Currency Pairs Fall Against the Safety of Dollars

Week Number 36 2023 Market Analysis (second update)

DERBYSHIRE GB / SEPTEMBER 6th, 2023 - The week so far is being controlled by the dollar bulls who are pricing in higher-for-longer rates from the Fed. The next update is planned to be published after the unemployment claims on Thursday, September 7th or before if any significant event occurs.

CME Group 30-Day Fed Fund futures

Sentiment towards interest rates in the US have softened following the labour report on Friday which showed unemployment to be rising more than anticipated.

September favours a hold and odds are holding at have risen to 94% from 88% last week. A 0.25 hike chance has fallen to 6% from 12%.

November favours a hold and odds have fallen to 60% from 65% earlier this week. A 0.25 hike chance has risen to 37% from 33%.

US Dollar Strength At Mercy of Fed Speakers

Macroeconomics suggest that the outlook for the US dollar is weighted in favour of the bulls. Dollars are in demand due to interest rates remaining higher-for-longer and safe-haven in-flows when risk aversion increases as the war in Ukraine progresses as well as the China-US trade war.

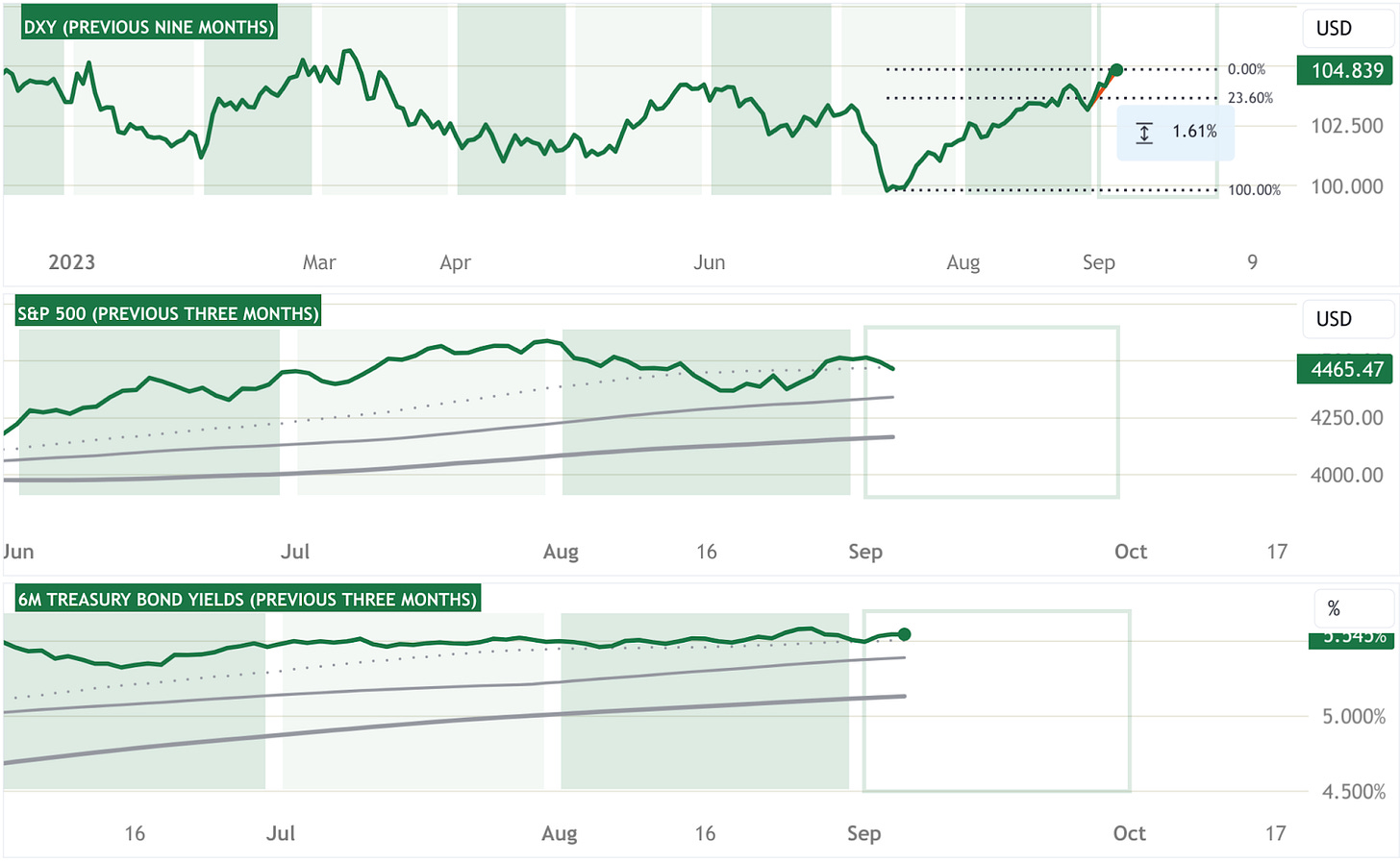

The US Dollar Index is extending its uptrend with a recent gain of 1.6% to match the macroeconomic bullish outlook. The gain is supported by last week’s NFP report and the risk-averse sentiment of investors who see the Fed holding rates higher-for-longer. This sentiment is reflected in the recent fall below the 50-day moving average of the S&P 500 while the yield on six-month treasury bonds remained steady above 5.5%.

This week’s data release shows that the economy remains strong as both the PMI and balance of trade came in higher than expected. The strong economy raises the risk of sticky inflation and thus interest rates will need to stay higher-for-longer. There are some Fed officials speaking throughout the remainder of the week and it is likely that they will stick to the hawkish rhetoric although be alert of any comments that could be interpreted as neutral or maybe even dovish.

The week after could further strengthen the bullish outlook of the dollar, as the Consumer Price Index report for August is expected to show a rise in inflation from 3.2% to 3.4% (Trading Economics forecast), which would warrant interest rates remaining higher for longer.

Euro Weakness May Stabilise Ahead of ECB Meeting

