EA Macroeconomic Analysis

The EUR has been Neutral, likely to Moderately Weaken

The EUR has been Neutral, likely to Moderately Weaken

Gauging the Euro's True Grit

In recent months, the Euro has presented a puzzle to Forex traders - neither clearly bullish nor bearish, its fundamental strength has remained firmly Neutral. Looking ahead, the outlook suggests a potential shift, with forces in motion that point towards a Moderately Weakening fundamental strength in the coming seven months. But what does this mean for traders navigating the ever-turbulent currency markets?

Context: Decoding Trader Sentiment in a Complex Landscape

Currency traders face a tough time with global economic and political shifts, especially in the Euro Area. The big question is how the Euro will fare with possible ECB rate cuts versus the area's economic health. Can German spending and the region's strength offset the impact of easier money? Political risks add to the worry, with the Ukraine war, trade disputes, and internal politics in countries like Germany and France all creating uncertainty. These issues can quickly move markets. This analysis looks at the Euro's past strength and tries to make sense of its uncertain path ahead.

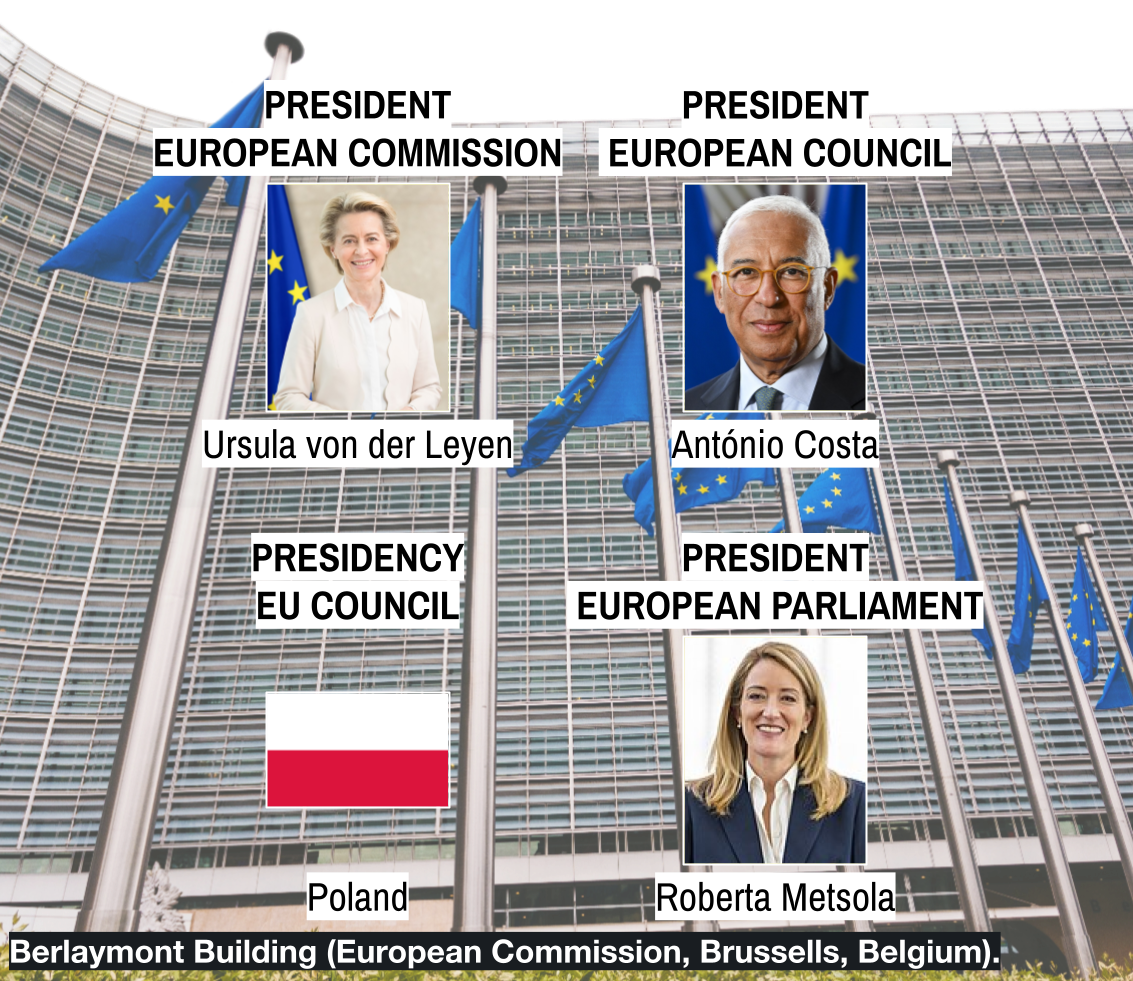

GOVERNMENT The Euro Area's Leadership Landscape

The Euro Area, governed by the EU, is led by key figures like the European Council President (António Costa) and European Commission President (Ursula von der Leyen). The EU's goals include peace, citizen well-being, and sustainable development, with the Commission prioritizing areas like prosperity, security, and the digital and climate transitions.

Recent Events: Shifting Priorities in Europe

Ukraine's war has spiked Euro Area defense budgets, particularly in Germany, sparking debt reform talks and Euro-bond ideas. New EU fiscal rules are in play, with members submitting plans. "Competitiveness Compass" aims to boost the economy amid trade concerns, notably US tariffs and China imports. Moldova's EU bid moves forward with sustainability policies. A likely center-right German election outcome in February 2025 could shift Euro Area strategies. High-level EU meetings highlight tight institutional coordination.

Outlook: Navigating Future Policy and Economic Paths

