Forex Market Braces for Fed, BoE, and a Potential BoJ Bombshell

Tuesday, 30th July, Week 31

Euro's Fate Hangs in the Balance: Will the Fed Deliver a Dovish Surprise or Will Eurozone Weakness Sink EURUSD?

Euro Under Pressure: Five Weeks of Dollar Dominance and Eurozone Concerns Weigh on EURUSD

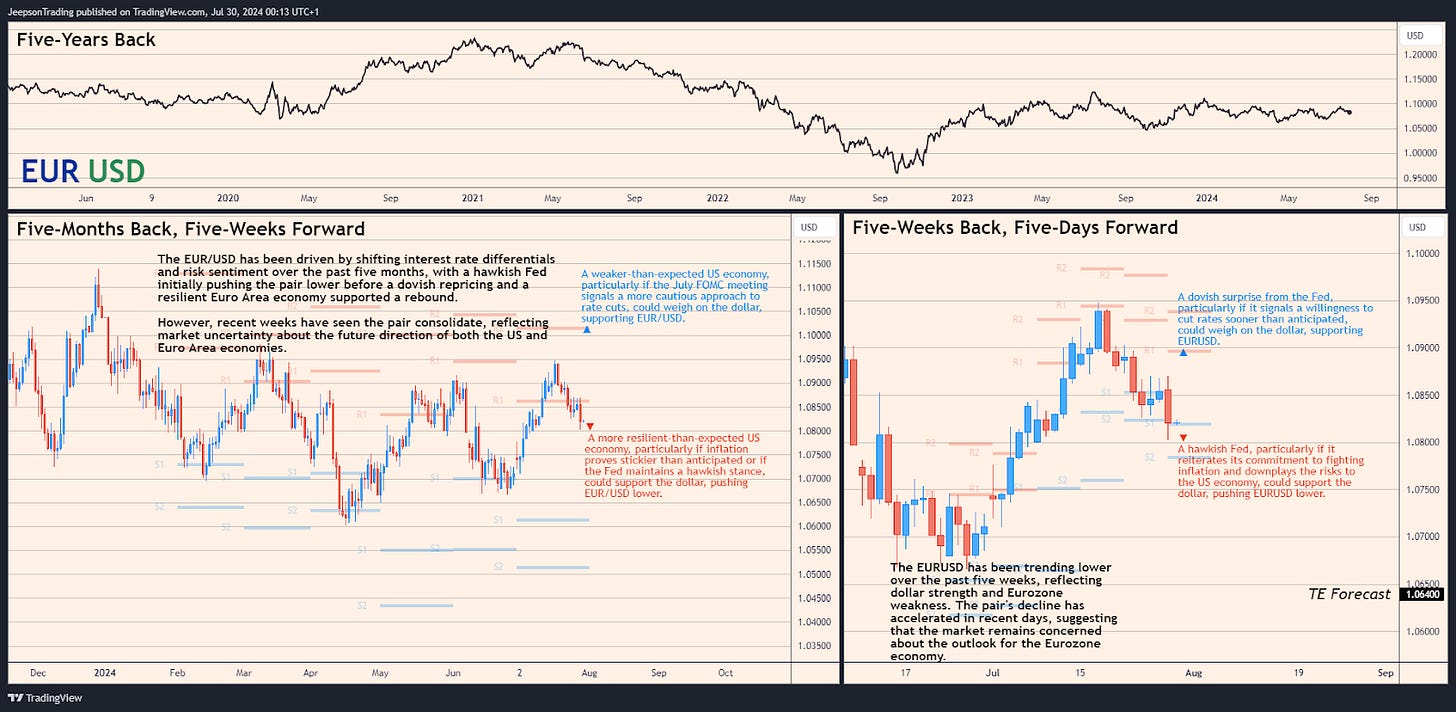

The EURUSD has been under pressure over the past five weeks, as the dollar has benefited from safe-haven flows amid escalating geopolitical tensions and concerns about the health of the Eurozone economy. The most significant move within this period occurred in mid-July, when EURUSD tumbled from a high of 1.0939 on July 17th to a low of 1.0815 on July 29th. This sharp decline was triggered by a combination of factors, including a resurgence in demand for the dollar as a safe-haven asset following Israel's pledge to retaliate against Hezbollah, disappointing Eurozone PMI data, and growing expectations for a dovish pivot from the Federal Reserve.

