EUR Fair Value Report

The EUR/USD has a fair value of 1.0900 - 1.1100

The EURUSD has a fair value of 1.0900 - 1.1100 and is expected to see a moderately bullish influence upon its fair value during the upcoming seven weeks.

Welcome to this analysis of the Euro Area and the EURUSD currency pair. Recent weeks have shown the Euro demonstrating notable resilience, particularly when compared against a US dollar grappling with significant policy uncertainty and conflicting economic signals. This report examines the key governmental, central bank, economic, and geopolitical factors shaping the Euro's current trajectory and offers insights into the potential path forward.

Looking ahead over the next seven weeks, the direction of the EURUSD pair will likely hinge on four main drivers. Firstly, the divergence in monetary policy expectations is critical; markets anticipate potential easing from the Federal Reserve while the European Central Bank appears more cautious. Secondly, relative economic performance matters, especially considering the Eurozone's recent positive growth surprise versus concerns about the impact of tariffs on the US economy. Thirdly, volatile global risk sentiment, heavily tied to developments in US trade policy, will continue to influence currency flows. Finally, specific Eurozone factors, such as progress on fiscal rule reforms and energy security measures, will play a role.

Governing the Euro Area

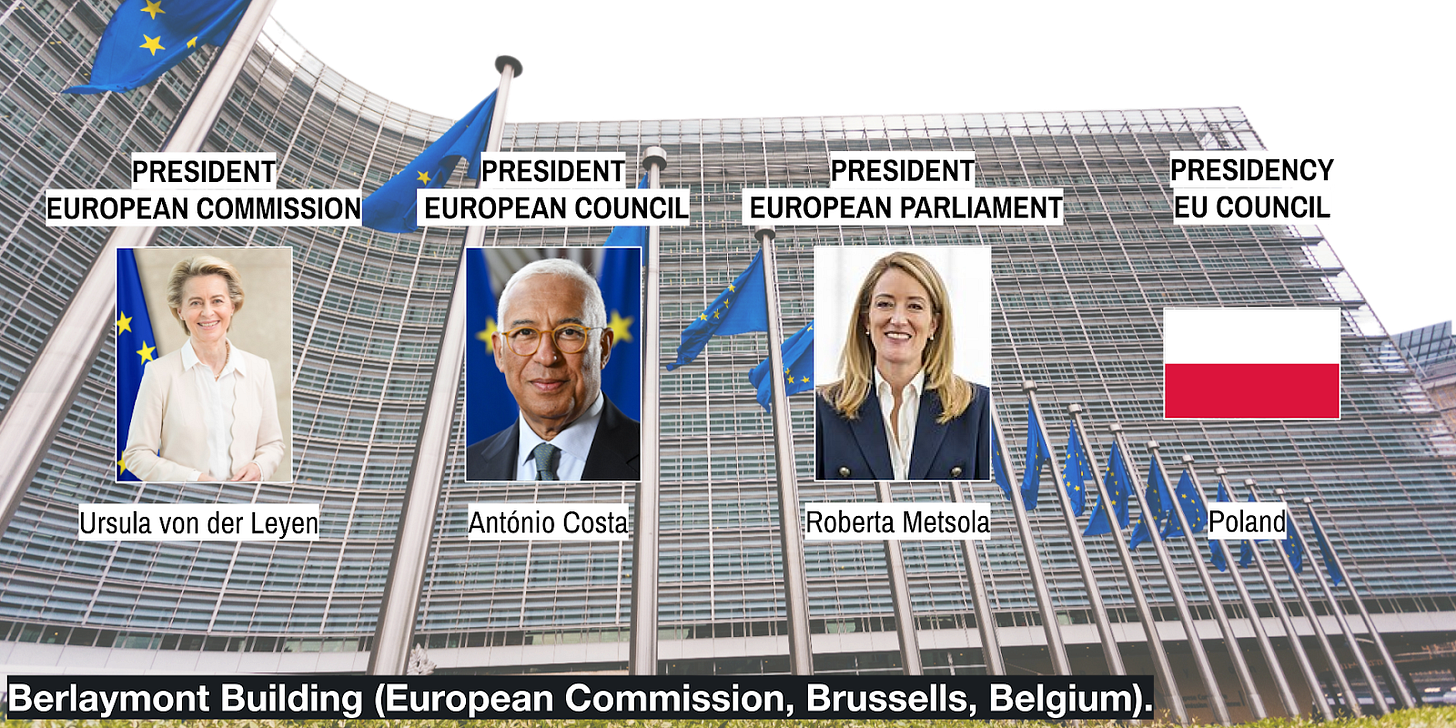

Euro Area governance involves a multi-layered structure blending supranational EU institutions with national governments. Key EU bodies include the European Commission (executive branch, led by President von der Leyen), the European Council (sets political direction, led by President Michel), and the co-legislators: the Council of the European Union (representing member states) and the directly elected European Parliament (led by President Metsola). The Eurogroup, an informal body of Eurozone finance ministers (chaired by President Donohoe), coordinates fiscal policy. Current priorities are shaped by recent crises and strategic goals like the Green Deal and digital transition. Policy fragmentation risk exists due to reliance on national implementation.

Recent Political Currents

The period from mid-March to early May 2025 likely saw continued debate on reforming the Stability and Growth Pact (SGP) fiscal rules, balancing debt sustainability with investment needs. Ongoing uncertainty surrounding these rules potentially acted as a drag on investor confidence. EU ministers probably also coordinated on energy security measures. Market sentiment remained sensitive to the bloc's unity on energy policy. Progress reports on NextGenerationEU fund deployment were also likely monitored, influencing growth expectations.

The Political Horizon

In the coming seven weeks (early May to late June 2025), negotiations on SGP reform remain critical; agreement could reduce uncertainty, while failure might increase volatility. Scheduled European Council summits will address key issues like Ukraine support and competitiveness, providing important signals of political unity. Further reviews of NextGenerationEU progress and legislative advancements on Green Deal/digital files are anticipated. The final shape of SGP rules will significantly influence the capacity for green public investment.

