Central Bank Decisions and Global Slowdown Risks Spark Currency Swings

Monitor Bank of Japan policy meeting, key economic data from Eurozone, UK, US, and geopolitical developments, especially US-China trade war.

Monday, 22nd July, Week 30

EUR/USD: Can the Euro Weather the Storm of ECB Uncertainty?

A Rocky Road: Euro's Five-Week Journey Marked by Dollar Weakness and ECB Ambivalence

The EUR/USD has been on a turbulent ride over the past five weeks, initially weakening as the dollar strengthened on better-than-expected US economic data. The pair fell from a high of 1.0922 on July 12th to a low of 1.0815 on July 9th, as the greenback found support from robust retail sales and industrial production figures. However, the EUR/USD quickly reversed course, rallying as the dollar weakened on growing expectations that the Federal Reserve would soon begin cutting interest rates. The pair surged to a high of 1.0939 on July 17th, as the DXY tumbled to a four-month low of 103.70. The euro's strength was also supported by data showing that the Eurozone economy was proving more resilient than anticipated, with GDP growth in Q1 2024 exceeding forecasts.

Adding to the volatility, the ECB's July monetary policy meeting delivered a mixed message, leaving markets uncertain about the central bank's policy intentions. While the ECB kept interest rates unchanged, policymakers struck a hawkish tone, stressing that rates would remain restrictive for as long as necessary to bring inflation back to target. However, the ECB also acknowledged that it would continue to follow a data-dependent approach, leaving the door open to potential rate cuts later in the year. This ambiguity has kept EUR/USD traders on edge, as they seek further clues about the ECB's policy path.

The recent five-week movements in EUR/USD differ markedly from the pair's performance over the previous five months. From February to June, the EUR/USD traded in a relatively tight range between 1.06 and 1.09, as markets grappled with the outlook for ECB monetary policy and the Eurozone economy. The pair's recent breakout above 1.09 suggests that the market may be becoming more optimistic about the euro's prospects, but the outlook remains clouded by uncertainty surrounding the ECB's policy intentions.

Forex traders should also be aware of the potential impact of the US-China trade war on the euro. An escalation of trade tensions between the world's two largest economies could weigh on global risk sentiment and pressure the euro, as the Eurozone is a major trading partner for both the US and China.

Summary: The EUR/USD has experienced significant volatility over the past five weeks, driven by shifting expectations for Federal Reserve and ECB monetary policy, the outlook for the Eurozone economy, and the broader performance of the US dollar. The pair's recent strength has been fueled by dollar weakness and signs of resilience in the Eurozone economy, but the outlook for the coming days is uncertain as markets await further clues about the ECB's policy intentions.

Crossroads Ahead: Will Eurozone Data and US Politics Steer the EUR/USD?

The EUR/USD could face a volatile week ahead, with key economic data releases from the Eurozone and the US likely to drive trading activity. On Tuesday, German Ifo Business Climate data for July will be released, providing insights into business confidence in the Eurozone's largest economy. A weaker-than-expected reading could weigh on the euro, while a stronger-than-expected reading could provide support.

On Wednesday, the focus will shift to the US, with the release of the S&P Global/CIPS Composite PMI Flash for July. A stronger-than-expected reading could boost the dollar and pressure the euro, while a weaker-than-expected reading could have the opposite effect.

Thursday will see the release of German CPI data for July, which will be closely watched for signs of whether inflation in the Eurozone's largest economy is moderating as expected. A higher-than-expected reading could increase pressure on the ECB to raise interest rates, potentially supporting the euro. A lower-than-expected reading could ease pressure on the ECB and potentially weigh on the euro.

Finally, on Friday, the US will release its advance estimate for Q2 GDP growth. A stronger-than-expected reading could boost the dollar and pressure the euro, while a weaker-than-expected reading could have the opposite effect.

Forex traders should also be aware of the potential impact of US political developments on the dollar. President Biden's decision to drop out of the 2024 race and endorse Vice President Harris has injected a fresh dose of uncertainty into the US political landscape, and the dollar could be sensitive to any headlines surrounding the Democratic nomination process.

Upside: The EUR/USD could strengthen if Eurozone economic data surprises to the upside, particularly the German Ifo and CPI releases, or if the US dollar weakens on political uncertainty or softer-than-expected economic data.