Over the past five days, EURUSD has been trending lower, extending the weakness seen in the previous five weeks. This suggests that the market remains concerned about the outlook for the Eurozone economy, particularly in light of the ongoing energy crisis and the potential for a further escalation of the conflict between Russia and Ukraine.

Summary: The EURUSD has been trending lower over the past five weeks, reflecting dollar strength and Eurozone weakness. The pair's decline has accelerated in recent days, suggesting that the market remains concerned about the outlook for the Eurozone economy.

Fed Decision in Focus: Five Days of Potential Volatility for EURUSD

The next five days could be a volatile period for EURUSD, as the market awaits the Federal Reserve's interest rate decision on Wednesday, July 31st. A dovish surprise from the Fed, particularly if it signals a willingness to cut rates sooner than anticipated, could weigh on the dollar, supporting EURUSD. Conversely, a hawkish Fed, particularly if it reiterates its commitment to fighting inflation and downplays the risks to the US economy, could support the dollar, pushing EURUSD lower.

Traders should also be aware of the potential for increased volatility around key economic data releases, such as the flash estimates for July inflation in Germany and the Euro Area (Wednesday, July 31st), and the preliminary estimate for Euro Area Q2 GDP growth (Tuesday, July 30th). Additionally, the outcome of the Bank of Japan’s monetary policy meeting, concluding on Tuesday 30th July, could impact the broader market sentiment and indirectly influence EURUSD trading.

Upside: A dovish surprise from the Fed, particularly if it signals a willingness to cut rates sooner than anticipated, could weigh on the dollar, supporting EURUSD.

Downside: A hawkish Fed, particularly if it reiterates its commitment to fighting inflation and downplays the risks to the US economy, could support the dollar, pushing EURUSD lower.

Loonie on Shaky Ground: Can a Dovish BoJ Rescue CADJPY or Will Canadian Weakness Seal its Fate?

Rate Cut Hangover: Five Weeks of Loonie Weakness Weigh on CADJPY

The CADJPY has been trending lower over the past five weeks, as the Canadian dollar has weakened in the wake of the Bank of Canada's surprise decision to cut interest rates in June and July. The most significant move within this period occurred in late July, when CADJPY tumbled from a high of 118.0835 on July 2nd to a low of 110.8825 on July 27th. This sharp decline was triggered by the BoC's back-to-back rate cuts, which fuelled concerns about the health of the Canadian economy and reduced the loonie's yield advantage over other major currencies.

Over the past five days, CADJPY has continued to trend lower, extending the weakness seen in the previous five weeks. This suggests that the market remains concerned about the outlook for the Canadian economy, particularly in light of the recent slowdown in growth and the potential for further rate cuts from the BoC.

Summary: The CADJPY has been trending lower over the past five weeks, reflecting the Canadian dollar's weakness in the wake of the Bank of Canada's surprise rate cuts. The pair's decline has continued in recent days, suggesting that the market remains concerned about the outlook for the Canadian economy.

BoJ Decision Looms: Five Days of Potential Volatility for CADJPY

The next five days could be a volatile period for CADJPY, as the market digests the outcome of the Bank of Japan’s monetary policy meeting concluding on Tuesday 30th July. A dovish BoJ, particularly if it maintains its current policy stance and refrains from any hawkish surprises, could weigh on the yen, potentially supporting CADJPY. Conversely, any hints of a potential shift towards policy normalisation, such as a reduction in bond purchases or even a surprise rate hike, could support the yen, putting downward pressure on CADJPY.

