EUR/USD Trade Plan |:| WN42

Sell while Euro-Area CPI is inflating

SUMMARY

Risk Level 2 sell orders to be placed on $EURUSD at the month on month downtrend break-zone. This stance is to be maintained until the Euro-Area CPI report on Wednesday and cancelled if the report comes in below expectations of 10.0 percent inflation.

SENTIMENT

The sentiment that is presently influencing valuations on the Euro and the United States Dollar is the narrative regarding rate hikes and how aggressive the central banks will be. Both the ECB and the Fed are considering 75bps hikes at their next meetings.

The near-term attention of speculators is on the Euro-Area CPI rate which is out on Wednesday and is expected to show an inflation of 10.0 percent which would be much higher than the 9.1 percent inflation last month.

FUNDAMENTALS

EURO-AREA

The Governing Council of the European Central Bank (ECB) met last month on the 8th of September and a decision was made to hike the Main Refinancing Operations Rate (Interest Rate) by 75bps to 1.25 percent from 0.50 percent which was as expected. The policy outlook is hawkish as Trading Economics are forecasting it to rise to 3.50 percent next year in 2023(prev. 2.00). The next scheduled meeting for the Governing Council is next month on Thursday the 27th of October.

The outlook for:

- EA GDP is pessimistic deterioration (pr. )

- EA CPI is pessimistic improvement (pr. )

- EA Unemployment is indifference (pr. )

UNITED-STATES

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met a few weeks ago on the 21st of September and a decision was made to hike the Federal Funds Rate (Interest Rate) by 75bps to 3.00-3.25 percent from 2.25-2.50 percent which was as expected. The policy outlook is hawkish as the FOMC also provided a projection of 4.6 percent for next year in 2023 which is up nearly a percent from the 3.8 which they projected in June. The next scheduled meeting for the FOMC is Wednesday the 2nd of November and the CME FedWatch tool indicates 98 percent odds of a 75bps hike (up from 54 before the recent inflation report).

The outlook for:

- US GDP is pessimistic improvement (pr. )

- US CPI is optimistic improvement (pr. )

- US Unemployment is pessimistic deterioration (pr. )

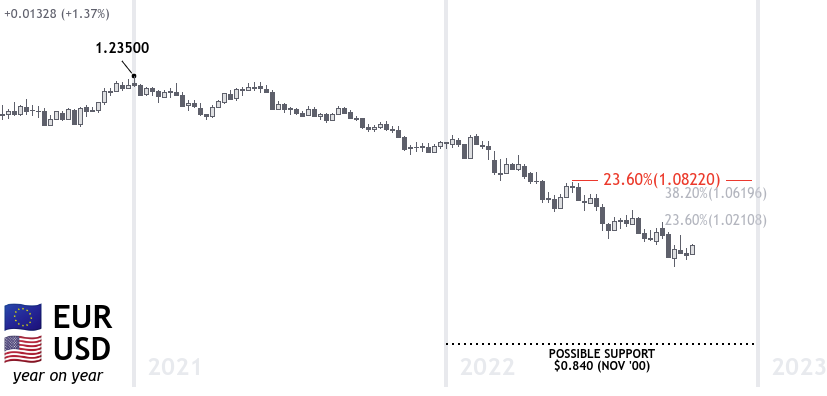

YEAR ON YEAR CHART

TREND

On a year to year view, the EUR/USD is in a downtrend since the high of 1.235 in January 2021. This is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair retraced 23.6 percent towards the end of May as speculators considered a less hawkish Fed as it was anticipated that inflation had peaked at 8.3 percent in April.

POTENTIAL TARGET

The downtrend is potentially looking to fall towards 0.84 USD which was previously tested over twenty-year ago in November 2000.

FORECAST

Trading Economics forecast 0.92 USD by Oct '23 (prev. 0.93)

MONTH ON MONTH CHART

TREND

On a month to month view, the EUR/USD is in a downtrend since the high of 1.0200 in September. This is supported by the fundamental analysis which indicates that the USD is the stronger of the pair.

RETRACEMENT

The pair retraced 38.2 percent during September into October which is not supported by a sentiment narrative, instead this can be attributed to technical moves as it bounced from twenty-year lows.

POTENTIAL TARGET

The downtrend is potentially looking to fall towards 0.855 USD which was previously tested twenty-years ago in January 2002.

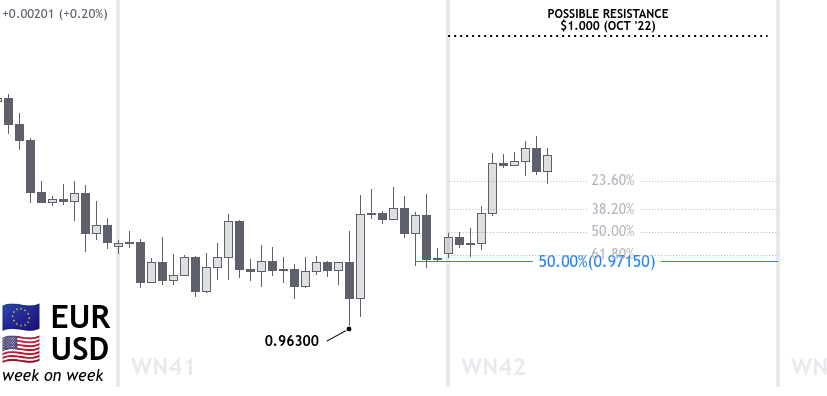

WEEK ON WEEK CHART

TREND

On a week to week view, the EUR/USD is in an uptrend since the low of 0.963 on Thursday last week. This is not supported by a sentiment narrative, instead this can be attributed to technical moves as it bounces from twenty-year lows.

RETRACEMENT

The pair retraced 50.0 percent towards the end of last week which can be attributed to speculators looking to benefit from a strong dollar as the fundamentals point to hawkish interest rate hikes.

POTENTIAL TARGET

The uptrend is potentially looking to climb towards 1.000 USD which was previously tested earlier this month in October.

FORECAST

Trading Economics forecast 0.96 USD by Dec '22 (prev. 0.97)

TRADE-PLAN

HIGH RISK PLAN

The year on year resistance level at 1.08 has only had a single test but is at such an elevated level that it would be suitable for a Risk Level One order to sell, however any moves towards this level are unlikely unless the fundamental picture were to change, at which point this plan should be evaluated.

The optimum position for the Stop Loss is at 1.0915.

LOW RISK PLAN

The month on month resistance level at 1.00 has only had a single test but is well placed for a Risk Level Two order to sell. It is likely that a move to this level will occur when the EUR benefits or the USD disadvantages from changes to sentiment.

The optimum position for the Stop Loss is at 1.019.

MICRO RISK PLAN

The week on week performance shows that an uptrend has formed which goes against what is forecasted by the fundamental analysis. The possible resistance level is 1.00 which is where a reversal may occur which also coincides with the resistance level on the month on month chart. A rally above this level may occur if the Euro Area CPI comes in at a lower than expected level when it is reported on Wednesday.

A Risk Level Three order to buy can be placed at market value if the Euro-Area CPI comes in at a lower than expected value.

The optimum position for the Stop Loss is at 0.962 although the risk should be eliminated towards the entry as soon as possible.

𝗘𝗡𝗗 𝗗𝗜𝗦𝗖𝗟𝗔𝗜𝗠𝗘𝗥

The content provided is intended for informational purposes only. Investments on the forex markets and trading decisions are made at your own risk.