Monday, March 03, 2025, Week 10

The EUR gained in value against the CHF following a spike in CPI. The trade has been aborted near its entry to end with a profit of 6 pips.

Monday, February 17, 2025, Week 08

The EUR gained in value against the CHF as was anticipated and triggered its order to sell. The trade is playing out…

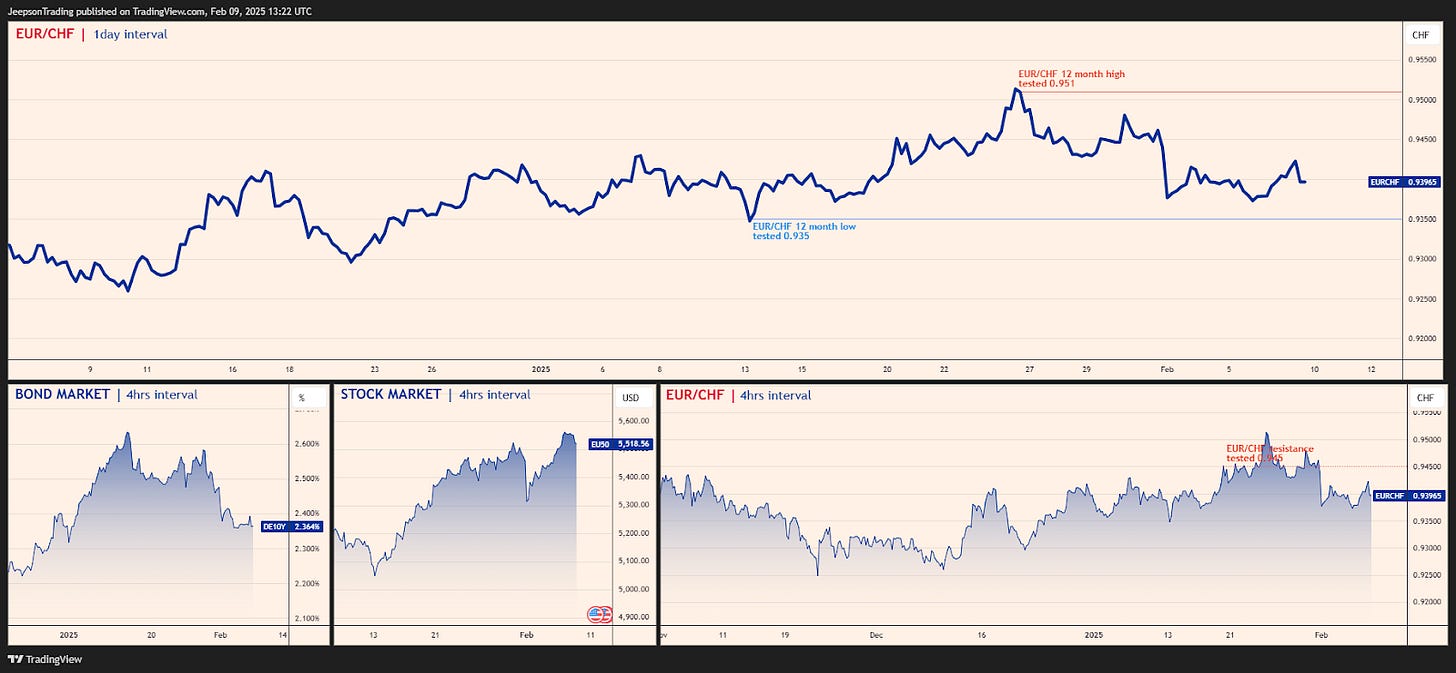

The EUR/CHF pair presents a compelling opportunity, shaped by a confluence of factors impacting both the Euro (EUR) and the Swiss Franc (CHF). In the past few weeks, Trump's tariff announcements have amplified the safe-haven flows into CHF, pressuring the EUR/CHF pair. Simultaneously, mixed economic data from the Eurozone and speculation about potential SNB intervention have added to the market's indecision regarding the pair's near-term trajectory. This trade plan aims to provide a comprehensive overview of these factors and outline a strategy for navigating the EUR/CHF market in the coming days.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

