Currency Markets in Turmoil as US, Euro, UK Central Banks Signal Divergence in Monetary Policy

Market Analysis for Week Number 51 2023

DERBYSHIRE UK, Dec 17, 2023, Week 51. The US Dollar's dance with uncertainty continues, shaped by the Federal Reserve's delicate balance between potential rate cuts and mixed economic signals. Mark your calendars for key events like the US GDP Growth Rate QoQ Final on December 21 and the US Core PCE Price Index on December 22, as they may pivot the Fed's narrative and sway the DXY's direction.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

United States and DXY

The overarching narrative that is influencing the US Dollar is the Federal Reserve's cautious approach towards future rate cuts amid mixed economic signals, including resilient employment and consumer spending data, juxtaposed with a weaker manufacturing sector and moderated inflation expectations, creating an environment of uncertainty and fluctuating market expectations.

The CME Group 30-Day Fed Fund futures shows a hold is 90% priced in for the next meeting in January and the first rate cut of 0.25% has been priced in for March which has been brought forward from May last week (62% in favour).

The DXY lost value during the previous six days primarily due to a combination of factors that influenced market perceptions about the future trajectory of US monetary policy and economic strength. Earlier in the week, the Federal Reserve signalled 75 basis points of interest rate cuts for 2024, a more aggressive pace than previously anticipated, which suggested a potential shift towards a more accommodative monetary policy in response to changing economic conditions. This dovish stance was further reinforced by Fed Chair Powell's remarks about the possibility of reducing borrowing costs, spurred by a quicker-than-expected decline in inflation. Moreover, the robust labour market, as indicated by the creation of 199,000 jobs in November and a decrease in the unemployment rate, alongside stronger-than-expected retail sales, contributed to a complex economic picture. Despite these positive indicators, a surprise decline in the NY Empire State Manufacturing Index highlighted weaknesses in the manufacturing sector, underscoring the mixed economic signals. Collectively, these factors brought forward expectations for 2024 Q1 rate cuts, diminishing the dollar's attractiveness to investors and thereby contributing to its depreciation in value over the week.

The Economic Performance of the United States has been influenced by a mix of headwinds and tailwinds, impacting the direction of the US Dollar Index (DXY). On the one hand, the economy has demonstrated resilience with an annualised growth of 5.2% in Q3 2023, robust retail sales growth in November, and a declining unemployment rate, reflecting strong consumer spending and a healthy labour market. These positive indicators have been supported by a cautiously optimistic Federal Reserve, keeping the fed funds rate steady while signalling potential rate cuts in 2024, in response to easing inflation. However, the economy faces headwinds including a slowdown in job gains and a contraction in manufacturing, alongside mixed global economic signals. This environment of uncertainty, combined with moderated inflation expectations, has led to fluctuating market expectations, influencing the US Dollar's strength in the currency markets.

The Economic Outlook of the United States presents a nuanced picture that could shape the future direction of the US Dollar Index (DXY). The Federal Reserve’s projection of GDP growth slowing in 2024, alongside anticipated rate cuts, suggests a cautious approach to balancing economic growth with inflation control. The continued strong consumer spending and a robust labour market provide tailwinds, potentially supporting economic stability and the Dollar's attractiveness. However, headwinds such as potential global economic downturns, ongoing geopolitical tensions, and domestic policy challenges, including the management of inflation and the impact of fiscal policies, could introduce volatility. Additionally, the international context, particularly the monetary policies of other major economies, will play a crucial role in shaping the DXY's trajectory. Overall, the outlook suggests a complex interplay of domestic economic strengths and vulnerabilities, set against a backdrop of global economic uncertainty.

Here are some key events to watch in relation to the US;

Thu Dec 21, US GDP Growth Rate QoQ Final Q3: This measures the final quarterly change in the value of all goods and services produced by the economy.

A revision upwards could signal stronger economic health than anticipated, possibly leading to a firmer stance by the Fed on interest rates and potentially strengthening the DXY.

