EUR: Euro Steady as ECB Rate Cut Bets Fade, Focus Shifts to US GDP and ECB Meeting

Fundamental Analysis of the EUR

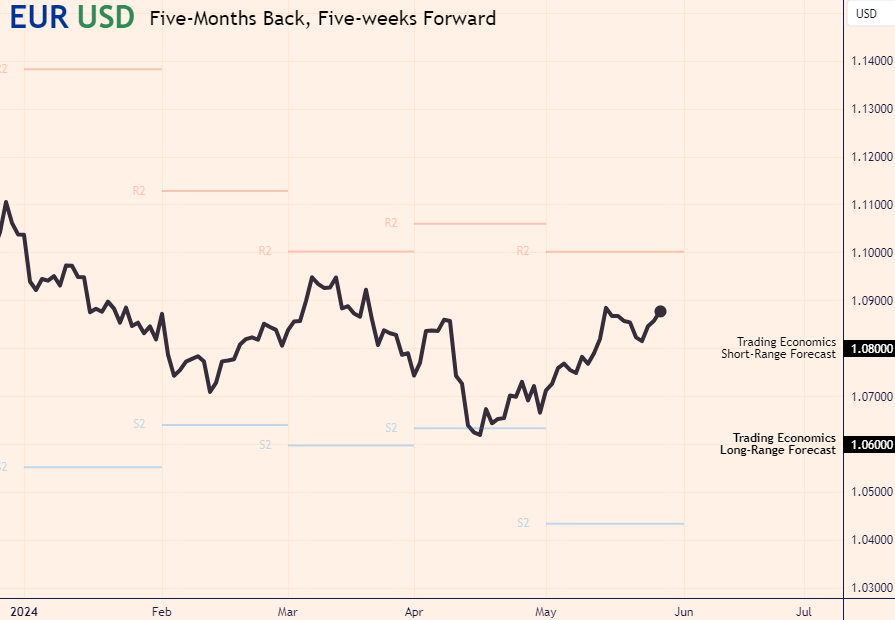

Tuesday, 28 May 2024, Week 22: This report provides a comprehensive analysis of the fundamental factors influencing the EUR, incorporating data from various sources, including economic data releases, central bank communications, and geopolitical developments. The report aims to provide Forex traders with a clear and concise understanding of the current EUR landscape, covering economic performance, monetary policy, and potential market movers. The analysis delves into the factors that have driven the euro's performance over the past five months and five weeks, concluding with a five-month and five-week outlook.

ASSESSMENT

The euro has been trading within a relatively tight range against the US dollar over the past five weeks, reflecting a period of mixed economic data and shifting market expectations regarding the European Central Bank's (ECB) monetary policy trajectory.

Economic Growth: The Eurozone economy expanded by 0.3% quarter-on-quarter in the first three months of 2024, recovering from a 0.1% contraction in each of the previous two quarters (Source: EUROSTAT). This positive development suggests that the Eurozone is on a path to recovery, albeit a gradual one. However, the outlook for growth remains subject to downside risks, including the ongoing conflict between Israel and Hamas, persistent inflationary pressures, and potential spillover effects from a slowing global economy.

Labour Market: The Euro Area labour market has remained resilient, with the unemployment rate holding steady at a record low of 6.5% in March 2024 (Source: EUROSTAT). This ongoing strength in the labour market provides some support for the euro, as it suggests that domestic demand remains relatively robust. However, wage growth has slowed, with wages in the Eurozone rising 3.1% year-on-year in the fourth quarter of 2023, the least since the third quarter of 2022 (Source: EUROSTAT). This slowdown in wage growth could potentially weigh on consumer spending in the coming months.

Inflation: Inflation in the Euro Area remains above the ECB's 2% target, but has shown signs of moderating in recent months. Annual inflation rate in the Euro Area was confirmed at 2.4% in April of 2024, the same as in March (Source: EUROSTAT). While this suggests that inflationary pressures may be easing, core inflation, which excludes volatile energy and food prices, remains elevated. The ECB will be closely monitoring inflation developments in the coming months to assess whether further policy action is needed to bring inflation back to its target sustainably.

Monetary Policy: The ECB maintained interest rates at its April meeting, with the main refinancing operations rate remaining unchanged at 4.5% (Source: European Central Bank). However, the central bank's communication has shifted slightly in recent weeks, with some policymakers suggesting that the ECB may be nearing the end of its rate-hiking cycle. Market expectations for further rate hikes from the ECB have diminished, which has contributed to the recent stabilization of the euro. However, the ECB's policy path remains data-dependent, and any resurgence in inflationary pressures could prompt a more hawkish stance from the central bank.

