DERBYSHIRE GB / 2023, August 25th, 2023 - Trade plan to buy EUR/USD dips.

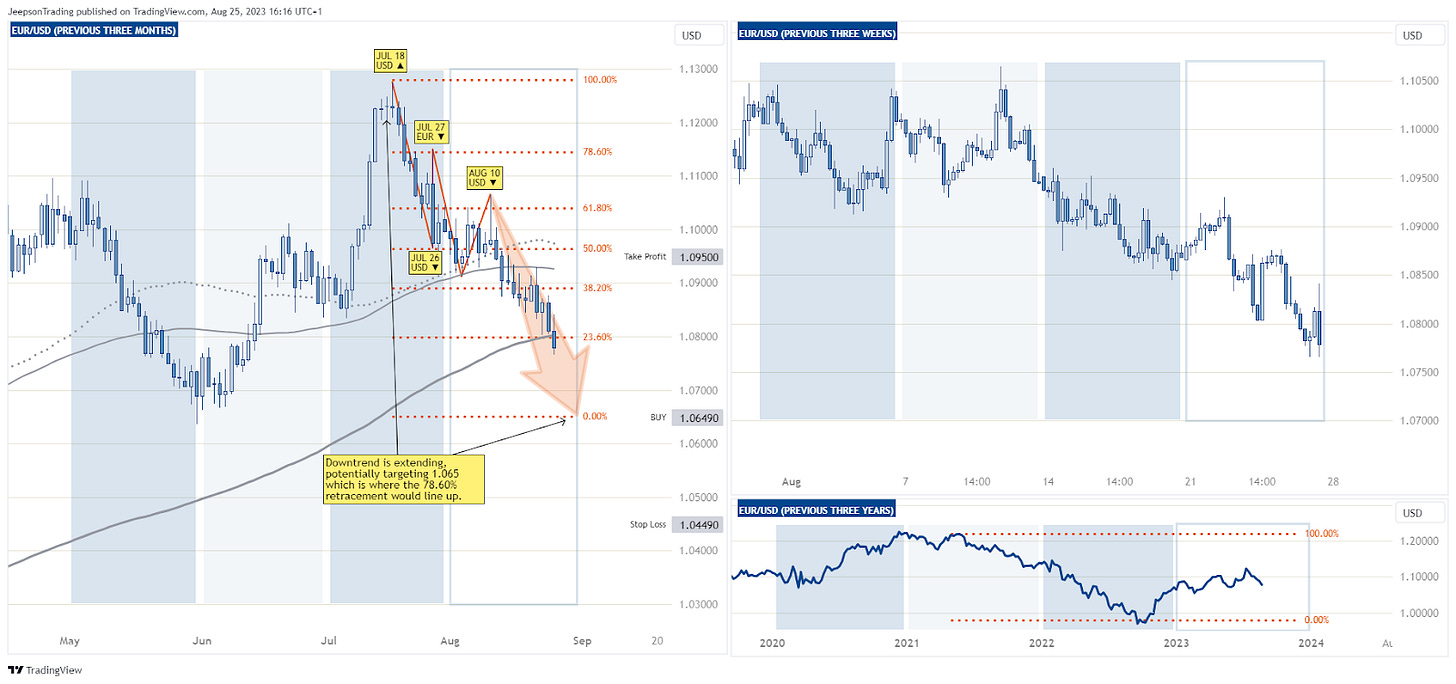

Short Term, Previous Three Months View

The EUR/USD is currently trading in the $1.07 area and has strong bearish momentum due to being lower than the 100 day moving average and recently fell below the 200 day moving average.

July 18th Start of Downtrend: USD strengthened as sentiment reevaluates the path of the Fed's monetary policy.

July 26th Retracement: USD weakened as the Fed may be at the end of its hiking cycle.

July 27th Downtrend Resumes: USD strengthened as sentiment shifts towards a potential further hike from the Fed.

August 3rd Retracement: USD weakened ahead of and into the jobs report which showed fewer new jobs than expected indicating a cooling economy.

August 10th Downtrend Resumes: USD strengthened as US CPI moves higher and sentiment reconsiders the path of the Fed’s monetary policy.

EUR/USD Trade Plan

The base case for events in the upcoming week are favoured towards a weaker dollar, applying upward support to the EUR/USD due to an expected peak hiking cycle by the Fed and weak non farm payrolls. Potential risk for a stronger dollar is possible if sentiment interprets the Jackson Hole speech as overtly hawkish.

The EUR/USD trade plan is to buy if the value dips to $1.0649 with stop loss at $1.0449 and profits to be considered at $1.0995.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-