Dollar's Dilemma, Yen's Resilience, Pound's Peril, Euro's Enigma

Tuesday, October 15, 2024 (Week 42)

Forex markets are grappling with a confluence of influential forces. Diverging monetary policies, persistent inflation in certain economies, and escalating geopolitical risks are all contributing to currency volatility. The US dollar's recent strength reflects hotter-than-expected inflation data, impacting Fed easing expectations. Meanwhile, the yen's resilience is being tested by the Bank of Japan's hawkish stance. Sterling faces uncertainty ahead of the UK Autumn Budget. The euro is under pressure from stagnation fears in the Eurozone, despite the European Central Bank's move towards an easing bias.

USDJPY: Yen Holds Ground Amidst Dollar Strength

The USDJPY pair is a cornerstone of the forex market. Traded by banks, asset managers, leveraged funds, and retail investors, its deep liquidity stems from Japan's economic significance and the yen's safe-haven appeal. Rising US Treasury yields typically support the pair. The latest COT report (October 8, 2024) shows mixed positioning. Leveraged funds are net short, asset managers are net long, and dealers lean short, highlighting the current uncertainty surrounding the pair's direction.

Dominant Market Theme: BOJ Policy and Yen Volatility

The USDJPY narrative continues to be dominated by the diverging paths of the Federal Reserve and the Bank of Japan (BOJ). The Fed’s recent shift towards easing, contrasted with the BOJ's hawkish bias, creates downward pressure on the pair. Persistent inflation in Japan and haven flows into the yen amid escalating geopolitical tensions add further complexity.

Upside Thesis (USDJPY): Moderate Conviction. USDJPY could continue its ascent in the upcoming week, driven by stronger-than-anticipated US retail sales and a resilient Philly Fed Manufacturing Index reading on October 17th. These results could reinforce the narrative of a more gradual Fed easing cycle. This outlook could extend throughout the month, but the US Presidential election on November 5th introduces a significant element of political risk, making sustained JPY weakness less certain.

Downside Thesis (USDJPY): Low Conviction. A JPY recovery in the upcoming week would require significantly weaker than anticipated US economic data releases. This scenario could trigger a more dovish tone from the Fed and potentially weigh on USD. Simultaneously, the BOJ would need to signal a hawkish stance, which seems likely given their persistent concerns over inflation. Geopolitical tensions remain a key driver of yen strength, as haven flows have supported the currency previously.

What to Watch (USDJPY):

US Retail Sales (Thu, Oct 17, Week 42): Forecast 0.3%. In line data could strengthen USD, supporting USDJPY.

US Initial Jobless Claims (Thu, Oct 17, Week 42): Forecast 241K. A higher-than-expected figure could weaken USD.

US Philadelphia Fed Manufacturing Index (Thu, Oct 17, Week 42): Forecast 3. A weaker than anticipated reading could trigger USD weakness.

Japan Machinery Orders MoM (Wed, Oct 16, Week 42): No forecast. Strong orders could signal renewed JPY strength.

USDCAD: Loonie's Tightrope Walk

The USDCAD pair, actively traded by a diverse range of market participants, is heavily influenced by oil prices, given Canada's status as a major oil exporter. The pair's liquidity is also driven by the strong trade relationship between the two countries. A negative correlation often exists between USDCAD and oil prices, with rising oil typically weakening the pair. The latest COT report (October 8, 2024) shows a divergence in positioning. Asset managers are net long CAD, while leveraged funds are heavily short, suggesting mixed views on the pair’s direction. Dealers lean long.

The USDCAD narrative focuses on the interplay between the TSX's performance and oil price fluctuations. The TSX's recent record highs have supported the CAD, countering the impact of weaker than usual oil prices. The emerging theme is BoC policy uncertainty. As the Fed signals easing, the BoC's path appears less certain, impacting the pair’s volatility.

Upside Thesis (USDCAD): Moderate Conviction. USDCAD could strengthen further if upcoming US retail sales figures exceed expectations, bolstering USD and reinforcing a more hawkish Fed outlook. A lower-than-projected result for Canadian inflation (September YoY) on October 15th and continued weakness in Canadian housing starts could add to CAD’s vulnerability, thereby boosting USDCAD. This scenario could persist into the upcoming month.

Downside Thesis (USDCAD): Low Conviction. A USDCAD decline requires a substantial shift in the current narrative. This would likely involve considerably weaker than anticipated US retail sales. It would also require stronger-than-expected Canadian inflation data alongside positive housing data to reignite confidence in the Canadian economy. Such a development would put pressure on the BoC to maintain its current stance, potentially strengthening CAD.

What to Watch (USDCAD):

US Retail Sales (Thu, Oct 17, Week 42): Forecast 0.3%. Strong US data could boost USD.

US Initial Jobless Claims (Thu, Oct 17, Week 42): Forecast 241K. Higher-than-expected claims could soften USD.

