Forex Market on High Alert: BoE and BoJ Decisions to Steer the Ship

Sunday, 28th July, Week 30

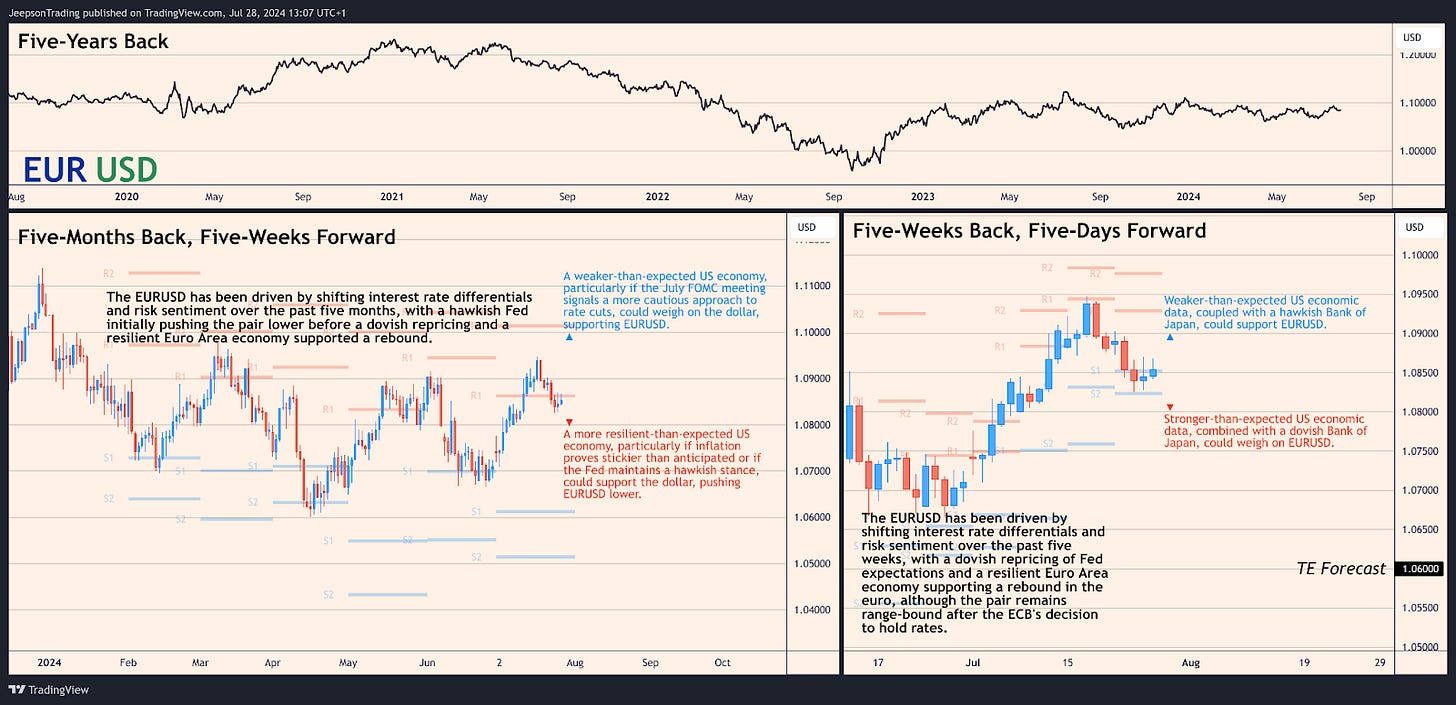

EURUSD: Euro Holds Steady After ECB Holds Rates, Awaiting US Data Storm

Euro Stands Firm: Five Weeks of Range-Bound Trading After ECB Hold

The EURUSD has been locked in a tight range over the past five weeks, with the pair largely consolidating after the European Central Bank's decision to hold interest rates steady on July 18th. The most significant move within this period occurred on July 17th, as the euro surged to a five-week high of 1.0939, driven by a dovish repricing of Fed expectations and a more resilient-than-expected Euro Area economy. This move reflected growing confidence in the Euro Area's economic outlook and a shift in market sentiment towards the euro.

However, the dollar has since regained some ground, with EURUSD trading within a relatively tight range over the past five days, hovering around the 1.0850 mark. This suggests a period of consolidation as traders await further clarity on the outlook for US monetary policy and digest the implications of the ECB's recent decision.

