Forex Mid-Week Update (WN07 2026): CARRY TRADE DIVERGENCE REACHES HISTORIC EXTREMES

The AUD/JPY and NZD/JPY remain as the focus pairs for the week. RBA Deputy Governor Hauser’s hawkish escalation on February 11 declaring inflation is “too high,” Takaichi’s 352-seat supermajority cons

The AUD/JPY and NZD/JPY remain as the focus pairs for the week. RBA Deputy Governor Hauser’s hawkish escalation on February 11 declaring inflation is “too high,” Takaichi’s 352-seat supermajority consolidating fiscal dominance fears in Japan, and Westpac’s confirmation of a brought-forward RBNZ hike timeline to December 2026.

The market mood is “Hawkish Escalation Meets Fiscal Recklessness,” rewarding Antipodean central bank discipline while punishing Japanese fiscal indiscipline. The Yen’s 2.6 percent household spending collapse and twelfth consecutive month of negative real wages confirm structural weakness that no single GDP print can fix, while the dairy super-cycle and RBA tightening bias provide genuine fundamental momentum for the Antipodean currencies.

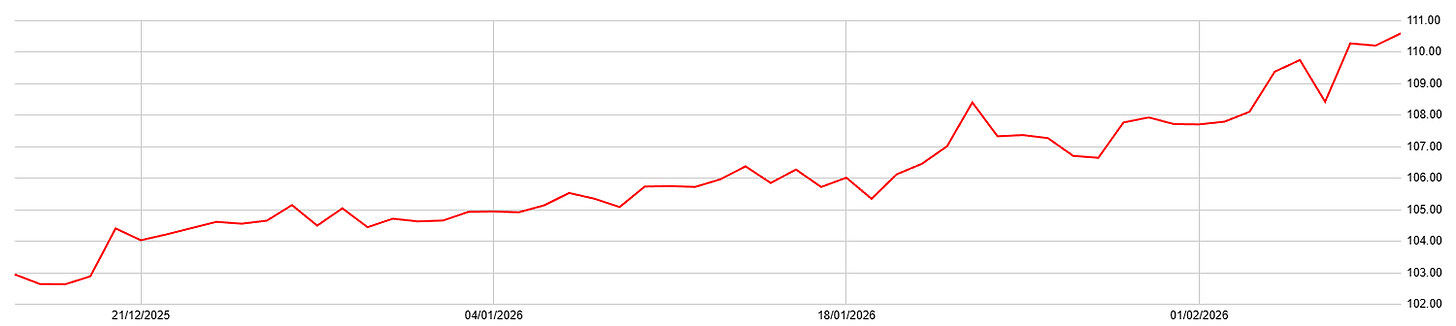

AUD/JPY: Highly Convincing BULLISH Sentiment Over the Coming Weeks Due to RBA-BoJ Policy Divergence

AUD/JPY has torn higher to decade-highs near 110.32 over the previous seven weeks, driven by the most dramatic monetary policy decoupling in G10 this cycle. The RBA’s unanimous hike to 3.85 percent on February 3 — making Australia the first major central bank to pivot from cuts back to hikes — sent 10-year yields to 4.87 percent, the highest in the developed world. RBA Deputy Governor Hauser doubled down on February 11, declaring “inflation is too high” with willingness to tighten further (https://www.fxstreet.com/news/rbas-hauser-inflation-is-too-high-202602110149). On the opposite side, Japan’s household spending collapsed 2.6 percent YoY while Takaichi’s February 8 election landslide with 352 seats cemented fiscal dominance fears around the 122.3 trillion JPY budget funded by 29.6 trillion JPY in new bond issuance, pushing JGBs to 2.27 percent on fiscal panic rather than growth (https://tradingeconomics.com/japan/government-bond-yield). Looking ahead, the bullish case has intensified. Markets price a 70 percent probability of a May RBA hike to 4.10 percent, and even if Japan’s Q4 GDP rebounds at the 1.6 percent Reuters poll median on February 16, the structural headwinds remain severe. Westpac consumer confidence fell to 90.5 on February 10 but the carry premium is overwhelming. Key recent events: RBA hiked to 3.85 percent (Feb 3), Japan Household Spending at negative 2.6 percent (Feb 6), Takaichi supermajority (Feb 8). Pivotal upcoming events: Japan Q4 GDP (Feb 16, 1.6 percent expected), RBA Minutes (Feb 17, hawkish conviction check), Japan CPI and Australia Labour Force (Feb 20, dual divergence test).