EUR/CHF: Bearish Outlook Amidst Safe-Haven Flows and ECB Dovishness

The EUR/CHF pair has been under pressure due to the ECB's dovish tilt, driven by concerns about slowing growth in the Eurozone. This has led to expectations of further rate cuts, weighing on the EUR. Conversely, the CHF has benefited from safe-haven demand amid global uncertainties, despite the SNB's recent rate cut to 0.5%. An emerging theme is the uncertainty surrounding the SNB's next move. Will they prioritise further easing or managing the CHF's strength? This uncertainty is creating a dynamic trading environment.

In recent weeks, Trump's tariff announcements exacerbated the existing risk aversion, further boosting the CHF and pressuring the EUR/CHF pair. The mixed economic data from the Eurozone, including weaker-than-expected retail sales, added to the EUR's woes. Simultaneously, speculation about potential SNB intervention to curb excessive CHF appreciation has added another layer of complexity to the EUR/CHF outlook.

Over the next ten days, several factors could influence EUR/CHF. The upcoming SNB policy assessment on March 21st will be crucial. Any hints of further easing or intervention could weaken the CHF. Conversely, if the SNB expresses concerns about the Franc's strength, it could provide some support. For the EUR, the focus will be on the February 14th release of the second estimate of Q4 GDP growth. Weaker-than-expected data could further pressure the EUR. The political situations in France and Germany, with new governments navigating economic challenges, are ongoing risks for the EUR. Finally, the global risk environment, particularly US-China trade relations, will continue to influence safe-haven flows and impact the CHF.

The fundamental and sentiment outlook for EUR/CHF remains bearish. The ECB's dovish stance, the Eurozone's economic challenges, and the safe-haven demand for CHF all point to further downside potential. The mixed COT data (Dealers long, Asset Managers short, Leveraged Funds mixed) suggests some uncertainty, but the overall market narrative favours CHF strength. This suggests that the current bearish trend in EUR/CHF is likely to continue.

Upcoming Economic Indicators

Feb 13: CH Inflation Rate YoY (JAN). Higher-than-expected inflation could temper SNB easing expectations, potentially supporting CHF.

Feb 14: EA GDP Growth Rate QoQ 2nd Est (Q4). Weaker-than-expected growth could further pressure EUR, adding to EUR/CHF's decline.

Feb 18: CH Industrial Production YoY (Q4). Stronger data could boost CHF, while weaker data could weigh on it.

Feb 20: CH Balance of Trade (JAN). A wider-than-expected surplus could support CHF, while a smaller surplus or deficit could weaken it.

EUR/CHF Trade Plan: Riding the Downward Momentum

The EURCHF trade plan is based on a bearish outlook, targeting a move towards historical support levels. The entry level is set at 0.943 which allows for a potential retracement before entering the trade. A stop-loss order will be placed at 0.9630 (200 pips) to limit potential losses if the market moves against the trade. The target profit level is set at 0.93300.

Entry: 0.943

Stop-Loss: 0.963

Take-Profit: 0.933

Trade Plan Conclusion

This EUR/CHF trade plan is based on a confluence of factors favouring a bearish outlook. The ECB's dovish stance, the Eurozone's economic challenges, the safe-haven demand for CHF, and the widening interest rate differential between the SNB and ECB all support a move lower. The mixed COT data warrants some caution, but the overall market narrative and recent price action suggest further downside potential. Careful risk management is crucial, given the potential for unexpected market events and SNB intervention.

Sources

Financial Juice, Bloomberg, Reuters, Trading Economics, ForexLive, Federal Reserve, ECB, BOJ, BOE, RBA, RBNZ, SNB, BOC, US Bureau of Labor Statistics, Eurostat, Statistics Canada, Australian Bureau of Statistics, Statistics New Zealand, Swiss Federal Statistical Office, Office for National Statistics, Cabinet Office Japan, Ministry of Internal Affairs and Communications, Ministry of Finance Japan.