EUR Fundamental Analysis: Five Months of Volatility, Five Weeks of Downward Pressure, French Elections to Determine Next Direction (June 30th)

Saturday, 15 June 2024, Week 24: The EUR has experienced a turbulent five months, initially strengthening on hopes for easing inflation and a potential shift in global monetary policy. However, recent political uncertainty in France, coupled with a strengthening US dollar, has put downward pressure on the EUR over the past five weeks. The upcoming French parliamentary elections on June 30th will be pivotal in determining the next direction for the EUR. A victory for the far-right National Rally could lead to further EUR weakness, while a Macron victory could provide some support for the currency.

Fiscal Policy

The Euro Area's fiscal stance is expected to tighten significantly in 2024, primarily due to the withdrawal of energy and inflation support measures implemented in response to the 2022 energy crisis. This tightening is projected to continue, albeit at a slower pace, in 2025 and 2026. The withdrawal of these support measures will contribute to a reduction in the budget deficit, which is expected to fall below the 3% of GDP reference value by 2025. The debt-to-GDP ratio is projected to stabilise over the projection horizon.

Over the next five weeks, the fiscal outlook is likely to remain relatively stable, with no major policy changes anticipated. However, the market will be closely watching the implementation of the EU's revised economic governance framework, which aims to encourage fiscal responsibility among member states.

Economics

Economic Growth

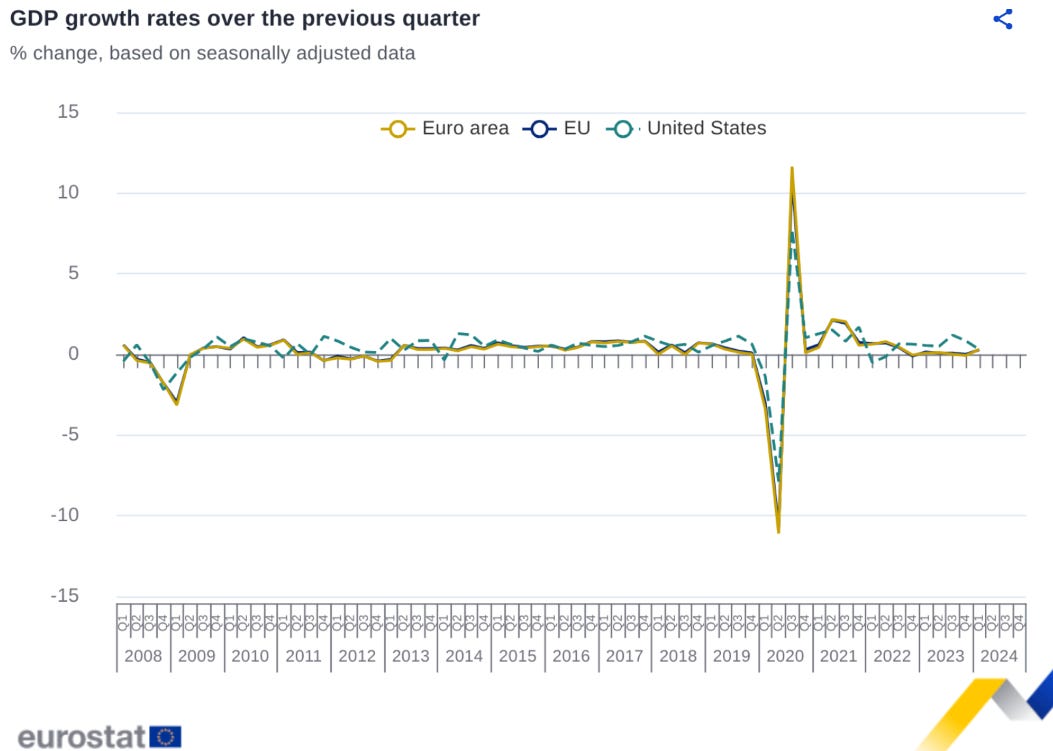

The Eurozone economy is projected to grow by 0.9% in 2024, 1.4% in 2025, and 1.6% in 2026, according to the June 2024 Eurosystem staff projections. This growth will be driven by rising real incomes, strengthening foreign demand, and the fading impact of monetary policy tightening. However, political uncertainty in France and geopolitical tensions pose downside risks to the growth outlook.

Over the next five weeks, the economic growth outlook is likely to remain relatively stable, with no major data releases scheduled. However, the market will be closely watching for any signs of a slowdown in economic activity, particularly in light of the political uncertainty in France.

Labour

The Euro Area labour market remains resilient, with the unemployment rate reaching a record low of 6.4% in April 2024. Employment growth is projected to moderate in the coming years, but the unemployment rate is expected to remain low. Wage growth remains elevated, but is expected to moderate over the course of the year.