Downside: The EUR/USD could weaken if Eurozone economic data disappoints, particularly the German Ifo and CPI releases, or if the US dollar strengthens on safe-haven demand or better-than-expected economic data.

GBP/USD: Can Sterling Ride the Wave of Labour's Victory?

A New Dawn: Sterling's Five-Week Surge Fuelled by Dollar Weakness and Labour's Election Triumph

The GBP/USD has been on a tear over the past five weeks, surging to its highest level in over a year as the dollar weakened and the Labour Party secured a decisive victory in the UK general election. The pair rallied from a low of 1.2682 on June 24th to a high of 1.3006 on July 17th, as the DXY tumbled to a four-month low of 103.70. The pound's strength has been fuelled by a combination of factors, including growing expectations that the Federal Reserve will soon begin cutting interest rates, easing concerns about the UK's economic outlook, and optimism about the Labour Party's ability to provide stable and competent government.

The Labour Party's victory in the general election has been a major catalyst for the pound's recent rally. The market has welcomed the prospect of a change in government after 15 years of Conservative rule, and there is optimism that the Labour Party will be able to address some of the UK's long-standing economic and social challenges. Labour leader Keir Starmer has pledged to focus on boosting economic growth, tackling the cost of living crisis, and restoring the UK's international standing.

The recent five-week movements in GBP/USD differ markedly from the pair's performance over the previous five months. From February to June, the GBP/USD traded in a relatively tight range between 1.24 and 1.28, as markets grappled with the outlook for BoE monetary policy, the UK's economic prospects, and the Conservative Party's internal turmoil. The pair's recent breakout above 1.29 suggests that the market may be becoming more optimistic about the pound's prospects under a Labour government, but the outlook remains clouded by uncertainty surrounding the BoE's policy intentions and the new government's economic agenda.

Forex traders should also be aware of the potential impact of the US-China trade war on the pound. An escalation of trade tensions between the world's two largest economies could weigh on global risk sentiment and pressure the pound, as the UK is a major trading partner for both the US and China.

Summary: The GBP/USD has experienced a remarkable surge over the past five weeks, driven by dollar weakness, the Labour Party's victory in the general election, and easing concerns about the UK's economic outlook. The pair's recent strength suggests that the market may be becoming more optimistic about the pound's prospects under a Labour government, but the outlook for the coming days is uncertain as markets await further clues about the BoE's policy intentions and the new government's economic agenda.

Sterling's Summer Test: Will UK Data and Global Headwinds Dent the Pound's Rally?

The GBP/USD could face a volatile week ahead, with key economic data releases from the UK and the US likely to drive trading activity. On Tuesday, the UK will release its CBI Distributive Trades survey for June, providing insights into retail sales trends. A weaker-than-expected reading could weigh on the pound, while a stronger-than-expected reading could provide support.

On Wednesday, the focus will shift to the US, with the release of the S&P Global/CIPS Composite PMI Flash for July. A stronger-than-expected reading could boost the dollar and pressure the pound, while a weaker-than-expected reading could have the opposite effect.

Thursday will see the release of the UK's S&P Global/CIPS Composite PMI Flash for July, providing a timely snapshot of the UK's private sector activity. A weaker-than-expected reading could weigh on the pound, while a stronger-than-expected reading could provide support.

Finally, on Friday, the US will release its advance estimate for Q2 GDP growth. A stronger-than-expected reading could boost the dollar and pressure the pound, while a weaker-than-expected reading could have the opposite effect.

Forex traders should also be aware of the potential impact of global economic developments on the pound. Growing concerns about a global economic slowdown, particularly in China and Europe, could weigh on risk sentiment and pressure the pound, as the UK is a major trading partner for both regions.

Upside: The GBP/USD could strengthen if UK economic data surprises to the upside, particularly the CBI Distributive Trades and S&P Global/CIPS PMI releases, or if the US dollar weakens on political uncertainty or softer-than-expected economic data.

Downside: The GBP/USD could weaken if UK economic data disappoints, particularly the CBI Distributive Trades and S&P Global/CIPS PMI releases, or if the US dollar strengthens on safe-haven demand or better-than-expected economic data, or if global growth concerns intensify.