Fri Dec 22, US Core PCE Price Index MoM NOV: The Personal Consumption Expenditures Price Index is a preferred inflation measure by the Federal Reserve.

Higher-than-expected inflation figures could complicate the Fed's rate cut narrative, potentially boosting the DXY as expectations for continued rate hikes or a slower pace of cuts might set in.

Fri Dec 22, US Personal Income and Spending MoM NOV: These indicators provide insights into consumer financial health and spending behaviour.

Potential Impact: Strong increases could indicate robust consumer confidence and economic activity, potentially influencing the Fed's rate decisions and supporting the DXY.

Fri Dec 29, US Chicago PMI DEC: The Purchasing Managers' Index assesses business conditions in the Chicago area, indicating the economic health in the manufacturing sector.

Potential Impact: A higher than expected reading could suggest economic resilience, influencing the Federal Reserve's monetary policy and possibly leading to a strengthened DXY in anticipation of a less dovish Fed stance.

Paid-subscribers can view the Dollar Trade Plans here.

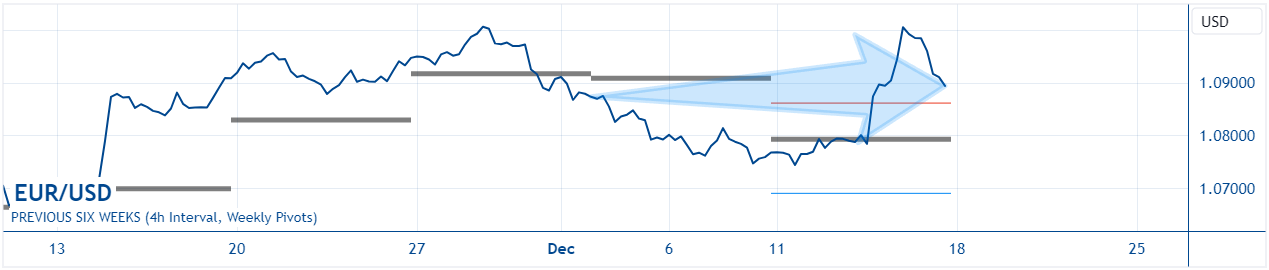

Euro Area and EUR/USD

The overarching narrative that is influencing the Euro is the European Central Bank's commitment to maintaining elevated interest rates to address inflation, juxtaposed with weakening economic activity in the Eurozone and global market reactions to the US Federal Reserve's dovish outlook and potential rate cuts, creating a complex interplay of regional economic challenges and external monetary policy influences.

The EUR/USD gained value during the previous six days primarily due to the European Central Bank's (ECB) decision to maintain steady interest rates, resisting market expectations of rate cuts, which helped to bolster confidence in the Euro. This decision was set against a backdrop of the US Federal Reserve signalling the likelihood of future rate cuts in 2024, contributing to a more dovish outlook on the US dollar. Additionally, the Eurozone's PMI figures, although showing a contraction in private sector activity, did not significantly dampen investor sentiment towards the Euro. The contrast between the ECB's firmer stance on interest rates to counteract inflation and the Fed's hint at a softer monetary policy approach in the future created a favourable environment for the Euro to appreciate against the US dollar during this period.

The Economic Performance of the Euro-Area has been characterised by several headwinds and tailwinds, impacting the direction of the Euro (EUR/USD). The contraction of the Eurozone economy by 0.1% in Q3 2023 reflects ongoing challenges, with significant contractions in major economies like Germany and France, indicative of broader regional economic strains. High inflation, although easing to 2.4% in November, continues to be a concern, leading the ECB to maintain interest rates at multi-year highs and end its bond purchase scheme. This approach aims to tackle inflation but also poses risks of further economic slowdown. Retail sales showing modest growth signals restrained consumer demand amid high inflation and borrowing costs. The stagnant unemployment rate at 6.5% indicates a relatively stable but cautious labour market. These factors combined present a complex picture for the Euro, with the ECB's hawkish stance on rates providing some support, but underlying economic weaknesses and global uncertainties, including geopolitical tensions, potentially applying downward pressure on the currency.

