EUR/USD Trade Plan

Updated on Monday the 10th of October

SUMMARY

From a fundamental perspective, the USD is stronger than the EUR due to the hawkish rate hikes so the EUR/USD is forecasted to lose value and is being monitored for opportunities to sell.

From a sentiment perspective, the USD is likely to benefit from the global growth slowdown due to safe haven flows into USD. However, the EUR will benefit if the outlook for rising energy costs begins to improve.

YEAR ON YEAR ANALYSIS

TREND

On a year to year view, the EUR/USD has been in a downtrend since May 2021 which is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair retraced 23.6 percent towards the end of May as speculators considered a less hawkish Fed as it was anticipated that inflation had peaked at 8.3 percent in April.

POTENTIAL TARGET

The downtrend is potentially looking to fall towards 0.84 USD which was previously tested over twenty-year ago in November 2000.

FORECAST

Trading Economics forecast 0.93 USD by Oct '23

MONTH ON MONTH ANALYSIS

TREND

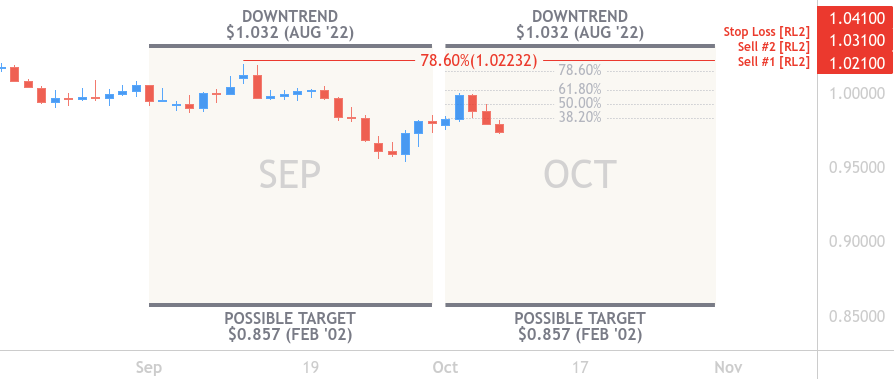

On a month to month view, the EUR/USD has been in a downtrend since August which is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair retraced 78.6 percent during September which is not supported by a sentiment narrative, instead this can be attributed to technical moves as it bounces from twenty-year lows.

POTENTIAL TARGET

The downtrend is potentially looking to fall towards 0.857 USD which was previously tested twenty-years ago in February 2002.

WEEK ON WEEK ANALYSIS

TREND

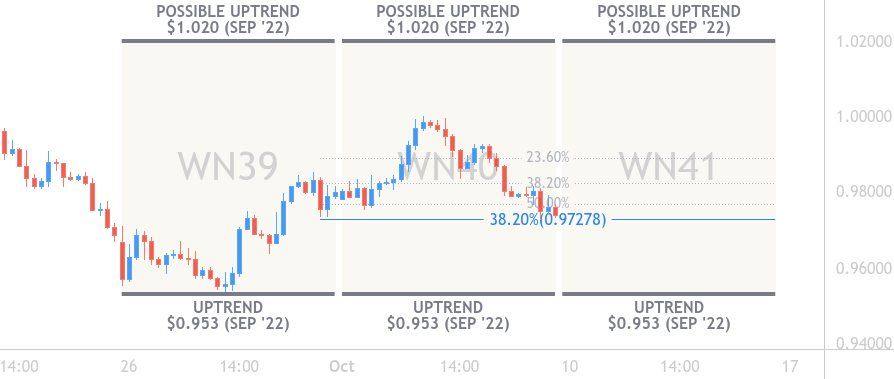

On a week to week view, the EUR/USD has been in an uptrend since WN39 which is not supported by a sentiment narrative, instead this can be attributed to technical moves as it bounces from twenty-year lows.

RETRACEMENT

The pair retraced 38.2 percent towards the end of WN39 which can be attributed to speculators looking to benefit from a strong dollar as the fundamentals point to hawkish interest rate hikes.

POTENTIAL TARGET

The uptrend is potentially looking to climb towards 1.020 USD which was previously tested last month in September.

FORECAST

Trading Economics forecast 0.97 USD by Dec '22

TRADE PLAN

HIGH RISK PLAN

The year on year resistance level at 1.08 has only had a single test but is at such an elevated level that it would be suitable for a Risk Level One order to sell, however any moves towards this level are unlikely unless the fundamental picture were to change, at which point this plan should be evaluated.

The optimum position for the Stop Loss is at 1.0915.

LOW RISK PLAN

The month on month resistance level at 1.022 has only had a single test but is well placed for a Risk Level Two order to sell. It is likely that a move to this level will occur when the EUR benefits or the USD disadvantages from changes to sentiment.

The optimum position for the Stop Loss is at 1.0315.

MICRO RISK PLAN

The week on week performance shows that an uptrend has formed which goes against what is forecasted by the fundamental analysis. The upper level is 1.02 which is where a reversal may occur which also coincides with the resistance level on the month on month chart. A rally towards this level may occur if the US CPI comes in at a lower than expected level when it is reported on Thursday.

A Risk Level Three order to sell can be placed at market value if the US CPI comes in at a higher than expected value.

The optimum position for the Stop Loss is at 1.0215 although the risk should be eliminated towards the entry as soon as possible.