). Forecast: ¥ 100B. Previous: ¥-117.6B. A larger-than-expected deficit might weigh on JPY.

Jan 24, 2025: JP Inflation Rate YoY (Jan). Forecast: 2.60%. Previous: 2.90%. A higher reading could strengthen rate hike bets.

Jan 24, 2025: JP BOJ Interest Rate Decision. Forecast: 0.50%. Previous: 0.25%. A rate hike, while partially priced in, could boost JPY.

Jan 10, 2025: JP Household Spending YoY (Nov). Forecast: -0.60%. Previous: -1.30%. An improvement could signal stronger consumer demand.

Jan 10, 2025: JP Household Spending MoM (Nov). Forecast: N/A. Previous: 2.90%. A positive reading would further support consumer spending growth.

GBP/JPY Trade Plan: Capitalizing on Divergent Monetary Policy

The UK's slowing growth, persistent inflation, and potential BoE rate cuts contrast with Japan's economic recovery and potential BOJ rate hikes, making GBP/JPY a sell opportunity.

Entry, Stop-Loss, and Profit Targets:

Entry Level: 193.20

Stop-Loss: 195.20

Profit Target: 191.20.

Extended Profit Target 2: 189.20.

Conclusion: A High-Conviction Sell Opportunity

This trade plan offers a compelling opportunity to profit from diverging central bank policies and contrasting economic conditions. The bearish GBP sentiment and bullish JPY outlook suggest a strong likelihood of GBP/JPY depreciation. Continuous reassessment of market conditions is crucial for successful trade management.

Sources

Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve, ECB, BOJ, BOE, RBA, RBNZ, SNB, BOC, US Bureau of Labor Statistics, Eurostat, Statistics Canada, Australian Bureau of Labor Statistics, Statistics New Zealand, Swiss Federal Statistical Office, Office for National Statistics, Cabinet Office Japan, Ministry of Internal Affairs and Communications, Ministry of Finance Japan.