Forcing Doves on the Fed

Weekly Forex Briefing (WN46)

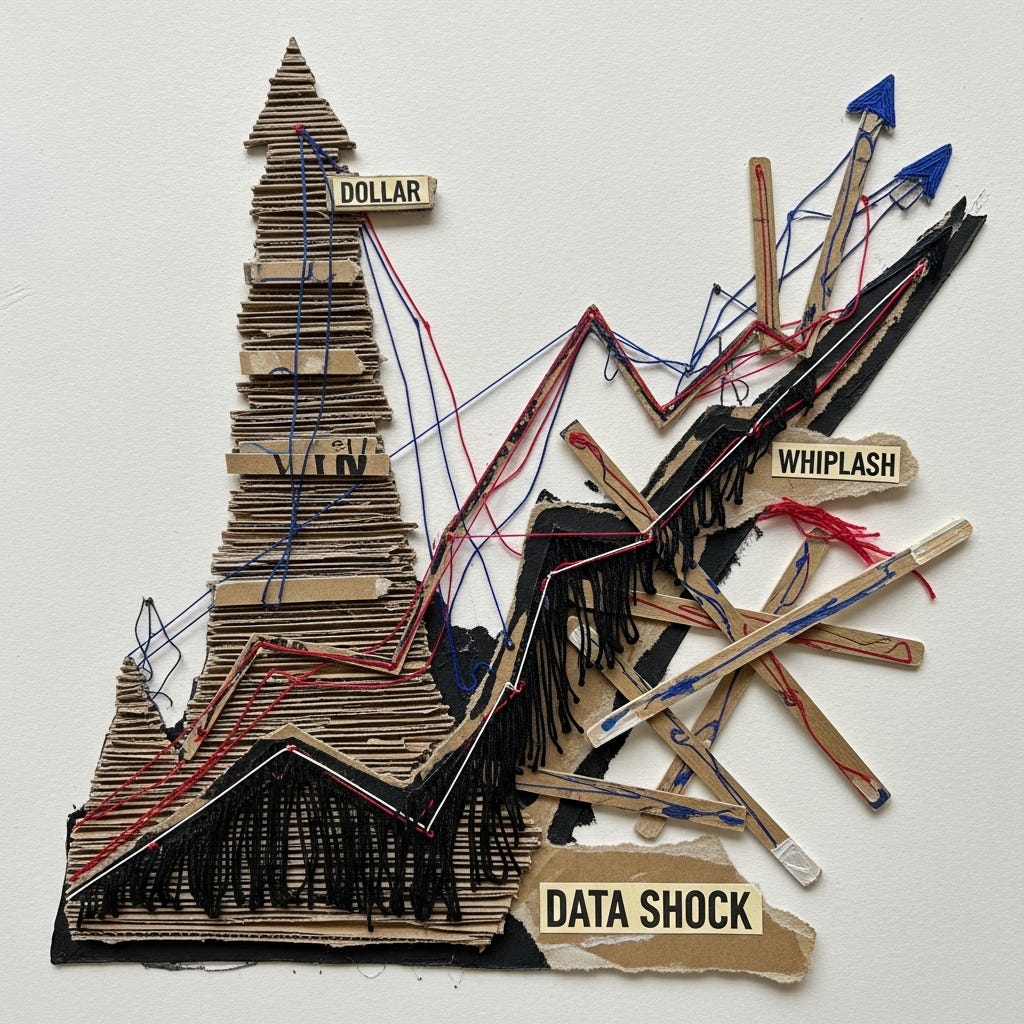

The past two weeks have been a masterclass in market whiplash, a story of how quickly a dominant narrative can be shattered by a single piece of data. We watched the US dollar, powered by a hawkish Federal Reserve, climb to a 12-week high, only to see its rally completely annihilated by a catastrophic collapse in US consumer sentiment and alarming labor data. This violent reversal has reset the board, establishing monetary policy divergence as the premier theme for traders to navigate. The coming days will test whether this new narrative holds or if another data shock lies in wait.

The Great Reversal: A Trader’s Recap

The final days of October were all about the “hawkish cut” from the US Federal Reserve. On Wednesday, October 29, Fed Chair Powell surprised everyone by pushing back against the certainty of a December rate cut. The market reacted instantly, sending the US Dollar Index surging towards the 99.8 mark by the end of the month, its highest level since early August. This dollar strength was the sledgehammer that crushed everything in its path. We saw the Euro slip towards 1.15, and the Canadian dollar get hammered by its own disastrous GDP report, which showed a surprise contraction in August. The narrative was supported by surprisingly resilient private-sector data, with the ADP employment report on Wednesday, November 05, showing a gain of 42,000 jobs and the ISM Services PMI rising to 52.4, its best reading since February.

Then, the narrative was completely upended. The first major crack appeared on Thursday, November 06, with the Challenger Job Cuts report, which revealed over 153,000 announced layoffs in October—the highest for that month in 22 years. That sent the Dollar Index tumbling below the pivotal 100 level. Then came the final nail in the coffin on Friday, November 07: the preliminary University of Michigan consumer sentiment report plunged to 50.3, the second-lowest reading on record. The market’s reaction was brutal and decisive. Bets on a December Fed rate cut surged to over 70 percent, and the dollar collapsed, finishing the week at 99.4. The global equity market, already nervous about stretched AI valuations, took this as a sign of deep economic trouble, with the Nasdaq plunging 1.9 percent on Friday, led by names like Nvidia and Tesla. In a stunning divergence, Canada dropped a blockbuster jobs report that same day, adding 66,600 jobs and sending the loonie soaring. It was a perfect storm of data shocks that reset the entire board.

The Week Ahead: Data-Dependent Central Banks and Policy Cues

Looking ahead to the week of November 10, the market is laser-focused on one thing: central bank guidance. The narrative has shifted from “the Fed is hawkish” to “the Fed is being forced to be dovish.” The question now is whether Fed officials will validate this view. We have a string of speakers scheduled from Wednesday, November 12 through Friday, November 14, including the October meeting’s dissenters: the dovish Governor Miran and the hawkish President Schmid. Their words will be dissected for any hint of a consensus forming around a December cut. If they push back hard against the market’s pricing, we could see another violent reversal in the dollar.

The other major story will be out of Australia. The Reserve Bank of Australia has been on a “hawkish pause,” but that stance will be put to the test this week. We get the Q3 Wage Price Index on Wednesday, November 12, a direct measure of the risk of a wage-price spiral, followed by the October Labour Force Survey on Thursday, November 13. If this data comes in hot, it will lock in the RBA’s hawkishness and likely send the Australian dollar higher, especially against currencies with dovish central banks like the New Zealand dollar. If the data is weak, the RBA’s hawkish narrative could crumble, putting significant pressure on the Aussie. It’s a high-stakes week for data-dependent central banks, and the moves could be significant.

The market’s violent reversal proves one thing: data is king. The dollar’s fate now rests not on past hawkishness, but on the words of divided Fed officials this week. All eyes are on them, and on the pivotal Australian jobs and wage data, which will determine if the next major policy shock is just days away.