Dollar Pressured but Relief Rally Possible

DERBYSHIRE GB / APR 18 - This is the US Dollar Forex Playbook and contains analysis based on the US Dollar Forex Reference. It is intended to be used as a guide to aid in your analysis.

Banking Crisis Averted

Eleven U.S. banks injected $30 billion into First Republic Bank on March 16, 2023, to prevent it from collapsing like Silicon Valley Bank (SVB), which had invested heavily in bonds. The move was orchestrated by JPMorgan Chase CEO Jamie Dimon, Treasury Secretary Janet Yellen, and Federal Reserve Chair Jerome Powell.

The injection of capital was welcomed by investors, but some worried that it would set a precedent for future bailouts. SVB's collapse was caused by a combination of factors, including rising interest rates and a decline in the value of its bond portfolio. The Federal Reserve's decision on interest rates will have a major impact on the U.S. economy. It needs to keep rates low enough to support growth but high enough to control inflation.

The move to bail out First Republic Bank was unprecedented, but it was seen as necessary to prevent a wider financial crisis. The U.S. government has a responsibility to protect the financial system, and this move was a sign that the government is willing to take action when necessary. The Federal Reserve's decision on interest rates will be closely watched, as it will have a major impact on the U.S. economy.

The situation has led investors to believe that the Federal Reserve (Fed) will take a dovish approach to future policy so as to avoid a recurrence at other banks.

Mixed Expectations for Next Week

Next week, the U.S. will release a fresh batch of economic data, including GDP and PCE.

GDP will be the advance report for Q1 and is expected to grow by 2%. This is below the previous quarter's growth rate of 2.6%. Trading Economics' are forecasting a rise to 2.9%.

PCE is expected to have risen by 0.4% in March, up from 0.3% in February. This could upset markets that are expecting the Fed to take a more dovish approach to monetary policy. Trading Economics, however, is forecasting a smaller increase of 0.2%.

The release of this data could have implications for the Fed's monetary policy decisions and will be closely watched.

DXY Forecast

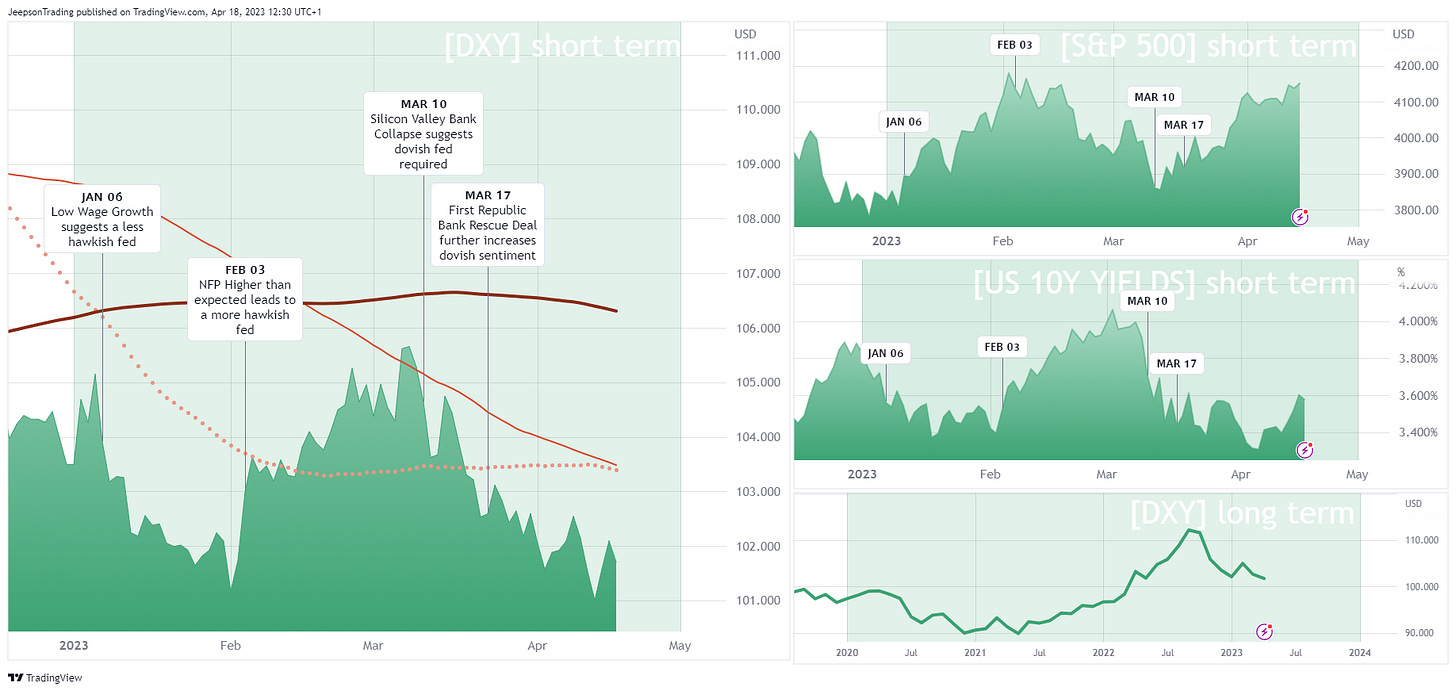

The outlook for interest rates has been a major concern for forex traders since inflation began to overheat in 2020. The value of the US dollar (DXY) has been trending upwards throughout the tightening cycle, but there have been dips when speculators have anticipated a potential Fed pivot.

The DXY plummeted from nearly $106 in March to $101 in April as the banking crisis unfolded. This can be attributed to the growing sentiment that the Fed will not continue with its hawkish tightening policy during a time of economic uncertainty. Additionally, with inflation falling quickly, some loosening of conditions may be appropriate sooner than planned. The Fed has projected that rates will fall from a peak of 5.1% this year to 4.3% next year.

The CME FedWatch Tool indicates increasing odds, currently at 85%, that the market expects the Federal Reserve (Fed) to raise interest rates by 0.25% in May. The market also expects the Fed to hold rates steady in June, with a 65% and rising chance of this happening. However, the market is starting to price in the possibility of rate cuts later this year. There is a 25% and rising chance of a rate cut in July, and a 40% chance in September.

The mixed expectations for data next week suggest that the DXY is unlikely to deviate significantly from its current range, although downside pressures will persist. It is expected to remain below $104.00. A re-evaluation will be made on Friday, April 28, after the release of PCE data.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-