Forex Field Guide for Canadian Dollar (SEP 2022)

Reference guide covering Fundamental, Sentiment and Technical factors of the CAD

TECHNICAL ANALYSIS

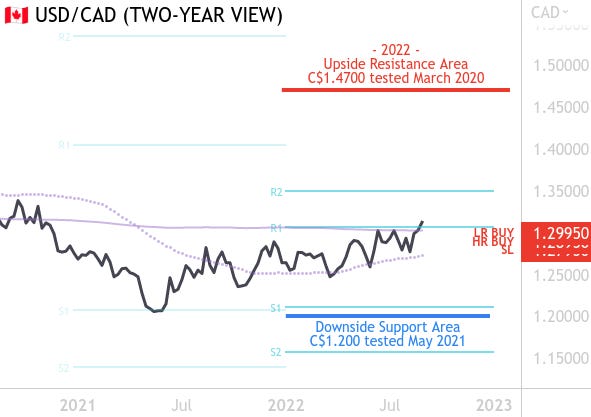

Last year in 2021, the value of the Canadian Dollar fell 0.80% as it moved from $1.28 to $1.26 which was in alignment with the trajectory which turned bearish in April when the 50 day moving average fell below the 200 day. The momentum was bearish until November when it turned mixed as the value climbed above the 50 day moving average but below the 200 day.

This year, the momentum has turned bullish while the trajectory remains bearish. This indicates that the upside resistance area at $1.47 is being targeted which was previously tested in March 2020.

Trading Economics forecasts a more valuable US Dollar when measured in Canadian Dollars: $1.33 in Q3; $1.34 in Q4; $1.36 in Q1.

SENTIMENT ANALYSIS

GLOBAL GROWTH SLOWDOWN NARRATIVE

What’s Happening? | In the Bank of Canada’s ‘Monetary Policy Report - July 2022’ it mentioned that global growth is moderating. This will affect the oil demand which in turn reduces the value of the Canadian Dollar.