Euro weakness pressured by stronger dollar and growth pessimism

Euro Currency Report -October (format update)

Derbyshire, UK – October 24th, 2023 - This is the currency report for the Euro and is intended to be a reference aid for your own analysis and trade planning. The next update will be after the ECB meeting on Thursday, October 26th.

Decisions to trade are made at your own monetary risk.

Euro weakness pressured by stronger dollar and growth pessimism

ECB hikes interest rates to combat inflation, dampening economic growth. The economic outlook for the European Union is mixed, with growth slowing but a recession possible. Unemployment is stable, but the Russia-EU gas dispute and the war in Ukraine are adding uncertainty to the global economy.

Monetary Policy

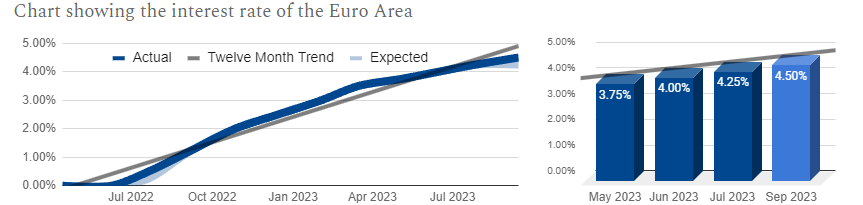

The European Central Bank (ECB) has been raising interest rates in an effort to combat high inflation. The latest hike was 0.25% in September, bringing the main refinancing operations rate to 4.50%. This hawkish stance is likely to dampen economic growth, which is now expected to be 0.7% in 2023. However, the ECB is committed to bringing inflation back to its 2% target, and will keep interest rates at restrictive levels for as long as necessary. The economy is slowly growing, but there is a mixed outlook for the future. Annual real GDP is expected to contract, while annual HICP is expected to come in below expectations.

Interest Rates Hiked, ECB Target Inflation Over Growth

The six members of the European Central Bank’s (ECB) Governing Council (plus nineteen governors from the national banks of the countries using the euro) set monetary policy, including the Main Refinancing Operations rate (interest rate). The main refinancing operations rate is the interest rate that banks pay to borrow money from the ECB overnight and is secured by bonds. This rate affects the interest that banks charge their borrowers.

The governing council meets to set monetary policy eight times a year, the latest was September 14th and the next is on October 26th.

The interest rate of the EA was hiked at the September meeting by 0.25% after also being hiked by 0.25% in August and throughout almost all of the previous twelve meetings. This indicates that the ECB is hawkish and is focused on stamping out the high rate of inflation. Trading Economics forecast 4.50% to be the peak rate and 2024 to see cuts of 0.75%.

Key points of the ECB’s Governing Council September 2023 meeting:

Raised its key interest rates by 25 basis points in order to bring inflation back to its 2% medium-term target.

Expects inflation to average 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025.

Rate increase is likely to dampen economic growth, which is now expected to be 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025.

Will keep interest rates at restrictive levels for as long as necessary to bring inflation back to target.

Sources: European Central Bank, Macroeconomic Projections, Trading Economics, FXStreet

The Economy is Slowly Growing but has a Mixed Outlook

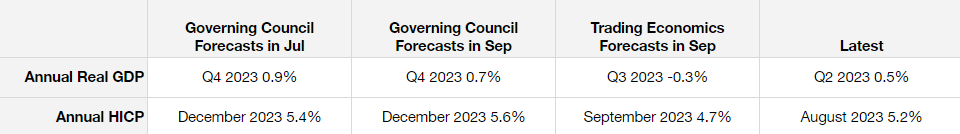

The ECB’s Governing Council makes macroeconomic projections four times a year. The most recent was at their September meeting and they will be updated in November.

Annual Real GDP has a pessimistic outlook compared to the Governing Councils forecast and shows a contraction is likely.

Annual HICP has an optimistic outlook compared to the Governing Councils forecast and is on track to come in below expectations.

