Forex Playbook WN34: PMI’s Rock the Markets Ahead of Jackson Hole

New format that condenses analysis to be easily digestible

INTENDED USE: Analysis of the Forex Markets that can be studied to aid with your trade planning.

DERBYSHIRE GB / AUGUST 23rd, 2023 - Updated following the PMI reports, all of which missed expectations. Next update tomorrow if US unemployment claims surprise otherwise after Jackson Hole on Friday.

Macroeconomic Snapshots

US DOLLAR: Macroeconomic factors are likely to provide upward support to the fundamental value of the dollar. However, there are downside risks from sentiment surrounding the end of the Feds hiking cycle and an improving situation regarding inflation. The intermarkets show that there has recently been a lack of confidence in the economic outlook as the S&P 500 took a slightly bearish fall last week below the 50 day moving averages while the six month treasury yields reflects hold expectation from the Fed at 5.52% vs the Fed Funds rate of 5.50%. Over the long term, the US Dollar Index (DXY) is expected to remain above the 100 area and possibly climb to test the 105 area so look for opportunities to buy and sell from these extremities.

EURO: Macroeconomic factors are likely to provide upward support to the fundamental value of the euro. However, there are downside risks from sentiment surrounding the end of the ECB's hiking cycle and risk aversion if the situation in Ukraine deteriorates. The intermarkets show that there has recently been a lack of confidence in the economic outlook as the DAX took a bearish fall last week below the 50 and 100 day moving averages while the six month bund yields reflects dovish expectations from the ECB at 3.55% vs the Main Refinancing rate of 4.25%. Over the long term, the EUR/USD is expected to remain above the 0.97 area with an eventual return to the 1.20 area so look for opportunities to buy into the existing downtrend.

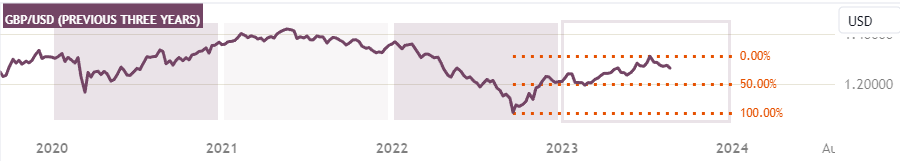

POUND STERLING: Macroeconomic factors are likely to provide upward support to the fundamental value of the pound. However, there are downside risks from sentiment surrounding the end of the Bank of England’s hiking cycle, the cost of living crisis and risk aversion if the situation in Ukraine deteriorates. The intermarkets show that there has recently been a lack of confidence in the economic outlook as the FTSE 100 took a bearish fall last week below the 50, 100 and 200 day moving averages while the six month gilt yields reflects hawkish expectation from the Bank of England at 5.7% vs the Bank rate of 5.25%. Over the long term, the GBP/USD is expected to remain above the 1.20 area with an eventual return to the 1.31 area so look for opportunities to buy into retracements of the existing uptrend.

Last Week's Events

Tuesday, August 15th

US Retail Sales

Wednesday, August 16th

GB CPI

US FOMC Meeting Minutes

Thursday, August 17th

US Unemployment Claims

Friday, August 18th

GB Retail Sales

This Week's Events

Wednesday, August 23rd

EA PMI

GB PMI

US PMI

Thursday, August 24th

US Unemployment Claims

Day 1 of the Jackson Hole Symposium

Friday, August 25th

Day 2 of the Jackson Hole Symposium

Next Week's Events

Tuesday, August 29th

US CB Consumer Confidence

US JOLTS Job Openings

Wednesday, August 30th

EA GE Prelim CPI

US ADP Non-Farm Employment Change

US Prelim GDP

Thursday, August 31st

EA CPI Flash Estimate

US PCE Price Index

US Unemployment Claims

Friday, September 1st

US Average Hourly Earnings

US Non-Farm Employment Change

US Unemployment Rate

US ISM Manufacturing PMI

Gavin Pearson

Retail trader since 2008

Specialises in forex G7 currencies

Funded account from the5ers.com

Member of the eToro Popular Investors Program

Regular contributor to FXStreet.com analysis and education pages

Jeepson Trading Fund

Returned 27% in 2022 and 5.8% in 2023 H1

Forex focused

Copy Trading available at eToro

eToro

eToro is a social trading platform

Users can copy trades by clicking the "Copy" button on the profile page

Disclaimer

Past performance is not indicative of future results

Trading involves risk, and you could lose money

-end-