Euro Forex Factbook AUGUST (GDP Update)

Growth as expected, Gas prices have significantly fallen since last year

INTENDED USE: Factual data that can be studied to aid your analysis on the Euro.

DERBYSHIRE GB / AUGUST 17th, 2023 - Updated following GDP report and improved situation regarding gas prices. Next update after the CPI report tomorrow on Friday, August 18th or before if any significant event occurs.

ABOUT

The euro is the currency of the European Union. It was introduced in 1999 and is now used by nineteen of the twenty-seven EU member states. The euro is the second-largest reserve currency in the world and is the most traded currency after the US dollar. It is a symbol of European unity and is seen as a sign of economic stability.

MONETARY POLICY

The European Central Bank (ECB) Governing Council

In the Euro Area, the benchmark interest rate is set by the Governing Council which consists of six members from the Executive Board plus governors of the national central banks from the nineteen countries using the euro.

The July meeting matched expectations with a 0.25% hike of the Main Refinancing Operations rate setting it at 4.25% which is up from 4.00% and the 0.25% hike in May.

The latest rate is just below the Trading Economics Q3 ‘23 forecast of 4.50% which they also identify as the peak.

Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.00% and a high of 4.25%. Over the previous six months, the rate has continued to climb.

The next meeting is due on Thursday, September 14th.

The Governing Councils June statement summarised:

Rates raised by 25 basis points to combat high inflation

Inflation is still high and expected to remain high for an extended period

The past rate increases are having a dampening effect on demand, which is helping to bring inflation back to target

Rates will be kept high until inflation returns to target

Rates will be adjusted based on incoming data and the strength of monetary policy transmission

The ECB will no longer pay interest on minimum reserves, which will preserve the effectiveness of monetary policy and improve efficiency

The APP portfolio is shrinking slowly and predictably. The PEPP portfolio will be reinvested until 2024. The Governing Council will be flexible in reinvesting PEPP redemptions.

The ECB will monitor how TLTROs and their repayments affect monetary policy.

Sources: European Central Bank, Macroeconomic Projections, Trading Economics, FXStreet

Macroeconomic Projections

The Governing Council revised its macroeconomic projections at their June meeting. They will update them again in September.

Economic activity is expected to slow in 2023, but to rebound in 2024 and 2025.

Inflation is expected to remain high in 2023, but to decline in 2024 and 2025.

The main drivers of economic growth are expected to be:

strong labour market, unemployment hitting new historical lows

rebound in foreign demand

resolution of supply chain bottlenecks

The main drivers of inflation are expected to be:

higher energy prices

tighter labour markets

higher unit labour costs

ECONOMIC DATA

Gross Domestic Product (GDP)

In the EU, GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers.