In the coming months, the Euro Area will prioritize competitiveness and new fiscal rules, navigating critical US trade relations. Germany's coalition and debt debate will shape the region's economy. 2026 EU budget talks loom. Early 2025 GDP growth is seen around 0.2%, with the EU50 stock index near 5399 points, inflation at 2.2%, and unemployment at 6.4%. The European Commission forecasts gradual GDP growth to 1.3% in 2025 and 1.6% in 2026, with inflation easing to 2.1% in 2025 and 1.9% in 2026. The ECB is more cautious, predicting 0.9% GDP growth in 2025, rising to 1.3% in 2027, with inflation averaging 2.3% in 2025, 1.9% in 2026, and 2.0% in 2027. Watch for the March Euro Area Inflation Rate on April 1, the ECB's monetary policy decision on April 17, and the Q1 2025 GDP Growth Rate around April 30.

CENTRAL BANK

The ECB's Stance on Price Stability

The ECB, focused on keeping inflation under 2%, is led by Christine Lagarde until October 2027, with Luis de Guindos as Vice-President. The Executive Board sets monetary policy, using interest rates to control inflation. Rates, recently cut by 25 basis points, now stand at 2.50% (deposit), 2.65% (main refinancing), and 2.90% (lending), effective March 12, 2025.

Recent Events: Navigating Inflation and Economic Growth

Since August 2024, the ECB has steadily cut rates by 25 basis points, reflecting easing inflation and growth worries. Council talks reveal a delicate balance: managing sticky service and energy inflation while supporting the economy. Caution against early rate-cut halts is urged. February 2025 saw headline inflation at 2.3%, with core inflation also slowing. Q4 2024 GDP growth was a modest 0.2%, and 2025 forecasts have been slightly lowered due to global uncertainty. The ECB stresses a data-driven, meeting-by-meeting approach. Updated March 2025 projections are key for future policy.

Outlook: Further Monetary Easing Expected

Markets foresee continued ECB easing in 2025, with rates potentially dropping to 1.90% by 2026 and 1.50% by 2027. The April 17 meeting is key for rate clues. Analysts predict the deposit rate could dip to 2.25% or less by year's end. A policy stance shift could pause cuts, but data drives the pace. Inflation is seen nearing 2%. Watch for March inflation data April 1, the April 17 rate decision, and Q1 GDP around April 30. Further April cuts are likely, pending economic updates.

ECONOMIC GROWTH

Euro Area's Economic Engine

The Euro Area, a global economic heavyweight, ranks third after the US and China. Germany, France, and Italy drive its economy, contributing over half of the EU's $20 trillion GDP.