Traders should also be aware of the potential for increased volatility around key economic data releases, such as the July Labour Force Survey (Friday, August 9th), and the August S&P Global Manufacturing PMI (Monday, August 5th).

Upside: A dovish Bank of Japan, particularly if it maintains its current policy stance and refrains from any hawkish surprises, could weigh on the yen, potentially supporting CADJPY.

Downside: Any hints of a potential shift towards policy normalisation from the BoJ, such as a reduction in bond purchases or even a surprise rate hike, could support the yen, putting downward pressure on CADJPY.

Sterling Slides as BoE Decision Looms: Can Labour's Policies Rescue GBPJPY?

Labour's Inheritance: Five Weeks of Pound Weakness Weigh on GBPJPY

The GBPJPY has been on a downward trajectory since reaching a high of 207.7065 on July 10th, as the pound has weakened amid concerns about the UK's economic outlook and the potential for a dovish shift from the Bank of England. The most significant move within this period occurred in mid-July, when GBPJPY tumbled from that high to a low of 197.4241 on July 27th. This sharp decline was triggered by a combination of factors, including weaker-than-expected UK economic data, growing expectations for a BoE rate cut, and a resurgence in demand for the yen as a safe-haven asset following the escalation of tensions in the Middle East.

Over the past five days, GBPJPY has continued to trend lower, extending the weakness seen in the previous two weeks. This suggests that the market remains concerned about the outlook for the UK economy, particularly in light of the recent slowdown in growth and the potential for a change in policy direction under the new Labour government.

Summary: The GBPJPY has been trending lower since July 11th, reflecting the pound's weakness amid concerns about the UK's economic outlook and the potential for a dovish shift from the Bank of England. The pair's decline has continued in recent days, suggesting that the market remains concerned about the outlook for the UK economy.

BoE and Labour in the Spotlight: Five Days of Potential Volatility for GBPJPY

The next five days could be a volatile period for GBPJPY, as the market awaits the Bank of England's interest rate decision on Wednesday, August 1st, and assesses the new Labour government's policy agenda. While the odds for a rate cut by the BoE have shortened, nearly 50% of traders still bet the BoE will maintain rates at their current level. A rate cut could weigh on the pound, dragging GBPJPY lower. Conversely, a decision to hold rates steady could support the pound, boosting GBPJPY.

Traders should also be aware of the potential for increased volatility around key economic data releases, such as the July CPI inflation report (Wednesday, August 14th), the June unemployment rate (Thursday, August 15th), and Chancellor Rachel Reeves' first statement to Parliament (Monday, July 29th).

Upside: A decision by the Bank of England to hold interest rates steady on August 1st could support the pound, boosting GBPJPY.

Downside: A rate cut by the Bank of England on August 1st could weigh on the pound, dragging GBPJPY lower.

Action Points: Forex Market on High Alert

The next five days will be crucial for forex traders, with several key events and data releases likely to shape market sentiment and influence currency valuations.

Key Events to Monitor:

Week 31 (31st July - 4th August):

Wednesday, 31st July: BOJ Policy Rate, Germany Inflation Rate YoY Flash JUL, Euro Area Inflation Rate YoY Flash JUL, US ADP Employment Change, US EIA Crude Oil Stocks Change, FOMC Interest Rate Decision

Thursday, 1st August: Euro Area Unemployment Rate JUN, BoE Interest Rate Decision, US ISM Manufacturing PMI, US Initial Jobless Claims

Friday, 2nd August: US Non-Farm Payrolls, US Unemployment Rate, US Average Hourly Earnings MoM/YoY

Sources:

Newsquawk

Trading Economics

Stratfor

Bank of England

European Central Bank

Bank of Canada

Federal Reserve

Office for National Statistics

EUROSTAT

Statistics Canada

Ministry of Finance, Japan

Cabinet Office, Japan

Ministry of Internal Affairs & Communications, Japan

Ministry of Economy Trade & Industry (METI), Japan