EUR/USD TRADE PLAN 🇪🇺 🇺🇸

Continue to sell prior to Fed meeting

Risk Level Two orders are in progress that were sold below the Stop Loss of $1.0140. This was to capitalise on the short term downtrend resistance near $1.0040

This plan is to be maintained until the Federal Reserve meeting this week on Wednesday the 2nd of November and aborted if there are pivot signals although this is not the base case. Following the meeting, there will be Non-Farm payrolls on Friday the 4th of November and another opportunity to abort if these come in below 200K.

EUR/USD FUNDAMENTAL SUMMARY

EURO-AREA

The Governing Council of the European Central Bank (ECB) met last month on the 27th of October and a decision was made to hike the Main Refinancing Operations Rate (Interest Rate) by 75bps to 2.00 percent from 1.25 percent which was as expected. The policy outlook is hawkish as Trading Economics are forecasting it to rise to 3.50 percent next year in 2023 (prev. 2.00). The next scheduled meeting for the Governing Council is next month on Thursday the 15th of December.

The outlook for:

- EA GDP is pessimistic deterioration (pr. )

- EA CPI is pessimistic improvement (pr. )

- EA Unemployment is indifference (pr. )

UNITED-STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met last month on the 21st of September and a decision was made to hike the Federal Funds Rate (Interest Rate) by 75bps to 3.00-3.25 percent from 2.25-2.50 percent which was as expected. The policy outlook is hawkish as the FOMC also provided a projection of 4.6 percent for next year in 2023 which is up nearly a percent from the 3.8 which they projected in June. The next scheduled meeting for the FOMC is this week on Wednesday the 2nd of November and the CME FedWatch tool indicates 88 percent odds of a 75bps hike (down from previously 99 percent).

The outlook for:

- US GDP is pessimistic deterioration (pr. )

- US CPI is optimistic improvement (pr. )

- US Unemployment is pessimistic deterioration (pr. )

EUR/USD SENTIMENT SUMMARY

EURO

The sentiment that is presently in focus and influencing valuations on the Euro is the ‘ECB Rate Hikes’ narrative.

Speculators are considering that the dire outlook on growth will cause the ECB to take a less hawkish approach to rate hikes.

This has provided some bullish momentum for the Euro which has been gaining in value throughout October but may begin to wane as the flash inflation report for October came in at 10.7 percent which is far above the expectations of 10.2 percent and suggests the ECB may resolve to hike faster.

UNITED STATES DOLLAR

The sentiment that is presently in focus and influencing valuations on the United States is the ‘Fed Rate Hikes’ narrative.

Through October, speculators have been evaluating if a pivot could occur where the Fed begins to slow down the pace of hikes so as to avoid a hard landing.

This has provided some bearish momentum for the US Dollar which has been losing in value throughout October but may begin to wane as the PCE report for September came in at 6.2 percent which is above the expectations of 6.1 percent and suggests the Fed still has work to do. Markets may be subdued until the Fed meeting on Wednesday.

EUR/USD TECHNICAL SUMMARY

LONG TERM

The long term view (year on year) shows that the EUR/USD has been downtrending from 1.22 since May last year (2021) when the outlook on fed policy looked hawkish as they evaluated a tapering plan.

The downtrend fell to 1.11 where it then retraced higher as the sentiment on EA growth improved although this was temporary as the downtrend resumed in February as tensions between Russia and Ukraine escalated before an invasion at the end of the month.

Price has continued to fall ever since without any significant retracements. The next potential support is at $0.840 which was last tested over twenty-years ago in November 2000.

SHORT TERM

The short term view (month on month) shows that the EUR/USD has been downtrending from the September high of $1.020 when the sentiment towards US inflation improved.

The downtrend fell to 0.995 where it then retraced higher as the sentiment on EA growth improved although this was temporary as the downtrend resumed a week later as that sentiment turned back to pessimism.

Price has been mostly sideways ever since as speculators consider the outlook of how hawkish the central banks can be in the face of contracting economies. The next potential support is at $0.8550 which was last tested over twenty-years ago in January 2002.

MICRO TERM

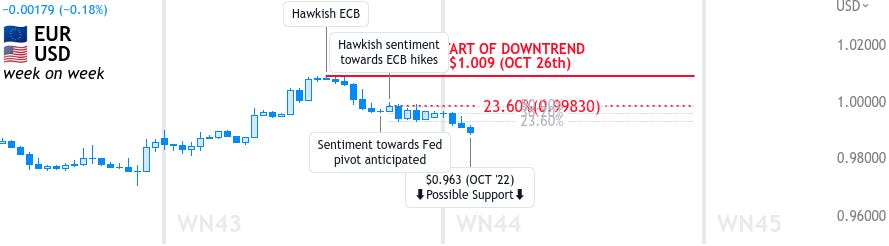

The micro term view (week on week) shows that the EUR/USD is downtrending from last week’s high of $1.009 when the ECB struck a hawkish tone at their policy meeting and provided another 75bps hike.

The downtrend fell to 0.995 before retracing higher as speculators evaluate a Fed pivot from their hawkish policy.

Price has since fallen as inflation looks to still be out of control, this meaning a pivot is less and less likely. The next potential support is at $0.963 which was last tested earlier in the month (October).

FORECASTS

The possible targets are as follows:

Long Term: fall towards $0.84

Short Term: fall towards $0.855

Micro Term: fall towards $0.963

Trading Economics:

Fall towards $0.98 this quarter (prev. 0.97)

Fall towards $0.94 by December 2023 (prev. 0.93)

- Copy traders will automatically be entered into all orders placed by JeepsonTrading.

- subscribe for full access to research and analysis www.jeepsontrading.substack.com

END DISCLAIMER

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.