Recent Events: Mixed Economic Signals

Euro Area economic data is a mixed bag. March's PMI hints at slight Q1 growth, with manufacturing showing a recovery. Q4 2024 GDP was revised up to 0.2% quarterly and 1.2% yearly, fueled by spending and investment. January's industrial output stabilised, and manufacturing grew in March for the first time in two years. However, retail trade fell in January, and consumer confidence dipped in March, signalling weaker spending.

Outlook: Moderate Growth Forecasts

Economic forecasts for the Euro Area suggest continued moderate growth. Flash PMI data points to a slow 0.1% GDP growth for Q1 2025. Trading Economics projects quarterly GDP growth at 0.2% for Q1 2025 and 0.1% for Q2 2025. Focus Economics anticipates accelerated GDP growth in 2025 due to interest rate cuts and lower inflation but has lowered export forecasts due to US trade tensions. The Conference Board projects around 0.2% quarterly growth for the first half of 2025, accelerating to 0.3% in the second half, with an annual growth forecast of 0.9% for 2025. Vanguard forecasts a more optimistic 1.0% GDP growth for 2025. The ECB anticipates a slower recovery in 2025 due to geopolitical and policy uncertainty, but expects growth support from rising household incomes and easing financing conditions. Overall, forecasts indicate moderate economic expansion for the Euro Area in 2025, with potential risks from global trade tensions.

Economic Indicators: Monitoring the Euro Area's Health

Forex traders closely monitor Euro Area economic indicators like inflation, unemployment, GDP growth, and sentiment measures to assess the economy's health and future direction. Fiscal policy indicators and ECB interest rate decisions are crucial. Sentiment indicators, including economic sentiment, consumer confidence, and inflation expectations, are also closely watched. Broader market themes such as energy costs, demographics, productivity, trade shifts, green transition financing, technological advancements, and defense spending also shape the Euro Area's economic landscape.

Recent Events: A Mixed Bag of Signals

Recent trends in Euro Area economic indicators present a mixed picture. Inflation has decreased from 2023 levels, with the Eurozone inflation rate at 2.4% in February 2025, although there was a slight increase in January 2025 to 2.5% due to energy prices. The labor market remains tight, with the Eurozone unemployment rate at 6.2% in January 2025. Industrial production has stabilised, with a 0.8% month-on-month increase in January 2025 and a year-on-year figure of 0.0%, marking improvement from previous declines. However, retail sales decreased by 0.3% month-on-month in January 2025, and consumer confidence fell to -14.5 in March 2025, suggesting weakening consumer spending and increased pessimism.

Outlook: Moderating Inflation, Uncertain Consumer Spending

Forecasts suggest inflation will continue to moderate in 2025, averaging around 2.3%, with Trading Economics projecting a quarterly moderation from 2.1% in Q1 2025 to 2.2% in Q4 2025. The unemployment rate is expected to gradually increase throughout 2025, reaching 6.7% by Q4 2025, according to Trading Economics. Retail sales outlook remains volatile with uncertain monthly forecasts. Consumer confidence is expected to remain subdued, with Trading Economics forecasting -14.5 for March 2025, reflecting continued caution among households. Near-term forecasts suggest inflation moderation but a potentially weakening labour market and subdued consumer spending, presenting a mixed economic outlook for the Euro Area.

GEOPOLITICS TENSIONS CREATE SUBSTANTIAL ECONOMIC UNCERTAINTIES

The Euro Area is a major global player in trade, finance, and diplomacy. Its key partners are the US (NATO, trade), China (trade, rivalry), and the UK (post-Brexit ties). It also engages with Canada, Japan, South Korea, and India.

Recent Events: Responding to Global Challenges

Post-Ukraine, European defence budgets are up, with nations questioning US guarantees. The EU's backing of Ukraine is solid, covering finances, aid, and military support. Trade spats aside, EU-US ties hold through the TTC. China relations? Tricky, balancing cash with political worries. A Parliament decision to loosen China meeting rules hints at a shift. EU growth stays key, Moldova's getting support. President Costa's been busy – Ukraine talks, EU meetings, and summits on Gaza, South Africa, and the G7 show the EU's global push.