US Philadelphia Fed Manufacturing Index (Thu, Oct 17, Week 42): Forecast 3. Disappointing US data could weigh on the dollar.

Canada Inflation Rate YoY (Tue, Oct 15, Week 42): Forecast 2.1%. Lower-than-expected inflation could weaken CAD.

Canada Housing Starts (Wed, Oct 16, Week 42): Forecast 235K. Continued weakness in housing could trigger CAD vulnerability.

Canada New Housing Price Index MoM (Thu, Oct 24, Week 43): Forecast 0.4%. A negative surprise could pressure CAD.

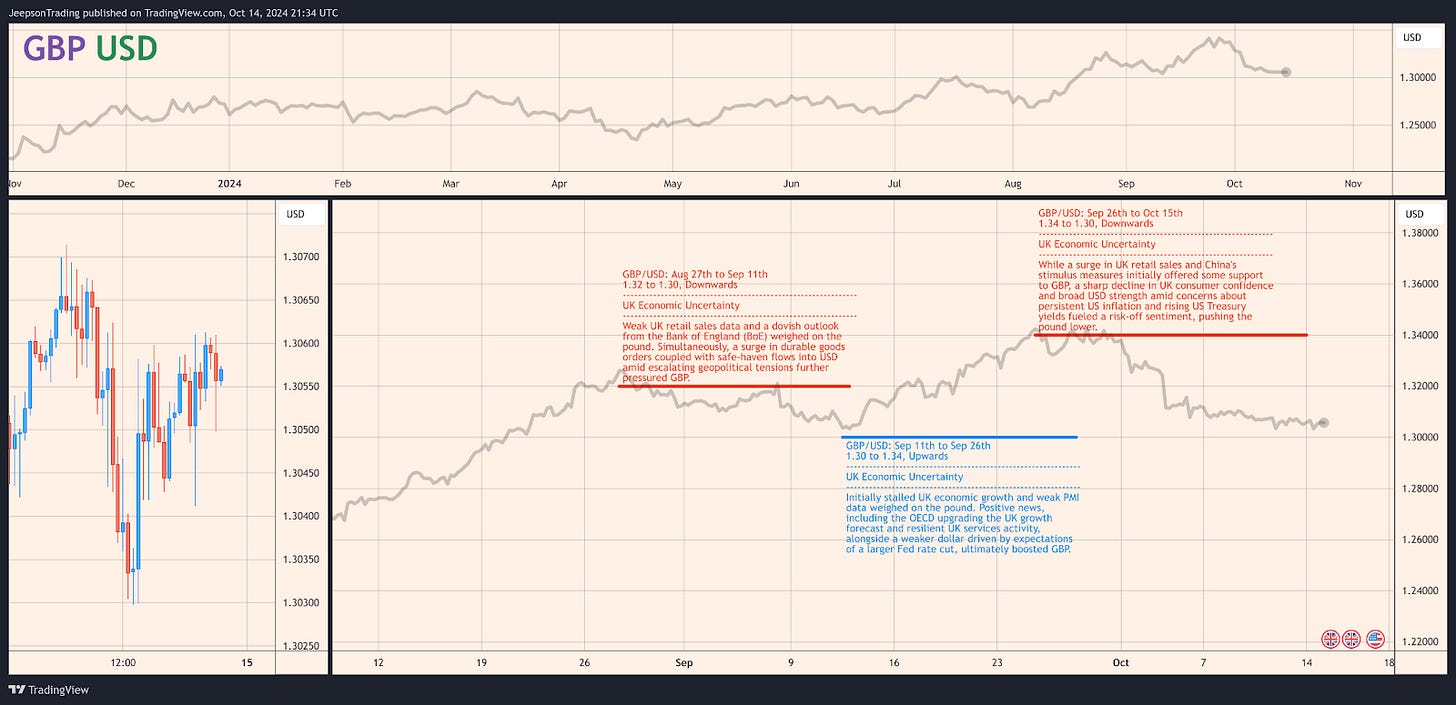

GBPUSD: Cable's Budget Conundrum

GBPUSD is a highly liquid pair, attracting significant trading volume due to the economic importance of the UK and the US. Banks, hedge funds, corporations, and retail traders actively participate in this market. The pair typically exhibits an inverse relationship with UK Gilt yields, with yields influencing flows into and out of GBP-denominated assets. The latest COT report (October 8, 2024) reflects divided opinions. Asset managers are net long GBP, whereas leveraged funds hold net short positions. This is a similar sentiment to Dealers who are also net short.

The GBPUSD storyline has been clouded by UK economic uncertainty. Mixed economic data, an unclear BoE policy path, and looming Autumn Budget anxieties are all influencing GBP. The housing market’s resilience, however, offers a contrasting narrative.

