Dollar Strength to Weigh on GBP/USD in the Near Term

Pound Sterling Forex Playbook for JUNE - Outlook update

DERBYSHIRE GB / June 28th, 2023 - Updated outlook. Next update after the Next update after Friday the 30th of June, or before if any significant event occurs.

This is the Pound Sterling Forex Playbook and is intended to be used as a guide to aid in your trade planning.

Macroeconomic Snapshot

The United Kingdom is facing a challenging macroeconomic situation that is causing high inflation and low growth which will pressure the pound lower but the outlook for improvement and the higher interest rates may add some upward support to the Pound’s value.

June Meeting of the Bank of England’s, Monetary Policy Committee (MPC)

The Bank Rate was hiked by 0.50% in June to 5.00%, higher than the 0.25% hike in May

The next meeting is on Thursday the 3rd of August

The hiking cycle has risen higher and faster than anticipated and is expected to rise further with the 1Y Gilt Yield heading towards 5.5% which is an indication of future hikes. These higher yields could attract foreign investors which is expected to apply upward support on the pound's value.

GDP Growth Rate for Q1 2023, Preliminary Estimate

GDP in the UK for Q1 remained steady at a 0.1% quarterly expansion since Q4 2022

The final Q1 report is due on Friday the 30th of June

The economy has grown as anticipated but is expected to grow a bit faster. This is likely to lead to increased stock market prices and a shift in investor preference away from safer assets, such as government bonds. This is expected to apply upward support on the pound’s value.

CPI Report for May

CPI in the UK for May remained at 8.7% annual inflation from 8.7% in April

The June report is due on Wednesday the 19th of July

CPI has not fallen as anticipated although is expected to over the longer term. This is likely to cause higher interest rates and a shift in investor preference towards safer assets, such as government bonds. This is expected to apply upward support on the pound’s value.

Labour Report for April

Unemployment in the UK for April fell slightly to 3.8% from 3.9% in March

The May report is due on Tuesday the 11th of July

The labour market has improved better than anticipated but is expected to slightly deteriorate. This is likely to lead to slightly reduced growth and a shift in investor preference towards safer assets, such as government bonds. This is expected to apply indifferent support/pressure on the pound’s value.

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and UK economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty. This is expected to apply downward pressure on the pound’s value.

Brexit

The UK's decision to leave the European Union (EU) has created a great deal of uncertainty about the future of the UK economy. This uncertainty has made investors less willing to take risks, which has led to a sell-off in risky assets, such as stocks and currencies. The resultant effects are expected to limit upward support on the pound’s value.

Cost of Living Crisis

The UK cost of living crisis is having a negative effect on the value of the pound. This is because investors are becoming less confident in the UK economy and are therefore less willing to invest in British assets. This is expected to apply downward pressure on the pound’s value.

GBP/USD (Four Weeks)

The GBP/USD has risen in the past four weeks, supported by central bank disparity. The Fed's hiking cycle is ending, weakening the dollar, while high inflation in the UK has warranted a more aggressive BoE. However, dollar strength has recently returned as traders begin to price in a Fed hike in July.

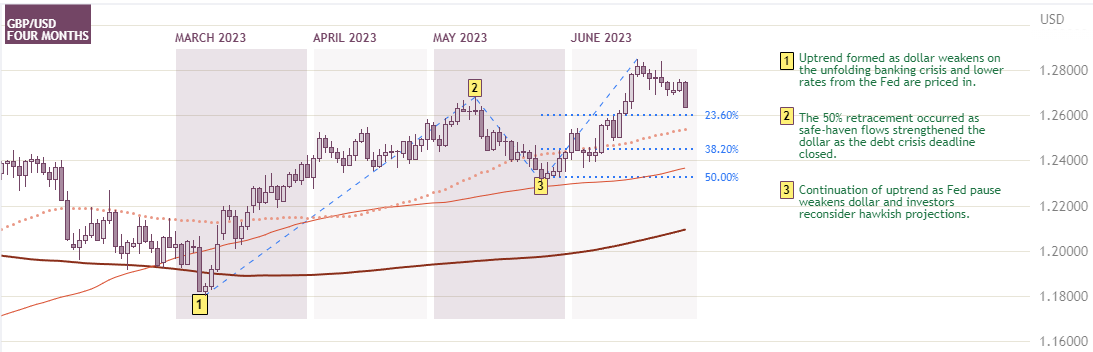

GBP/USD Longer Term (Four Months)

The GBP/USD has been in an uptrend since the start of March when investors priced in a lower Fed Fund peak due to the banking crisis. This move was retraced in May as safe-haven flows strengthened the dollar when the US ran the risk of default due to the debt ceiling not being extended. This crisis was resolved at the end of May and the pair continued its climb to a new peak although this is now retracing as investors are again, looking to price in a higher Fed Fund peak. A move below the 50% fib near 1.23 would form a downtrend.

GBP/USD Outlook

The events to keep an eye on:

Tuesday the 27th of June

US CB Consumer Confidence Big beat at 109.7 vs 103.9 exp. and prev. 102.5

Wednesday the 28th of June

BoE Governor Bailey speaks ECB Forum on Central Banking, in Sintra

Fed Chair Powell speaks ECB Forum on Central Banking, in Sintra

Thursday the 29th of June

Fed Chair Powell speaks Fourth Conference on Financial Stability hosted by the Bank of Spain

US GDP Q1 final Slight upward revision to 1.4% exp. from prev. 1.3%

Monday the 3rd of July

ISM Manufacturing PMI

Wednesday the 5th of July

FOMC Minutes

Thursday the 6th of July

US ADP Non-Farm Employment Change prev. 278K

ISM Service PMI

JOLTS Job openings

Friday the 7th of July

US Average Hourly Earnings m/m

US Non-Farm Employment Change

US Unemployment Rate

CME Group 30-Day Fed Fund futures

July: steady sentiment of a 0.25% hike, 75% in favour (prev. 75%)

September: holding sentiment of a hold, 70% in favour (20% for a 0.25% cut - prev. 15%)

Six Month Bond Yields

Gilt: down to 5.6% from 5.8% last week

Treasuries: holding at 5.4% from 5.4% last week

Value of the GBP/USD to remain above 1.25 unless UK inflation outlook significantly improves: The four week moves have been rising from 1.25 to 1.28. Events this week are favoured towards a stronger dollar as CB Consumer confidence was a big beat, Powell is likely to remain hawkish and the GDP is looking to be upwardly revised on Friday. There is also a risk for a weaker Pound as the bond yields are falling which suggests the peak UK Bank Rate is going to be lower than anticipated.

Longer Term Value of the GBP/USD to remain above 1.18, downtrend formed on moves below 1.23: The four month moves have been climbing from 1.18 to 1.28 although is retracing to test 1.26. The macroeconomic situation suggests the downtrend is unlikely to extend which would indicate moves beyond 1.28 are eventually possible to extend the uptrend.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-