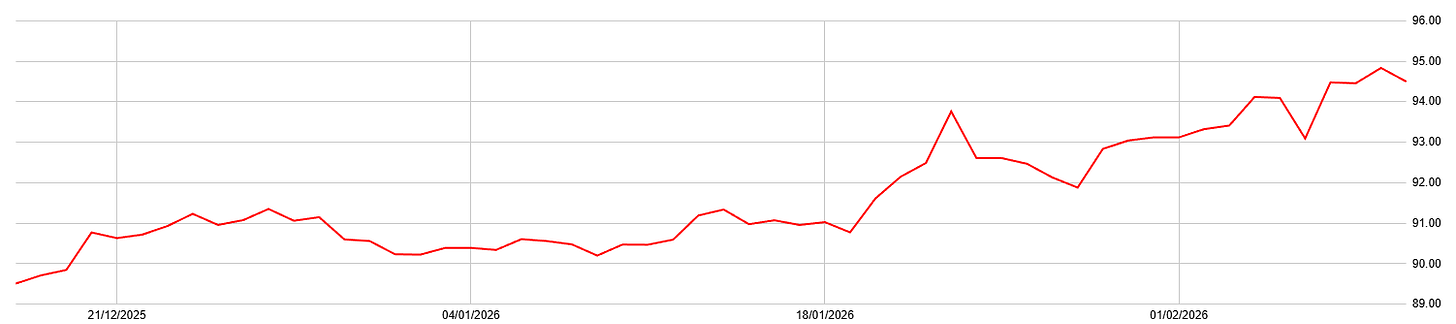

NZD/JPY: Highly Convincing BULLISH Sentiment Over the Coming Weeks Due to Dairy-Led Terms of Trade Divergence

NZD/JPY has surged to 52-week highs near 94.55, powered by the strongest GDT dairy auction result in years — a 6.7 percent surge on February 3 with Chinese buyers taking 35 percent of volume and Whole Milk Powder hitting 3,614 USD per tonne (https://www.globaldairytrade.info). This dairy super-cycle narrative is underpinned by Fonterra’s farmgate forecast of 8.50-9.50 NZD per kilogram of milk solids and Westpac’s bullish 9.40 NZD projection. New Zealand’s sticky 3.1 percent CPI has killed the easing cycle, and Westpac confirmed the RBNZ will hold at 2.25 percent on February 18 while bringing forward its projected first hike to December 2026 — a major hawkish shift (https://www.westpaciq.com.au/economics/2026/02/preview-of-rbnz-february-2026-monetary-policy-statement). Despite unemployment hitting 5.4 percent, record participation of 70.5 percent and employment growth of 0.5 percent softened the blow. Against this, Japan’s structural fragility — fiscal dominance, collapsing household spending, and the Takaichi budget — remains unaddressed by any single GDP rebound. Key recent events: GDT surged 6.7 percent (Feb 3), NZ Unemployment at 5.4 percent with record participation (Feb 4), Takaichi election supermajority (Feb 8). Pivotal upcoming events: RBNZ Inflation Expectations (Feb 13, previous 2.28 percent), Japan Q4 GDP (Feb 16, 1.6 percent expected), RBNZ Rate Decision (Feb 18, hold at 2.25 percent with Breman’s forward guidance as key catalyst).

DISCLAIMER: The information printed here is informational only, NOT advice. Trading involves risk, and you could lose money.