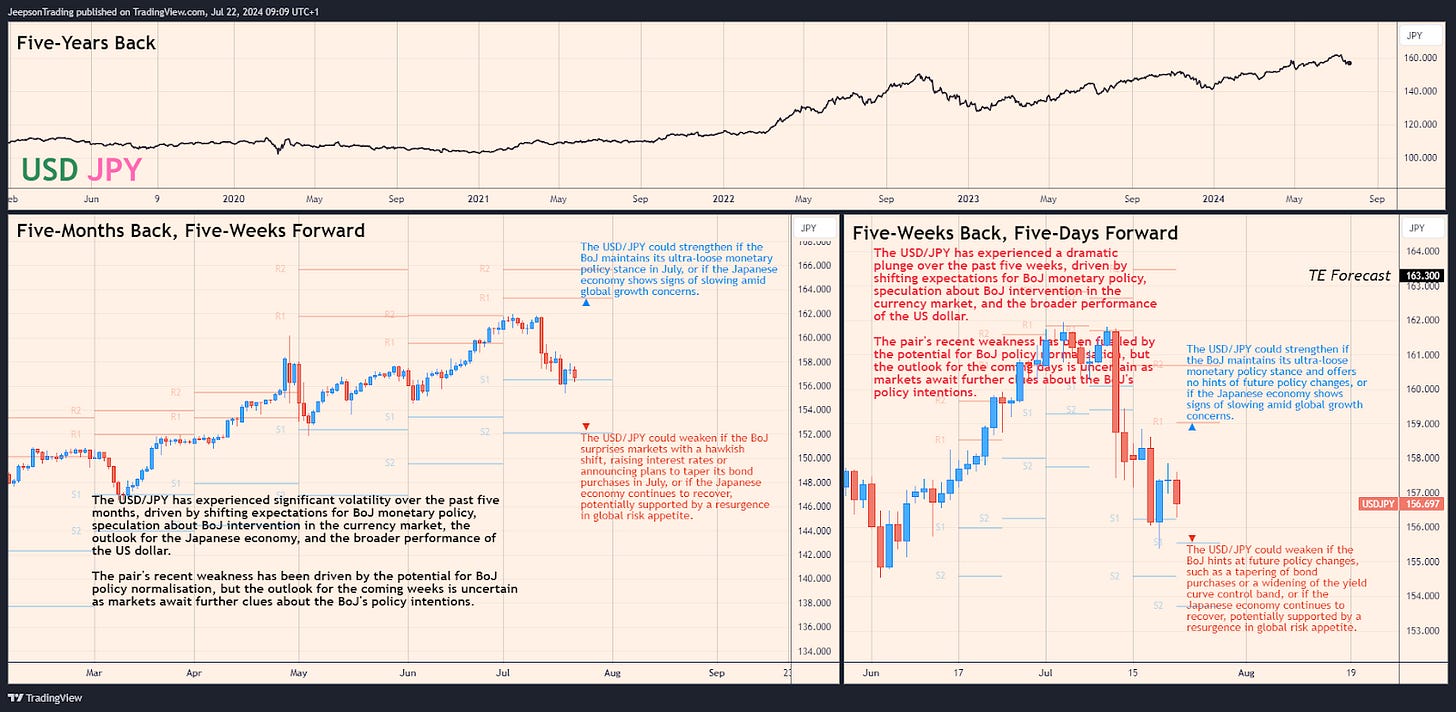

USD/JPY: Will the Yen Find its Footing Amidst BoJ Uncertainty?

A Yen for Change: USD/JPY's Five-Week Plunge Driven by BoJ Speculation and Intervention Fears

The USD/JPY has been in freefall over the past five weeks, plummeting from record highs to multi-week lows as the Bank of Japan (BoJ) hinted at a potential shift away from its ultra-loose monetary policy. The pair plunged from a high of 161.6085 on July 10th to a low of 155.6925 on July 17th, as the yen rallied on speculation that the BoJ would soon begin to normalise monetary policy. The yen's strength was further fuelled by suspicions that the BoJ had intervened in the currency market to support the yen, although there has been no official confirmation of intervention.

The BoJ's June monetary policy meeting did little to quell speculation about a policy shift. While the central bank kept interest rates unchanged, Governor Kazuo Ueda signalled that the BoJ was open to adjusting its yield curve control policy if inflation continued to rise. This has kept USD/JPY traders on edge, as they seek further clues about the BoJ's policy intentions.

