EUR/USD Could Be Supported by EA CPI on Thursday

2023, Week Number 35, Wednesday

DERBYSHIRE GB / 2023, Week Number 35, Wednesday - Charts updated along with economic outlooks. Next update after the EA CPI on Thursday, August 31st.

Last Week's Events

PMI’s from the EA, UK and the US all missed expectations indicating slowing economies. Fed chair Powell reiterated his hawkish stance on monetary policy at the Jackson Hole Symposium.

This Week's Events

Tuesday, August 29th

US CB Consumer Confidence declined a lot more than expected

US JOLTS Job Openings declined a lot more than expected

Wednesday, August 30th

DE Prelim CPI expected to remain steady

US ADP Non-Farm Employment Change large decline expected

US Prelim GDP expected to remain steady

Thursday, August 31st

EA CPI Flash Estimate expected to slightly decline

EA Unemployment Rate expected to remain steady

US PCE Price Index expected to remain steady

US Unemployment Claims expected to remain steady

Friday, September 1st

US Average Hourly Earnings slight decline expected

US Non-Farm Employment Change large decline expected

US Unemployment Rate expected to remain steady

US ISM Manufacturing PMI expected to remain steady

Next Week's Events

Wednesday, September 6th

US ISM Services PMI

Thursday, September 7th

US Unemployment Claims

CME Group 30-Day Fed Fund futures

September favours a hold and odds have risen to 88% from 85%. A 0.25 hike chance has fallen to 12% from 15%.

November favours a hold but odds have fallen to 52% from 61%. A 0.25 hike chance has risen to 44% from 37%.

US DOLLAR

The economy of the United States (US) is facing a mixed outlook. The Federal Reserve is expected to keep interest rates steady although at a high level, which could dampen economic growth. However, GDP is projected to grow at a modest pace, and inflation is expected to remain stable. The war in Ukraine and the China-US trade war are factors that could support the dollar higher due to safe-haven flows.

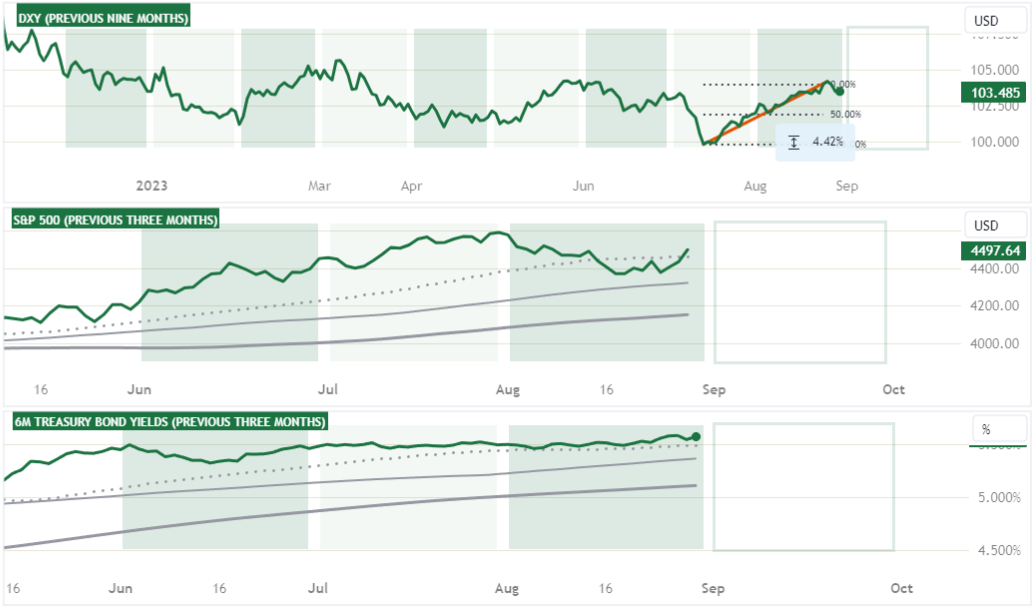

This mixed outlook has been recently reflected in the US Dollar Index which has been moving within a 500 pip range for the past nine months although pessimistic views are gaining as the index has climbed 4.4% in the past two months to form an uptrend. Signs that the pessimism is worsening can be seen by the higher yields of the six month Treasury bonds which have broken above 5.5% although the S&P 500 stock index shows some rising optimism as it gains above the 50-day moving average.