Market Narratives

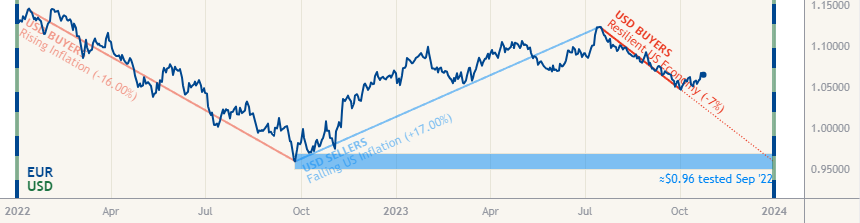

Resilient US Economy is applying bearish pressure to the EUR/USD

The EUR/USD has gained and lost value in a contrarian correlation with US inflation rates which peaked in late 2022. The current downtrend of the EUR/USD formed in July 2023 when investors began to reposition for the likelihood that the Fed will keep rates higher-for-longer due to the US economy being more resilient than anticipated.

In the previous month, the EUR/USD has advanced this downtrend as economic indicators support the "Resilient US Economy" narrative.

Downside moves have the potential to test the support area ≈$0.960 while upside retracements could climb to test the 50-day average price of ≈$1.070.

Economic Indicators

The European economy is slowing down, with risks of a recession. Inflation is falling, but at a faster pace than expected, which is putting downward pressure on growth. Retail sales are also falling sharply, suggesting that consumers are spending less. Unemployment remains stable, but there is some concern that it could rise in the coming months.

Overall, the economic outlook for Europe is uncertain. The slowdown in growth could lead to a recession, but the fall in inflation could help to support the economy. The key will be to see how quickly inflation falls and how consumers respond to the rising cost of living.

Slowing economy falls short of recovery and signals recessionary risk ahead

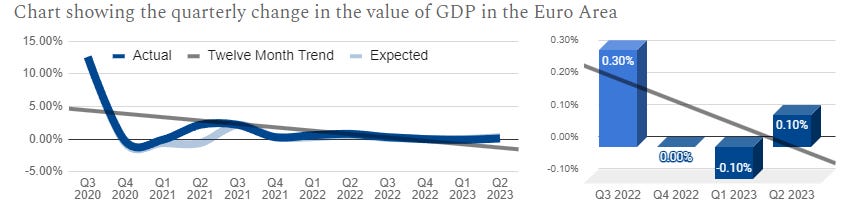

The EA GDP quarterly rate report measures the change in value of goods and services produced in the EA over a given month compared with the previous. The latest data covers the Q2 period and was published on September 7th by Eurostat and the next version is out on October 31st.

The latest result of 0.10% was below expectations and signals that the economy is at a risk of recession although it is higher than the previous quarters contraction and above the baseline trend.

Trading Economics are forecasting 0.4% for Q4 which would be above the baseline trend of -0.5% and suggest optimism with regards to economic growth.

Sources: Eurostat, Trading Economics, FXStreet

Falling inflation quickens and applies bearish pressure to growth

The EA inflation rate report measures the change in value of a basket of goods and services in the EA over a given month compared with the previous. The latest data covers the September period and was published on October 18th by Eurostat and the next version is out on October 31st.

The latest result of 4.30% was as expected and signals that the falling rate of inflation is picking up pace as it is a sharp fall from the previous month and below the baseline trend. This applies bearish pressure to the economic outlook as demand falls and businesses compete for fewer customers. However, it could also be a sign that supply chains are improving.

Trading Economics are forecasting 3.6% for Q4 which would be below the baseline trend of 3.9% and suggest optimism with regards to the speedier pace of falling inflation.

Sources: Eurostat, Trading Economics, FXStreet

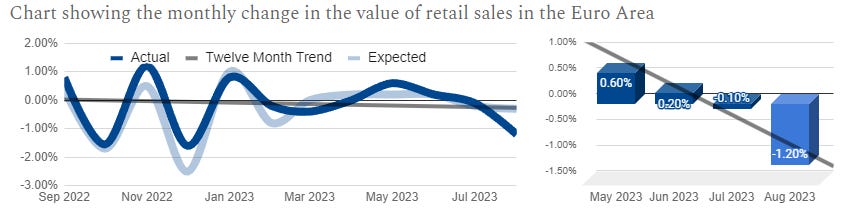

Falling retail sales quickens and applies bearish pressure to growth

The EA retail sales report measures the change in value of aggregated retail goods and services sales over a given month compared with the previous. The latest data covers the August period and was published on October 4th by Eurostat and the next version is out on November 8th.

