Euro Forex Reference -April

DERBYSHIRE GB / APR 24 - This is the Euro Forex Reference and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

ABOUT THE EURO

The euro is the currency of the European Union. It was introduced in 1999 and is now used by nineteen of the twenty-seven EU member states. The euro is the second-largest reserve currency in the world and is the most traded currency after the US dollar. It is a symbol of European unity and is seen as a sign of economic stability.

MONETARY POLICY

The European Central Bank

In the Euro Area, the benchmark interest rate is set by the Governing Council which consists of six members from the Executive Board plus governors of the national central banks from the nineteen countries using the euro.

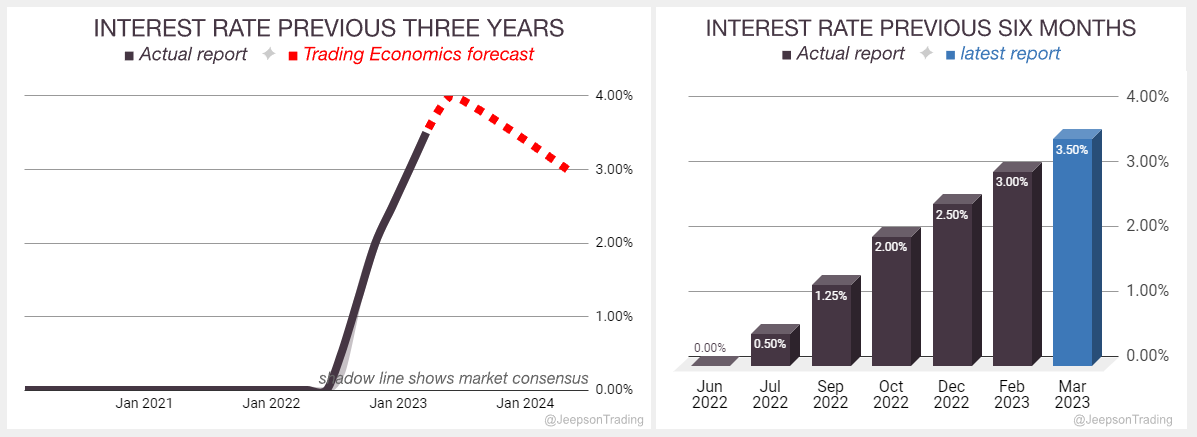

The European Central Bank (ECB) raised the Main Refinancing Operations Rate by 50 basis points on the 16th of March, to 3.50 percent. This was the sixth consecutive rate hike and the largest since 2008. The move was intended to combat rising inflation.

The rate hike came amid a banking crisis in Switzerland. Investors lost confidence in Credit Suisse, one of the country's largest banks, after it was hit by a series of scandals. The Swiss National Bank (SNB) provided a 50 billion Swiss franc loan to Credit Suisse, but this did not stop the bank's share price from falling. In a bid to avert a wider crisis, UBS made a 3 billion Swiss franc rescue bid to take ownership of Credit Suisse.

The ECB's next meeting is on the 4th of May.

Sources: European Central Bank, Macroeconomic Projections, Trading Economics

March Macroeconomic Projections

The Governing Council revised its macroeconomic projections at their March meeting. They will update them again in June.

The eurozone economy is expected to grow in 2023 and 2024, but growth will be weaker than previously expected.

Inflation is expected to remain high in 2023, but is expected to fall in 2024.

The ECB is expected to continue raising interest rates in order to combat inflation.

The war in Ukraine is a major downside risk to the economic outlook.

The global economy is expected to continue growing, but growth is expected to be slower than previously expected.

ECONOMIC DATA

Gross Domestic Product (GDP)

Measures the quarter on quarter change of the inflation-adjusted value of goods and services that are produced.

