Euro and Pound May Be Ready to Bounce, But Don't Get Too Excited

Week Number 37 2023 Market Analysis - SECOND UPDATE

Derbyshire, UK – September 14, 2023: The week has seen the dollar surge higher putting pressure on the other currencies amid an era of inflation becoming sticky as consumers continue to spend. Investors are focused on next Wednesday when the FOMC meet and decide on their course of action.

Decisions to trade are made at your own monetary risk.

DXY May Stabilise, Resistant Against Significant Dips

The DXY, a measure of the dollar's strength against a basket of currencies, gained value in July and August. This was due to market expectations that the US Federal Reserve would keep interest rates high for longer than previously thought. The strong dollar is expected to continue in the near term due to high inflation and safe-haven demand.

Intermarkets are reacting to the pessimistic macroeconomic outlook with the S&P 500 moving below the 50-day moving average and the yield on six-month Treasury bonds holding around 5.5%.

Markets can be volatile and so be observant to signs that could limit further gains of the DXY:

Signals that the CPI rate in the US is slowing more than expected. This can lead to a less hawkish Fed, reducing the yield on Treasury Bonds and reducing the demand for USD.

Signals that investors are growing tolerant to risk. This can lead to investors moving money out of safe havens such as Treasury Bonds and reducing the demand for USD.

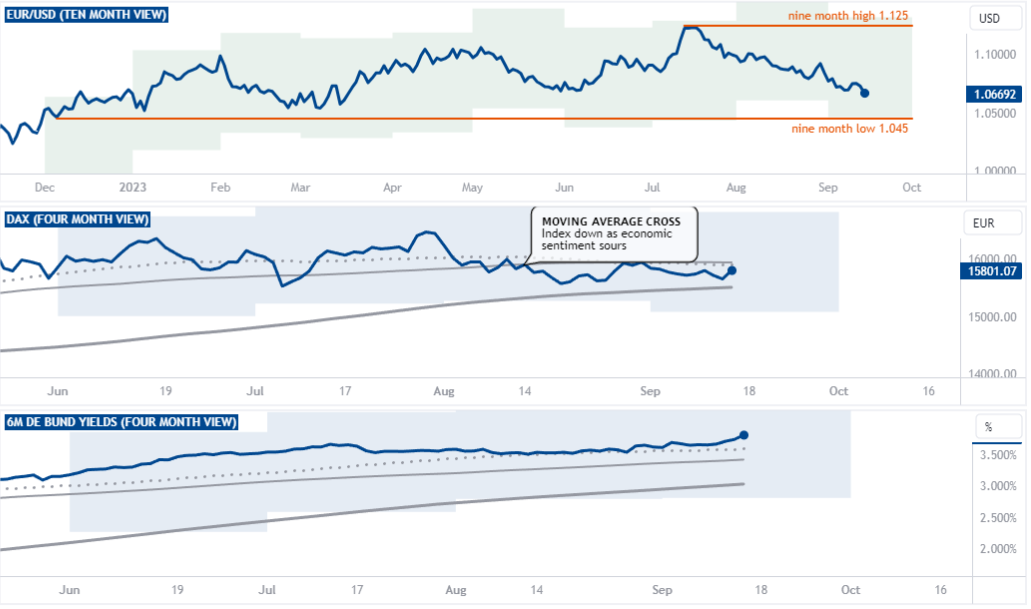

EUR/USD May Stabilise, Resistant Against Significant Rallies

The euro has been losing value against the dollar since July due to the Federal Reserve's decision to keep interest rates high for longer than previously thought. The war in Ukraine is also hurting the euro, as it is disrupting trade and causing uncertainty in the global economy. The euro could start to gain value if the European economy improves or the US economy weakens.

Intermarkets are reacting to the slightly pessimistic macroeconomic outlook with the DAX falling below the 100-day moving average and the yield on six-month German bunds climbing above 3.7%.

Markets can be volatile and so be observant to signs that could limit further falls of the EUR/USD:

Signals that show the economic outlook in the EA is growing more than expected. This can lead to increased foreign investment in EA stocks and increased demand for the euro.

Signals that the CPI rate in the US is slowing more than expected. This can lead to a less hawkish Fed, reducing the yield on Treasury Bonds and reducing the demand for USD.