Summary: The EURUSD has been driven by shifting interest rate differentials and risk sentiment over the past five weeks, with a dovish repricing of Fed expectations and a resilient Euro Area economy supporting a rebound in the euro, although the pair remains range-bound after the ECB's decision to hold rates.

Euro Awaits US Catalyst: Data Deluge and BoJ Decision in Focus

The next five days could see increased volatility for EURUSD, with the focus shifting to the US economic data deluge and the Bank of Japan's monetary policy decision. While the ECB's decision to hold rates is now in the rearview mirror, the market will be closely watching US data releases for clues about the Fed's next move. Stronger-than-expected US data could boost the dollar, pushing EURUSD lower, while weaker-than-expected data could weigh on the dollar, supporting EURUSD.

The BoJ's decision on Wednesday could also impact EURUSD indirectly, as a hawkish BoJ could boost the yen, potentially triggering a broader unwinding of carry trades funded in Japanese yen. This could weigh on the dollar, supporting EURUSD. Conversely, a dovish BoJ could limit the yen's upside, potentially supporting the dollar and weighing on EURUSD.

Traders should be particularly attentive to key US data releases, such as the Conference Board Consumer Confidence Index (Tuesday), the ADP Employment Change report (Wednesday), the ISM Manufacturing PMI (Thursday), and the Non-Farm Payrolls report (Friday).

Upside: Weaker-than-expected US economic data, coupled with a hawkish Bank of Japan, could support EURUSD.

Downside: Stronger-than-expected US economic data, combined with a dovish Bank of Japan, could weigh on EURUSD.