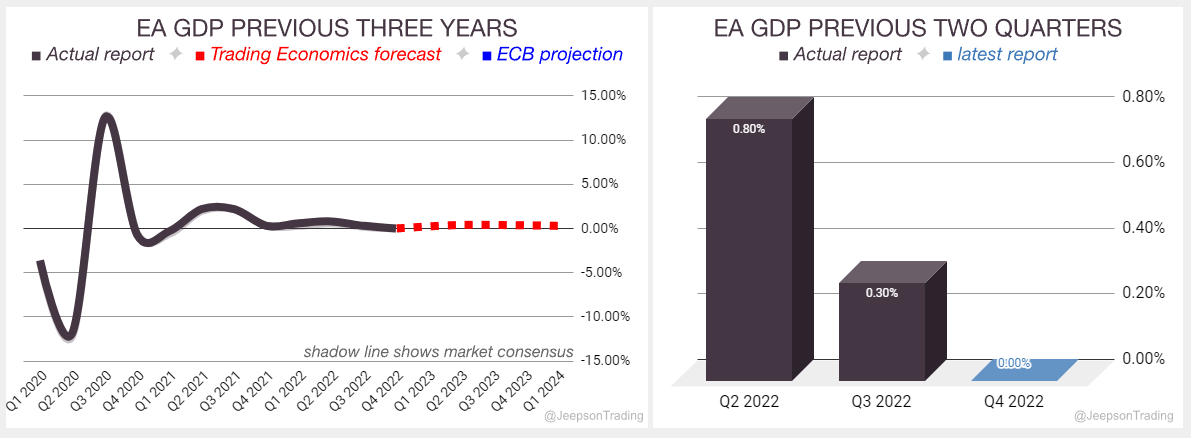

The eurozone economy grew by 0.0% in Q4 2022, matching expectations but slower than the 0.3% expansion in Q3. The slowdown has been attributed to the war in Ukraine, rising energy prices, and supply chain disruptions. The ECB projects growth to expand by 1.6% in 2024, down from 1.9% previously. Trading Economics forecasts Q2 growth of 0.4%. The Q1 2023 flash report is due on the Friday the 28th of April.

The outlook for growth is uncertain, but it can be characterised as pessimistic improvement. This means that expansion is likely, but it is not expected to be as fast as previously thought.

Sources: Eurostat, Trading Economics

CONSUMER PRICE INDEX

Measures the yearly change in the price of goods and services purchased by consumers using the weighted average of the Harmonised Index of Consumer Price (HICP) aggregates.

CPI in the Euro Area fell to 6.9% inflation in March, lower than the 7.1% expected and far lower than the previous 8.5%. The significant movers were Food, alcohol and tobacco which climbed 1.3% on the month. Energy fell 2.2% on the month. The ECB is projecting 5.3% for 2023 with a fall to 2.9% next year. Trading Economics are forecasting 5.8% in Q2. The April report is due on Tuesday the 2nd of May.

The outlook for CPI can be characterised as optimistic improvement. This means that a lower rate of inflation is likely, possibly lower than projected.

Sources: Eurostat, Trading Economics

LABOUR

Measures the number of people actively looking for a job as a percentage of the labour force.

EA Unemployment decreased to 6.6%, lower than the consensus of 6.7% and matching the previous report of 6.6%. Trading Economics are forecasting a rise to 6.8% in Q2. The March report is due on Wednesday the 3rd of May.

The outlook for EA unemployment can be characterised as an indifferent deterioration. This means that a higher rate of unemployment is likely at the levels projected.

Sources: Eurostat, Trading Economics

GEOPOLITICAL EVENTS

The War in Ukraine

The war in Ukraine has had a significant impact on the global economy, and the eurozone is no exception. The war has led to higher energy prices, which has contributed to inflation in the eurozone. It has also disrupted supply chains, which has slowed economic growth.

MARKET THEMES

ECB Policy Narrative

The European Central Bank (ECB) began raising interest rates in July 2022 to combat persistent inflation. In 2021, annual inflation in the eurozone had risen from -0.3% to 5.0%. The first rate hike in this cycle was on July 21st, 2022, when the ECB raised its key interest rate by 0.50 percentage points, from 0.00% to 0.50%. This was the first rate hike by the ECB in over a decade.

There are risks and challenges that the ECB faces as it raises interest rates:

A slowdown in economic growth. Higher interest rates make it more expensive for businesses to borrow money, which can slow economic growth.

A rise in unemployment. A slowdown in economic growth can lead to a rise in unemployment, as businesses are forced to lay off workers.

A decline in asset prices. Higher interest rates can lead to a decline in asset prices, such as stocks and bonds. This can hurt consumers and businesses who have invested in these assets.

The ECB will need to carefully manage these risks as it raises interest rates. The central bank will need to strike a balance between controlling inflation and supporting economic growth. If the ECB raises rates too quickly, it could trigger a recession. However, if the ECB raises rates too slowly, it could allow inflation to get out of control.

Hawkish ECB actions will support bonds, but pressure the Euro and stock market.

Less hawkish ECB actions will support the euro and stock market, but pressure bonds.

March 17th: First Republic Bank Rescue Deal improves risk-on sentiment

Bank bailout by major U.S. banks on March 16, 2023, improves confidence, leads to Fed dovishness and a weaker US dollar.

March 10th: Silicon Valley Bank Collapse leads to risk-on moves

Bank collapse due to poor risk management and investor panic considered to induce Fed dovishness and a weaker US dollar.

February 2nd: ECB signal hawkish path

The euro fell after the ECB hike by 50bps and signalled further 50bps ahead.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-