Upside Thesis (GBPUSD): Low Conviction. A GBPUSD rebound in the upcoming week hinges on a positive market reaction to the Autumn Budget and stronger-than-forecast UK CPI data. Such developments could bolster confidence in the UK economy and its currency. However, significant and sustained upside would require a simultaneous USD weakening, which seems unlikely at present.

Downside Thesis (GBPUSD): Moderate Conviction. GBPUSD is more likely to decline further if the Autumn Budget triggers concerns about the UK's fiscal health. Weaker than projected UK CPI data would likely reinforce the likelihood of a dovish BoE stance adding to downside pressure. Continued USD strength amid persistent US inflation concerns could amplify GBPUSD’s losses, potentially extending this trend into the upcoming month.

What to Watch (GBPUSD):

US Retail Sales (Thu, Oct 17, Week 42): Forecast 0.3%. Strong US data would support USD, impacting GBPUSD.

US Initial Jobless Claims (Thu, Oct 17, Week 42): Forecast 241K. A surprisingly high number could weigh on USD.

US Philadelphia Fed Manufacturing Index (Thu, Oct 17, Week 42): Forecast 3. Weaker than anticipated data could trigger USD weakness.

UK Unemployment Rate (Tue, Oct 15, Week 42): Forecast 4.1%. A higher figure could fuel BoE easing expectations.

UK Inflation Rate YoY (Wed, Oct 16, Week 42): Forecast 1.9%. A miss could weaken GBP.

UK Retail Sales MoM (Fri, Oct 18, Week 42): Forecast -0.3%. A further decline could weigh on sentiment.

EURUSD: Euro Under Pressure

EURUSD is a highly liquid pair, with active participation from a broad spectrum of traders. Its movements are closely tied to interest rate differentials and economic growth prospects in the Eurozone and the US. The pair often demonstrates an inverse relationship with German Bund yields. The latest COT report (October 8, 2024) indicates a net short position held by leveraged funds and other reportables, with asset managers net long, revealing conflicting market views. Dealers are also positioned net short.

EURUSD's performance reflects the interplay between ECB policy and global growth anxieties, particularly concerning the Eurozone's health. Weaker PMI figures and Germany's economic struggles have increased the likelihood of further ECB easing. Hopes for Chinese stimulus, particularly its potential impact on export-oriented Eurozone businesses, offer a glimmer of hope, creating a volatile environment for the pair.

Upside Thesis (EURUSD): Low Conviction. A rally for the pair requires a substantial change to the current macroeconomic environment. This would include a softer than anticipated US retail sales release triggering a less hawkish than anticipated Fed outlook along with more upbeat-than-expected Euro Area industrial production data. Further optimism surrounding Chinese stimulus efforts could also lend some support to the euro.

Downside Thesis (EURUSD): Moderate Conviction. EURUSD is likely to remain under pressure if weaker-than-expected Euro Area retail sales and industrial production figures worsen growth concerns. A more hawkish-than-anticipated communication from the Fed, reinforcing the narrative of resilient US economic growth, could exacerbate the euro’s weakness, potentially extending this downward trend into the upcoming month.

What to Watch (EURUSD):

US Retail Sales (Thu, Oct 17, Week 42): Forecast 0.3%. Strong US data would support USD, weakening EURUSD.

US Initial Jobless Claims (Thu, Oct 17, Week 42): Forecast 241K. A higher-than-expected figure could weigh on the dollar.

US Philadelphia Fed Manufacturing Index (Thu, Oct 17, Week 42): Forecast 3. Weaker than expected data could lead to USD weakness.

Euro Area Industrial Production MoM (Tue, Oct 15, Week 42): No forecast. A decline could fuel concerns over the region’s growth potential.

Euro Area ZEW Economic Sentiment Index (Tue, Oct 15, Week 42): Forecast 10. A miss could further weigh on EUR.

Conclusion

Sentiment towards the USD remains mixed, driven by a combination of better-than-expected economic data and persistent core inflation. The JPY faces uncertainty as the BOJ attempts to balance inflation concerns with the potential impact of a strong yen. The GBP is bracing for the UK Autumn Budget, while the euro remains under pressure due to stagnation fears in the Eurozone. In the upcoming week, key economic data releases and central bank communications, including US Retail Sales and the UK CPI report, will be crucial in shaping sentiment and influencing currency pair movements.

Key Action Points:

Closely monitor US economic data for clues about the Fed's easing path, as it will have broad implications for forex markets.

Stay informed about developments surrounding the UK Autumn Budget, which could trigger significant GBP volatility.

Watch for signs of stabilisation or further deterioration in the Eurozone economy, as this will be crucial for the euro's trajectory.

Sources:

Bloomberg

Trading Economics

Federal Reserve

Bank of Japan

Bank of England

European Central Bank

Statistics Canada

Ivey Business School

GfK Group

BRC - British Retail Consortium

Office for National Statistics

INSEE, France

Federal Statistical Office, Germany

EUROSTAT

S&P Global

CFTC (Commodity Futures Trading Commission)

Reuters