EUR/USD Unlikely to Fall Below the 1.08 Area

Euro Forex Playbook for AUGUST (EU CPI report outlook)

INTENDED USE: Analysis data that can be studied to aid your Euro trade planning.

DERBYSHIRE GB / AUGUST 17th, 2023 - Updated following the GDP report. Next update is planned for after the EU CPI report tomorrow on Friday, August 18th or before if any significant event occurs.

Macroeconomic Snapshot

EUROPEAN CENTRAL BANK (ECB) GOVERNING COUNCIL: The July meeting matched expectations with a 0.25% hike of the Main Refinancing Operations rate setting it at 4.25% which is up from 4.00% and the 0.25% hike in May. The latest rate is just below the Trading Economics Q3 ‘23 forecast of 4.50% which they also identify as the peak. Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.00% and a high of 4.25%. Over the previous six months, the rate has continued to climb. The next meeting is due on Thursday, September 14th.

The EA interest rate is anticipated to be raised again although the peak is near which is likely to lead to stabilised bund yields which may dissuade investors and limit upward support on the value of the Euro

GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE: Second Q2 ‘23 estimate matched expectations coming in at 0.3% expansion and up from 0.0% contraction in Q1 ‘23 which was revised up from -0.1%. The latest report is below the Governing Council 2023 Real GDP forecast of 0.9% (revised down from 1.0%) and slightly below the Trading Economics Q3 ‘23 forecast of 0.4%. Over the previous three years, since the start of 2020, GDP has been trending up with a low of -4.3% and a high of 14.6%. Over the previous six months, GDP has been falling although recently reversed. The third estimate Q2 report is due on Thursday, September 7th.

EA GDP is anticipated to improve this year which may increase investor confidence in EA stocks which may limit downward pressure on the value of the euro.

CONSUMER PRICE INDEX (CPI): June flash estimate slightly beat expectations coming in at 5.3% inflation and slightly down from 5.5% in May. The latest report now matches the Governing Council 2023 HICP forecast of 5.3% although Trading Economics are more optimistic with a Q3 ‘23 forecast of 4.7%. Over the previous three years, since the start of 2020, CPI has been trending up with a low of -0.3% and a high of 10.6%. Over the previous six months, CPI has been falling quickly. The final July report is published on Friday, August 18th.

EA CPI is anticipated to improve a little further this year but to remain high although with the peak now past, investor confidence in EA stocks is likely to improve which may limit downward pressure on the value of the euro.

LABOUR: June ‘23 report slightly beat expectations coming in at 6.4% which is the same as April ‘23 which has been revised down from 6.5%. The latest report has fallen to beat the Trading Economics Q3 ‘23 forecast of 6.6%. Over the previous three years, since the start of 2020, Unemployment has been trending down with a high of 8.6% and a low of 6.4%. Over the previous six months, unemployment has been steady. The July report is due on Thursday, August 31st.

EA unemployment is anticipated to remain steady this year which may stabilise investor confidence in EA stocks which is likely to limit downward pressure on the value of the euro.

RUSSIAN EU GAS DISPUTE: The Russia-EU gas dispute caused an increase in the cost of energy which has reduced the spending power of consumers and resulted in slower economic growth.

This price pressure has since significantly eased and is expected to lead to increased foreign investment in the stock market and upward support on the Euro’s value.

RUSSIAN INVASION OF UKRAINE: The war is having a detrimental effect on the global and EA economy by causing higher energy prices, supply chain disruptions, financial market volatility, refugee crisis and geopolitical uncertainty

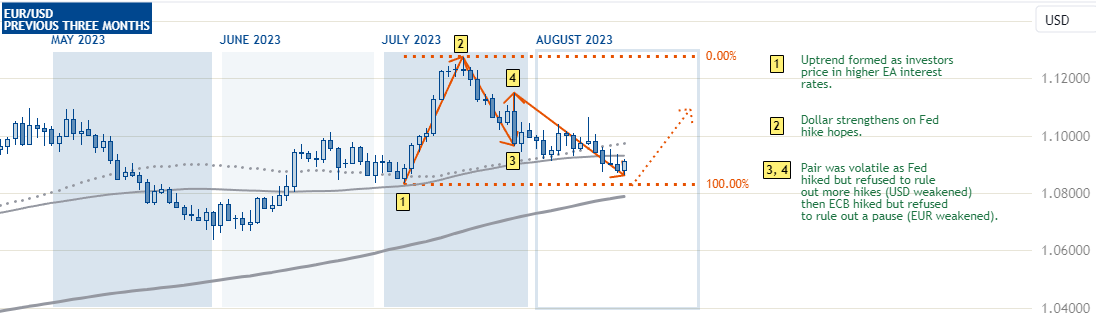

EUR/USD Term (Previous Three Months)

The EUR/USD has formed an uptrend since the start of July when the Euro strengthened on the back of elevated sentiment regarding EU rates. The pair is currently retracing the uptrend as the Dollar strengthened due to a strong economy possibly requiring further hikes from the Fed and looking to test the 100.00% fib near 1.083. If the fib level breaks then the uptrend will be broken.

Shorter Term EUR/USD (Previous Three Weeks)

Over the shorter term, the EUR/USD has been volatile with a slow fall as the Euro and US Dollar each weaken from central bank policy that looks to act on data rather than take a proactive approach. The pair has fallen below the 50 and 100 day moving averages indicating a lack of bulls.

EUR/USD Outlook

Upcoming and Recent Events:

Thursday, August 10th

US CPI y/y climbed to 3.2% vs 3.3% exp

Wednesday, August 16th

FOMC Meeting Minutes Fed Leaves Door Open to Further Tightening

Thursday, August 17th

US Unemployment Claims fell a little more than expected to 239K from 248K prev.

Friday, August 18th

EU Final CPI y/y fall to 5.3% exp. From 5.5% prev.

Wednesday, August 23rd

EU Flash Manufacturing PMI 42.7 prev.

EU Flash Services PMI 50.9 prev.

US Flash Manufacturing PMI 49.0 prev.

US Flash Services PMI 52.3 prev.

Thursday, August 24th

Day 1 of the Jackson Hole Symposium

US Unemployment Claims

Friday, August 25th

Day 2 of the Jackson Hole Symposium

CME Group 30-Day Fed Fund futures

September: falling sentiment of a hold, 85% in favour (from 90%), 15% for a 0.25 hike (from 10%)

November: falling sentiment of a hold, 57% in favour (from 61%), 37% for a 0.25 hike (from 35%)

Six Month Bond Yields

Treasuries: steady at 5.50% from 5.50% last week

Bund: steady at 3.50% from 3.50% last week

Value of the EUR/USD to remain above 1.08: The previous three month moves have created an uptrend climbing from 1.08 area to 1.12 area although it has almost fully retraced to test the 1.08 area again. The macroeconomic situation suggests the uptrend is likely to extend.

Shorter Term Value of the EUR/USD to remain above 1.083 unless the EU CPI report comes in lower than expected tomorrow on Friday: The previous three week moves have been volatile although slowly falling from 1.115 to 1.086. Events this week are favoured towards a slightly weaker EUR over the shorter term. A fall further than expected in the EU CPI report would signal that the ECB may be done with hikes and weaken the euro over the shorter term.

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-