Outlook: An Uncertain Geopolitical Horizon

Seven months out, Ukraine's war still shapes Europe, hitting energy and Russia ties hard. The '25 US election? Big wildcard for EU-US relations, especially trade and NATO. Europe's China dance continues, balancing business with human rights. Expect a push for stronger European defence, less outside reliance. The Middle East, with the Israel-Hamas conflict, threatens energy and stability. Economic recovery in Europe? Geopolitics will likely slow it down. Trade worries, mainly with the US and China, will keep hitting exports and investment. Events like the March '25 pharma law conference show the EU's focus on regulations and trade, both with global implications. Bottom line: Europe's facing ongoing uncertainty, demanding quick diplomatic and economic moves.

Fundamental Strength Debate: Euro's Resilience and Future

Previous Seven Months

Cases for Strong Euro Fundamentals:

Monetary Policy Normalisation

Economic Diversification

Fiscal Policy Shift in Germany

Safe Haven Status

Trade Surplus

Cases for Weak Euro Fundamentals:

Economic Stagnation

Deflationary Pressures

Geopolitical Risks

Trade Tensions

Consumer Confidence

Upcoming Seven Months

Cases for a Strengthening Outlook for the Euro Fundamentals:

Potential for ECB Policy Pause

Fiscal Stimulus Impact:

Resolution of Trade Tensions

Safe-Haven Demand

Cases for a Weakening Outlook for the Euro Fundamentals:

Continued Monetary Easing:

Persistent Economic Slowdown

Escalating Trade Wars

Geopolitical Instability

Divergence in Economic Performance

MOST PROBABLE SCENARIO: A Neutral Stance with Potential for Moderate Weakening

Fundamental Strength of the Euro During the Previous Seven Months: Neutral.

The Euro's fundamental strength in the past seven months is best characterised as Neutral. While the Euro Area boasts a robust and diversified economy, its performance has been weighed down by sluggish growth and persistent, though moderating, inflationary pressures. The ECB's monetary policy has shifted towards a more accommodative stance, reflecting concerns about economic headwinds, which has exerted downward pressure on the currency. However, the Euro has also demonstrated resilience, supported by its safe-haven status and a consistent trade surplus. These counteracting forces suggest a neutral fundamental strength, with neither strong bullish nor bearish factors dominating.

Fundamental Strength Outlook of the Euro During the Upcoming Seven Months: Moderately Weakening.

The fundamental strength outlook for the Euro in the upcoming seven months is tilted towards Moderately Weakening. The primary driver for this outlook is the anticipated continuation of the ECB's monetary easing cycle, which is expected to further reduce the Euro's attractiveness relative to other currencies, particularly if the US Federal Reserve maintains a less dovish stance. Persistent geopolitical uncertainties and the potential for escalating trade tensions, especially between the US and Euro Area, pose downside risks to the Euro Area economy, further supporting a weakening outlook for the currency. While Germany's fiscal stimulus package offers a potential upside, its actual impact and effectiveness in boosting Euro Area growth remain uncertain. Therefore, while not projecting a rapid collapse, the balance of probabilities suggests a moderate weakening in the Euro's fundamental strength over the next seven months.

CONCLUSION

Euro's Path Ahead - Navigating Neutrality

In conclusion, assessing the Euro Area and the Euro reveals a nuanced picture of fundamental strength. Over the preceding seven months, the Euro's position can be best described as Neutral. This reflects a balance between underlying economic strengths and persistent headwinds. While the Euro Area economy is diversified and benefits from a robust export sector, it grapples with moderate growth and inflation that, while easing, remains a concern for the ECB.

Looking forward across the upcoming seven months, the most probable scenario points towards a Moderately Weakening fundamental strength for the Euro. This outlook is primarily shaped by the expectation of continued monetary easing from the ECB, contrasting with other major central banks. Escalating global trade tensions and geopolitical uncertainties further cloud the horizon, potentially dampening investor confidence in the Euro Area's economic prospects. For Forex traders, understanding this nuanced outlook is essential for strategic decision-making in the months ahead.

Sources:

EA Macro Research File, Trading Economics, European Central Bank, European Commission, Conference Board, Vanguard, Nomura, Deloitte, European Commission, German Federal Statistical Office, Bloomberg, Reuters, Financial Times, Wall Street Journal, CNBC, Teletrade, Mitrade, The Bull Vine, Forex24, Trading Economics, Unspecified News Agencies, Agrimoon, S&P Global Commodity Insights, ICE Futures U.S.