Order details…

Sunday, November 17, 2024 (Week 46)

This report examines the complex interplay between Eurozone and UK economic dynamics, particularly focusing on the recent political upheaval in Germany and the upcoming UK budget announcement. By understanding these factors, traders can better position themselves for potential market movements in the weeks ahead.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Currency Pair: Cross-Continental Dynamics

The EUR/GBP, often called the "Euro-Sterling," represents one of Europe's most liquid currency crosses, primarily traded by institutional investors, hedge funds, and retail traders focused on European economic divergence. Trading volumes typically peak during London market hours, with volatility driven by monetary policy divergence between the European Central Bank (ECB) and Bank of England (BoE), as well as political developments in both regions.

German Political Crisis

The collapse of Germany's coalition government following Chancellor Olaf Scholz's dismissal of his Finance Minister has emerged as the dominant market theme. This political upheaval, occurring against the backdrop of broader European economic challenges, has pushed the Euro lower. The uncertainty could extend through December as markets assess the implications of potential snap elections in February 2025.

Emerging Theme: UK Budget Impact

Labour's planned £40 billion tax increase, scheduled for announcement on November 30th, has emerged as a critical market focus. The BoE estimates this could boost GDP by 0.75% at peak impact but also lift inflation by 0.5 percentage points, creating a complex backdrop for Sterling valuation.

Scenarios

Potential Catalysts for EUR/GBP Appreciation

UK inflation data (Nov 20th) printing below 2.0%, suggesting deeper economic weakness

UK Core CPI falling more than expected from current 3.2%

Negative market reaction to UK budget details on November 30th

Signs of stabilisation in German political situation

Stronger than expected Eurozone PMI data (November 22nd)

UK retail sales data showing consumer weakness

Potential Catalysts for EUR/GBP Depreciation

UK inflation data (Nov 20th) printing above 2.2% forecast

UK Core CPI remaining sticky above 3.2%

Weaker than forecast Eurozone inflation data

Escalation of German political crisis

Positive reception of UK budget measures

Better than expected UK retail sales data (November 22nd)

Trade Thesis: Strategic Positioning for Political Risk

Based on current market dynamics and upcoming UK inflation data (November 20th), the trading thesis requires careful timing. UK inflation has been falling faster than expected, reaching 1.7% in September, the lowest since April 2021. Wednesday's October CPI print is forecast at 2.2%, and the outcome will be crucial for near-term EUR/GBP direction.

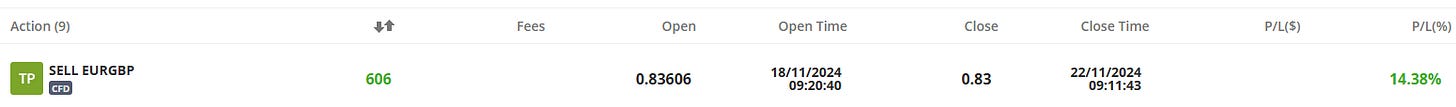

Strategic Short Position Parameters: Entry Level: 0.8360 (contingent on UK CPI meeting/exceeding 2.2% forecast) Stop Loss: 0.8560 (200 pips above entry) Near-term Target: 0.8300 (Previous support level) Extended Target: 0.8200 (Key psychological level)

Alternative Scenario: If UK CPI prints below 2.0%, consider long positions on any dips to 0.8300 with a 200-pip stop loss.

Conclusion

The EUR/GBP faces a critical period with several high-impact events on the horizon. Our analysis suggests a bearish bias with carefully managed risk parameters.

Key Takeaways:

German political uncertainty creates near-term headwinds for the euro

UK budget announcement represents a crucial inflection point

Technical setup favours strategic short positions with defined risk parameters

Sources: Bank of England, European Central Bank, Bloomberg, Reuters, Trading Economics, S&P Global, Bundesbank, Office for National Statistics.