Dollar slides, Euro and Pound fly as rate cuts considered

Market Analysis for Week Number 47 2023

DERBYSHIRE UK, Nov 19, 2023, Week 47. The dollar has taken a beating as future rate hikes are priced out and cuts priced in. The detail herein is created to quickly bring you up to speed with the recent direction of currencies and the narratives that have influenced these moves.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Dollar slides on weak data, traders eye rate cut timing

DXY Market Narrative: The US dollar is facing downward pressure due to weaker-than-anticipated economic data, which has reinforced expectations that the Federal Reserve is nearing the end of its monetary tightening cycle. The dollar index, which gauges the greenback's strength against a basket of six major currencies, fell below 104 on Friday, its lowest level since September 1st.

Traders' attention is now focused on when the Fed might start reducing interest rates, with some anticipating a move as early as the second half of 2023. The central bank is widely expected to maintain interest rates unchanged once again in December.

The dollar's weakness is proving beneficial to other major currencies, with the Australian dollar and the euro leading the gains. The euro has gained more than 1% this week, while the Australian dollar has advanced by over 0.5%.

Economic Events to Watch: The upcoming economic events that could influence the market narrative include:

Wednesday, November 22: Revised UoM Consumer Sentiment: A higher-than-expected reading could indicate increased consumer confidence in the US economy, which could be positive for the dollar. Conversely, a lower-than-expected reading could signal waning consumer confidence, potentially weighing on the dollar.

Thursday, November 23: Flash Manufacturing PMI: A higher-than-expected reading could indicate expansion in the US manufacturing sector, which could bolster the dollar. On the other hand, a lower-than-expected reading could suggest contraction in the manufacturing sector, potentially weakening the dollar.

Friday, November 24: Flash Services PMI: A higher-than-expected reading could point to growth in the US services sector, which could support the dollar. In contrast, a lower-than-expected reading could indicate contraction in the services sector, potentially detracting from the dollar's strength.

The FOMC Meeting Minutes release on Monday, November 20, may provide insights into the Federal Reserve's stance on interest rates; however, the market already anticipates that the Fed will maintain rates unchanged at this meeting. The Unemployment Claims release on Wednesday, November 22, measures new claims for unemployment benefits. A higher-than-expected reading could suggest a weakening labour market, potentially harming the dollar. However, the labour market has been relatively robust in recent months, so a higher reading is unlikely to cause major market disruptions. The Durable Goods Orders released on Wednesday, November 22, gauge new orders for durable goods. A higher-than-expected reading could indicate increased business confidence in the economy, potentially strengthening the dollar. Conversely, a lower-than-expected reading could suggest waning business confidence, potentially weakening the dollar. However, durable goods orders have been volatile in recent months, making it difficult to predict with certainty how the market will react to these releases.

Overall, the upcoming economic events that are most likely to influence the market narrative are the Revised UoM Consumer Sentiment release, the Flash Manufacturing PMI release, and the Flash Services PMI release.

Paid-subscribers can view the Dollar Trade Plans here.

