Euro Forex Reference - June

DERBYSHIRE GB / JUNE 11th, 2023 - This is the Euro Forex Reference and contains factual information that has been researched from official sources as well as market commentators. It is intended to be used as a guide to aid in your analysis.

ABOUT THE EURO

The euro is the currency of the European Union. It was introduced in 1999 and is now used by nineteen of the twenty-seven EU member states. The euro is the second-largest reserve currency in the world and is the most traded currency after the US dollar. It is a symbol of European unity and is seen as a sign of economic stability.

MONETARY POLICY

The European Central Bank

In the Euro Area, the benchmark interest rate is set by the Governing Council which consists of six members from the Executive Board plus governors of the national central banks from the nineteen countries using the euro.

May Meeting of the Governing Council

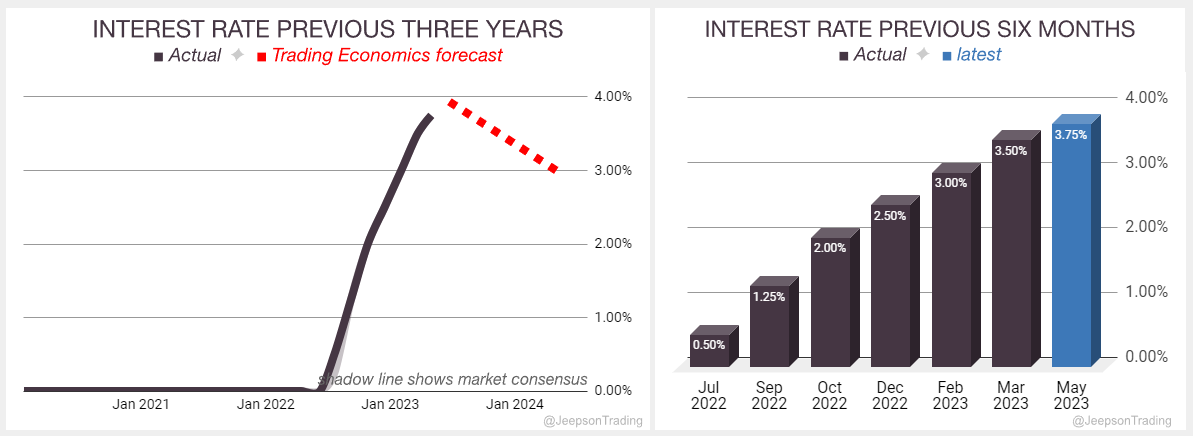

The Main Refinancing Operations rate was hiked on the 4th of May by 0.25% to 3.75%

This was as expected by analysts

This was the seventh consecutive rate hike although is the slowest in this cycle which began last year in July 2022. The bond-buying program will end in July. Inflation in the Euro Area remains high, at 7% in April, and President Lagarde said the central bank will continue to raise rates until inflation is brought under control.

Trading Economics have retained their Q2 2023 Main Refinancing Operations Rate forecast at 4.00%

The data analysed indicates that the Main Refinancing Operations Rate has risen as anticipated but is not expected to rise much further: the outlook can be characterised as indifferent indifference

The next meeting is on Thursday the 15th of June

The Governing Councils May statement contained cautious sentiment and a measured approach to monetary policy:

Inflation is too high and has been for too long

Will continue to monitor the situation and take further action if necessary

Will follow a data-dependent approach to determining the appropriate level and duration of restriction

Will reduce the Eurosystem's asset purchase programme (APP) portfolio at a measured and predictable pace

Expects to discontinue the reinvestments under the APP as of July 2023

Sources: European Central Bank, Macroeconomic Projections, Trading Economics

Macroeconomic Projections

The Governing Council revised its macroeconomic projections at their March meeting. They will update them again in June.

The Eurozone is expected to grow in 2023 and 2024, but be weaker than previously expected

Inflation is expected to remain high in 2023, but is expected to fall in 2024

The ECB is expected to continue raising interest rates in order to combat inflation

The war in Ukraine is a major downside risk to the economic outlook

The global economy is expected to continue growing, but slower than previously expected

ECONOMIC DATA

Gross Domestic Product (GDP)

In the US, GDP Growth Rate measures the yearly change in the price of goods and services purchased by consumers.