The Economic Outlook of the Euro-Area suggests a cautious trajectory, likely influencing the direction of the Euro (EUR/USD). The ECB’s projection of inflation averaging 5.4% in 2023 and a gradual decline in subsequent years indicates continued focus on inflation control, potentially through maintaining elevated interest rates. This could support the Euro's value in the short term. However, the forecasted modest GDP growth, with only a 0.2% expansion expected by the end of this quarter, highlights persistent economic challenges. Elevated unemployment rates, particularly youth unemployment, combined with subdued retail sales, suggest ongoing consumer caution. Geopolitically, tensions and trade relationships, especially with key partners like the US, will play a crucial role. If the ECB's restrictive monetary policy successfully curbs inflation without significantly hampering growth, the Euro could see support. However, any signs of deeper economic downturns or discrepancies in policy approaches compared to other major economies, like the US, could introduce volatility and pressure on the Euro.

Here are some key events to watch in relation to the Euro-Area:

Tuesday, December 19, 2023 - EA Inflation Rate YoY Final NOV: This event will provide the finalised year-over-year inflation rate for November 2023 in the Euro-Area.

A higher than expected inflation rate could reinforce the ECB's stance on maintaining high interest rates, potentially strengthening the Euro. Conversely, a lower inflation rate might increase speculation about potential rate cuts, possibly weakening the Euro.

Thursday, January 04, 2024 - EA Services PMI Final DEC: This event will release the final Services Purchasing Managers’ Index (PMI) for December 2023, indicating the health of the service sector in the Euro-Area.

Potential Impact: A strong PMI could signal robust economic activity, supporting the Euro. A weak PMI, however, might highlight economic challenges, potentially exerting downward pressure on the Euro.

Friday, January 05, 2024 - EA Inflation Rate YoY Flash DEC: This preliminary report will provide an early estimate of the year-over-year inflation rate for December 2023.

This data is crucial for gauging the ECB's future monetary policy direction. Higher inflation might support a continued hawkish stance, possibly boosting the Euro, while lower inflation could lead to speculation of easing rates, potentially weakening the Euro.

Friday, January 05, 2024 - EA Core Inflation Rate YoY Flash DEC: This will offer a preliminary look at the core inflation rate, which excludes volatile items like food and energy, for December 2023.

Core inflation is often considered a more accurate measure of long-term inflation trends. A higher core inflation rate may reinforce the need for elevated interest rates, potentially strengthening the Euro. A lower rate might raise concerns about economic stagnation, possibly affecting the Euro negatively.

Paid-subscribers can view the EUR/USD Trade Plans here.

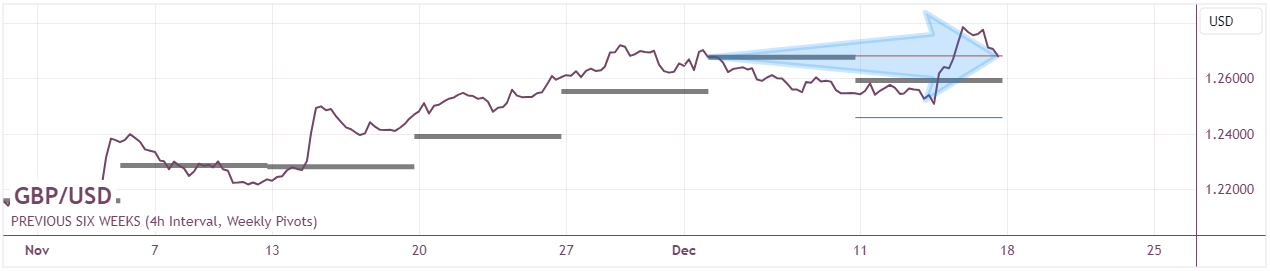

United Kingdom and GBP/USD

The overarching narrative that is influencing the Pound-Sterling is the Bank of England's hawkish stance on interest rates, coupled with signs of expansion in the UK's service sector and improving consumer confidence, which are offsetting concerns about economic slowdown and influencing market expectations about the future trajectory of monetary policy.