The latest result of -1.20% was far below expectations and signals that the falling rate of retail sales is picking up pace as it is a very sharp fall from the previous month and far below the baseline trend. This applies bearish pressure to the economic outlook as consumers spend less.

Trading Economics are forecasting 0.6% for Q4 which would be below the baseline trend of -0.3% and suggest optimism with regards to a rebound of falling sales.

Sources: Eurostat, Trading Economics, FXStreet

Stable unemployment remains steady and applies indifferent pressure to growth

The EA unemployment rate report measures the number of people actively looking for a job as a percentage of the labour force over a given month. The latest data covers the August period and was published on October 2nd by Eurostat and the next version is out on November 3rd.

The latest result of 6.40% was as expected and signals that the stable rate of unemployment continues as it is the same as the previous month and the same as the baseline trend. This applies indifference to the economic outlook as businesses maintain employment levels.

Trading Economics are forecasting 6.8% (revised down from 7.0%) for Q4 which would be below the baseline trend of 6.3% and suggest some pessimism with regards to a stable labour market.

Sources: Eurostat, Trading Economics, FXStreet

Geopolitical Events

The Russia-EU gas dispute has caused significant disruptions to gas supplies to Europe. This has led to soaring gas prices, which are putting upward pressure on inflation. The war in Ukraine has also added uncertainty to the global economy, and is weighing on the euro area economy.

Russia-EU Gas Dispute Applies Upwards Pressure to Inflation

The Russia–EU gas dispute flared up in March 2022 following the invasion of Ukraine. Russia cut the flow of gas to Europe significantly, and in September 2022, it stopped it altogether. As of August 2023, Russian pipeline gas exports continued to flow to some EU countries and non-EU countries in Europe, but the flow was significantly reduced from pre-war levels. Europe also imported record volumes of liquefied natural gas (LNG) from Russia in 2022.

Recent Key Events

Russia has cut gas supplies to Europe significantly since April 2022, and stopped them altogether to Poland, Bulgaria, Finland, and Ukraine.

Russia has also reduced gas flows via the Nord Stream 1 pipeline, citing technical difficulties.

In September 2022, the Nord Stream 1 and 2 pipelines ruptured, likely due to sabotage.

European countries have been working to secure alternative gas supplies, including from Norway, Qatar, and the United States.

EU gas prices have soared in response to the disruptions, but have fallen in recent months as storage levels have increased.

The gas delivery disruptions have had a significant impact on the European economy, as gas is a key source of energy for many industries and households.

Russian Invasion of Ukraine Adds Uncertainty

On February 24, 2022, Russia invaded Ukraine in an escalation of the Russo-Ukrainian War which began in 2014. The invasion is the largest military conflict in Europe since World War II and has resulted in tens of thousands of casualties on both sides. The invasion has also caused a humanitarian crisis, with millions of Ukrainians displaced from their homes. The international community has condemned the invasion and imposed sanctions on Russia. The International Criminal Court is investigating possible war crimes and crimes against humanity committed by Russian forces.

Recent Key Events

June 2023: The Ukrainian counteroffensive in June 2023 made significant progress, with Ukraine liberating villages and reclaiming territory in the eastern Donbas region. The Wagner Group's rebellion against the Russian government was a major setback for Russia.

August 2023: Ukraine counteroffensive slowed by millions of mines laid by Russia. Ukrainian drones damage the Russian landing ship Olenegorsky Gornyak.

September: An attack on Russian naval targets in Sevastopol damages the Black Sea fleet. Several oil and gas drilling platforms on the Black Sea held by Russia since 2015 have been retaken.

The war in Ukraine is having a negative impact on the global economy, including the value of the Euro. The war has caused energy prices to soar and disrupted supply chains, which are putting upward pressure on inflation and weighing on the EA economy.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-