Forex Briefing (WN3 2026): US Exceptionalism is Crushing Rivals as Yield Gaps Widen

You are currently witnessing a market defined by a ruthless economic decoupling that is making the USD the undisputed king. If you look at the landscape, the Greenback is crushing struggling peers lik

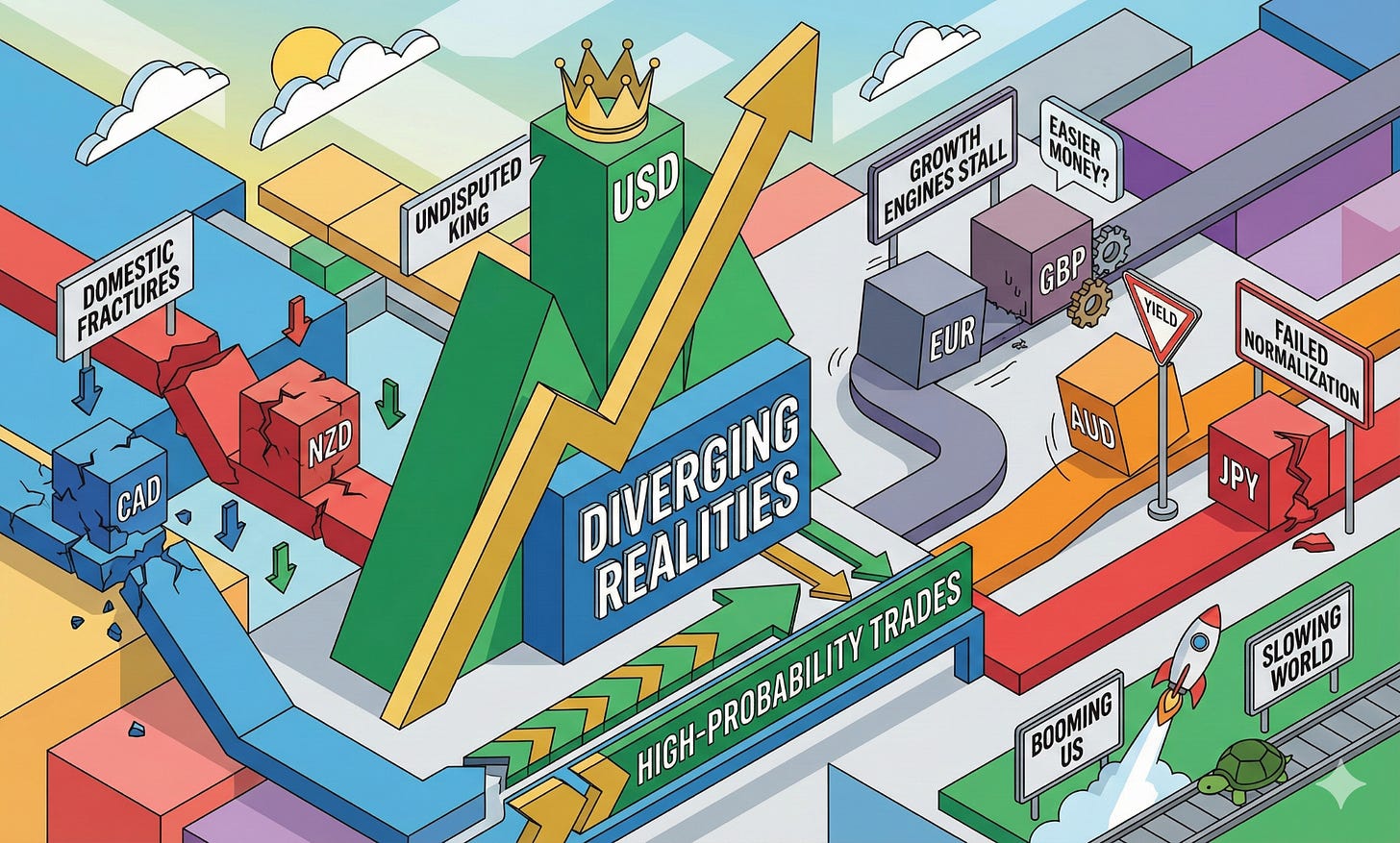

DIVERGING REALITIES ARE CREATING YOUR BEST OPPORTUNITIES

You are currently witnessing a market defined by a ruthless economic decoupling that is making the USD the undisputed king. If you look at the landscape, the Greenback is crushing struggling peers like the CAD and NZD, which are buckling under domestic fractures. Meanwhile, the EUR and GBP are dragging lower as their growth engines stall, crying out for easier money. On the flip side, the AUD is trying to resist based on yield, while the JPY suffers from a failed normalization story. This divergence between a booming US and a slowing world is setting up high-probability trades for you right now.