The Central Banker's Watch

The European Central Bank (ECB), led by President Christine Lagarde, is mandated to maintain price stability, targeting two percent inflation over the medium term. Policy is set by the Governing Council (Executive Board plus national central bank governors). Key tools include interest rates (deposit, refinancing, marginal lending), and balance sheet adjustments (currently Quantitative Tightening, QT). The Transmission Protection Instrument (TPI) exists to counter market fragmentation. The ECB balances its primary inflation mandate with supporting general EU economic policies.

Recent Policy Pulses

On April 17, 2025, the ECB cut its key interest rates by 25 basis points, lowering the deposit rate to 2.25 percent, citing easing inflation and growth concerns linked to trade risks. The accompanying statement removed "restrictive" language but lacked strong forward guidance on future cuts. Communication emphasized data dependency, particularly on sticky core inflation and wage growth. QT continued as planned.

Looking Ahead at Monetary Moves

The next key event is the June 5th Governing Council meeting. The decision will depend heavily on incoming data, especially May's flash HICP inflation (focus on core/services), final Q1 GDP details, May PMIs, and wage growth trends. Post-meeting accounts and speeches by key officials will be scrutinized. The challenge remains navigating the "last mile" of inflation while monitoring QT impacts and significant external risks.

Gauging the Economic Engine

The Euro Area features a diverse, advanced economy dominated by services (finance, tourism, IT). Manufacturing (Germany, France, Italy) is vital but faces challenges. Major trade partners include the US, UK, China, Switzerland, with significant intra-EU trade. High openness makes it sensitive to global trends/shocks. Leading firms span luxury (LVMH), tech (SAP, ASML), industrials (Siemens), energy (TotalEnergies), autos (VW), finance (BNP Paribas). Deep financial markets include Euronext, Deutsche Börse, benchmark indices (EURO STOXX 50, DAX), liquid government bond markets (German Bunds as benchmark), and the Euro as the second global currency. Significant economic divergence persists between member states.

Recent Economic Vital Signs

Recent data (mid-March to early May 2025) showed surprising resilience mixed with concerns. Q1 2025 GDP growth unexpectedly accelerated (+0.4 percent QoQ). Headline April HICP inflation held steady (2.2 percent YoY), but core inflation rose more than expected (2.7 percent YoY), indicating persistent underlying pressures. While flash April PMIs initially signaled stagnation, final readings were slightly better, though manufacturing remained weak. Labour markets stayed resilient (low unemployment), and March bank lending accelerated. However, April economic sentiment plunged significantly due to trade fears.