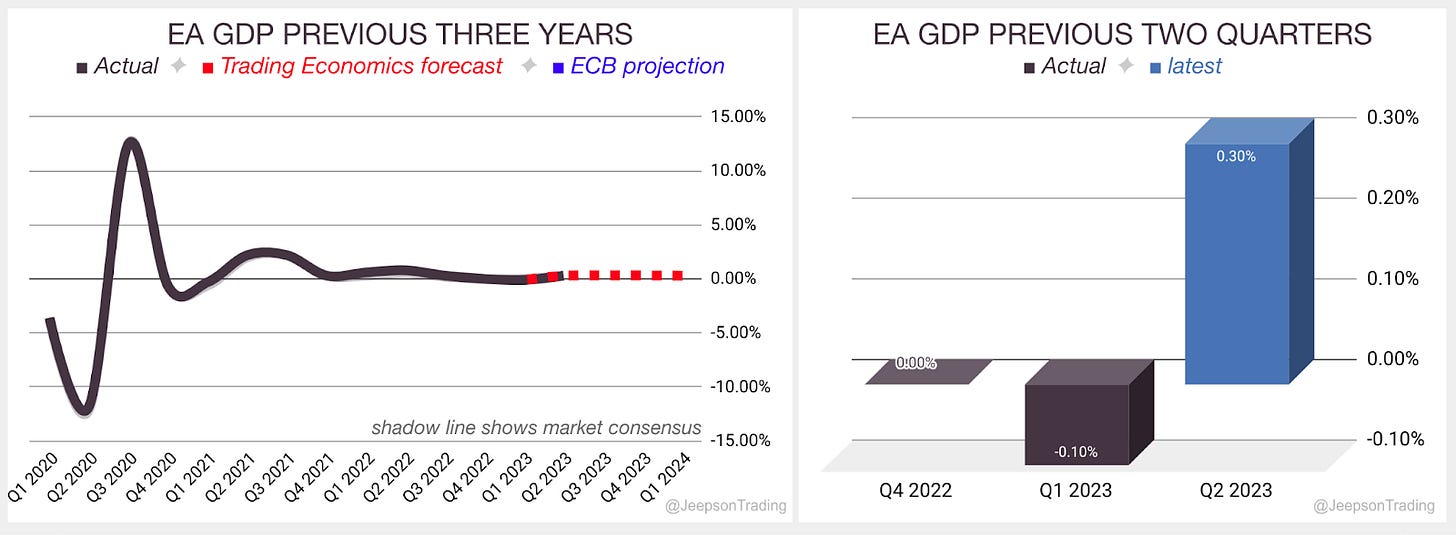

Second Q2 ‘23 estimate matched expectations coming in at 0.3% expansion and up from 0.0% contraction in Q1 ‘23 which was revised up from -0.1%.

The latest report is below the Governing Council 2023 Real GDP forecast of 0.9% (revised down from 1.0%) and slightly below the Trading Economics Q3 ‘23 forecast of 0.4%.

Over the previous three years, since the start of 2020, GDP has been trending up with a low of -4.3% and a high of 14.6%. Over the previous six months, GDP has been falling although recently reversed.

The third estimate Q2 report is due on Thursday, September 7th.

Sources: Eurostat, Trading Economics, FXStreet

Consumer Price Index (CPI)

Measures the yearly change in the price of goods and services purchased by consumers using the weighted average of the Harmonised Index of Consumer Price (HICP) aggregates.

June flash estimate slightly beat expectations coming in at 5.3% inflation and slightly down from 5.5% in Q1.

The latest report now matches the Governing Council 2023 HICP forecast of 5.3% although Trading Economics are more optimistic with a Q3 ‘23 forecast of 4.7%.

Over the previous three years, since the start of 2020, CPI has been trending up with a low of -0.3% and a high of 10.6%. Over the previous six months, CPI has been falling quickly.

The final July report is published on Friday, August 18th.

Sources: Eurostat, Trading Economics, FXStreet

Labour

Measures the number of people actively looking for a job as a percentage of the labour force.

June ‘23 report slightly beat expectations coming in at 6.4% which is the same as April ‘23 which has been revised down from 6.5%.

The latest report has fallen to beat the Trading Economics Q3 ‘23 forecast of 6.6%.

Over the previous three years, since the start of 2020, Unemployment has been trending down with a high of 8.6% and a low of 6.4%. Over the previous six months, unemployment has been steady.

The July report is due on Thursday, August 31st.

Sources: Eurostat, Trading Economics, FXStreet

MARKET NARRATIVES

Russia–EU gas dispute

The Russia-EU gas dispute had caused an increase in the cost of energy which has reduced the spending power of consumers and resulted in slower economic growth. This price pressure has since significantly eased and is expected to lead to increased foreign investment in the stock market and upward support on the Euro’s value.

The EU imported 83% of its natural gas in 2021, with 50% of that coming from Russia. However, after Russia invaded Ukraine in March 2022, the EU needed to diversify its gas imports and seek out more reliable suppliers.

The global energy market is likely to become more volatile in the years to come, due to a number of factors, including the increasing demand for energy from developing countries, the growing importance of renewable energy, and the uncertainty surrounding the future of fossil fuels. Europe is debating how to separate gas prices from electricity prices so that consumers are more protected from the volatile price of gas, which has been a major driver of rising electricity prices.

2022: In the wake of Russia's invasion of Ukraine, Russia began demanding that its natural gas customers pay in rubles, rather than euros or dollars. This led to a number of European countries, including Poland, Bulgaria, and Finland, refusing to pay, and subsequently having their gas supplies cut off. Russia also cut off gas supplies to Ukraine, which was a major transit point for Russian gas to Europe. These events have had a significant impact on the European energy market, causing gas prices to skyrocket and raising concerns about energy security.

2023: Europe has turned to LNG imports as pipeline gas fell and some LNG terminals are fully booked. With EU gas storage near full, prices have fallen to around €30/MWh from above €200 in 2022. Some companies have begun to store gas in Ukraine.

GEOPOLITICAL EVENTS

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and EA economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty.

2021: 92,000 Russian troops are amassed at the Ukraine border and President Putin proposes a prohibition of Ukraine joining NATO which is rejected.

2022: On the 21st of February, President Putin ordered Russian forces to enter the separatist republics in eastern Ukraine and announced recognition of the two pro-Russian breakaway regions (Donetsk People's Republic and Luhansk People's Republic). NATO applied sanctions and scaled them up as the war progressed. Ukraine mounted a counter-offensive which regained lost territory and as winter arrived, a stalemate began.

2023: Russian began a new offensive in January although gained little ground. In early June, Ukraine began its counteroffensive although progress has been slow even as Russia faced mutiny from the short-lived Wagner rebellion.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-