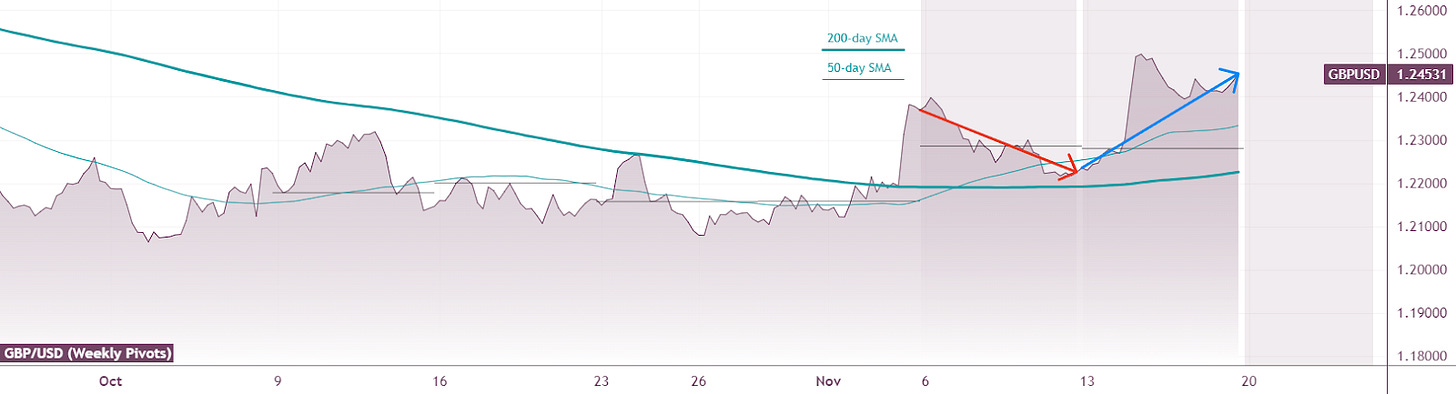

UK Pound soars as fed rate hike bets wane

GBP/USD Market Narrative: The forex market is currently experiencing a resurgence of risk appetite, with riskier currencies such as the British pound and the euro gaining ground against the US dollar. This shift in sentiment is being attributed to a combination of factors, including softer-than-expected US economic data, growing expectations that the Federal Reserve will pause its monetary tightening cycle, and signs of easing inflationary pressures in both the US and the UK.

GBP/USD Economic Events to Watch: Several key economic events are scheduled to take place in the coming days that could impact the market narrative. These include:

Existing Home Sales (USD) on Tue Nov 21

FOMC Meeting Minutes (USD) on Tue Nov 21

Unemployment Claims (USD) on Wed Nov 22

Core Durable Goods Orders m/m (USD) on Wed Nov 22

Durable Goods Orders m/m (USD) on Wed Nov 22

Revised UoM Consumer Sentiment (USD) on Wed Nov 22

Flash Manufacturing PMI (GBP) on Thu Nov 23

Flash Services PMI (GBP) on Thu Nov 23

Flash Manufacturing PMI (USD) on Fri Nov 24

Flash Services PMI (USD) on Fri Nov 24

Paid-subscribers can view the Pound Trade Plans here.

Euro climbs as dollar falters amid shifting rate hike expectations

EUR/USD Market Narrative

The US dollar is facing renewed weakness after a series of economic data releases that suggest the Federal Reserve may be nearing the end of its rate-hiking cycle. This has led to a shift in investor sentiment towards riskier assets, such as the euro. The euro is currently trading at its highest level since late August and is likely to continue to strengthen in the near term.

Economic Events to Watch

Existing Home Sales (USD) - November 19: This event is a key indicator of the health of the US housing market. If existing home sales are higher than expected, it could be a sign that the US economy is growing stronger than expected. This could lead to higher interest rates from the Federal Reserve, which could strengthen the dollar.

FOMC Meeting Minutes (USD) - November 21: This event will provide insights into the thinking of Federal Reserve policymakers. If the minutes show that policymakers are more hawkish than expected, it could lead to higher interest rates from the Federal Reserve, which could strengthen the dollar.

ECB President Lagarde Speaks (EUR) - November 20 and 24: This event will provide insights into the thinking of the European Central Bank (ECB) President. If Lagarde sounds more hawkish than expected, it could lead to higher interest rates from the ECB, which could strengthen the euro.

ECB Financial Stability Review (EUR) - November 22: This event will assess the risks to the financial stability of the eurozone. If the review shows that the risks are higher than expected, it could lead to a weakening of the euro.

Flash Manufacturing PMI (EUR, USD) - November 23 and 24: This event is a key indicator of the health of the manufacturing sector. If the PMI readings are higher than expected, it could be a sign that the economy is growing stronger than expected. This could lead to higher interest rates from the central banks, which could strengthen the respective currencies.

Paid-subscribers can view the Euro Trade Plans here.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-