Macroeconomics suggest that the outlook for the Euro is weighted slightly in favour of the bears. Euro’s are lacking in demand due to potentially higher interest rates that are slowing the economy as well as safe-haven out-flows when risk aversion increases as the war in Ukraine progresses.

The EUR/USD is extending its downtrend with a recent fall of 1.8% to match the macroeconomic slightly bearish outlook. The fall is pressured by last week’s EA CPI report which showed a climb to 5.3% during August as well as a strengthening dollar. This sentiment is reflected in the recent fall below the 100-day moving average of the DAX while the yield on six-month German bunds remained steady above 3.6%.

The upcoming week could strengthen the slightly bearish outlook of the euro, as data releases may confirm a slowing economy. On Wednesday, the retail sales report indicated a deteriorating economy with a 0.2% contraction since the previous month. Thursday will see the final estimate of GDP growth rate expected at 0.3%.

The week after could weaken the slightly bearish outlook of the euro, as the ECB Governing Council meeting is expected to hold interest rates at 4.25% (Trading Economics forecast) although they are unlikely to signal any future cuts.

Pound Weakness Has Little Reprieve In Sight

Macroeconomics suggest that the outlook for the Pound is weighted slightly in favour of the bears. Pound’s are lacking in demand due to potentially higher interest rates that are slowing the economy as well as safe-haven out-flows when risk aversion increases as the war in Ukraine progresses.

The GBP/USD has broken its uptrend and is now forming a downtrend with a recent fall of 4.8% to match the macroeconomic slightly bearish outlook. The fall is pressured by the strengthening dollar rather than a weakening pound. This sentiment is reflected in the steady moves of the FTSE 100 and stable yield on six-month gilt bonds which are holding above 5.6%.

The upcoming week has little economic events that could affect the slightly bearish outlook of the pound, although its value may somewhat be influenced by the strengthening dollar.

The week after has the UK unemployment rate and GDP data on the radar although it's too early to forecast. However, there is the potential for a weaker GBP/USD as the outlook for the dollar is likely to strengthen the bulls as the Consumer Price Index report for August is expected to show a rise in inflation from 3.2% to 3.4% (Trading Economics forecast), which would warrant interest rates remaining higher for longer.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-