Adding to the uncertainty, Prime Minister Fumio Kishida has also hinted at a potential shift in monetary policy, stating that the normalisation of the central bank's monetary policy would support Japan's transition to a growth-driven economy. This has further fuelled speculation that the BoJ could be preparing to raise interest rates or taper its bond purchases.

The recent five-week movements in USD/JPY differ markedly from the pair's performance over the previous five months. From February to June, the USD/JPY traded in a relatively wide range between 146 and 162, as markets grappled with the outlook for BoJ monetary policy, Japan's widening trade deficit, and the country's persistent deflationary pressures. The pair's recent plunge below 158 suggests that the market may be becoming more convinced that the BoJ is preparing to normalise monetary policy, but the outlook remains clouded by uncertainty surrounding the BoJ's policy intentions.

Forex traders should also be aware of the potential impact of the US-China trade war on the yen. An escalation of trade tensions between the world's two largest economies could weigh on global risk sentiment and boost safe-haven demand for the yen, as Japan is seen as a safe haven currency.

Summary: The USD/JPY has experienced a dramatic plunge over the past five weeks, driven by shifting expectations for BoJ monetary policy, speculation about BoJ intervention in the currency market, and the broader performance of the US dollar. The pair's recent weakness has been fuelled by the potential for BoJ policy normalisation, but the outlook for the coming days is uncertain as markets await further clues about the BoJ's policy intentions.

Yen's Moment of Truth: Will the BoJ Hint at Future Policy Changes?

The USD/JPY could face another volatile week ahead, with the BoJ's monetary policy meeting on Wednesday likely to be the main event risk for the pair. While a rate hike is unlikely at this meeting, the market will be closely watching for any signals from the BoJ about its future policy intentions. Any hints of a potential shift towards policy normalisation, such as a tapering of bond purchases or a widening of the yield curve control band, could spark a further yen rally.

However, the USD/JPY could strengthen if the BoJ maintains its current ultra-loose monetary policy stance and offers no hints of future policy changes. The yen could also weaken if there is an escalation of geopolitical tensions, particularly surrounding the US-China trade war, that weighs on market sentiment.

Forex traders should also be aware of the potential impact of Japanese economic data releases on the yen. On Tuesday, Japan will release its June trade balance data, which will be closely watched for signs of whether the country's trade deficit is narrowing as expected. A wider-than-expected deficit could weigh on the yen, while a narrower-than-expected deficit could provide support.

Upside: The USD/JPY could strengthen if the BoJ maintains its ultra-loose monetary policy stance and offers no hints of future policy changes, or if the Japanese economy shows signs of slowing amid global growth concerns.

Downside: The USD/JPY could weaken if the BoJ hints at future policy changes, such as a tapering of bond purchases or a widening of the yield curve control band, or if the Japanese economy continues to recover, potentially supported by a resurgence in global risk appetite.

Conclusion: A Week of Reckoning for Major Currencies

The forex market is on high alert this week, as central bank decisions in Japan and economic data releases from the Eurozone, UK, and US could spark significant currency swings. The EUR/USD, GBP/USD, and USD/JPY are all poised for volatility, as traders grapple with the outlook for monetary policy, economic growth, and geopolitical risks.

Action Points:

Monitor the BoJ's monetary policy meeting on Wednesday for potential policy signals.

Pay close attention to key economic data releases from the Eurozone, UK, and US, particularly the German Ifo Business Climate, UK CBI Distributive Trades, US S&P Global/CIPS Composite PMI Flash, German CPI, and US advance estimate for Q2 GDP growth.

Stay informed about geopolitical developments, particularly surrounding the US-China trade war, as they could impact risk sentiment and drive currency flows.

Key Economic Events to Monitor:

Tuesday, 23rd July, Week 30: German Ifo Business Climate (July), UK CBI Distributive Trades (June), Bank of Japan Summary of Opinions

Wednesday, 24th July, Week 30: US S&P Global/CIPS Composite PMI Flash (July), Bank of Japan Monetary Policy Meeting, Jibun Bank Japan Manufacturing PMI Flash (July)

Thursday, 25th July, Week 30: German CPI (July), US Durable Goods Orders (June), US GDP Growth Rate QoQ Adv (Q2), German Ifo Expectations New (July)

Sources:

Bloomberg

European Central Bank

Federal Reserve

Newsquawk

Office for National Statistics (UK)

Reuters

Stratfor

Trading Economics