GDP Growth Rate Third Estimate for Q1 2023

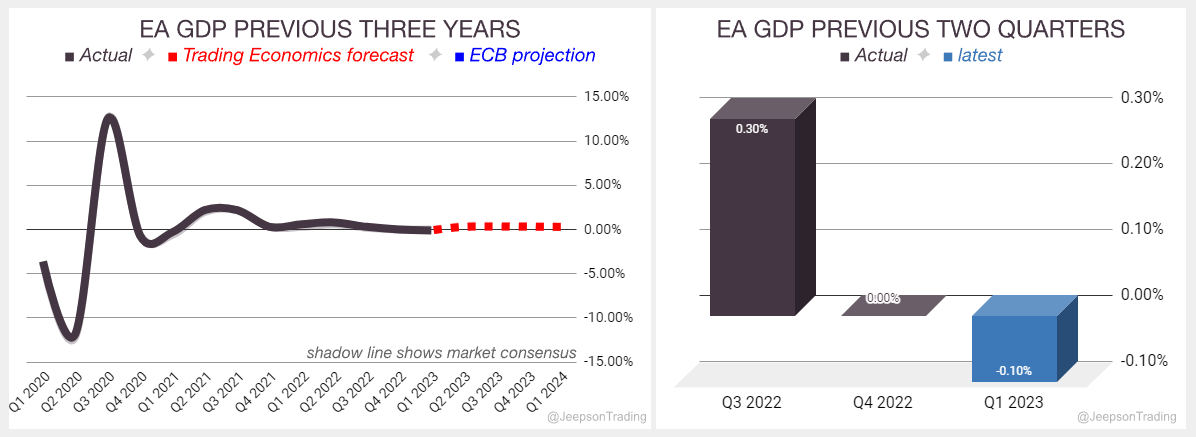

GDP in the EA for Q1 contracted at a quarterly rate of -0.1% which is lower than the 0.00% in Q4 2022

Lower than the 0.00% expansion expected by analysts

The eurozone economy is struggling to recover from the pandemic and the war in Ukraine. The decline in GDP was driven by a slowdown in both private consumption and investment. Household spending fell by 0.3%, while business investment fell by 0.6%. Exports and imports also fell, but by smaller amounts. The decline in GDP was widespread, with all but one of the eurozone's 19 member states reporting a fall in output. The only exception was France, which saw its economy grow by 0.3%.

In March, the Governing Council raised their 2023 growth projection (Real GDP) to 1.0% from 0.5%

Trading Economics have lowered their Q2 2023 annualised growth forecast to 0.3% from 0.4%

The data analysed indicates that the economy has shrunk against expectations although is expected to grow again: the outlook can be characterised as slightly pessimistic deterioration

The flash Q2 report is due on Monday the 31st of July

Sources: Eurostat, Trading Economics

CONSUMER PRICE INDEX

Measures the yearly change in the price of goods and services purchased by consumers using the weighted average of the Harmonised Index of Consumer Price (HICP) aggregates.

CPI Flash for May

Annual CPI in the EA for May inflated at a rate of 6.1% which is a lot slower than the 7.0% in April

This was slower than the 6.3% expected by analysts

The fall is driven by lower energy prices but it is too early to say if it is sustainable as core inflation remains high. The war in Ukraine and the pandemic are still major risks to the global economy.

In March, the Governing Council lowered their 2023 CPI projection to 5.3% from 6.3%

Trading Economics have lowered their Q2 2023 CPI forecast 5.6% from 5.8%

The data analysed indicates that CPI has fallen faster than anticipated and is expected to fall much further: the outlook can be characterised as optimistic improvement

The final May report is due on Friday the 16th of June

Sources: Eurostat, Trading Economics

LABOUR

Measures the number of people actively looking for a job as a percentage of the labour force.

Labour Report for April

Unemployment in the UK for April is 6.5% which is slightly lower than the 6.6% in March

This was as expected by analysts

Trading Economics have lowered their Q2 2023 unemployment rate forecast to 6.6% from 6.8%

The data analysed indicates that unemployment has fallen as anticipated and is expected to remain at these levels: the outlook can be characterised as indifferent indifference

The May report is due on Friday the 30th of June

Sources: Eurostat, Trading Economics

GEOPOLITICAL EVENTS

Russian Invasion of Ukraine

The war is having a detrimental effect on the global and EA economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty.

2021: 92,000 Russian troops are amassed at the Ukraine border and President Putin proposes a prohibition of Ukraine joining NATO which is rejected.

2022: On the 21st of February, President Putin ordered Russian forces to enter the separatist republics in eastern Ukraine and announced recognition of the two pro-Russian breakaway regions (Donetsk People's Republic and Luhansk People's Republic). NATO applied sanctions and scaled them up as the war progressed. Ukraine mounted a counter-offensive which regained lost territory and as winter arrived, a stalemate began.

2023: Russian began a new offensive in January although gained little ground. Ukraine is reported to be preparing for a new counteroffensive during late spring or early summer 2023.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 8.6% in 2023 Q1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-