Over the next five weeks, the labour market is likely to remain a key focus for investors. The release of the June Euro Area Consumer Confidence survey on June 20th will provide insights into consumer sentiment, which could impact labour market conditions.

Price Changes

Headline HICP inflation is projected to decline to 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026. This disinflationary path is driven by easing cost pressures, including from the labour side, and the lagged impact of past monetary policy tightening. However, inflation is expected to remain above the ECB's 2% target for most of the projection horizon.

Over the next five weeks, the inflation outlook is likely to remain a key driver of EUR movements. The release of the final Euro Area Inflation Rate for May on June 18th will be closely watched by the market.

Trade

The Euro Area recorded a trade surplus of €15 billion in April 2024. The cumulative trade surplus for January to April 2024 reached €72.8 billion, a significant improvement compared to the €20.5 billion deficit recorded during the same period in the previous year.

Over the next five weeks, the trade balance is likely to remain a source of support for the EUR. The release of the Euro Area Current Account for March on June 19th will provide further insights into the region's trade performance.

Monetary Policy

The ECB lowered its three key interest rates by 25 basis points in June 2024, marking a shift from nine months of stable rates. This decision was driven by the declining inflation outlook and the easing of underlying inflation. However, the ECB has signalled that it will keep policy rates sufficiently restrictive for as long as necessary to ensure that inflation returns to its 2% medium-term target.

Over the next five weeks, the ECB's monetary policy stance is likely to remain a key focus for investors. The release of the Bank of England Announcement on June 20th will be closely watched by the market, as it could provide clues about the ECB's future policy path.

Geopolitics and Market Themes

Political Uncertainty in France

Synopsis: Political instability in France following the European Parliament elections is raising concerns about fiscal stability and the country's ability to implement reforms. The prospect of a far-right victory in the upcoming parliamentary elections is adding to market uncertainty.

Key Developments:

French President Macron called for snap legislative elections after the far-right National Rally's strong performance in the EU elections.

The gap between French and German bond yields has widened, reflecting concerns about France's fiscal outlook.

European equities have declined as investors assess the potential for political instability in France.

Market Impact:

The euro has weakened against the dollar, reflecting concerns about political and fiscal risks in France. French bond yields have risen, while German bund yields have fallen as investors seek safe-haven assets. European equities are facing headwinds from political uncertainty, particularly in the financial sector.

Geopolitical Tensions

Synopsis: Geopolitical tensions, including the ongoing war in Ukraine and rising tensions between the US and China, are contributing to market volatility and risk aversion. These tensions are impacting commodity prices, supply chains, and investor sentiment.

Key Developments:

Russia continues its military offensive in Ukraine, raising concerns about energy security and global economic growth.

The US and China are engaged in a strategic competition, leading to trade disputes and technological decoupling.

Market Impact:

Oil prices remain elevated due to concerns about supply disruptions related to the war in Ukraine. Gold prices are finding support as a safe-haven asset amid geopolitical uncertainty. Global supply chains are facing disruptions, contributing to inflationary pressures.

Conclusion

EUR Upward Support

The EUR could find upward support in the coming five weeks if the following factors materialise:

Easing Inflation: The final Euro Area Inflation Rate for May, released on June 18th, confirms the preliminary estimate of 2.6% or shows a further decline. This would reinforce the view that inflation is easing in the Eurozone, potentially leading to a less hawkish ECB.

Macron Victory in French Elections: A victory for President Macron in the French parliamentary elections on June 30th would reduce political uncertainty in France and could boost investor confidence in the Eurozone.

EUR Indifference

The EUR could trade sideways in the coming five weeks if the following factors materialise:

Mixed Economic Data: Upcoming economic data releases, such as the Euro Area Current Account for March on June 19th and the Euro Area Consumer Confidence survey on June 20th, provide a mixed picture of the Eurozone economy. This would leave investors uncertain about the outlook for growth and inflation, leading to range-bound trading in the EUR.

Uncertainty over ECB Policy Path: The Bank of England Announcement on June 20th provides no clear signals about the ECB's future policy path. This would leave investors guessing about the timing and extent of future rate cuts, leading to continued volatility in the EUR.

EUR Downside Pressure

The EUR could come under downside pressure in the coming five weeks if the following factors materialise:

Higher-than-Expected Inflation: The final Euro Area Inflation Rate for May, released on June 18th, surprises to the upside, exceeding market expectations. This would raise concerns about persistent inflation in the Eurozone, potentially leading to a more hawkish ECB.

Far-Right Victory in French Elections: A victory for the far-right National Rally in the French parliamentary elections on June 30th would increase political uncertainty in France and could weigh on investor confidence in the Eurozone.

References

European Central Bank: https://www.ecb.europa.eu/

Eurostat: https://ec.europa.eu/eurostat/

Trading Economics: https://tradingeconomics.com/