FOREX FUNDAMENTALS: Euro, Pound, Yen Face Challenges as Dollar Holds Firm

Saturday, April 13, 2024 (Week 16)

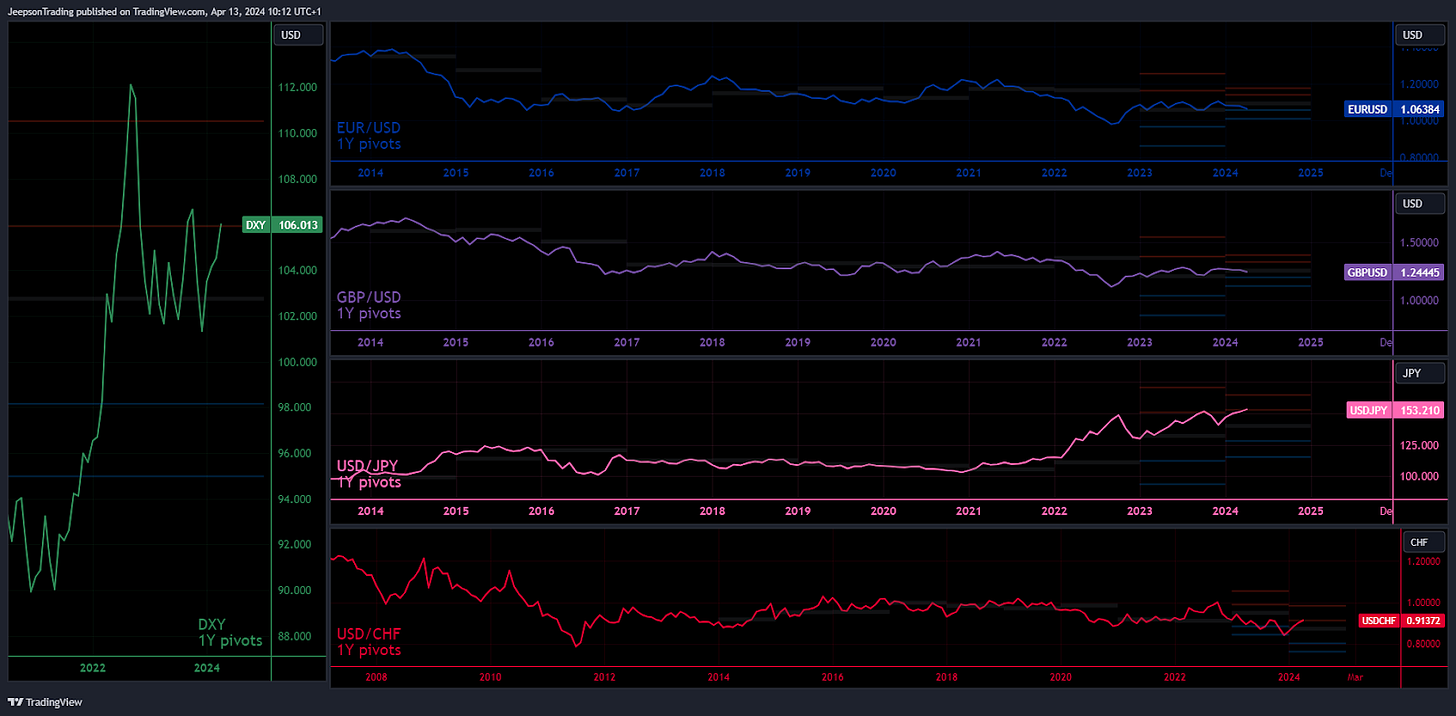

Saturday, April 13, 2024 (Week 16): The US dollar remains resilient as the Federal Reserve navigates a path toward gradual policy normalisation. Economic strength and persistent inflation support the Fed's stance, while other major currencies like the euro, pound, and yen face their own unique challenges. Geopolitical tensions add a layer of uncertainty. Forex traders must closely monitor economic indicators, central bank policies, and market sentiment to capitalise on opportunities and mitigate risks in this dynamic global currency market.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

US Dollar Holds Firm Amidst Policy Recalibration

US Economic Resilience Sets Stage for Gradual Policy Normalisation: The US economy has demonstrated remarkable resilience, maintaining its momentum despite persistent inflationary pressures. Robust employment data, with nonfarm payrolls surging by 303,000 in March and the unemployment rate dipping to 3.8%, underpins the Federal Reserve's plans to maintain restrictive interest rates in the near term. However, with inflation showing signs of moderation and GDP growth expected to slow, the central bank anticipates a gradual reduction in interest rates, starting with three cuts in 2024 and followed by further easing in subsequent years.

This balanced approach aims to support sustainable economic growth while keeping borrowing costs relatively consistent. The resilient labour market bolsters the Fed's hawkish stance, potentially lending strength to the US dollar in the short term. Forex traders should closely monitor key indicators such as inflation, employment, consumer spending, and business activity, as these will influence the timing and magnitude of the Fed's rate cuts, potentially impacting the dollar's value.

Nevertheless, geopolitical tensions, particularly in the Middle East and with China, pose risks to the currency's stability. The heightened tensions between the US and Iran, as well as the US efforts to counter Chinese influence in the Asia-Pacific region, could lead to increased market uncertainty and safe-haven flows, affecting the stability of the US dollar against other major currencies like the Japanese yen and the euro.

