Sunday, December 8, 2024 (Week 50)

Currency traders face a pivotal week ahead with both the ECB's December policy meeting and US CPI data poised to drive significant euro-dollar volatility. The collapse of the French government adds another layer of uncertainty just as markets grapple with diverging monetary policy paths on either side of the Atlantic. Whether the ECB can maintain its relatively hawkish stance amid deteriorating economic data will be crucial for EUR/USD price action in the days ahead.

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

EUR/USD - Bearish Dollar Dominance vs Fragile Euro

The EUR/USD enters a critical phase as the cross faces mounting downward pressure from both fundamental and technical perspectives. The pair has declined sharply from November highs of 1.0933 to current levels around 1.0568, reflecting the euro's vulnerability amid political instability in France and deteriorating economic data from the Eurozone.

Recent PMI data shows the manufacturing sector contracting further to 45.2 while services dropped below the expansion threshold to 49.5 in November. Core inflation, while easing slightly, remains stubbornly high at 2.7%, suggesting the ECB's policy tightening has yet to fully impact price pressures. Meanwhile, the collapse of the French government through a no-confidence vote adds significant political risk.

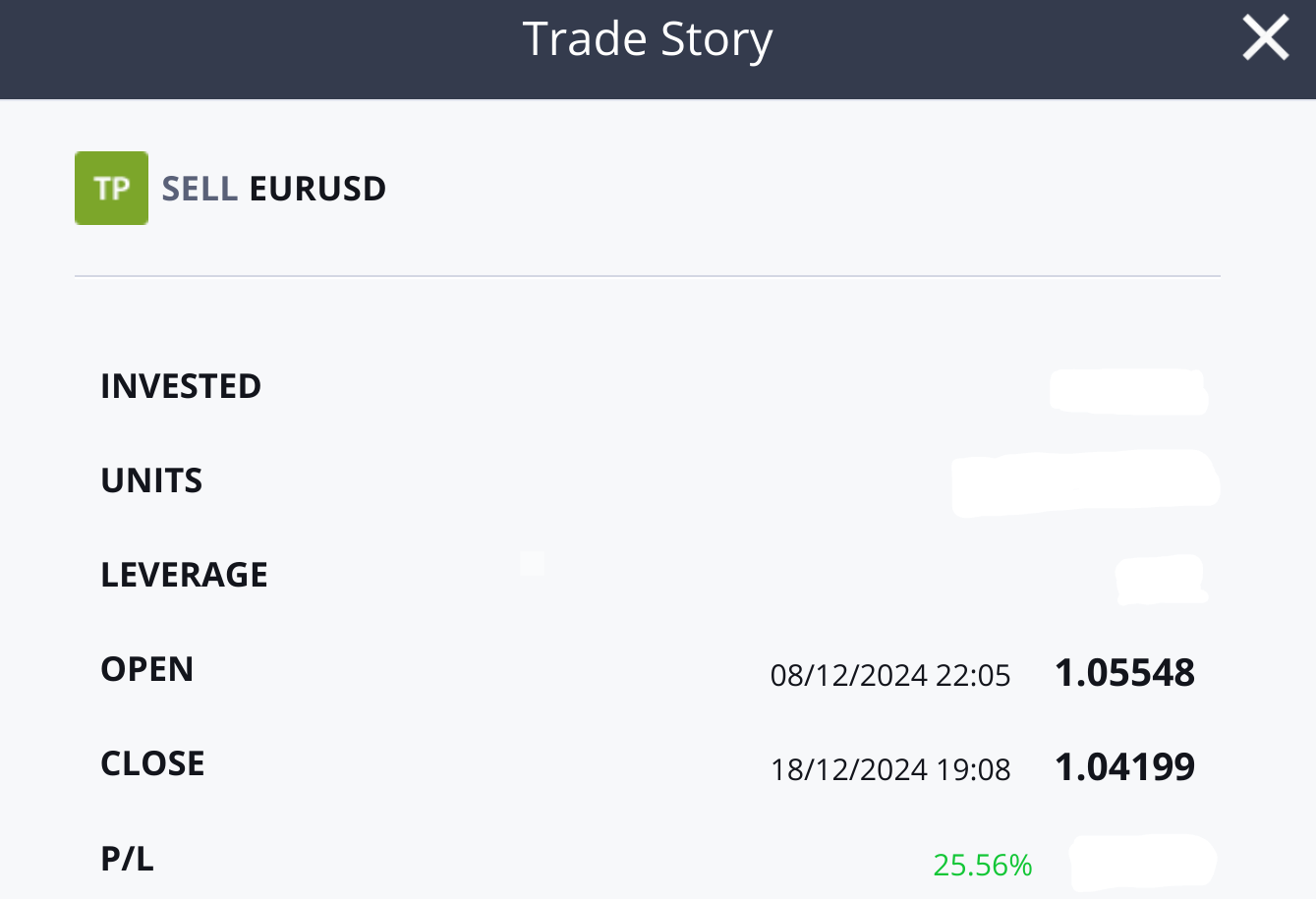

Projections from major financial institutions and the Trading Economics forecast model suggest EUR/USD trading at 1.05 by year-end 2024, with further weakness to 1.04 expected in 2025. This bearish outlook aligns with the diverging monetary policy paths between a cautious Fed and an increasingly dovish ECB.

Trade Thesis

A compelling case exists for initiating short positions in EUR/USD based on:

Political Risk Premium: The French government crisis creates uncertainty that will likely weigh on the euro

Economic Divergence: US data continues to show resilience while Eurozone indicators deteriorate

Monetary Policy Divergence: ECB expected to cut rates more aggressively than Fed in 2025

Technical Breakdown: Price action suggests continued downward momentum

Entry levels can be considered from above 1.0550 zone, with a stop loss placed 200 pips higher. Initial profit target is set at 1.0420 based on previous support levels and year-end forecasts. A secondary target of 1.0200 could be reached in Q1 2025 if bearish momentum accelerates.

The primary risks include:

Potential ECB hesitation to cut rates as aggressively as markets expect

Surprise deterioration in US economic data

Geopolitical developments affecting risk sentiment

Conclusion

Action Points:

Monitor ECB meeting on December 12 for policy guidance

Watch French political developments for signs of further instability

Track US CPI data on December 11 for Fed policy implications

Place limit orders to enter short positions on any rallies to 1.0580-1.0600

Consider scaling into the position to manage entry risk

Sources: European Central Bank, Federal Reserve Economic Data, Trading Economics, S&P Global Market Intelligence, Reuters, Bloomberg.