Signals that investors are growing tolerant to risk. This can lead to investors moving money out of safe havens such as Treasury Bonds and reducing the demand for USD.

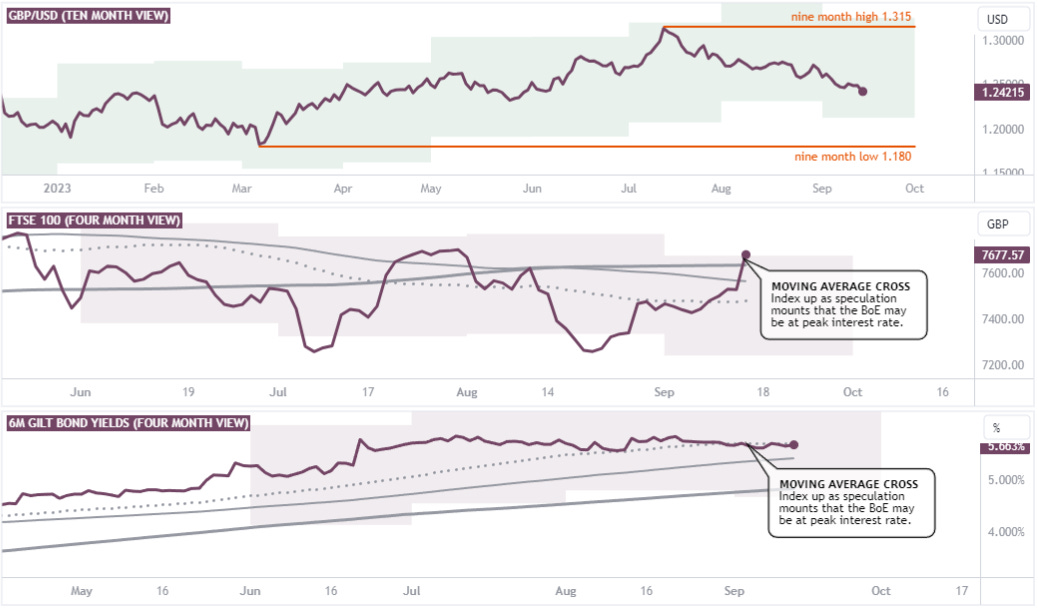

GBP/USD May Stabilise, Resistant Against Significant Rallies

The pound has been losing value against the dollar since July due to the Federal Reserve's decision to keep interest rates high for longer than previously thought. The pound could continue to weaken if inflation remains high and there is safe-haven demand for the dollar.

Intermarkets are rejecting the pessimistic macroeconomic outlook with the FTSE 100 above the 200-day moving average and the yield on six-month Gilt bonds holding around 5.7%.

Markets can be volatile and so be observant to signs that could limit further falls of the GBP/USD:

Signals that show the economic outlook in the UK is growing more than expected. This can lead to increased foreign investment in UK stocks and increased demand for the pound.

Signals that the CPI rate in the US is slowing more than expected. This can lead to a less hawkish Fed, reducing the yield on Treasury Bonds and reducing the demand for USD.

Signals that investors are growing tolerant to risk. This can lead to investors moving money out of safe havens such as Treasury Bonds and reducing the demand for USD.

Economic Events of Interest

Thursday, September 14 - US Retail Sales: The report was an upside surprise and signals that inflation may not be slowing, increasing the demand for USD.

Friday, September 15 - US Michigan Consumer Sentiment Prel: The report is expected to show a slight deterioration which may be a sign that inflation will slow, decreasing the demand for USD. Be cautious of a beat to the upside which could strengthen the USD.

Tuesday, September 19

EA CPI: The report is expected to match the preliminary which was a hold at 5.3% and may be a sign that inflation is sticky, increasing the demand for EUR. Be cautious of an interpretation that high inflation will damage the economy and reduce demand for the EUR.

US Building Permits Prel

Wednesday, September 20 - US FOMC Meeting, Rate Decision and Economic Projections

Wednesday, September 20 - UK CPI

Thursday, September 21 - UK MPC Meeting, Rate Decision

Friday, September 22 - UK Retail Sales

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-