Euro Navigates Uncertain Waters Amid Mixed Economic Signals

Euro Navigates Uncertain Waters as ECB Maintains Restrictive Stance Amid Mixed Economic Indicators: The Euro Area economy presents a mixed picture, with inflation showing signs of easing while industrial production and consumer spending remain subdued. The European Central Bank (ECB) maintained its key interest rates at record highs in April, underscoring its determination to bring inflation back to its 2% target. The central bank's cautious approach reflects the recognition that inflationary pressures persist, and the economy remains fragile.

The restrictive monetary policy aims to curb inflation but may lead to slower economic growth in the short term. Higher interest rates could dampen investment and consumption, potentially impacting sectors sensitive to interest rates such as utilities and real estate. However, if the ECB's actions successfully control inflation and stabilise the economy, it could lead to a more favourable environment for stocks in the long term.

Forex traders should closely monitor the ECB's policy decisions, economic data releases, and statements from ECB officials to gauge the potential impact on currency markets. Key indicators to watch include inflation rates, industrial production, services sentiment, and the ZEW Indicator of Economic Sentiment. The euro's value against other currencies may fluctuate based on the relative strength of the Eurozone economy compared to other major economies and the ECB's policy stance relative to other central banks.

Geopolitical tensions, such as the ongoing conflict in Ukraine and the alleged Russian infiltration of European institutions, continue to pose risks to the euro's value. These situations may lead to increased uncertainty and volatility in the foreign exchange market, as investors seek safe-haven assets during times of heightened geopolitical risk.

British Pound Faces Headwinds Amid Persistent Inflation and Sluggish Growth

British Pound Faces Headwinds Amid Persistent Inflation and Sluggish Growth: The UK economy showed modest growth in March, but persistent inflation and sluggish annual growth continue to pose challenges. The Bank of England maintained the Bank Rate at 5.25% in its March meeting, the highest level since 2008, reflecting a cautious approach to addressing inflationary pressures. The outlook for a gradual decrease in interest rates over the coming years could stimulate economic growth but may lead to a weaker Pound against other major currencies.

Forex traders should closely monitor a range of economic indicators to gauge the Pound's performance, including GDP growth and its components, inflation data, labour market statistics, retail sales, consumer confidence, PMI surveys, the Bank of England's monetary policy decisions, current account balance, public sector borrowing, and housing market indicators.

However, the British Pound's value is also susceptible to risks from geopolitical tensions, the UK's widening current account deficit, and uncertainties surrounding post-Brexit trade relationships. The alleged Russian infiltration of European institutions and the potential economic consequences of the COVID-19 pandemic could further impact the Pound's trajectory.

Japanese Yen Outlook: Economic Recovery Paves Way for Policy Normalisation

Japanese Yen Outlook: Economic Recovery Paves Way for Policy Normalisation Amid Geopolitical Headwinds: Japan's economy continues to recover from the COVID-19 pandemic, supported by a rebound in business spending and positive net trade contributions. In response to persistent inflation and rising wages, the Bank of Japan (BoJ) raised its key short-term interest rate to around 0% to 0.1% in March, ending eight years of negative interest rates. This move signals a gradual normalisation of monetary policy as the economy recovers and inflation exceeds the central bank's target.

The BoJ's policy changes could support a stronger Japanese yen, as higher interest rates typically attract foreign investment. However, a rapidly strengthening yen could negatively impact export competitiveness and corporate profitability. Forex traders should closely monitor Japan's inflation data, wage growth, GDP growth, and labour market indicators, as well as the BoJ's monetary policy decisions and the broader global economic context.

Geopolitical factors, such as the evolving security dynamics in the Asia-Pacific region and tensions in the Middle East, pose risks to the Japanese yen's stability. The US efforts to counter Chinese influence in the region and the heightened tensions with Iran could lead to increased market volatility, impacting the yen's performance against other major currencies.

Navigating the Currents: A Balancing Act of Resilience and Adaptability

As the global economic landscape continues to shift, forex traders must navigate the intricate currents of currency markets with a delicate balance of resilience and adaptability. While the US dollar holds firm amidst policy recalibration, the euro faces uncertain waters, and the British pound grapples with persistent inflation and sluggish growth. Meanwhile, the Japanese yen's outlook is shaped by economic recovery and policy normalisation, tempered by geopolitical headwinds.

In this ever-changing environment, forex traders must remain vigilant, closely monitoring key economic indicators, central bank policies, and geopolitical developments across major economies. By maintaining a diversified portfolio, employing prudent risk management strategies, and staying agile in adapting to evolving market conditions, traders can fortify their resilience and seize opportunities amidst the shifting tides of the foreign exchange market.

Geopolitical risks, trade tensions, and policy divergences among central banks will continue to influence currency movements, necessitating a proactive approach to risk management. Traders should also consider the potential impact of factors such as fiscal policies, commodity prices, and investor sentiment on currency valuations.

Ultimately, success in the forex market hinges on the ability to navigate economic crosscurrents with a combination of robust analysis, disciplined execution, and a willingness to adapt strategies as market dynamics evolve. By fostering resilience and agility, forex traders can position themselves to weather turbulence and capitalise on emerging opportunities in the ever-shifting currents of global currency markets.

Gavin Pearson

Retail trader since 2008

Specialises in forex

Funded account from the 5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Returned 27% in 2022 and -2.7% in 2023

Exclusively forex focused

Copy Trading available at eToro

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-