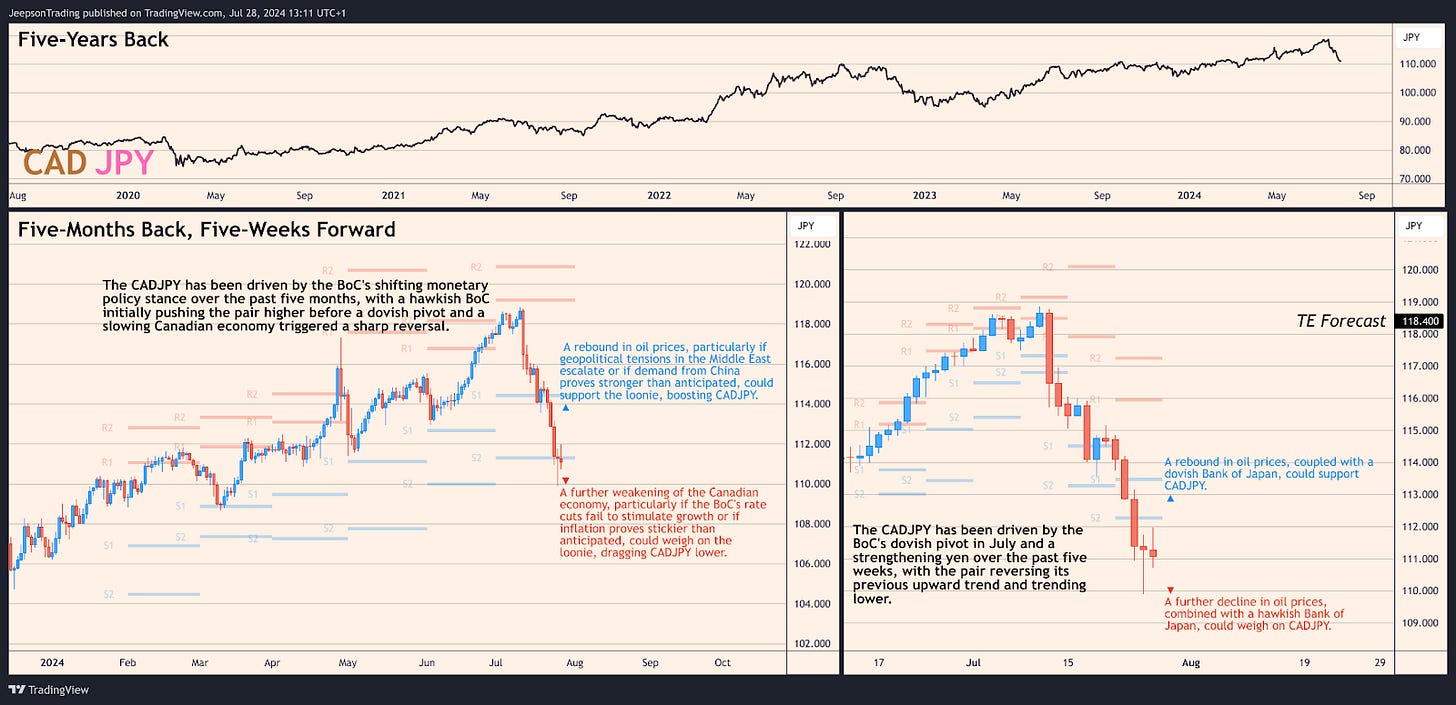

CADJPY: Loonie Eyes Oil's Fate as BoJ Decision Looms Large

Loonie's Rollercoaster: Five Weeks of Rate Cut Frenzy and Yen Resurgence

The CADJPY has been on a wild ride over the past five weeks, driven by the Bank of Canada's surprise rate cut in July and a resurgence in the Japanese yen. The most significant move occurred in mid-July, as the BoC's rate cut sent the loonie tumbling, dragging CADJPY down from a five-week high of 118.0835 on July 2nd to a low of 110.8825 on July 27th. This sharp reversal reflected growing concerns about a slowing Canadian economy and easing inflation, prompting the BoC to shift towards a more accommodative monetary policy stance.

Adding to the loonie's woes, the yen has been strengthening in recent weeks, driven by safe-haven flows amid global risk aversion and expectations that the Bank of Japan could further adjust its yield curve control policy. This has created a double whammy for CADJPY, pushing the pair lower.

Summary: The CADJPY has been driven by the BoC's dovish pivot in July and a strengthening yen over the past five weeks, with the pair reversing its previous upward trend and trending lower.

Loonie's Trial by Fire: BoJ Decision and Oil Market Volatility to Determine Fate

The next five days could be crucial for CADJPY, with the Bank of Japan's monetary policy decision and oil market volatility likely to influence the pair's direction. The BoJ's decision on Wednesday could spark volatility, particularly if it signals a willingness to further adjust its yield curve control policy. A hawkish BoJ could support the yen, putting downward pressure on CADJPY.

Oil prices will also be closely watched, with any signs of a rebound potentially supporting the loonie and boosting CADJPY. Conversely, a further decline in oil prices could weigh on the loonie, dragging CADJPY lower.

Traders should also be aware of the potential for increased volatility around key economic data releases, such as the US EIA Crude Oil Stocks Change (Wednesday), and the Canadian Labour Force Survey (Friday).

Upside: A rebound in oil prices, coupled with a dovish Bank of Japan, could support CADJPY.

Downside: A further decline in oil prices, combined with a hawkish Bank of Japan, could weigh on CADJPY.