The Economic Calendar Ahead

Upcoming data (early May to late June 2025) includes flash May HICP (critical for core inflation trend), final Q1 GDP details, May/June PMIs (activity momentum), labour market reports (wage growth crucial), sentiment surveys, and retail sales figures. These releases will be vital for assessing underlying economic health amidst conflicting signals and external pressures, heavily influencing ECB policy expectations.

Global Currents and Crosswinds

Europe's Place in the World

The Euro Area (via the EU) holds significant global economic and regulatory influence, championing multilateralism. Key relationships are with the US (ally, occasional friction), China (complex partner/competitor/rival, pursuing "de-risking"), UK (post-Brexit management), and Russia (adversary). Attracts substantial FDI but portfolio flows are sensitive to rates, growth, and risk sentiment. Highly sensitive to US policy shifts. Risks include geopolitics (Ukraine, US-China), trade fragmentation, inflation/recession, energy security, financial stability, and internal political cohesion.

Recent Geopolitical Tremors

The period from mid-March to early May 2025 was dominated by fallout from US trade policy escalation. Tariffs implemented in early April hit sentiment and markets. The EU prepared countermeasures but engaged in a 90-day pause after US adjustments for allies (excluding China). High-level EU-China dialogue likely continued amidst de-risking efforts. The Ukraine war persisted as a background risk. Shifting Fed policy expectations heavily influenced EUR/USD.

Anticipating Future Fault Lines

Focus remains on US trade policy trajectory and negotiations (US-EU-China). The G7 summit (June) is key for assessing allied alignment. Ukraine war developments persist as risks. US monetary policy remains crucial for EUR/USD. Global energy market dynamics require monitoring. Internal EU political stability and progress on 'strategic autonomy' initiatives carry opportunities and risks amid a likely structural shift towards higher baseline inflation/rates and geopolitical tension.

EURUSD Pair Analysis

Finding the Floor

Analysis of price action over the previous seven months suggests EURUSD found significant interest around the 1.06 level multiple times, establishing it as a support zone.

Hitting the Ceiling

Conversely, the 1.15 level appears to have acted as a notable resistance area over the last seven months, capping rallies, including the strong advance seen in April 2025 which approached this vicinity.

Reason for the Rejection

The move towards the approximate 1.15 resistance level in April 2025 was primarily driven by sharp US dollar weakness. This stemmed from US policy uncertainty (tariffs, Fed independence concerns) and alarming US economic data (Q1 GDP contraction), contrasting with relative Eurozone economic resilience. The subsequent pullback likely occurred as US-China trade optimism resurfaced, boosting the US dollar, while sticky Eurozone core inflation tempered aggressive ECB easing bets.

Speculating on Fair Value

EURUSD fair value is projected at 1.0900-1.1100 in the next seven weeks, indicating a potential moderate Euro appreciation due to expected stronger Fed easing than ECB, improved Eurozone growth, and significant global trade risks.

Wrapping Up

The Euro Area currently presents a complex picture: an economy showing relative resilience but facing substantial external headwinds, primarily stemming from US trade policy uncertainty. While the European Central Bank proceeds cautiously with monetary easing, mindful of persistent core inflation, the Federal Reserve confronts expectations of potentially more aggressive easing due to domestic economic concerns. This dynamic of policy divergence, combined with recent positive Eurozone growth data, offers moderate underlying support for the EURUSD pair. Nevertheless, the high sensitivity to global risk sentiment shifts and unresolved internal policy debates, such as those surrounding fiscal rules, suggest that volatility is likely to remain a key feature of the market.

For forex traders focusing on EURUSD, key takeaways include:

Monitor communications from both the ECB and the Federal Reserve very closely, paying attention to any shifts in the expected policy divergence. The upcoming June meetings for both central banks are pivotal dates.

Track high-impact economic data releases relative to market expectations – particularly core HICP inflation in the Eurozone and PCE inflation/Nonfarm Payrolls in the US – to gauge economic momentum and anticipate potential policy responses.

Stay vigilant regarding US trade policy headlines and broader geopolitical developments, as these heavily influence global risk sentiment, which directly impacts EURUSD.

Consider the technically significant levels around 1.06 (support) and 1.15 (resistance) when formulating trading strategies.