The GBP/USD gained value during the previous six days primarily due to a combination of the Bank of England's hawkish monetary policy stance, which maintained interest rates at a 15-year high, and positive economic indicators that bolstered investor confidence in the UK's economic resilience. The robust expansion in the British services sector, as indicated by the latest PMI figures, suggested a more dynamic economic environment, offsetting weaker manufacturing performance and supporting the likelihood of the BoE sustaining its terminal rate for an extended period to manage inflation pressures. Additionally, the rise in the GfK Consumer Confidence indicator in December indicated improving sentiment among consumers, contributing to a more optimistic outlook for the UK economy. These factors, coupled with the contrasting dovish stance of the US Federal Reserve, which hinted at potential rate cuts in 2024, led to a weakening dollar and consequently, a strengthening Pound-Sterling, pushing the GBP/USD past the $1.27 mark, its highest level since early August.

The Economic Performance of the United-Kingdom has been influenced by a combination of factors that have shaped the Pound-Sterling's direction. The Bank of England's decision to maintain its benchmark interest rate at a 15-year high of 5.25% reflects a hawkish stance aimed at combating inflation, despite the economic landscape showing signs of deterioration. This decision, along with a divided vote suggesting further potential tightening, has provided some support to the GBP/USD. However, headwinds such as the stagnation of GDP growth in Q3 2023 and falling retail sales indicate underlying economic challenges. The drop in inflation to 4.6% in October and easing core inflation suggest that inflationary pressures may be moderating, potentially reducing the urgency for further rate hikes. Additionally, the steady unemployment rate at 4.2% and the slowing of pay growth signal a tightening yet cautious labour market. These factors collectively suggest a complex economic environment where the BoE's hawkish stance is counterbalanced by indicators of economic slowdown, impacting the Pound Sterling's strength and stability.

The Economic Outlook of the United-Kingdom, looking forward, is subject to various headwinds and tailwinds that could influence the direction of the Pound-Sterling (GBP/USD). Anticipated declines in interest rates next year, with the first cut expected in June, may lead to a softer monetary policy stance, potentially weakening the Pound in the short term. The GDP's stagnation and the continued decline in retail sales reflect ongoing economic challenges, including high inflation and its impact on consumer spending and business investment. The job market, while stable, shows signs of slowing wage growth, which could impact domestic consumption. Geopolitically, ongoing uncertainties, including Brexit-related trade issues and global economic trends, will also play a significant role. These factors could lead to increased volatility in the GBP/USD, with potential downward pressure if economic conditions worsen or if the BoE signals a more dovish approach than currently expected.

Here are some key events to watch in relation to the United-Kingdom:

Wednesday, December 20, 2023 - Inflation Rate YoY NOV: This will provide insights into the ongoing inflationary pressures within the economy. A higher than expected inflation rate may reinforce the Bank of England's hawkish stance, potentially supporting the GBP/USD, whereas a lower rate might raise concerns about economic slowdown, possibly weakening the Pound.

Friday, December 22, 2023 - Retail Sales MoM NOV: Retail sales data is a crucial indicator of consumer spending and confidence. Significant changes in this metric can influence market perceptions of economic health and consumer behaviour, impacting the GBP/USD depending on whether the data signals expansion or contraction in consumer spending.

Friday, December 22, 2023 - GDP Growth Rate QoQ Final Q3: The final GDP growth rate for the third quarter will provide a definitive picture of the UK's economic performance during this period. Stronger growth could enhance confidence in the Pound, while weaker growth might fuel concerns about an economic slowdown.

Thursday, January 4, 2024 - S&P Global/CIPS Services PMI Final DEC: As the service sector is a significant component of the UK economy, this PMI data will be closely watched. A robust service sector performance can underpin the Bank of England’s hawkish stance, potentially bolstering the GBP, whereas weaker figures might suggest slowing economic momentum.

Paid-subscribers can view the GBP/USD Trade Plans here.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from th e5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-