LABOR SHOCKS AND CENTRAL BANK PIVOTS ARE REDEFINING THE QUARTER

If you watched the markets close last week, you saw the landscape shift violently on Friday, January 9. We witnessed a massive divergence in labor data that forced everyone to reprice global risk. The US unemployment rate dropped unexpectedly to 4.4 percent, effectively shattering recession fears. This reinforces the “higher for longer” thesis for the Federal Reserve, as the economy refuses to land. Compare that to the disaster we saw in Canada, where the unemployment rate spiked to 6.8 percent on the same day. That is a crisis level that forces traders to price in aggressive Bank of Canada cuts just to keep the ship afloat.

As we look toward the end of February, you should expect this gap to widen further. The Federal Reserve’s meeting on January 27-28 is now poised to deliver a “hawkish pause,” capitalizing on this US exceptionalism to keep yields high. Conversely, the Bank of England is under immense pressure to cut rates at its February 5 meeting to stop the bleeding, as the “catching down” narrative takes hold (https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/december-2025). We also saw German exports contract by 2.5 percent, confirming the industrial capitulation weighing on the EUR (https://tradingeconomics.com/germany/exports). For AUD, the outlook hinges on whether domestic inflation can justify the Reserve Bank of Australia’s stubborn stance. Ultimately, the EUR faces structural headwinds as the European Central Bank pivots to easing, creating a toxic policy divergence that targets lower levels for your currency pairs through mid-Q1.

GEOPOLITICAL TENSIONS AND DATA ARE DRIVING VOLATILITY

Since the start of the year, we have transitioned from holiday thinness to a brutal repricing of risk assets. You might recall that back on Monday, January 5, the US ISM Manufacturing PMI contracted to 47.9. Initially, this softened the USD, but the geopolitical shock of Venezuela tensions quickly restored safe-haven demand, reminding us why the Dollar is King (https://tradingeconomics.com/united-states/currency). By Thursday, January 8, the AUD surrendered its gains after a dismal trade balance report showed the surplus narrowing to 2.94 billion AUD. That miss eroded confidence in the yield thesis you might have been relying on. Throughout this period, UK Gilt yields collapsed 13.5 basis points as the market aggressively bet on a dovish pivot from the Bank of England, stripping the GBP of the interest rate support it desperately needs.

Heading into Week 3, your spotlight must be on Tuesday, January 13, for the US Consumer Price Index. A print matching the 2.7 percent forecast would solidify USD dominance by confirming inflation is too sticky for immediate Fed cuts. Then, keep your eyes on Thursday, January 15. The UK releases Monthly GDP data, and a negative print here would confirm the economy is flirting with recession, likely punishing the GBP further (https://tradingeconomics.com/united-kingdom/calendar). Also on Thursday, the Australian employment report will be pivotal; a weak number could shatter the RBA’s hawkish outlier status and threaten the AUD’s medium-term bull case. For the CAD, unless we see a spike in oil prices from Venezuela tensions, there is little reprieve from the bearish pressure generated by its deteriorating labor market.

KEY TAKEAWAYS AND THE EVENTS YOU MUST WATCH

The path of least resistance clearly favors a strong USD, driven by a resilient labor market that contrasts sharply with the recessionary signals flashing across Canada, Europe, and the UK. You should prepare for continued downside in the CAD and EUR, particularly if the US Consumer Price Index on Tuesday confirms sticky inflation. The AUD remains your wildcard, dependent on Thursday’s employment data to sustain its yield advantage. Ultimately, the divergence in central bank mandates—growth support abroad versus inflation fighting in the US—dictates a clear bullish bias for the Greenback that you should look to exploit.

Remember to include Fundamental Analysis into all your trade plans.

DISCLAIMER: The information printed here is informational only, NOT advice. Trading involves risk, and you could lose money.