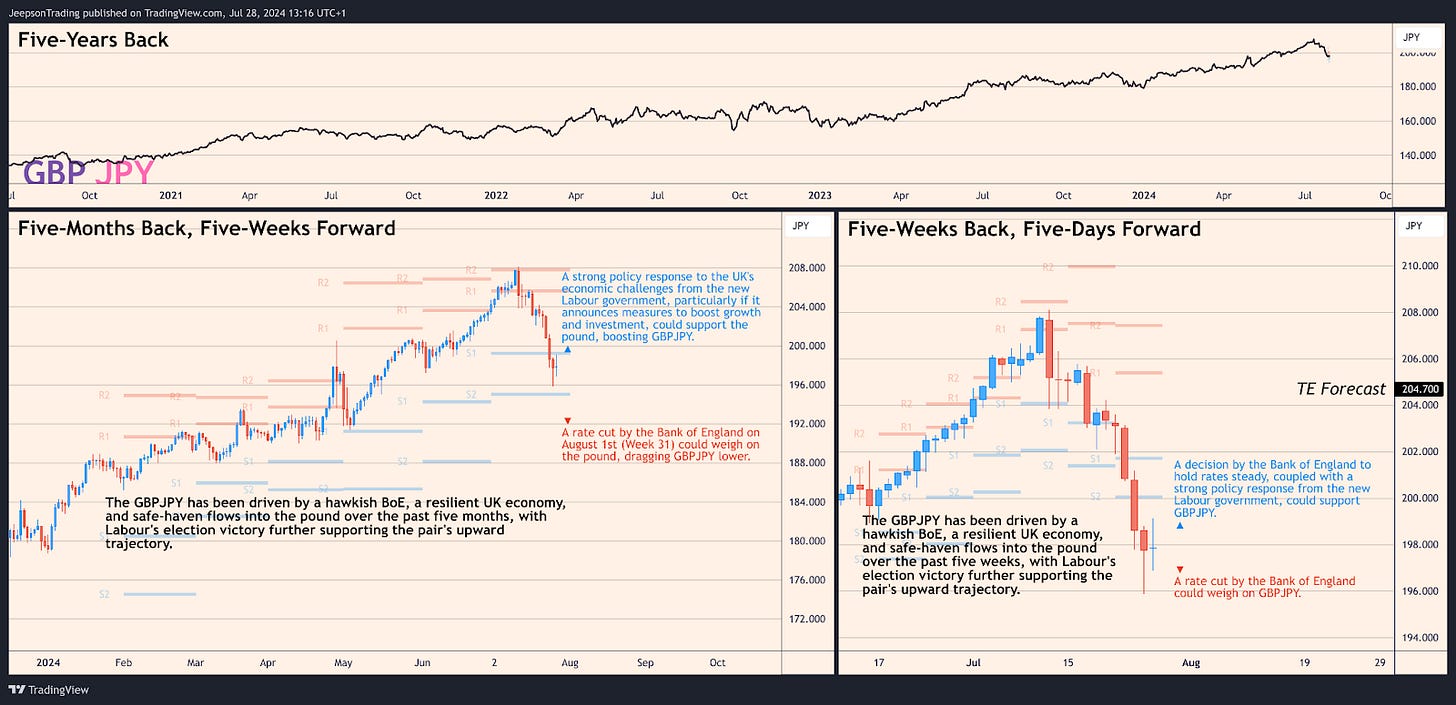

GBPJPY: Sterling's Moment of Truth as BoE Decision Looms Large

Sterling's Steady Ascent: Five Weeks of Pound Strength and Yen Weakness

The GBPJPY has been on a steady upward trajectory over the past five weeks, driven by the pound's resilience amid a challenging economic backdrop and political uncertainty. The most significant move occurred in early July, as the pound surged to a five-week high of 207.7065 on July 10th, driven by a hawkish Bank of England, a resilient UK economy, and safe-haven flows into the pound amid global risk aversion. This move reflected growing confidence in the UK's economic outlook and expectations that the BoE would maintain a restrictive monetary policy stance.

The pound's strength was further bolstered by Labour's landslide victory in the July 4th general election. The new government's commitment to fiscal responsibility and structural reforms boosted confidence in the UK economy, supporting the pound.

Summary: The GBPJPY has been driven by a hawkish BoE, a resilient UK economy, and safe-haven flows into the pound over the past five weeks, with Labour's election victory further supporting the pair's upward trajectory.

Sterling's Defining Week: BoE Decision to Shape GBPJPY's Trajectory

The next five days could be a pivotal period for GBPJPY, as the market awaits the Bank of England's interest rate decision on Thursday, August 1st. A rate cut by the BoE, which is currently seen as a close call, could weigh on the pound, dragging GBPJPY lower. Conversely, a decision to hold rates steady could support the pound, boosting GBPJPY.

Beyond the BoE's decision, the outlook for GBPJPY will depend on the new Labour government's policy agenda and its impact on the UK economy. Upside potential for GBPJPY could stem from a strong policy response to the UK's economic challenges, particularly if the government announces measures to boost growth and investment.

Traders should also be aware of the potential for increased volatility around key economic data releases, such as the US ISM Manufacturing PMI (Thursday), and the US Non-Farm Payrolls report (Friday).

Upside: A decision by the Bank of England to hold rates steady, coupled with a strong policy response from the new Labour government, could support GBPJPY.

Downside: A rate cut by the Bank of England could weigh on GBPJPY.

Action Points: Forex Market on High Alert

The coming week will be crucial for forex traders, with several key events and data releases likely to spark volatility and influence currency valuations.

Key Events to Monitor:

Week 31 (30th July - 3rd August):

Tuesday 30th July: Euro Area GDP Growth Rate QoQ Flash Q2, US CB Consumer Confidence

Wednesday 31st July: Germany Inflation Rate YoY Flash JUL, Euro Area Inflation Rate YoY Flash JUL, US ADP Employment Change, US EIA Crude Oil Stocks Change, BoJ Interest Rate Decision, FOMC Interest Rate Decision

Thursday 1st August: Euro Area Unemployment Rate JUN, BoE Interest Rate Decision, US ISM Manufacturing PMI, US Initial Jobless Claims

Friday 2nd August: US Non-Farm Payrolls, US Unemployment Rate, US Average Hourly Earnings MoM/YoY