Upcoming economic events could worsen the sentiment of rising pessimism and support the DXY higher as the labour report, out on Friday is forecasted to show a deterioration. However, a deterioration more significant than forecasted could sway the Fed away from its hawkish stance towards a view of cutting rates. This would be a boost to the economy and improve sentiment to be more optimistic, leading to a fall in the DXY.

Euro

The economy of the Euro Area (EA) is facing a cautiously pessimistic outlook. The European Central Bank (ECB) is expected to raise interest rates again, which could dampen economic growth. However, GDP is projected to improve in the third quarter, and inflation is expected to fall. The war in Ukraine is also a major concern, as it could disrupt trade and investment.

This cautiously pessimistic outlook has been recently reflected in the EUR/USD which has fallen 3.9% in the past two months to form a downtrend. Signs that the cautious pessimism is worsening can be seen by the higher yields of the six month German bunds which have broken above 3.7% as well as the DAX stock index holding below the 100-day moving average.

Upcoming economic events could diminish some of the pessimism and support the EUR/USD higher as the CPI report, out on Thursday is forecasted to show a small improvement. However, a CPI reading higher than forecast or even worse, higher than previous could strengthen the ECB’s hawkish policy and pressure the EUR/USD down.

Pound Sterling

The economy of the United Kingdom (UK) is facing a cautiously pessimistic outlook. The Bank of England (BoE) is expected to raise interest rates again, which could dampen economic growth. GDP is projected to slightly deteriorate in the third quarter, and inflation is expected to remain sticky. The cost of living crisis and the war in Ukraine are also major concerns and may also weigh on economic activity.

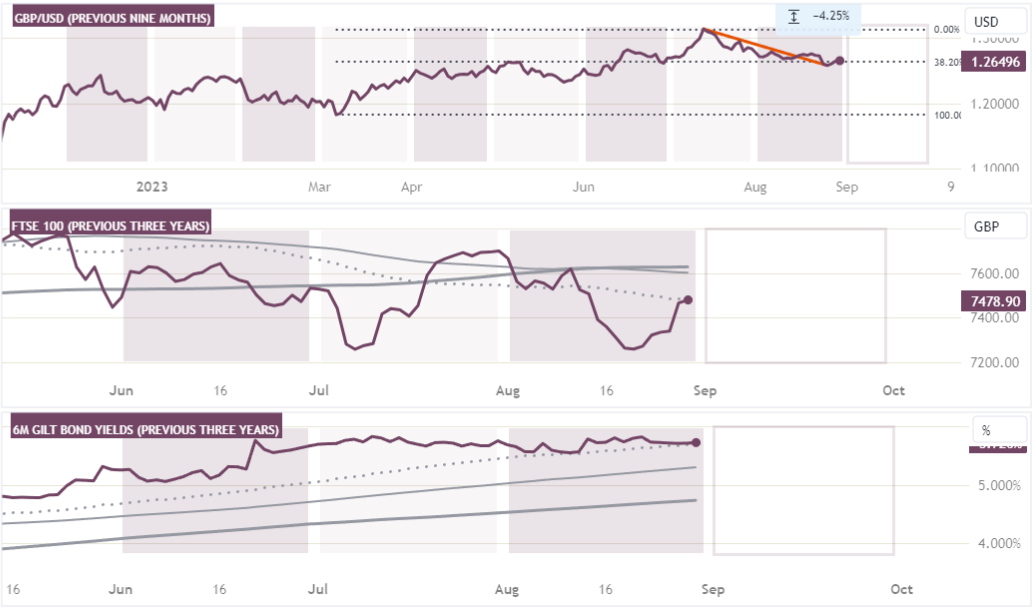

This cautiously pessimistic outlook has been recently reflected in the GBP/USD which has fallen 4.25% in the past two months as it retraces an uptrend. Signs that the cautious pessimism is softening can be seen by the yield of the six month Gilt bonds which although are high above 5.7% are stable as well as the FTSE 100 stock index which has climbed above the 50-day moving average.

There are no upcoming economic events of significance that could affect UK sentiment. However, the US labour report, out on Friday is forecasted to show a deterioration which if more significant than forecasted could sway the Fed away from its hawkish stance towards a view of cutting rates. This would be a boost to the US economy and improve sentiment to be more optimistic, leading to a rise in the GBP/USD.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-