Fed Pivot, China Slowdown, and Safe-Haven Demand: Key Drivers of Currency Volatility

Tuesday, 1st October, Week 40

Welcome to this week's market analysis, covering Monday, 30 September, to Friday, 11 October (Weeks 40 and 41). This report offers insights into key forex pairs (USD/JPY, AUD/USD, and EUR/USD), and delves into the narratives shaping the currency markets. Last week's dominant theme, the Fed's dovish pivot and hopes for a "soft landing," fuelled equity rallies. However, a resurgent US dollar, strengthened by safe-haven demand amid geopolitical tensions, is creating uncertainty. Weaker Chinese data further complicates the macroeconomic outlook. These factors will influence central bank policies as Q4 begins.

USD/JPY

USD/JPY trading involves carry traders, institutional investors, and corporations managing currency risk. Liquidity depends on US-Japanese interest rate differences, making the pair sensitive to bond yield fluctuations. The JPY acts as a safe haven in times of uncertainty, affecting the pair's intermarket relationships.

Currently, USD/JPY is influenced by diverging monetary policies between the Fed and BOJ. The Fed's 50 bps rate cut initially spurred risk appetite, but subsequent cautious statements from Chair Powell indicate a data-dependent easing path, stabilising the USD. In contrast, the BOJ has signalled potential rate hikes if inflation hits 2%, with Tokyo's August core CPI at 2.4% yoy, adding to tightening expectations and supporting the JPY. Escalating Middle East tensions, an emerging theme, is also driving safe-haven flows into JPY.

AUD/USD

AUD/USD trading is common among institutional investors, commodity traders, and central banks. The pair is sensitive to commodity price swings, particularly iron ore.

The RBA's hawkish policy and China's economic slowdown are key themes for AUD/USD. The RBA's seventh consecutive rate hold at 4.35% on Tuesday (24th) and Governor Bullock's comments projecting above-target inflation until 2026, despite easing to 2.7% in August, underpin AUD. China's slowdown, however, pressures iron ore and the AUD, despite recent stimulus efforts. A potential US recession adds to the risk-off sentiment impacting the AUD.

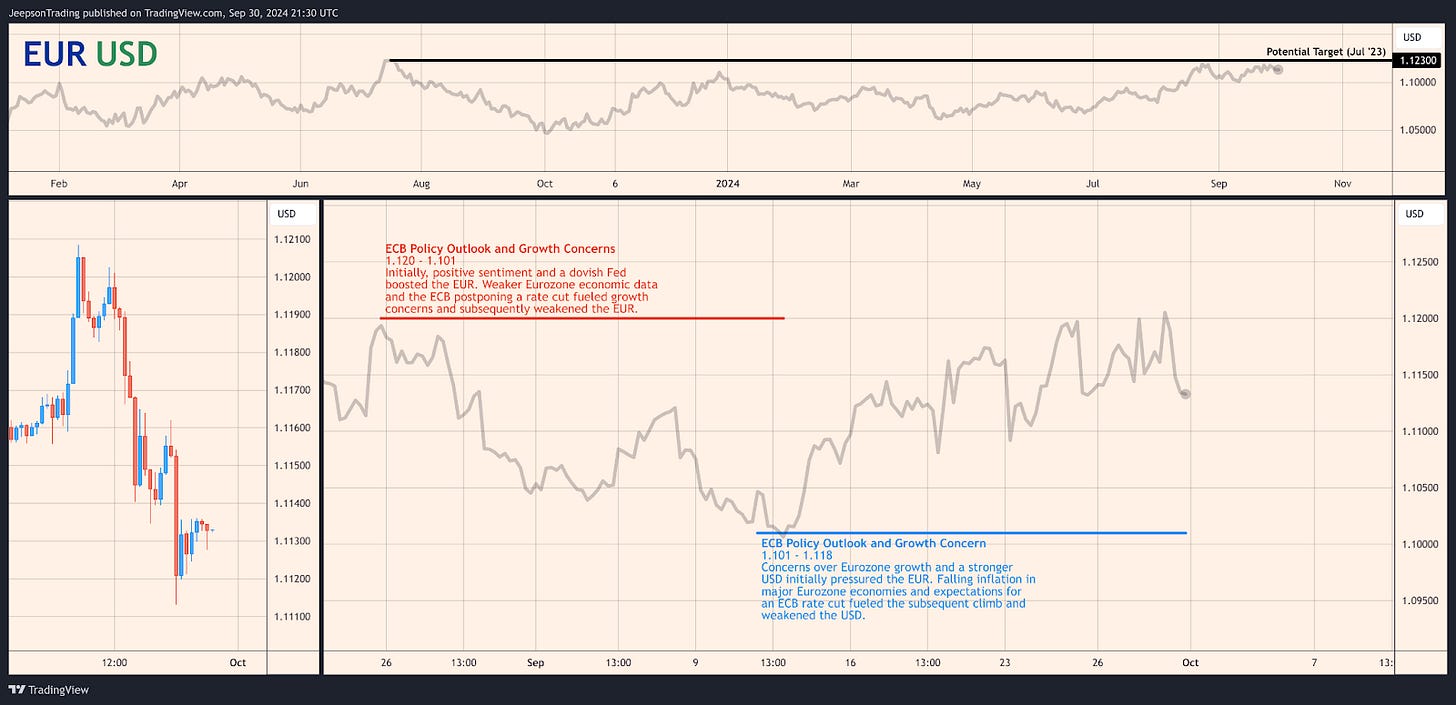

EUR/USD

EUR/USD is heavily traded, with high liquidity driven by factors such as interest rate differentials and economic releases. It usually moves inversely to the DXY.

Diverging monetary policy between the Fed and ECB is a primary driver for EUR/USD. The Fed has begun cutting rates, while the ECB has been more cautious, though recent weak Eurozone data is increasing the likelihood of further ECB easing. Chinese stimulus measures, though not dominant, have intermittently boosted European equities, adding support for EUR. However, disappointing Eurozone PMIs for September raise concerns about the region’s economic trajectory.

Conclusion

Currency markets face complex dynamics due to shifting central bank policies, economic slowdowns, and geopolitical tensions. The Fed's dovish pivot is a key theme, with expectations of a weaker USD. However, a stronger USD, driven by safe-haven flows, presents a counter-narrative. Weaker Chinese data and mixed results from other major economies add complexity. These themes will continue to shape market sentiment in the coming week.

Here are three key takeaways for traders:

Monitor US data: Focus on upcoming US economic indicators, particularly inflation and employment data, as these will heavily influence the Fed's next policy moves.

Assess geopolitical risk: Monitor escalating tensions in the Middle East, as any escalation could trigger significant risk-off sentiment and impact currency markets.

Watch central bank rhetoric: Central bank communications will be critical for gauging future policy direction and potential market volatility.

Sources

Federal Reserve (Fed), Bank of England (BoE), European Central Bank (ECB), Bank of Japan (BOJ), Reserve Bank of Australia (RBA), Reserve Bank of New Zealand (RBNZ), US Bureau of Labor Statistics, Statistics Canada, Office for National Statistics (UK), Eurostat, Australian Bureau of Statistics, Statistics New Zealand, Trading Economics, Bloomberg, Reuters, Financial Times, The Wall Street Journal, ForexLive, GfK Group, Westpac Banking Corporation, Melbourne Institute, Nationwide Building Society (UK), Confederation of British Industry (CBI), Ifo Institute, INSEE (France), S&P Global, Judo Bank, Ai Group, National Australia Bank (NAB), ANZ Bank New Zealand, Business NZ, Halifax, BRC - British Retail Consortium.