LOOKING-BACK

Five-Month Influences: The euro has experienced a period of volatility over the past five months, influenced by a confluence of factors, including shifting interest rate differentials, the evolving economic outlook for the Eurozone, and geopolitical developments.

Initially, the euro weakened against the US dollar as the US Federal Reserve embarked on an aggressive rate-hiking cycle to combat surging inflation. This widening interest rate differential between the US and the Eurozone made the US dollar more attractive to yield-seeking investors, putting downward pressure on the EUR/USD.

However, the euro found some support in early 2024 as the ECB adopted a more hawkish tone, signalling its intention to start raising interest rates sooner than previously anticipated. This shift in the ECB's stance, coupled with some softening in US economic data, led to a narrowing of interest rate differentials and a rebound in the EUR/USD.

Five-Week Influences: Over the past five weeks, the euro has traded within a narrower range against the US dollar, reflecting a period of consolidation as market participants assessed the evolving economic landscape and the potential trajectory of monetary policy.

The euro initially weakened in early May as the escalating conflict between Israel and Hamas fueled risk aversion and boosted demand for safe-haven currencies, such as the US dollar and the Japanese yen. The euro, being perceived as a riskier currency than the US dollar in times of geopolitical uncertainty, came under pressure.

However, the euro found some support later in the month as economic data from the Eurozone surprised to the upside, with the first-quarter GDP growth exceeding expectations and the unemployment rate remaining at a record low. This positive data reinforced expectations that the ECB would continue to raise interest rates in the coming months, providing some support for the euro.

LATEST and LOOKING-AHEAD

Five-Month Outlook

Looking ahead to the next five months, the euro's trajectory will likely be influenced by several key factors:

ECB Monetary Policy: The ECB's monetary policy stance will be crucial for the euro's performance. While the ECB has signaled its intention to continue raising interest rates, the pace and extent of future hikes remain uncertain. The ECB's policy decisions will be data-dependent, with inflation developments and the overall health of the Eurozone economy playing a significant role in shaping the central bank's course of action.

Global Economic Outlook: The global economic outlook remains uncertain, with risks tilted to the downside. The ongoing conflict between Israel and Hamas, persistent inflationary pressures, and the potential for a sharper-than-expected slowdown in major economies, such as the US and China, could weigh on global growth and impact the euro.

Geopolitical Developments: Geopolitical risks remain elevated, with the potential to impact market sentiment and currency valuations. The evolution of the Israel-Hamas conflict, tensions between the US and China, and political uncertainty in other parts of the world could all contribute to market volatility and influence the euro's performance.

Five-Week Outlook

In the coming five weeks, the euro's performance will likely be driven by the following factors:

US Economic Data: The release of key US economic data, including the second estimate of first-quarter GDP growth, inflation data, and employment figures, will be closely watched by market participants. Stronger-than-expected US data could boost the US dollar and weigh on the EUR/USD, while weaker-than-expected data could have the opposite effect.

ECB Meeting: The ECB's monetary policy meeting on 6 June will be a significant event for the euro. Market participants will be looking for further guidance from the ECB on the future path of interest rates. A hawkish tone from the ECB, suggesting further rate hikes are likely, could support the euro, while a more dovish stance could weigh on the currency.

Geopolitical Developments: The ongoing conflict between Israel and Hamas and its potential for escalation or de-escalation will continue to be a key driver of market sentiment and could impact the euro's performance. Any signs of a resolution to the conflict could boost risk appetite and weigh on the US dollar, potentially supporting the EUR/USD. Conversely, any escalation of the conflict could fuel risk aversion and benefit the US dollar, putting downward pressure on the EUR/USD.

CONCLUSION

The euro's outlook remains uncertain, with a confluence of factors likely to influence its performance in the coming months and weeks. The ECB's monetary policy stance, the global economic outlook, and geopolitical developments will all play a significant role in shaping the euro's trajectory.

Traders will be closely monitoring economic data releases, central bank communications, and geopolitical events for clues about the future direction of the euro. The upcoming releases of US GDP data and the ECB's interest rate decision will be particularly important events to watch in the coming weeks.

References:

Official Government Agencies:

EUROSTAT

US Bureau of Labor Statistics

US Census Bureau

Office for National Statistics

Government Documents:

Federal Open Market Committee (FOMC) minutes and statements

News Agencies:

Reuters

Bloomberg

Associated Press

CNBC

The Wall Street Journal

The Guardian

Politico

Sky News Arabia

The Times of Israel

The Times

Newsletters:

Newsquawk

Money Distilled

Economics Daily

Balance of Power

Publications:

STRATFOR Quarterly Forecast

STRATFOR Assessments

CFTC COT Report

Weekly Economic Release